AI! AI! AI!

Vol VIII, Issue 4 | Powered by NPB Neue Privat Bank AG

“If you do not expect the unexpected, you will not find it, for it is not to be reached by search or trail.”

— Heraclitus

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Due to market events I had to rewrite parts and truncate today’s Quotedian somewhat. For any incoherences I apologies upfront. We will be back with the usual quality and extent you learned to love next week, when we will review that January Barometer.

One down, 207 to go. Weeks of US President Trump’s second term, that is. If only the next 207 weeks will be as eventful as the first one just gone by … a heaven for traders and macro investors (us). May Trump never become a lame duck!

Albeit, given his gung-ho approach, risks are elevated. As usual, nothing here should be considered politically motivated.

But, today, Trump’s show has been stolen by the release of a Chinese version of a LLM (i.e. ChatGPT) called DeepSeek. Wait! One sec! Trump inaugauration on Monday and a Chinese LLM released on Friday? Coincidence anyone?

Overall, it was a great week for equities,

though Friday left a negative taste in investors’ collective mouth and futures are trading in deep red this early Monday morning:

Especially the Nasdaq is down nearly three percent, with the main culprit, as mentioned above, likely being the announcement/launch of AI-LLM and ChatGPT challenger DeepSeek.

The whole gist of DeepSeek is that it was built by a Chinese laboratory at a much lower cost (<$5 million) than other LLM-apps and above all, NOT on the newest Nvidia-built chips available. This is raising a red flag on overvalued chip companies and also regarding the true capex necessary to build out data centres.

This is what the Nasdaq futures chart looks like this Monday morning:

Nothing is broken YET, but a drop below 20,900 would mean we should take some chips of the table (pun fully intended).

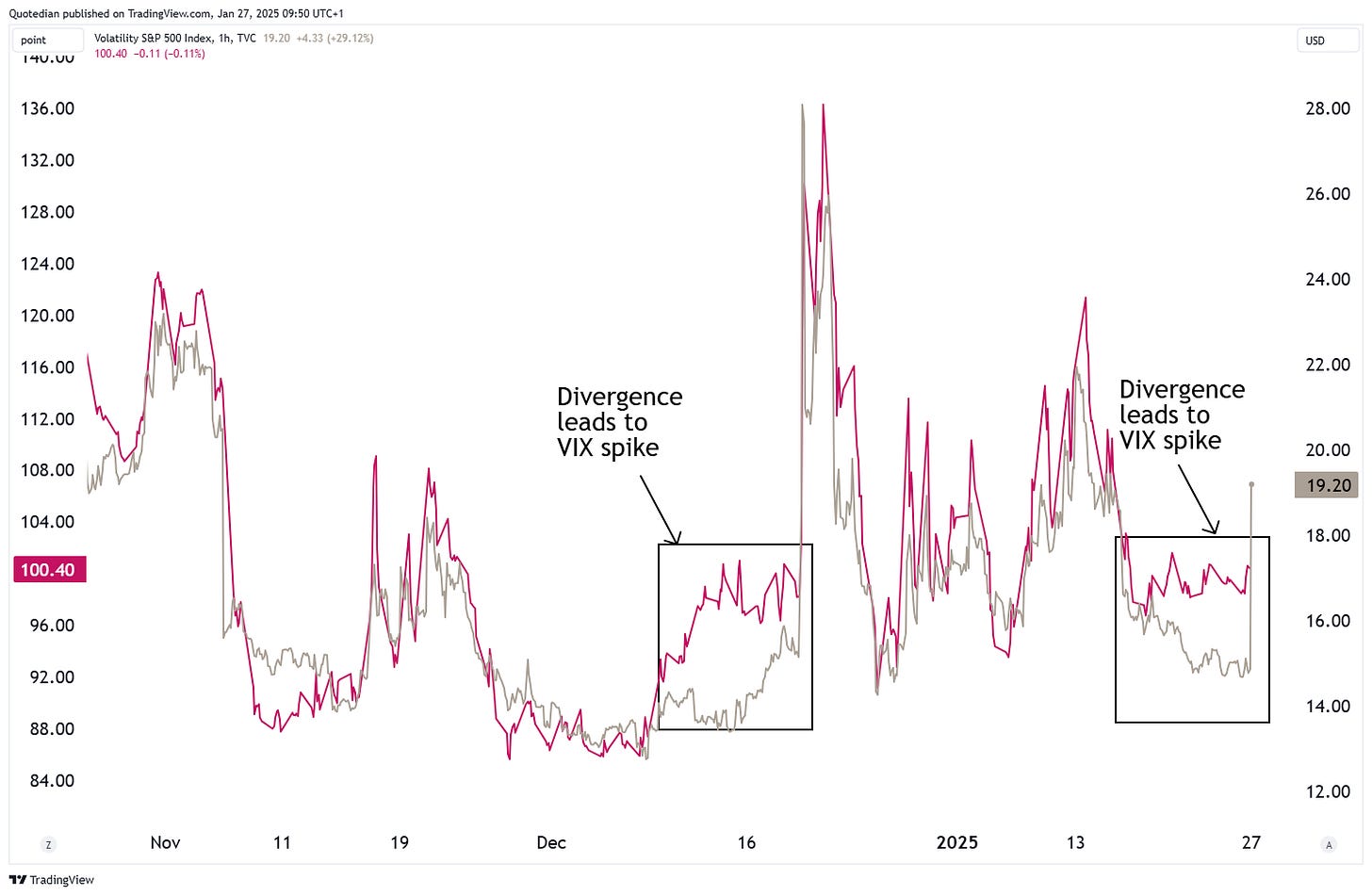

Vol of Vol (VVIX - red line) had been signalling with a divergence from ‘normal’ volatility (VIX - grey line) for a few days now that something may be afoot:

Which reminds of the timeless saying of: “Buy protection when you can, not when you have to…”. Here’s the VIX on a standalone basis:

Let’s see where the current spike ends - my guess is well above 20.

Back to last week, which saw the S&P 500 rallying each and every day after Trump’s inauguration, except Friday:

However, this very bullish looking chart, which includes a weekly close at a new all-time high, suddenly looks much less constructive this early and grey Monday morning when looking at the Futures (ES):

European stocks, which finally, finally broke out to new cycle highs, are also facing some ugly reversal this morning. Here’s the narrow EURO STOXX 50 index:

As long previous resistance now turned support at 5,100 holds, the bulls keep the upper hand.

The broader STOXX 600 Europe index is already challenging support:

One market that is (relatively) shining during this mornings reversal is Switzerland’s ‘defensive’ SMI, up on the day (at lunchtime):

Asian markets held up relatively well during their first session of the week, though index futures are now also showing accelerated losses post-closing.

Here’s the Nikkei for example:

Our downgrade of the Indian market to Neutral at the beginning of the year seems very timely now:

Our price target on the BSE500 remains below 30,000, so there could be close to 10% more downside:

Maybe this DeepSeek announcement is the excuse for the market finally to correct more meaningfully, with the YOLO, FOMO and 0DTE folks for once not trying to catch that proverbial knife … maybe.

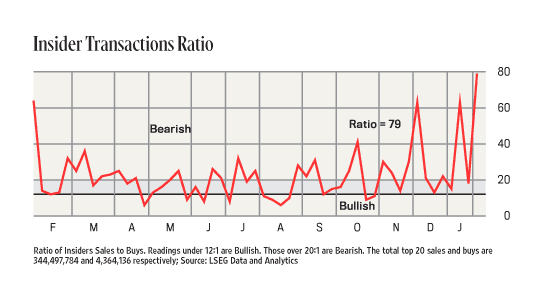

Sentiment definitely has been frothy for a while now and interestingly enough, company insiders have been increasing their sales recently:

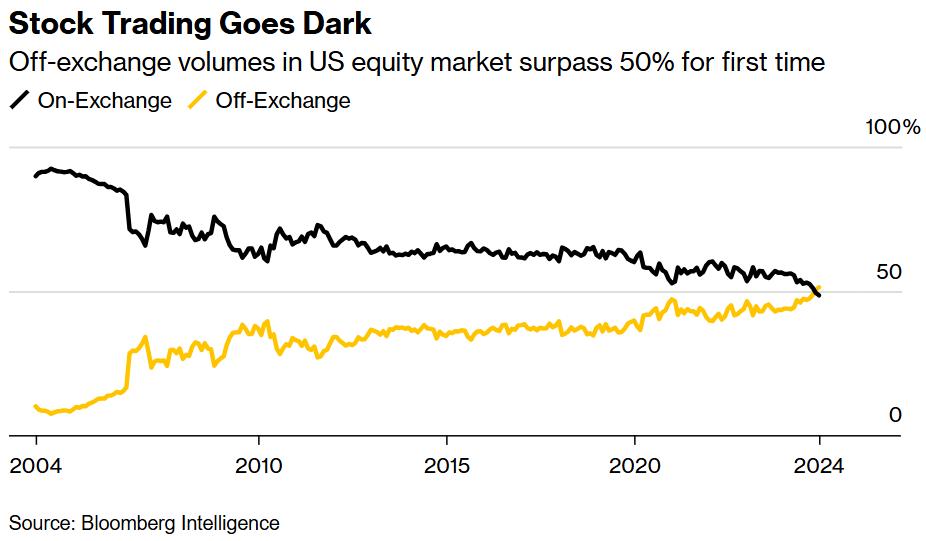

Also of interest was an article on Bloomberg last week, which showed that more trading takes now place off the exchanges (dark pools, market makers, etc) than on the exchanges:

Another way to interpret that reading is that trading in stocks below $1 is often handled internally by market-making giants like Citadel Securities and Virtu Financial.takes place. Stocks with a price of less than a buck are typically stocks traded by retail investors. Hence, the recent surge in off-exchange trading can be interpreted as another part of the speculative, get-rich-quick frenzy. And now add all the shitcoin altcoin trading and you have yourself a nice little mania …

Bond markets are experiencing some safe-haven buying this early Monday, with the US 10-year treasury yield back down at 4.50%:

This translates into about a one percent jump in the 10-Year Treasury Bond Futures:

European yields, below proxied by the German 10-year Bund, are down to a similar degree as their US cousin:

Credit spreads (CDX US High Yield) below are reacting to the upside, given the sell-off in equities today:

But of course in the bigger scheme of matters, “things” could get much worse (same chart again):

The US Dollar topped out two weeks ago and all major currencies are now up versus the Greenback over a fortnight:

The EUR/USD just crossed above 1.05 again and 1.0600 could be easily a first objective for this bounce:

Zooming out, we note the Euro is trying to climb back into its 2-year trading range:

Even the beleaguered British Pound has shown signs of life:

The Swissy is also recovering versus the Dollar:

Should the break out of the uptrend be confirmed at today’s close, the CHF should continue to strength to 0.8930 minimum.

The Dollar-Yen cross is breaking below its immediate uptrend line. This continues to be one of my favourite shorts (USD short, long JPY that is):

Of course, we also have to talk crypto. With the general risk-off mood prevailing today, cryptocurrencies are feeling under the motto “sell what can be easily sold” the heat too:

Albeit, all truth being told, Bitcoin (and many others) is off its intraday low:

In the commodity space, gold challenged its November 2024 all-time high, but was rejected for now:

A break higher is seeming a question of WHEN, not IF …

Silver has also recently recovered above $30, but is ‘miles’ off its cycle high of last November and overall the chart looks much less bullish than the one of Gold above:

Little change on the price of crude oil, which seems to be of less focus currently:

Nat Gas however is down big time (-6%) today. Is it also part of the wider AI-trade?

With that we shall end this week’s Quotedian. Again apologies for a bit a volatile writing style today - simply had to adjust to the current market environment.

André

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance