ABC

Vol VII, Issue 36 | Powered by NPB Neue Privat Bank AG

"Acronyms are just an excuse for people to pretend they understand something they don’t."

— E. Joseph Cossman

The Jackson Five used to sing:

“A B C,

It's easy as 1 2 3,

as simple as do re mi,

A B C, 1 2 3”

Yours truly has decided to change this now to:

But even ABC,

is not as easy as it used to be

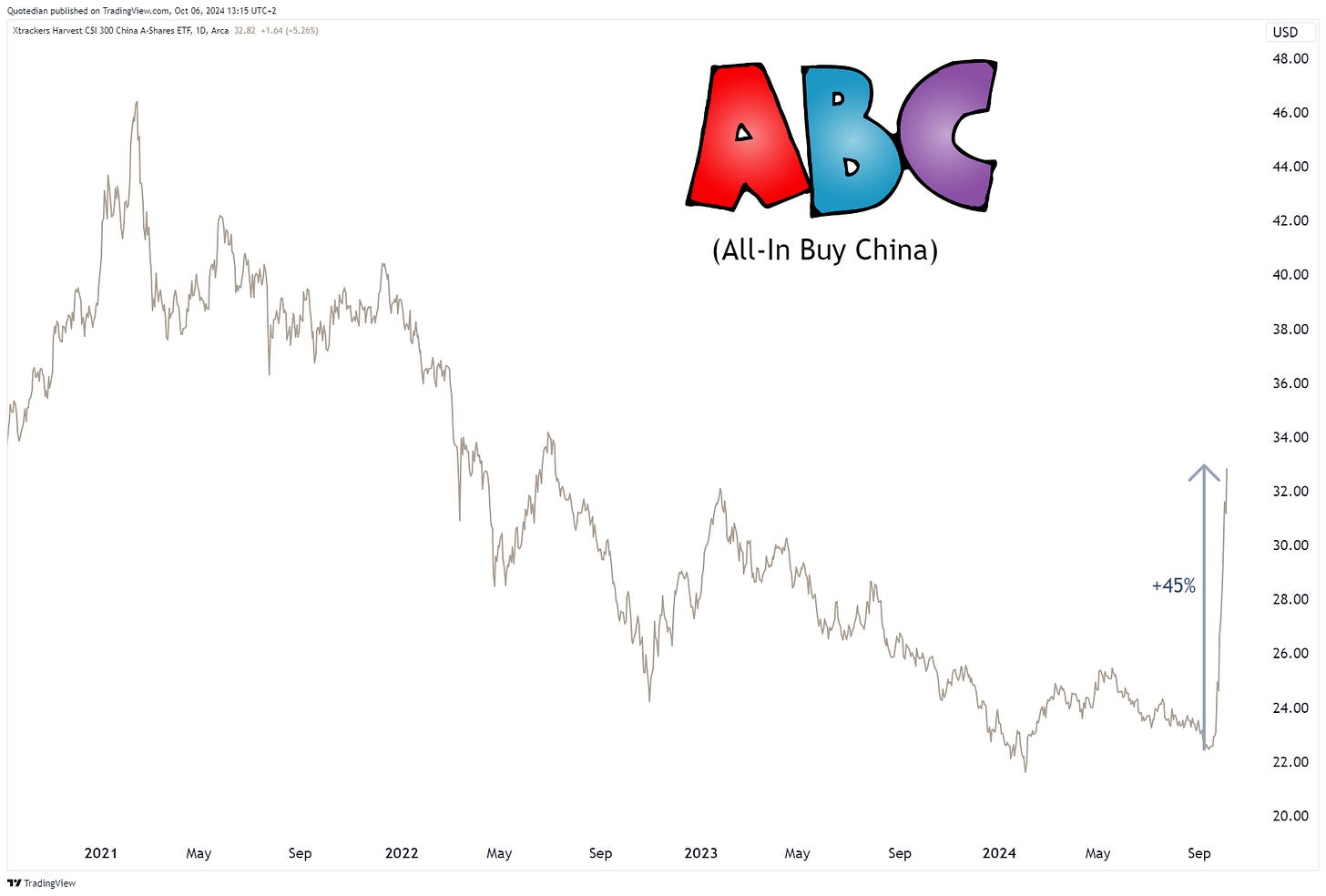

Why? Well, only two weeks ago, ABC used to mean in the investment world:

Anything But China!

Only a fortnight later, and it seemingly has changed to:

All-In Buy China!

As we are on a tight publication (remember: NPB Q4 Outlook is out later today), we’ll deviate from the usual long-form format and just concentrate on the main macro movers of the past week or two.

Staying with equities a moment longer, the S&P reached another new all-time high (ATH) on Monday last week, but then consolidated gains through Thursday. Friday saw another jump, leaving the index only a few basis points from a new ATH, however, this move puzzles me a little bit:

But, we come back to that in a moment.

Papa Dow in the meantime did reach a new ATH on Friday:

What is surprising here, at least to me, is that the VIX (equity volatility),

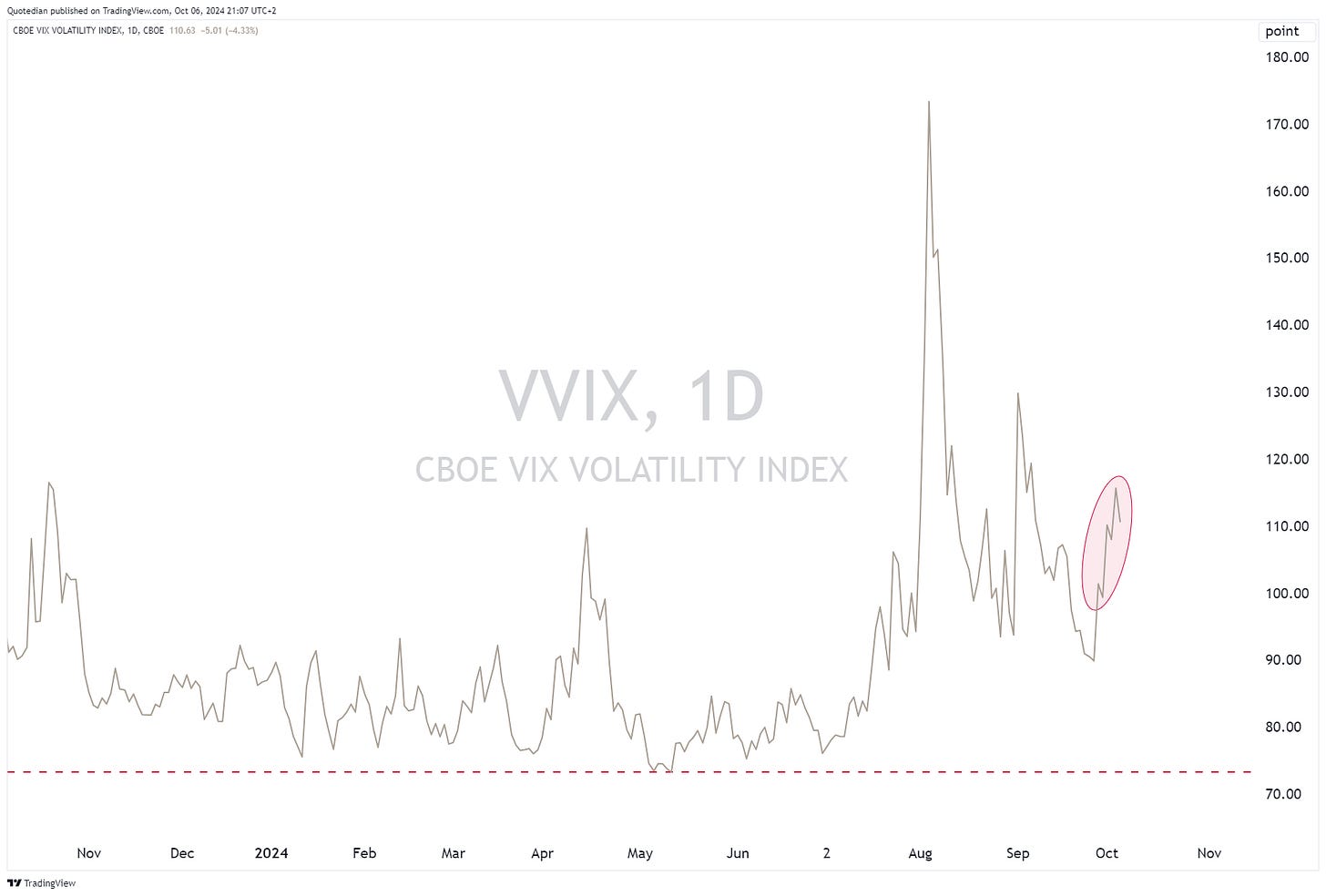

and the VVIX (Volatility of Volatility)

both headed higher during the week, which is a bit in conflict with rising equity prices.

European stocks did not behave as decent as their US cousins, which closed down nearly two percent on the week:

Weakness came out of two major corners. First, carmakers continued to suffer, with the tariff decision on Chinese EV´s probably largely backfiring on European carmakers’ stocks. Secondly, the honeymoon period for luxury stocks attaching themselves to the Chinese stimulus rebound seems to be already over again with most of them giving back a big junk of the previous week’s gains.

And not sure what is going on here, but Indian equities gave back more than four percent last week:

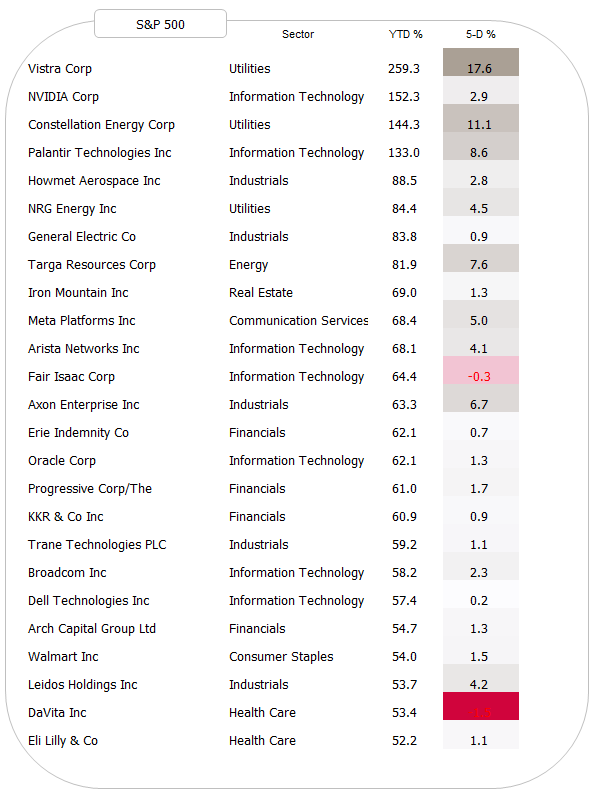

For completeness purposes, here are also our tables on the top performing stocks year-to-date and how the have behaved the past five sessions. Starting with US stocks:

And here’s the European list:

Another major macro event of last week was of course also US economic data coming in stronger than expected. ISM reported on Thursday was a blow-out in many aspects, but especially in '´Prices paid’ and ‘New Orders’:

And then there was Friday’s NFP (non-farm payroll) employment report. At 254k reported, it was beyond the wildest dream of even the most optimistic economist:

Not surprisingly (pun fully intended) have those surprising results pushed the Citi Economic Surprise index further north:

Overlaying the 10-year US treasury yield with a three months lag on the above chart, we note that this magical Hocus Pocus indicator would suggest further upside for bond yields (downside for bond prices):

In any case did US bond yields react vehemently to Friday’s NFP reading, rallying 12 basis points on the day, closing just shy of 4%:

As briefly touched upon further up, we would have expected that equity markets start struggling with quickly rising rates, but so far no signs of that.

Another asset that has been “saved by the bell” so to is the US Dollar. It was just about to break key support on the US Dollar index (DXY - see below), when first rising Middle East tensions (safe haven function) and then the better-than-expected economic data (interest rate differential function) made the greenback rally strongly:

Versus the Euro, this looks as follows:

A double-to at 1.12 now and possibly a key pivot point just below 1.0950. This one promises to provide further entertainment over the coming sessions!

In the commodity space, not surprisingly did China’s own Draghi “whatever it takes and believe me it will be enough”-moment also lift related commodities, such as for example iron ore:

Gold meanwhile as struggled a bit over the past few sessions, but given all that previously mentioned Dollar strength, the yellow metal is holding up formidably:

Enough for today. Tune back in next week to read your favourite weekly newsletter, and, if you can’t wait so long, make sure to sign up to sign up to our daily missive (Tuesday through Friday) by clicking on the button below:

Yours truly,

André

Geopolitical tensions and strong economic data were the focus of last week. The latter took the market somewhat by surprise and has re-opened the debate on “higher for longer”. Futures implied probabilities for FOMC rate cuts dropped from three cuts till the end of this year to two. Outside political motivation, we think that even two may be more than really necessary.

Stay tuned …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance