Age of Empires

Vol IX, Issue 03 | Powered by NPB Neue Privat Bank AG

“Historically, there has been a bull market in commodities every 20 or 30 years.”

— Jim Rogers

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

This week’s Quotedian, which, yes, is hitting your inbox a day or two later than usual is all about the 2026 outlook of at the investment committee (which I happen to chair) at NPB.

Given the gargantuan workload this outlook together with its 150-pages strong accompanying chart book represents, most of the following will be simply a selection of some of the best charts in that chart book for each asset class, to wet your appetite, so to say 😉.

The subtitle itself “Age of Empires”, refers to that Microsoft (XBox Studios) game first released in 1997, nearly 30 years ago.

Our focus goes as follows:

In the previously established world order, every country had its own resources, which they would ‘mine’ and then sell on the global marketplace. In the popular video game “Age of Empires”, the player has to gather all available resources and hoard them to ‘build’ villagers (player with most villagers wins the game). Should the player run out of resources, he will get (not buy) them from other nations via imperial expansion. Recent events, seem to confirm that this is the scenario we are moving into to. Points in case are for example China’s near-monopoly (*OMEC) on rare earths or the USA’s move into Venezuela, cutting access to resources to others.

* OMEC = Organisation of Materials Exporting Countries

Here’s our full outlook document:

For those of you wishing to receive a company of the accompanying chart book, please drop me an email by clicking on the button below and writing me a short, personalised message (do not request a copy by replying to this email):

You are free to share the document(s), but thank you for acknowledging copyright issues by referring NPB as original source AND advertising for us at will AND hitting the “Like” button in this and all future Quotedians :-)

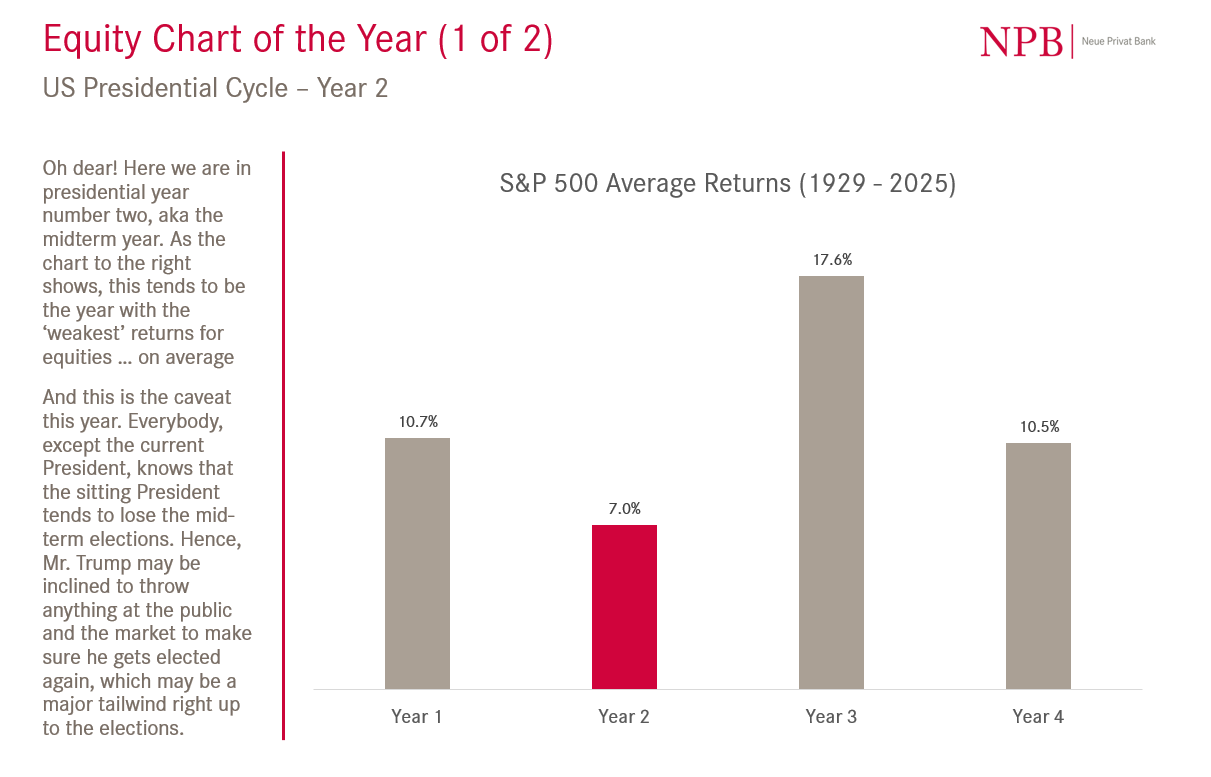

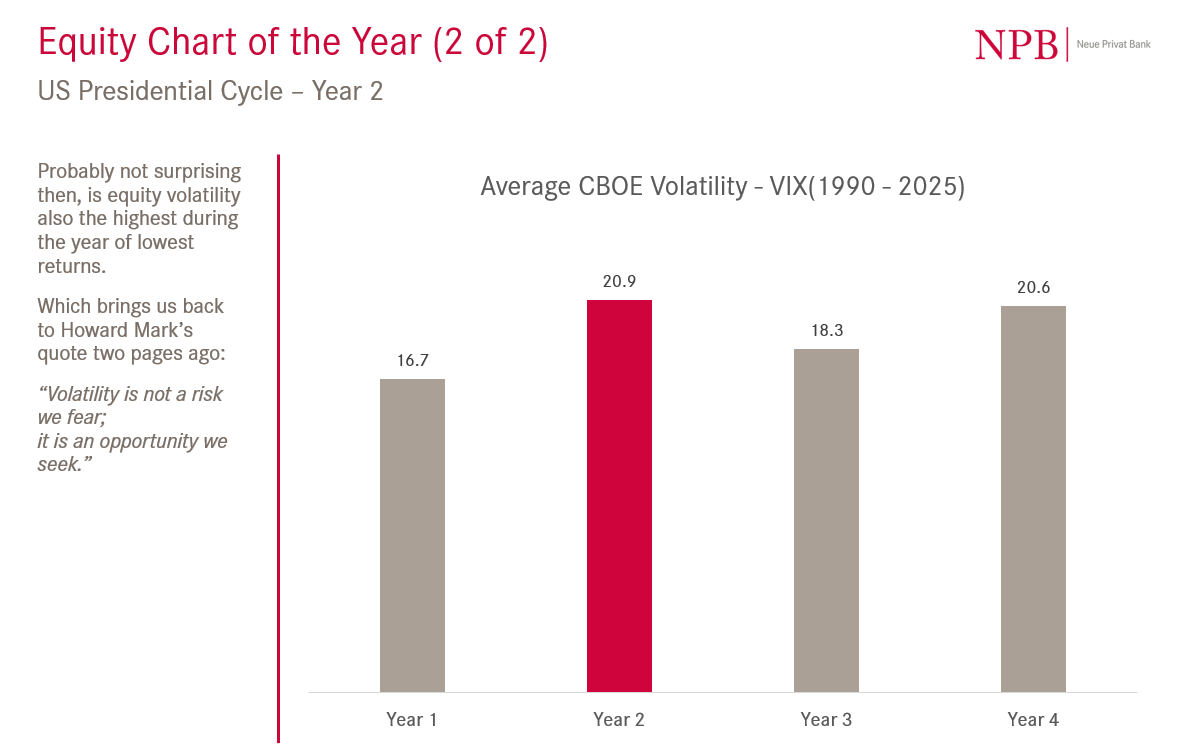

On the equity side, we show these two as equity charts of the quarter:

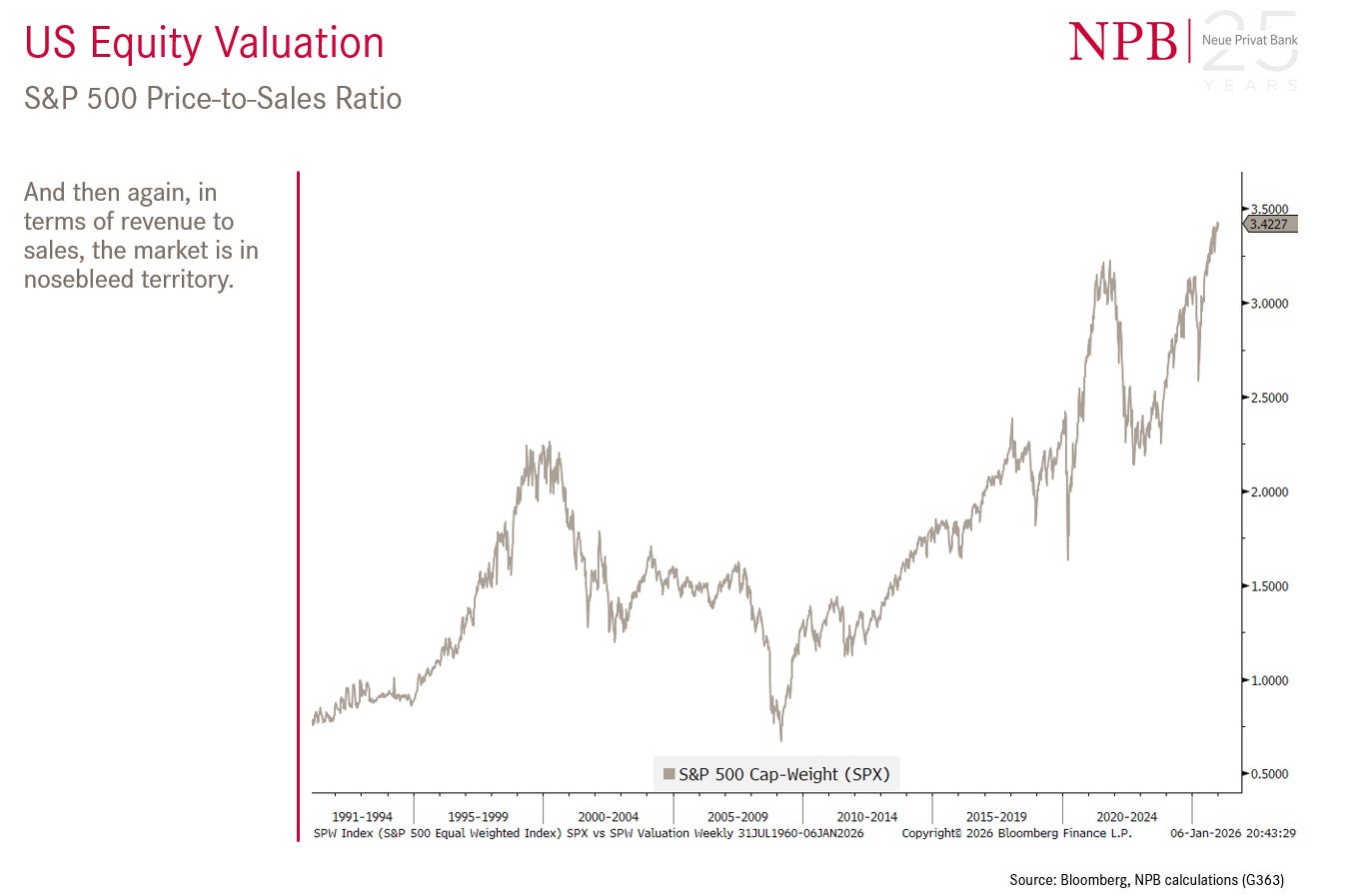

The (US) market is expensive:

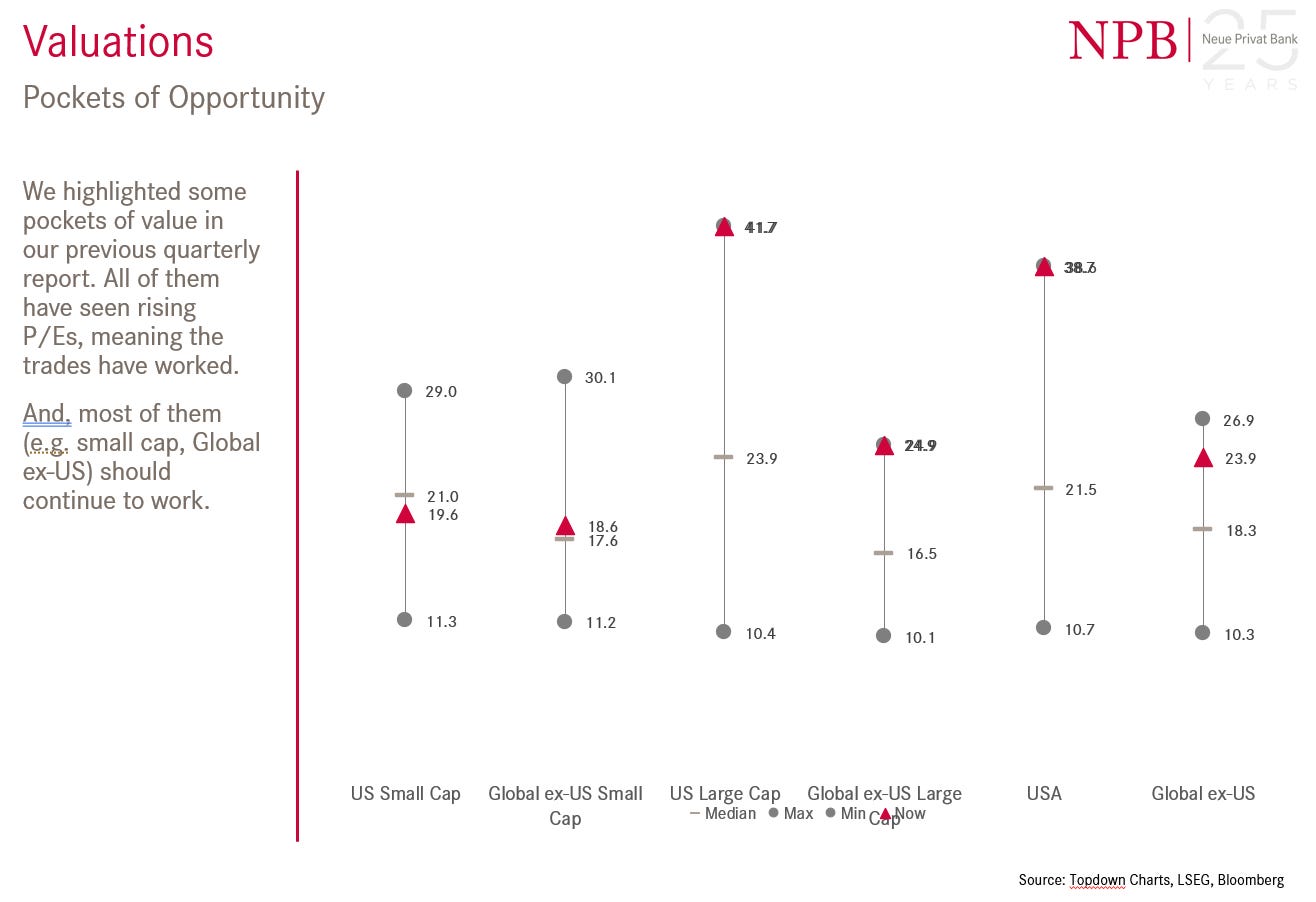

But pockets of value exist:

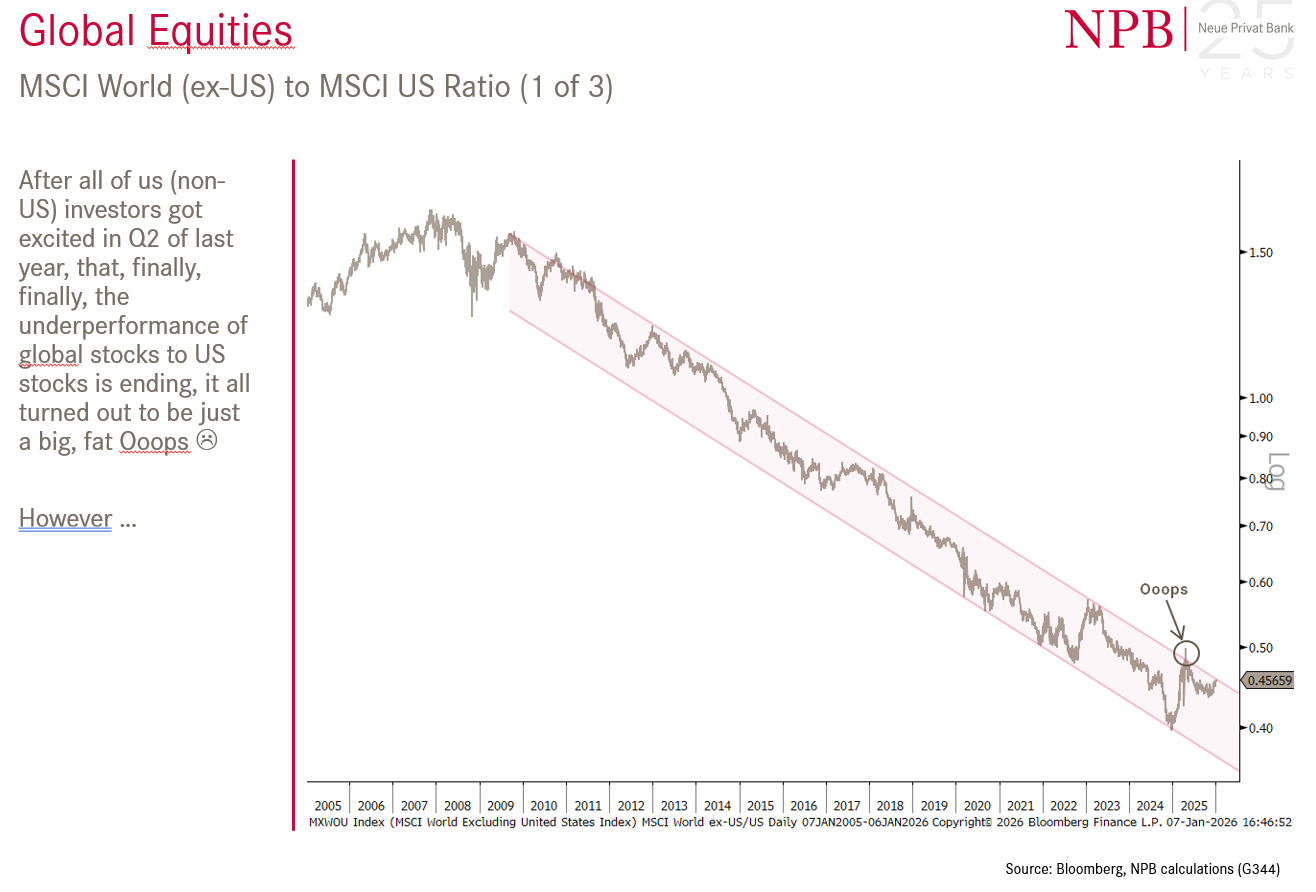

Can non-US markets finally start outperforming the almighty US equity market?

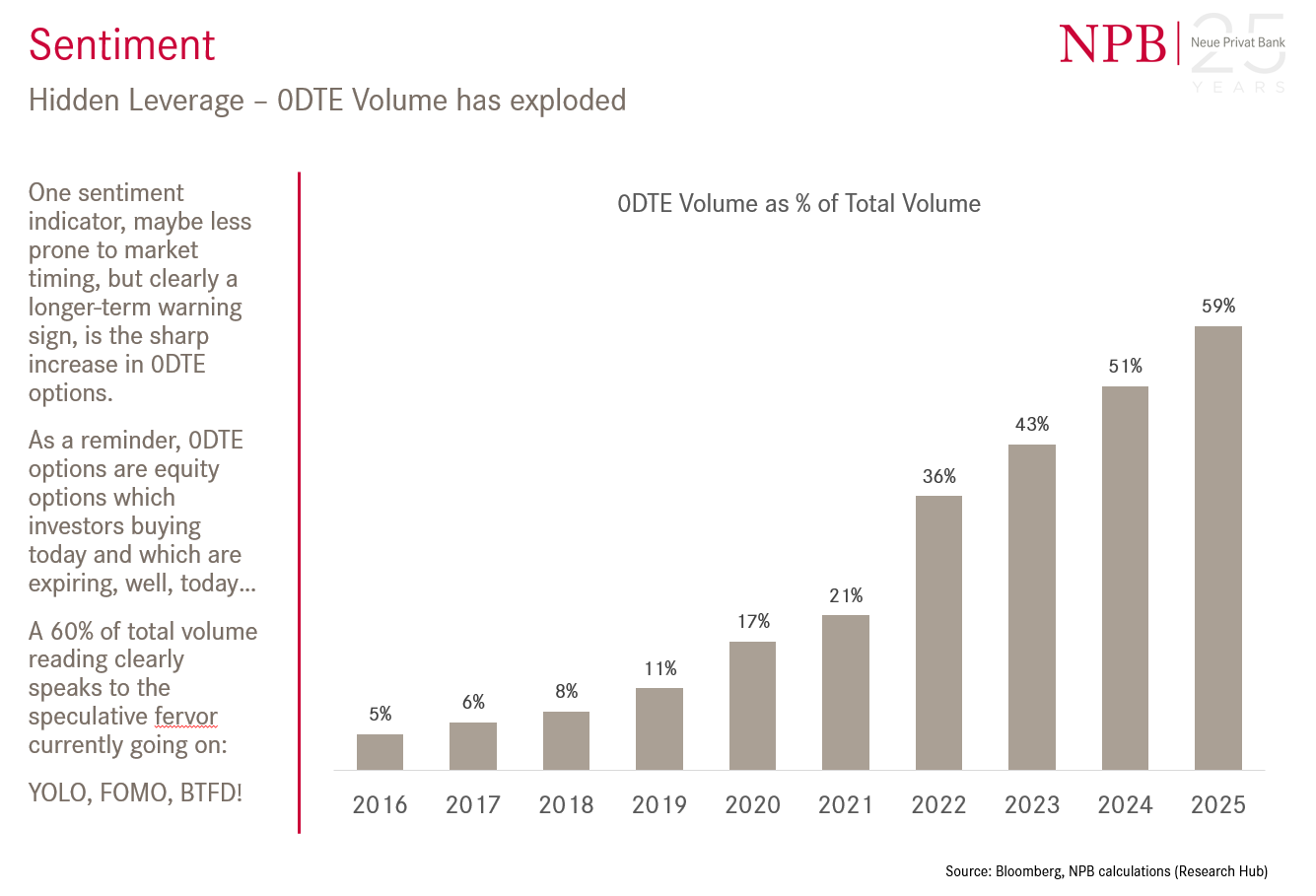

Speculation is rampant:

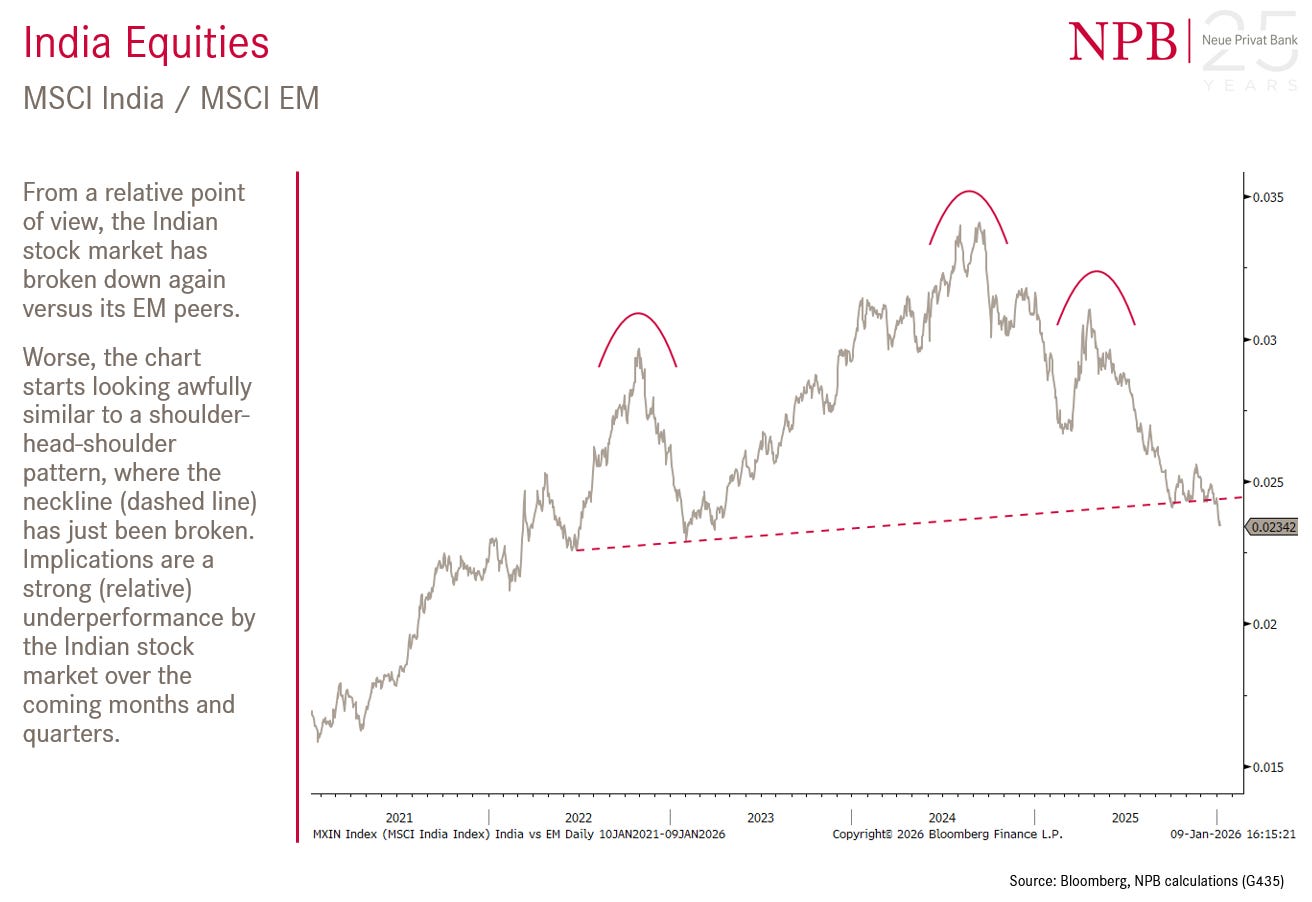

Indian equities have started a new leg in the underperformance versus other Emerging Markets:

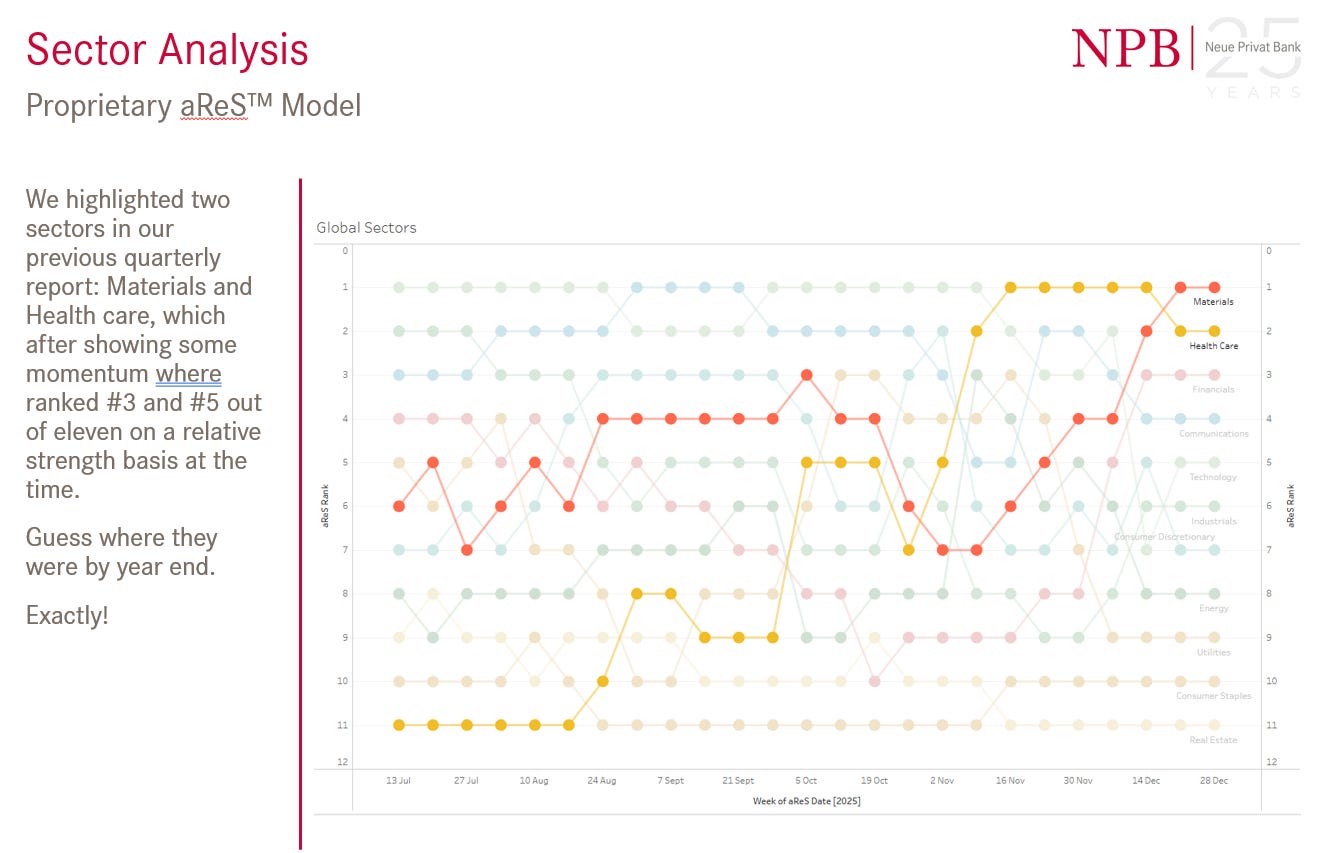

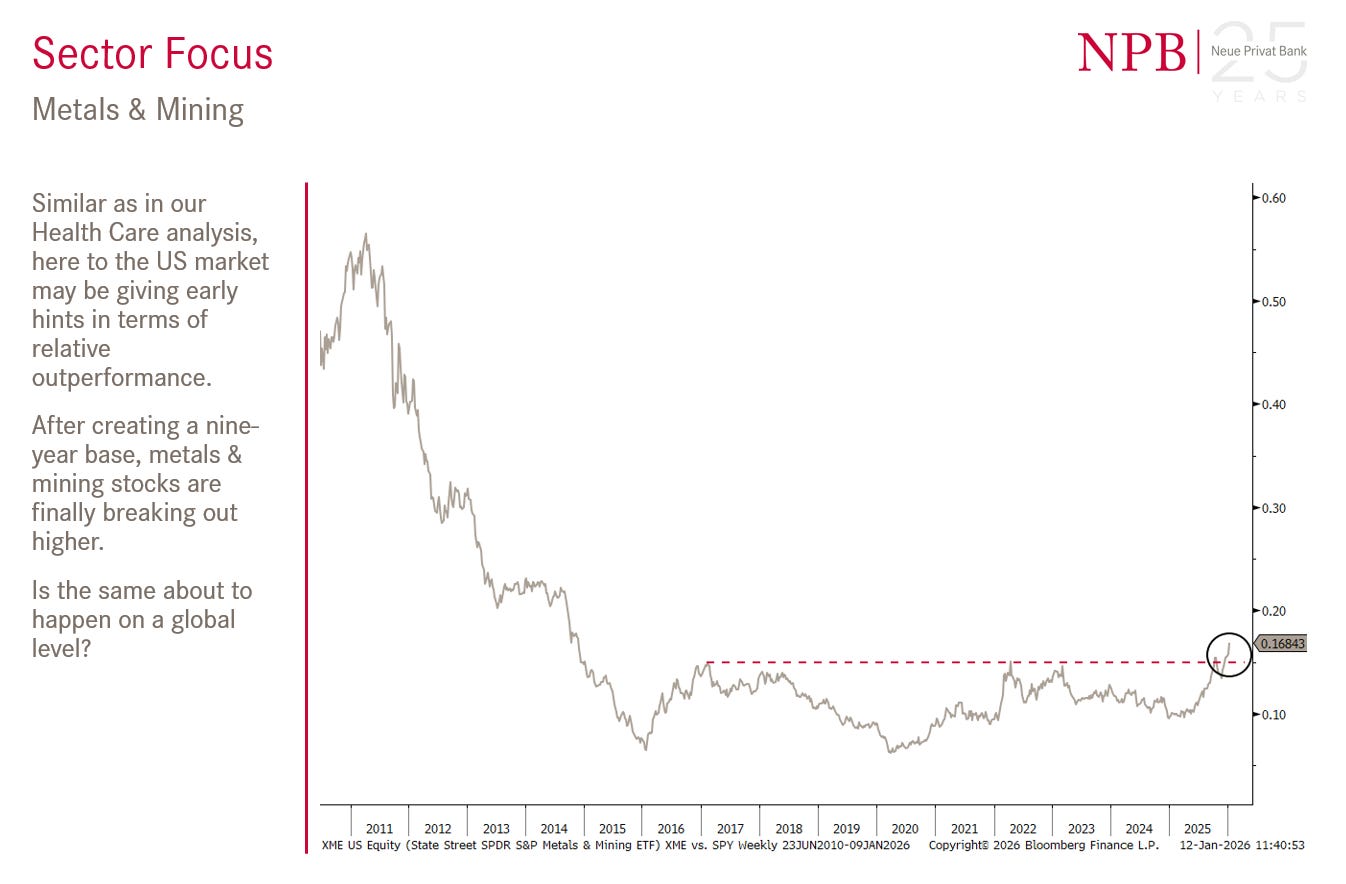

Unexpected relative strength leaders in Global sectors? Not to us:

More upside ahead:

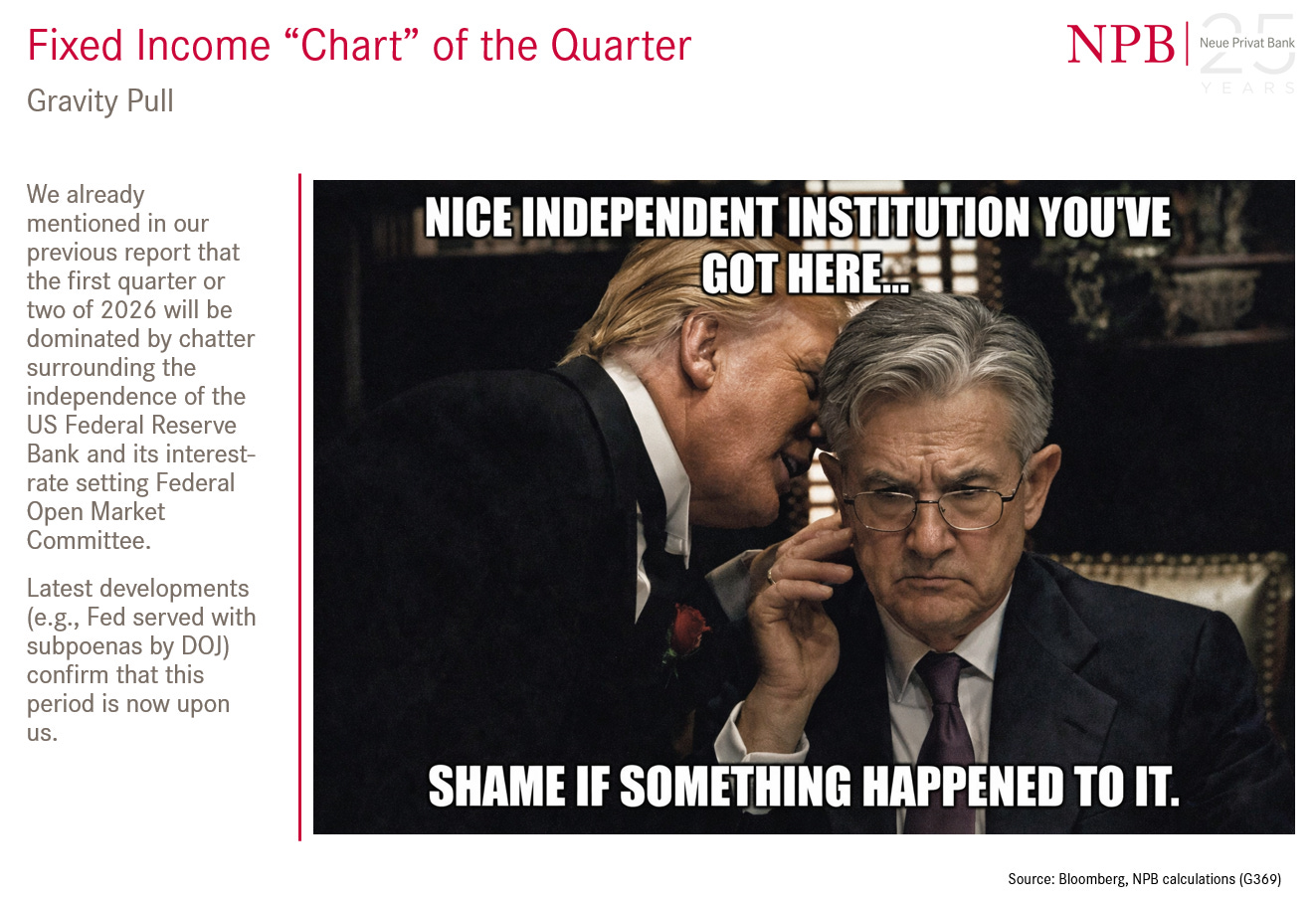

Fed bullying is a reality:

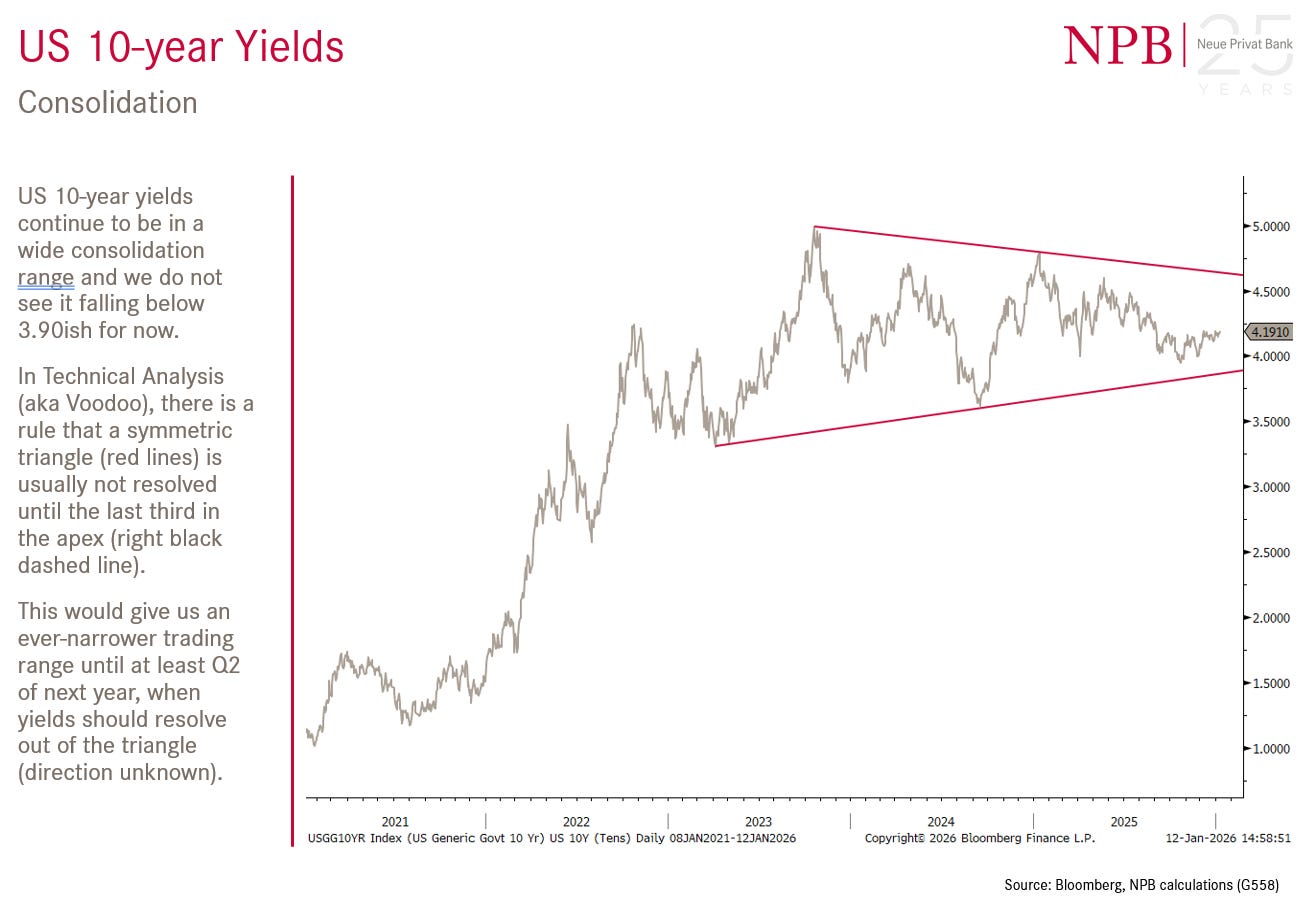

Which way will it break?

Watch this:

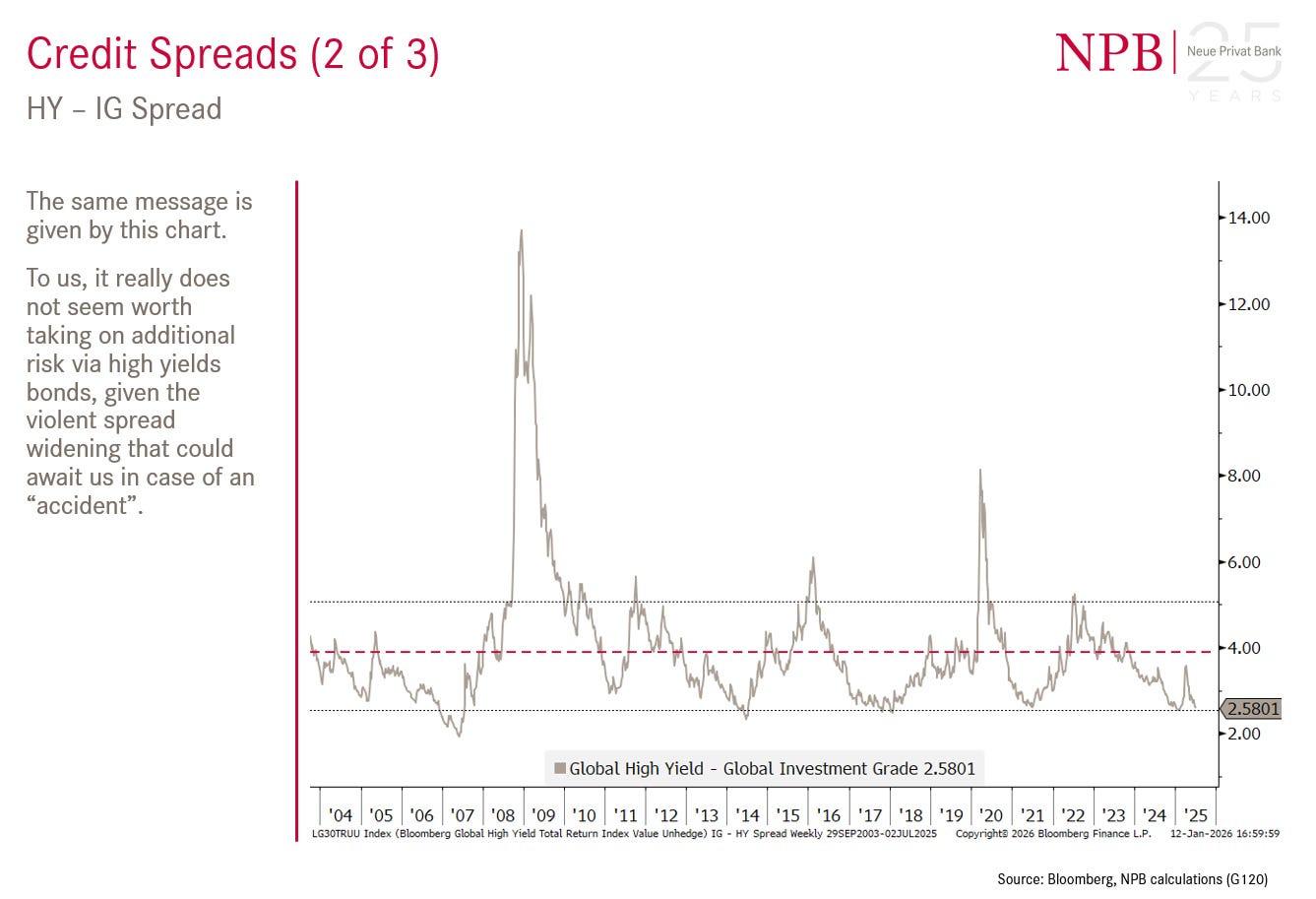

Not much more juice to press out of credit spreads:

The EM carry trade is living another golden age:

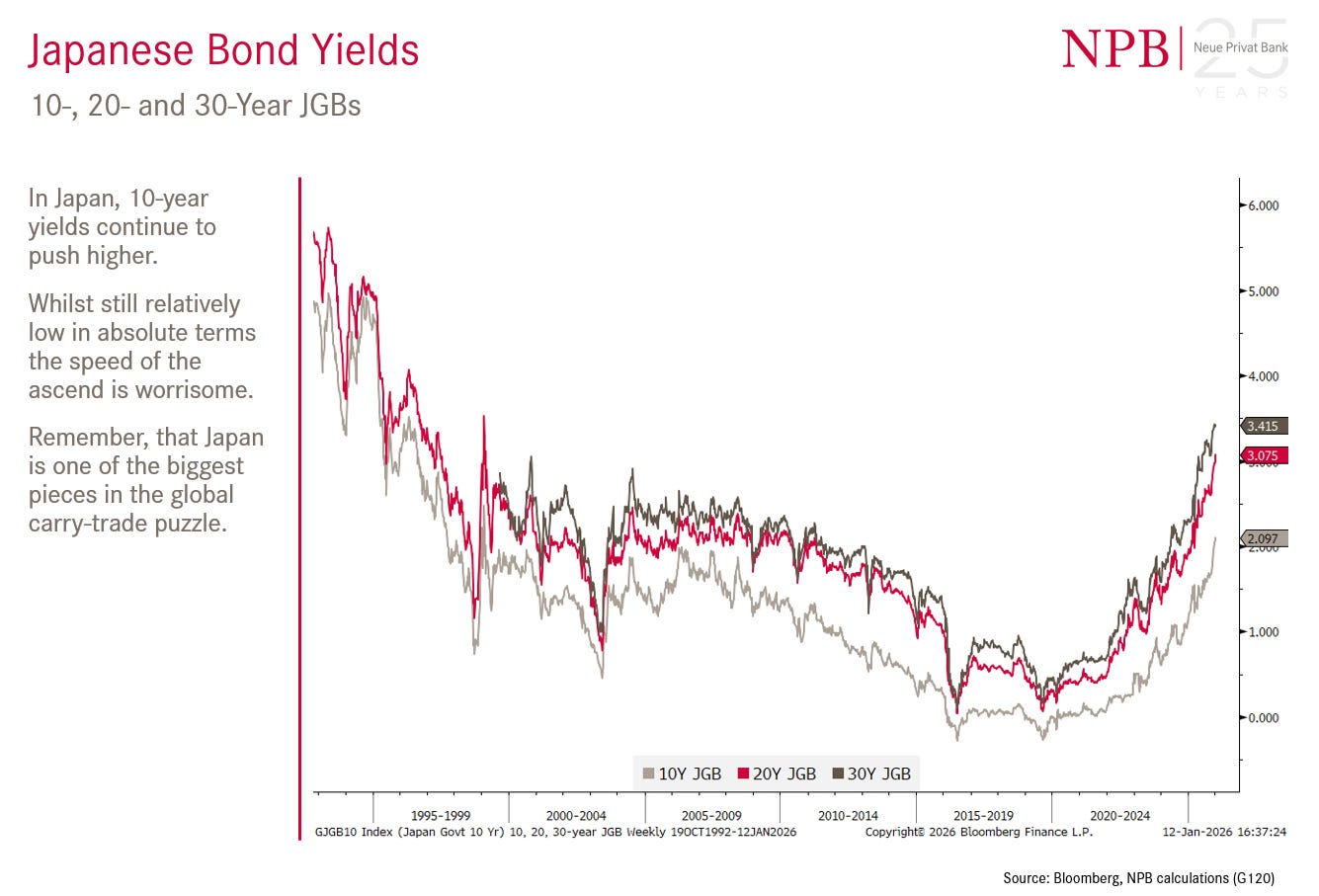

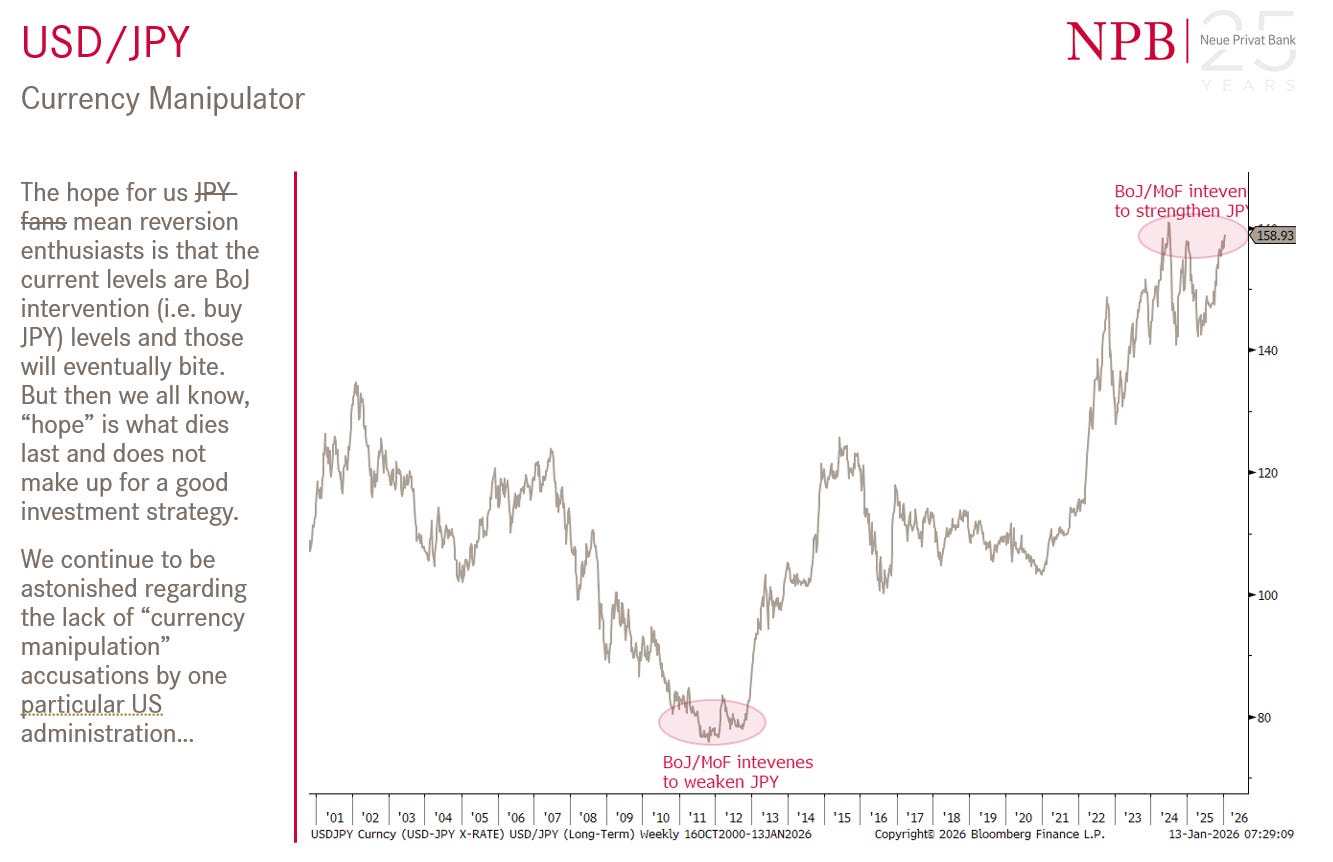

Will the BoJ intervene again?

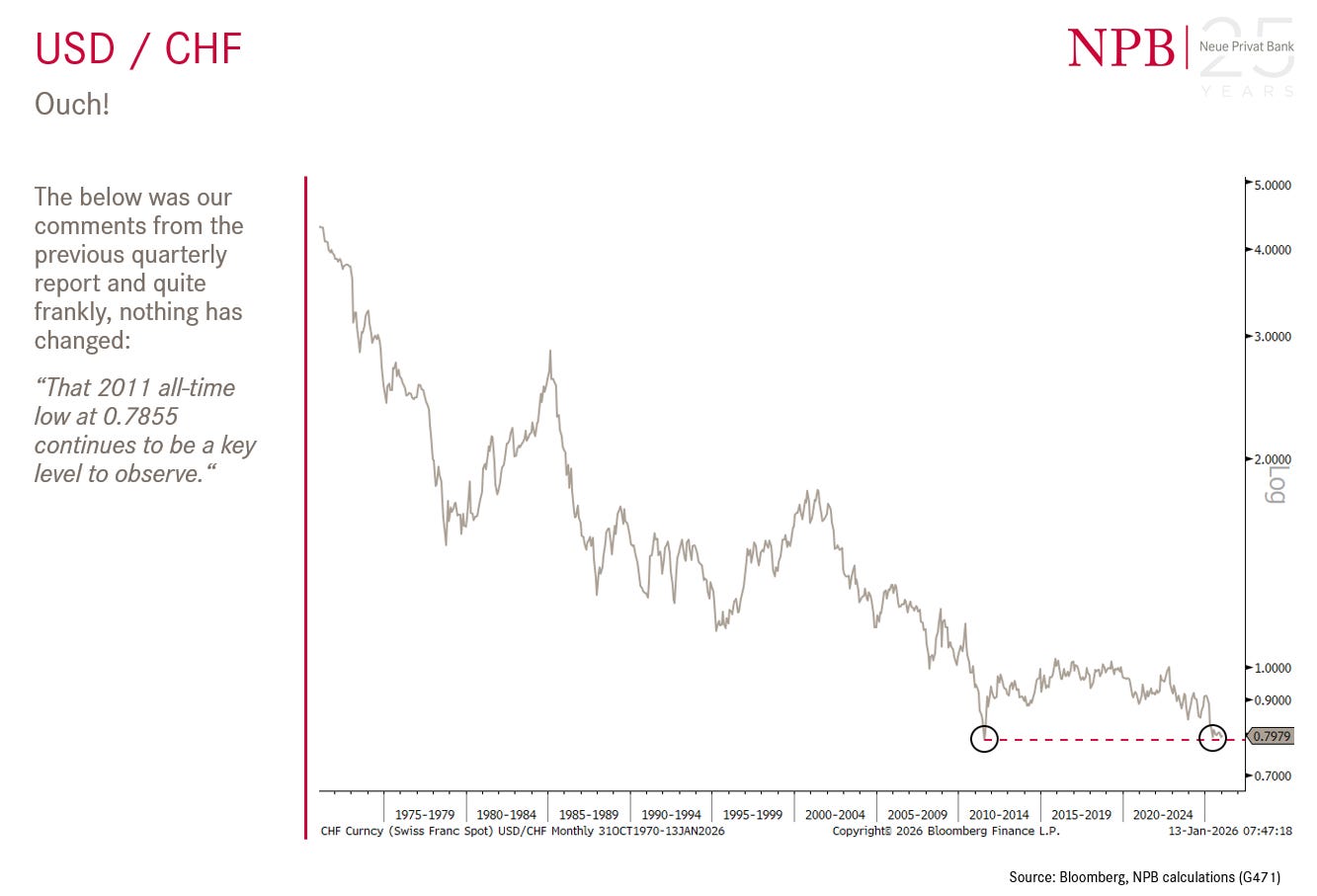

Watch out below!

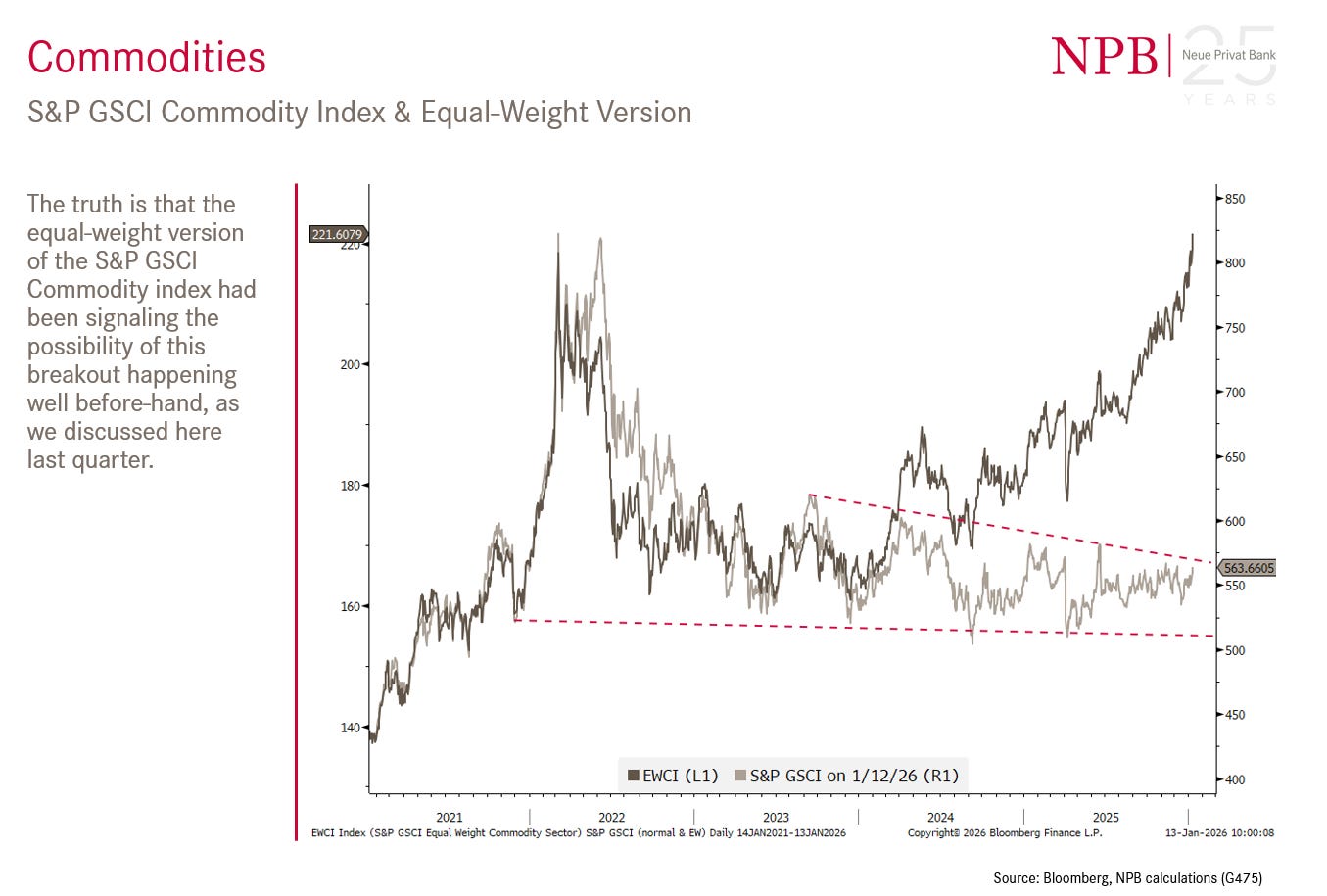

Equal-weight commodity index are showing the way for the weighted versions:

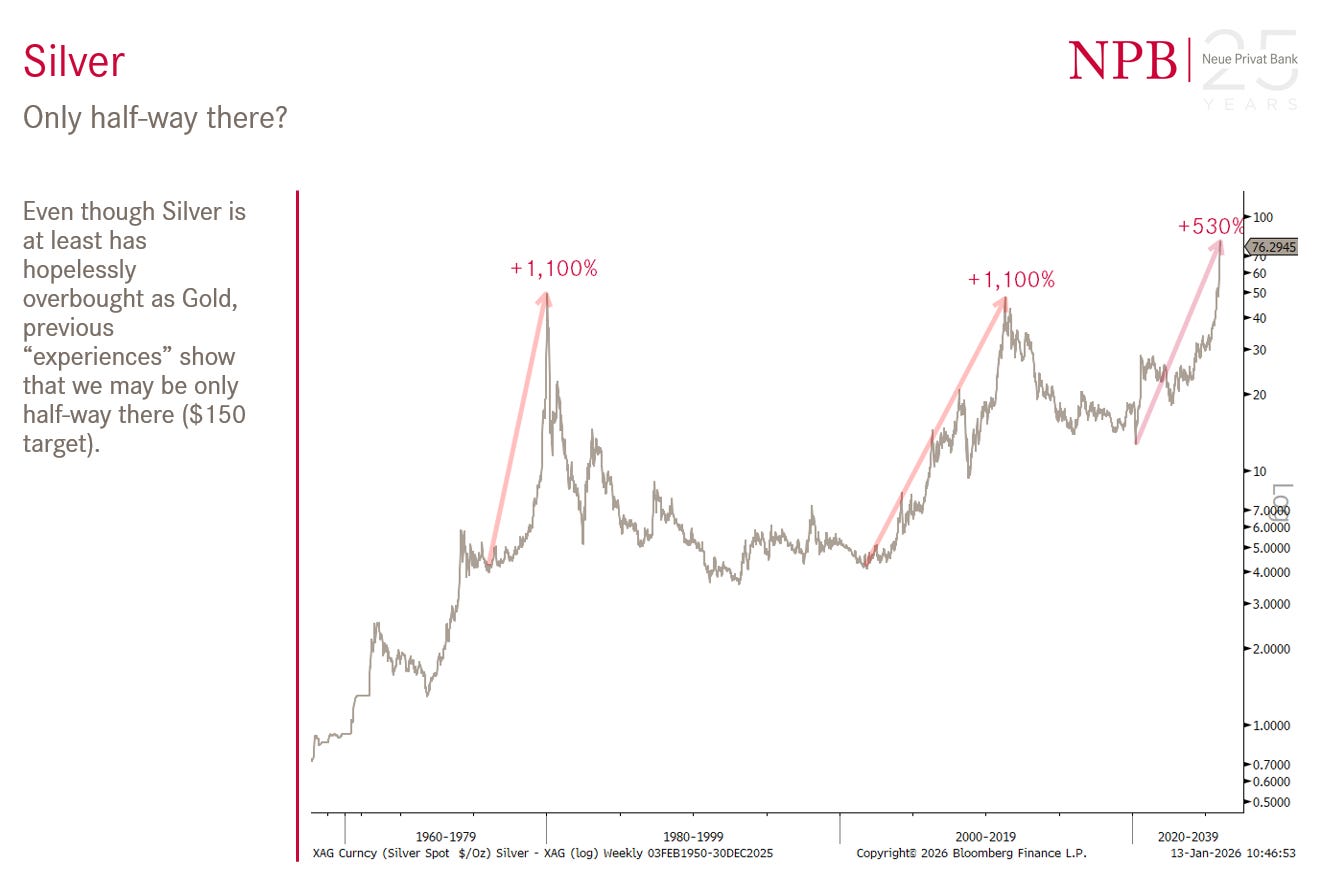

Is the Silver rally really only half-way there?

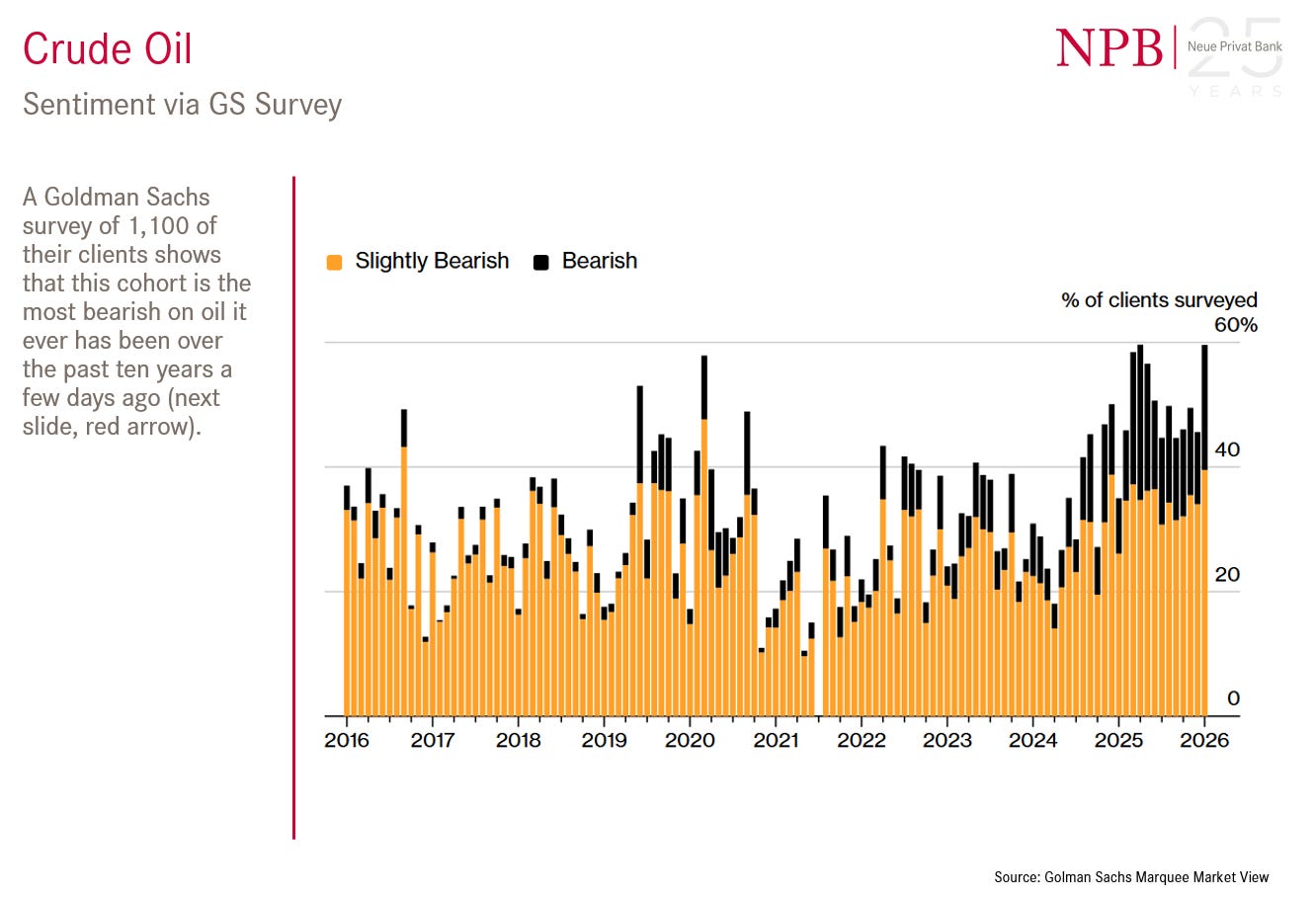

The most hated asset seems to be oil. Time to buy?

Ok, that is it already.

As mentioned, if these little chart book teasers have stirred your apetite, please drop me a line by clicking on the link below, and I will happily send you the copy you deserve:

Take care out there,

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG

![New bug in 41855] Resources reappear in fog of war after they have been depleted - II - Report a Bug - Age of Empires Forum New bug in 41855] Resources reappear in fog of war after they have been depleted - II - Report a Bug - Age of Empires Forum](https://substackcdn.com/image/fetch/$s_!p0em!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F8b078de3-a67c-4dfd-830b-f4fab403ddbb_737x461.gif)