1981

The Quotedian - Volume V, Issue 100

“Government is not the solution to our problem. Government is the problem.”

— Ronald Reagan

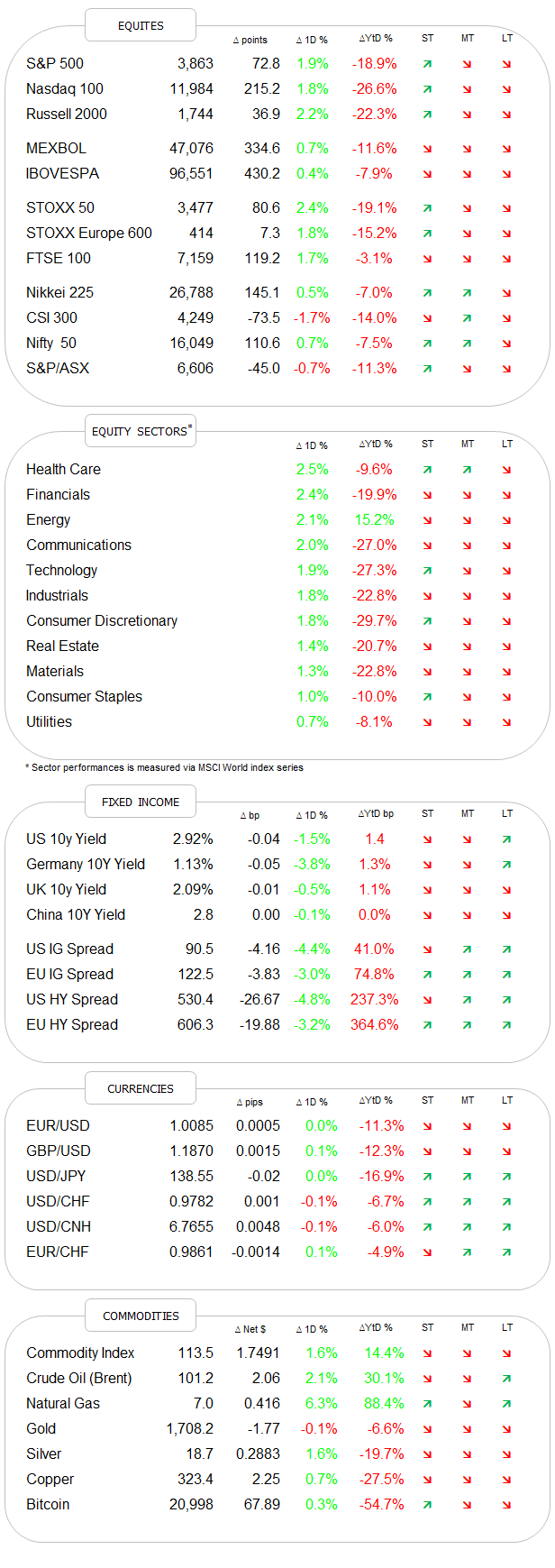

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

** Housekeeping ** Please note that The Quotedian is on holiday and hence updates will be less regular over the coming week. The objective is to publish 2-3 issues per week. Next likely issue up on Thursday 21.7.

Stocks rallied significantly on Friday, apparently triggered by a better-than-expected retail sales number in the US. The major indices (SP, Down, Russell, Nasdaq) all ended up around two per cent and the market carpet leaves no doubt that the rally was broad across stocks and sectors:

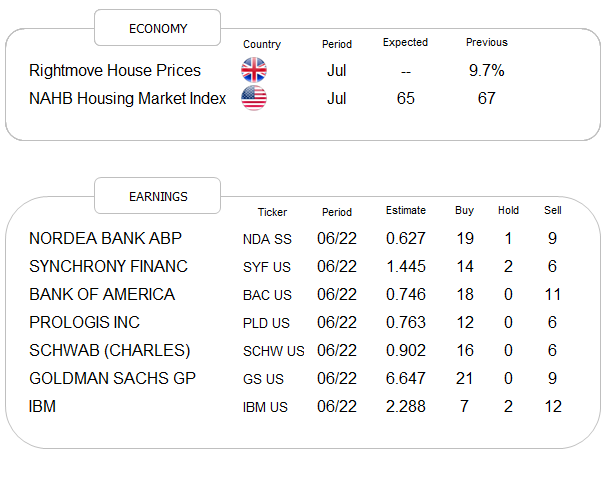

However, despite Friday’s strong gains, most equity indices around the globe still ended the week lower:

There were equally little places to hide amongst sectors, though energy stocks were some clear losers (again) as the price of crude continued to drop:

In fixed income market, the theme of last week was clearly the inversion of the yield curve. As reported US consumer inflation hit its highest level since 1981

short term interest shot up in expectation of the Fed continuing on an ‘aggressive’ hiking cycle, whilst yields at the longer end fell for the same reason (and implied growth slowdown). The 10-2 year Treasury spread (slope) fell to its lowest since 2006

Maybe more importantly, the 10y - 3 months Libor spread also dropped sharply, and albeit not negative yet, it seems obvious what will happen next:

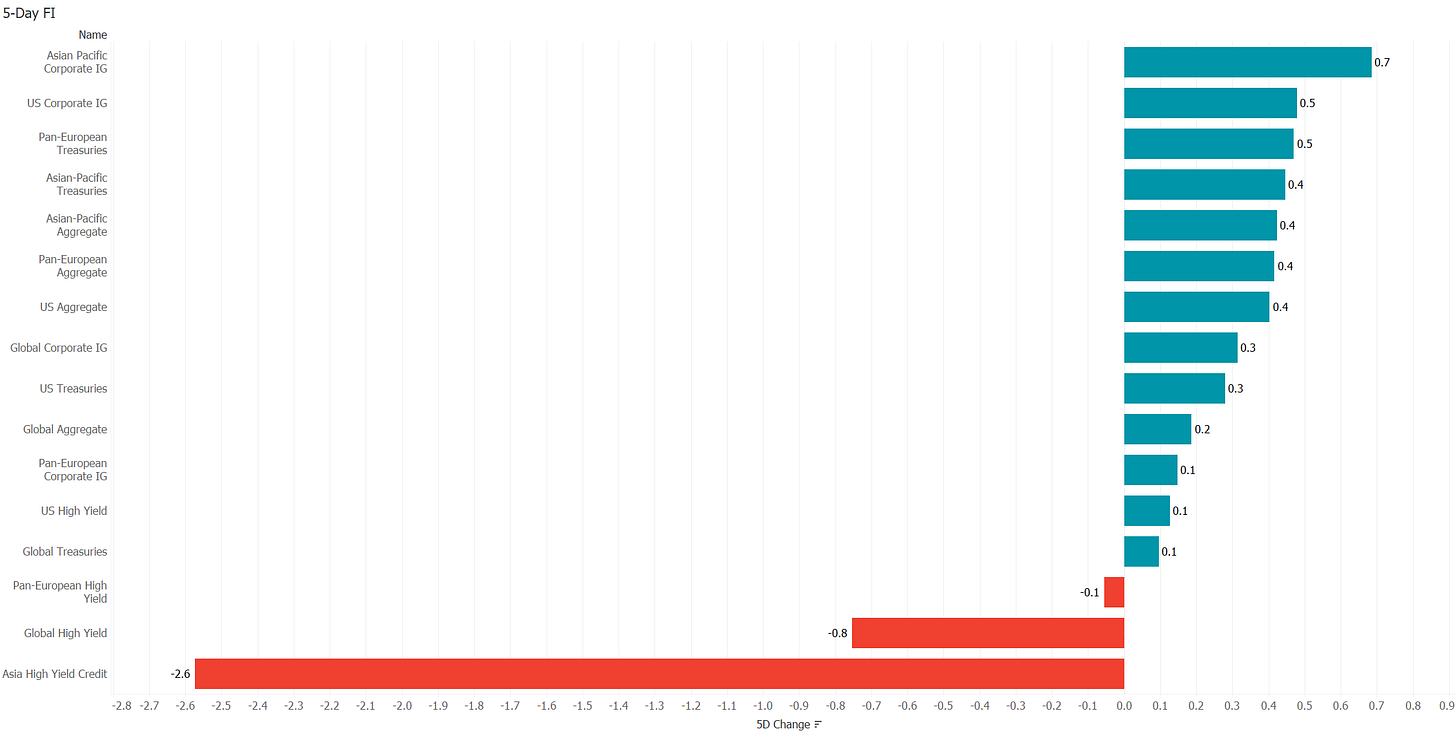

Hence, with the longer end of the yield curve falling, many fixed income benchmarks actually eked out a gain on the week:

The underperformance of Asian high yield in the chart above can likely be connected to the correction unfolding in the Chinese and Hong Kong equity markets and the usually associated credit spread widening.

And then there are currency markets … as everybody and his dog knows the Euro dipped below parity versus the USD last week, though as I type is actually rallying hard (1.0150). The other ‘child of worry’, the Japanese Yen, is also seeing some strength over the past few hours, which is of course pushing the US Dollar index (DXY) lower:

This will be interesting to continue to observe, as a weaker US Dollar could lead to more fuel for the equity rally and a generally friendlier environment for risky assets.

Let’s finish off with a quick performance-check on the commodity segment for the past five days:

Two conclusions: 1) volatile as hell and 2) fragmented as hell.

Ok, one more on crude … since I showed the chart below last week, highlighting how the price of crude had dropped to pre-Ukraine invasion levels, the cost of a barrel has actually started rising again (something seems not have gone to plan for Biden in Saudi Arabia):

I heard many commentators over the weekend calling for a drop to $80 or even lower for the oil as recession looms. Perhaps. Maybe central banks will indeed create enough demand destruction in order that we see such levels. Of course, the implication for most other asset classes would not be for the faint at heart either. But more importantly, the (lack of) energy issue continues to be one of supply, not demand, hence weakness should be seen as an opportunity.

Next Quotedian - from the beach!

CHART OF THE DAY

Fascinating chart here from Ben Hunt over at epsilontheory.com. Feel free to make your own conclusions…

LIKES N’ DISLIKES

Likes and Dislikes are not investment recommendations!

Long China equity (FXI) / short India equity (PIN)

Energy stocks (XLE)

Long some Gold (direct or via short puts)

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance