13/09

The Quotedian - Vol V, Issue 126

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

— Sam Ewing

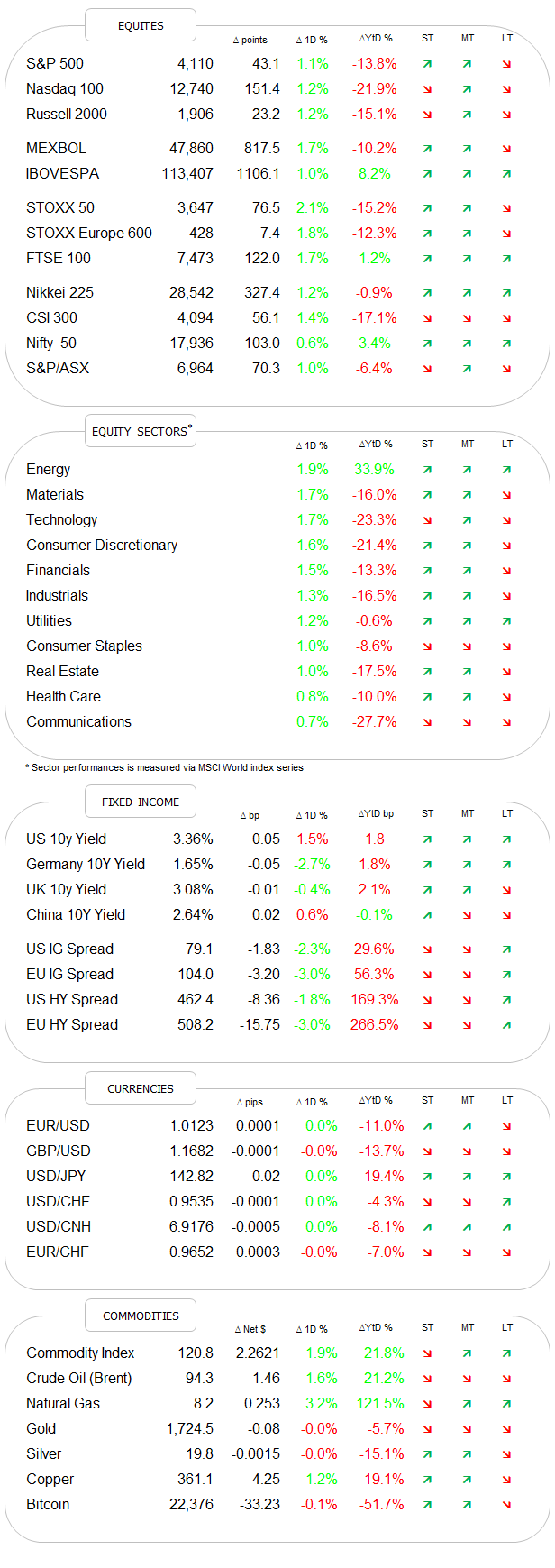

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

First things first - here’s the result of yesterday’s poll if the weekly Top 25 YTD performers should continue to be part of the Sunday issues:

Thank you for your vote and you have spoken.

After Sunday’s rather lengthy Quotedian we will keep it a bit shorter today. Not least because this afternoon could be a bit of a game changer, depending on the US inflation reading reported at 14:30 CET and the market’s reaction to it. Albeit, it shouldn’t. Consumer Price Inflation (CPI) is a strongly lagging indicator, with one of the more volatile contributors being energy prices and the most heavy-weight (home) owners’ equivalent rent (OER) being the slowest. This should mean that given the lower oil, heating oil and gasoline prices we have registered over the past few weeks and months, the reading today could be negative. Again, it shouldn’t matter. But it probably does, as the formidable Fed dropped forward guidance a few months ago and instead decided to base their decisions on this (all together now) strongly lagging indicator.

In any case, here are the estimates:

The low estimate is 7.9%, which I think could be achieved. If so, it will be interesting to see how bond yields will react, given that next week’s 75 basis point hike by the FOMC has been already communicated by the Fed whisperer:

In any case, the Fed is in (speak) blackout period for the next eight days, leaving up markets to their animal instincts …

Let’s get to yesterday’s market action then, where stocks put in their fourth consecutive day of gains, quickly turning the current move higher into the ‘most hated rally ever’ (as previously advertised in this space). Participation in the rally was broad once again, with close to 90% of stocks on both sides of the Atlantic moving higher. As seen in the ‘Dashboard’ section above, all eleven equity sectors eked out gains at an MSCI World level and the same was true for the S&P 500 sector performance

leading to a beautiful sea of green on the index’s market heat map:

One sector that deserves special mention is European financials. Since the ECB simultaneously increased rates and extended the period of and for excess liquidity, bank shares have been on fire - and for good reasons. The popular Lyxor STOXX Europe 600 Banks ETF (BNK) is up close to ten percent in three sessions:

A push to €20 and above could further accelerate the upside.

Asian markets continue to ride the wave higher this early Tuesday, with most indices up around half a percentage point. Index futures on European and US index futures suggest an equally friendly start to today’s session.

Bond traders are collectively holding their breath into today’s inflation number. CPI used not to matter a lot, but the Fed chose to give it importance and hence here we are. US 10-year yields continue within their defined uptrend channel, though have not made any new progress since that big up candle exactly a week ago:

A similar statement is true for German 10-year Bunds (not shown) and UK 10-year Gilts (below):

Quickly moving into currencies, the US Dollar could finally have found an at least short-term top, with pretty of room for a correction (not a forecast), if for example dropping back “only” to its 200-day moving average:

This would be of course good news for risky assets in general, with longer-term correlation (200-day) between the greenback and the S&P for example running at its lowest since the GFC:

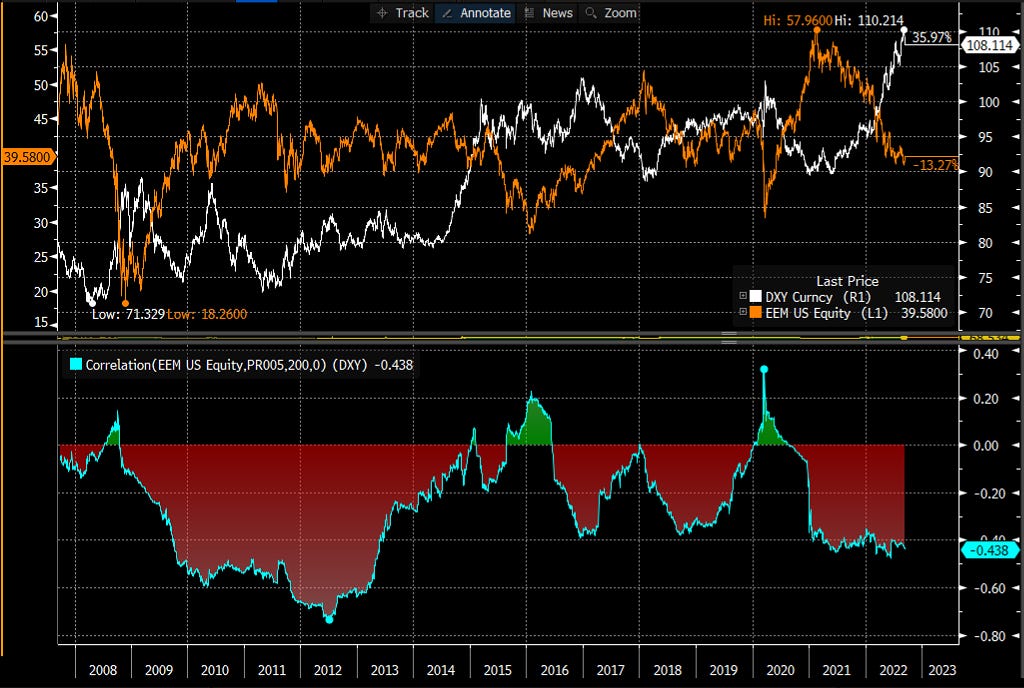

Of course, it would be even more constructive for emerging market equity:

Time to hit the send button (sorry for the delay had an interesting early morning call), but just before we do that, let’s look at just one chart in the commodity complex:

Silver shot up close to five percent yesterday and is now more than twelve percent higher than only a week ago. The best part - nobody is talking about it yet …

Have a great Tuesday!

André

CHART OF THE DAY

Here’s an interesting chart in relation to the introduction to today’s deliberation section. It shows how recently Eurodollar futures (not the currency, but interest rate futures most ‘influenced’ by Fed talk and action) have been diverging from 1-year USD swap rates AND gasoline futures prices - a correlation that previously had held up well. Is the Fed too late to (inflation) game and flooring it (i.e. too hawkish) when inflation is slowing rapidly already? Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance