An ARM and a leg

The Quotedian - Vol VI, Issue 70 | Powered by NPB Neue Privat Bank AG

“An IPO is like a negotiated transaction – the seller chooses when to come public – and it’s unlikely to be a time that’s favourable to you.”

— Warren Buffet

Actually, despite the cartoon above, today’s introductory subject is not oil (we already know, we are bullish), but rather last week’s IPO (Initial Public Offering) of chip-designing company ARM Holdings in particular and IPOs in general. We discuss the latter here and ARM in the COTD section.

ARM’s re-IPO last week raised hope that the market for the listing of new companies would start picking up again, after it has been a shadow of itself since last year:

However, be careful what you wish for, as they say. Or put in other words, be careful in what group you are for wishing. I.e., if you are an investment banker in charge of bringing private companies public, you of course want the good old days of 2020 and 2021 coming back, as your 'gain’ is fees from selling those companies. However, if you are an investor, you may want to consider the chart below first, before investing your hard-earned money in investment bankers initial public offerings:

The red line is the Renaissance IPO ETF which does what is written on the tin and the grey line is the SPDR S&P 500 ETF (aka Spider). Not a great track record… Of course, I have slightly dramatized the picture by carefully choosing the time period under observation, but even zooming out to the whole history of data available, there is little in favour of being an IPO investor:

OF COURSE, is the principal and noble intention of a company to raise capital in order to grow and handsomely reward future shareholders. On the most miserable cynics amongst us would think that a company owner may sell to the public because he thinks his company is too dearly valued … Now go and read the QOTD again.

Looking for decent, applicable, and non-hyped investment advice?

Contact us at ahuwiler@npb-bank.ch

On to yesterday’s market action …

Nothing happened. Zip. Zilch. Nada.

Done.

Ok, as we’re here anyway, let’s make the effort and look at a couple of things, but indeed it seems the market has gone in full pre-FOMC mode already on Monday, with no change expected anyway for US monetary policy on Wednesday.

The biggest intraday move for the S&P 500 came from the intraday lows shortly after the opening bell to the intraday highs around NY lunchtime and was only 0.50%:

The index closed the day 3.2 points or 0.07% higher …

The move was so small it obviously did not move the needle on the daily chart, where the index continues to be stuck quite precisely midway between our two lines in the sand:

Out of the eleven sectors, six were up, five were down:

And guess what? The ratio of advancing to declining stocks was 1.15, i.e., extremely balanced.

Nothing happened. Zip. Zilch. Nada.

We could argue that the European session was a bit more exciting with a 1% retreat of the STOXX 600 Europe index, but in fact, this was just playing catch-up with US stocks which dove on Friday after we Europeans were already on the third drink in our happy hour.

Asian stocks this morning are a sea of red, as crude oil (Brent) hit its highest since January at $95, once again lifting fears that central banks around the globe may be far from stopping to hike rates. As Yogi Berra would say: “It’s deja vu all over again”…

As mentioned, it is FOMC week and the Fed's decision not to move key policy rates is due on Wednesday afternoon. Here is the implied probability for a hike this week, deduced via Fed Fund Futures:

You cannot see it, but the probability is 0.8%.

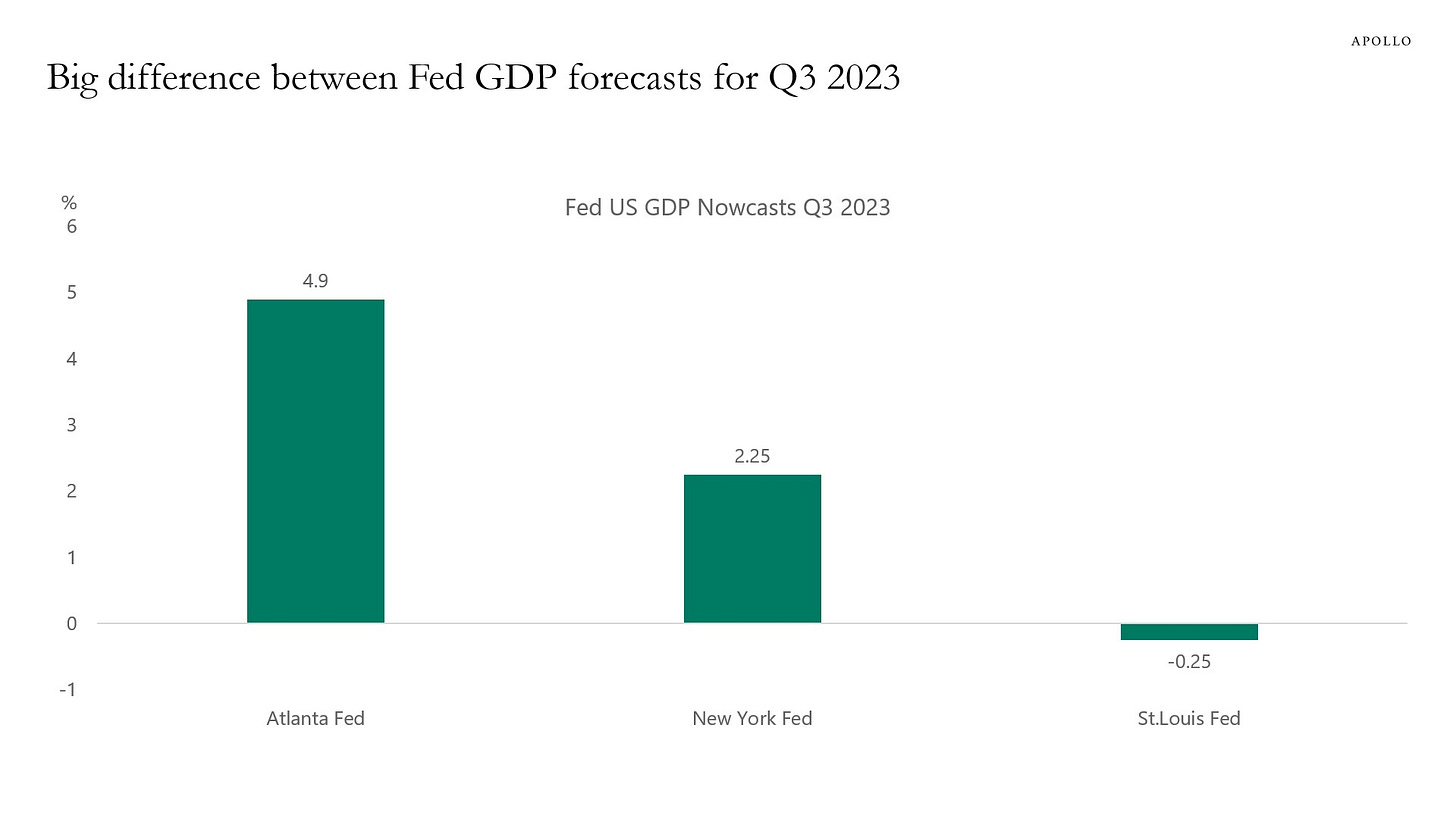

And no wonder futures markets are not pricing anything specific in - the data has been/is very confusing. Consider this chart of three different GDPNowcasts from three regional federal reserve banks:

The Atlanta Fed sees strong growth, New York says it is muddle through and St. Louis puts the US economy into a recession already… No wonder everybody is confused.

But let me put up the following chart of “yields around the globe”, which to me leaves little doubt where this is heading to:

To finish the rates section, just a quick reminder that the Fed is not the only central bank announcing their monetary policy this year, but is joined by several other CBs too: Norges, SNB, Boe, BoJ, Riksbank

Really nothing to write back home from the currency front either, where the EUR/USD continues to fight around a key support zone:

Aahhh, finally a market pocket with some movement!

Let’s start with Gold.

With three decent back-to-back up sessions, the gold chart suddenly looks pretty constructive again:

Thinking about it, even though the past months have been frustrating to any gold bug, given the strength of the US Dollar and the sharp upmove in US real yields, the yellow metal has “hung on up there” with dignity:

Maybe the time has come to play gold and silver mining stocks again. Here’s the chart of the PHLX Gold and Silver Index (XAU):

On a clearer break, we may add this to our trade gallery ;-)

And then there’s energy/oil of course, which continues to go from strength to strength. Here’s the Brent version:

At the same time that oil is creeping higher, oil volatility is actually receding, which is a good prerequisite for higher prices yet:

I think I do not have to repeat my bullishness on the black gold and related energy stocks.

Ok, time to hit the send button. Enjoy your Tuesday and remember that we are in one of the weakest periods for stock returns as measured since 1950:

André

Back during my time at a Geneva-based private bank on a rocky place in the Mediterranean, I looked after a bunch of GBP-denominated portfolios, many of them carrying individual stock picks.

One of the “safest” bets for good upside potential always was ARM Holding, then listed on the LSE. It was my darling stock during the early 2000’s, not unlike NVDA (now and then). And then came Masayoshi Son from Softbank and swallowed the company - good on him, shame for the rest of us.

Now, as we know, Masayoshi Son has decided to give part (10%) of the company back to the public last week, and the stock shot up 20% on the first trading day.

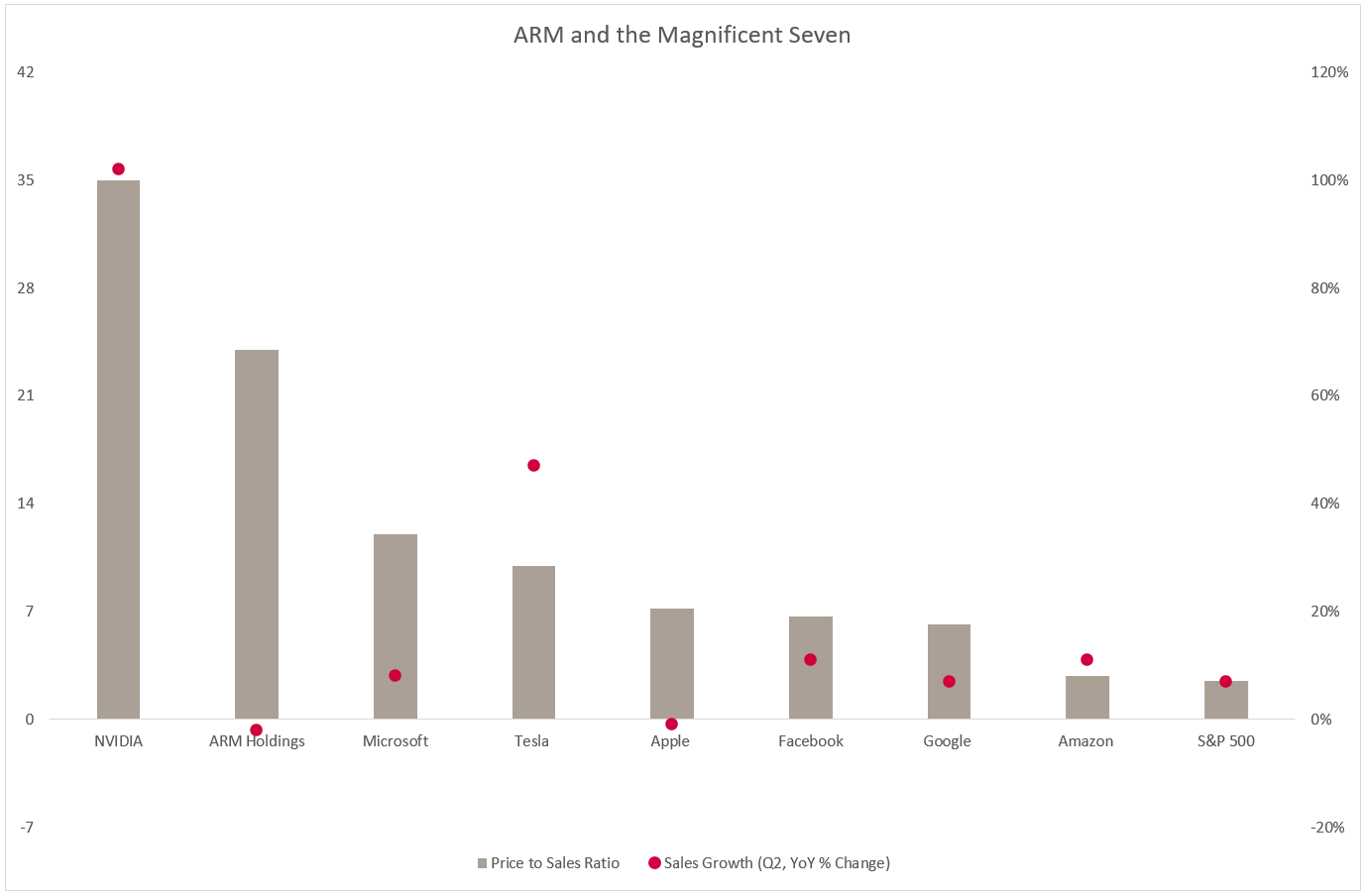

This rally could be explained (but not justified) due to the small float of the stock and many participants’ eagerness to get a piece of the pie. But looking at today’s COTD, which shows ARM, the Magnificant Seven, and the S&P 500, we note a very high valuation (Price/Sales - grey bars) and relatively mediocre growth (Revenue Growth - red dots) for ARM in comparison:

Buying ARM here seems to cost an ARM and a leg. Caveat Emptor!

Still beta …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance