AY AI!

The Quotedian - Vol VI, Issue 49 | Powered by NPB Neue Privat Bank AG

“I visualise a time when we will be to robots what dogs are to humans, and I’m rooting for the machines.”

— Claude Shannon

DASHBOARD

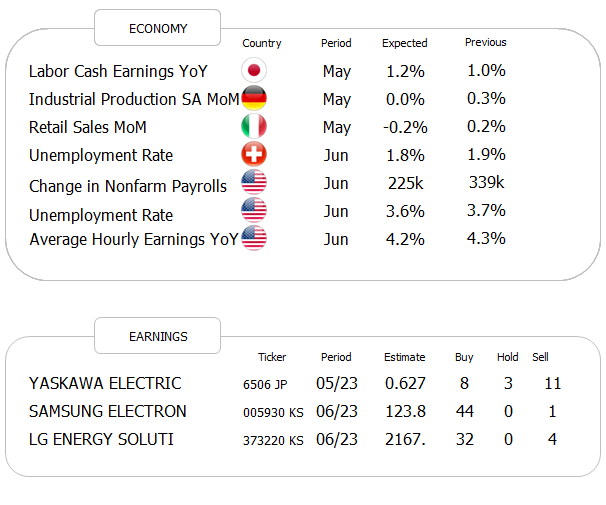

AGENDA

CROSS-ASSET DELIBERATIONS

**Housekeeping**

This is only the second (and kind of last) Quotedian of the week. After Monday’s monstrous end-of-month, end-of-quarter and end-of-half-year report I thought I give you a couple of days to recover. The lack of publishing had hence absolutely nothing to do with a too-busy schedule … ;-)

Most of today’s letter is written before market close, which is dangerous, as fast-moving markets can change in a split second.

Nevertheless, I have the feeling that the trends which started to set in after yesterday’s (Wednesday) and accelerated during Thursday’s session are likely to persist into the closing.

But let’s roll back …

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Contact us at info@npb-bank.ch

During Wednesday’s session, the Fed released the minutes from their last FOMC meeting, where they had decided to pause (or skip) the current hiking cycle. However, in the ensuing press conference, Fed Boss Powell sounded pretty hawkish and as recently as last week he affirmed two more rate hikes by year-end. The market didn’t seem to care and neither did US stocks last night after the release of the minutes where all of the above was simply confirmed yet once again.

But, for some reason, which as usual nobody can really put his finger on, Asia decided to sell off on Thursday morning, led by a three percent drop in Hong Kong’s Hang Seng index:

Europe equally traded in negative territory until the release of ADP Employment data, which serves as kind of “canary in the coal mine” for Friday’s non-farm payroll data.

Here’s what ADP reported:

Previous: 278k

Expected: 225k

Reported: 497k!!!!

The trend acceleration upon data release is well visible on the STOXX 600 intraday chart:

Hence, the S&P 500 opened an hour after the data release sharply lower too, continued to drop right to the European closing bell and then … started recovering!

Bond yields (small spoiler alert) of course jumped heftily on the back of the strong job data (strong economy = Fed pivot pushed further out in time), with the 2-year Treasury up 17 basis points (believe me, that’s massive for a half an hour move) right after the numbers release.

Now, armed with that knowledge, we turn back to equity and of course deduct that the weakest sector must have been long-duration technology stocks, right?

Well, I am sure that one day, in a galaxy far, far away it will make sense …

Maybe the market heat map of the S&P 500 will give us a clue on what’s going on:

Indeed, a first conclusion would be that similar to recent occasions, investors prefer the largest tech- and capitalized stocks (Apple & Microsoft) as safe-haven investments over treasury bonds. This leads me to exhale a completely non-judgemental:

This early Friday morning, Asian markets generally trade softer, with the Hang Seng down about 1% and the Topix half of that as this publication goes to “print”.

European equity futures point to a slightly stronger start to the cash session - after our market once again got spoofed by Wall Street …

As mentioned further up, yields spiked upon the release of the ADP number, but that was not quite the end of the ‘drama’, as rates gave back nearly half the gains in the afternoon session. Here’s the intraday chart of the US10-year yield:

The same asset on the daily chart has now clearly broken out of its nearly 1-year consolidation range:

This, from a technical analysis point of view, has bullish (bearish) implications for yields (prices).

I will cut short here today, as I am off to a really early appointment. Today’s focus will be on the Non-Farm Payroll in the US - nothing else matters :-)

Have a great weekend!

André

CHART OF THE DAY

Did you know there already is an ETF for generative AI? No?! Well, now you do!

Under the ticker CHAT (another ingenious marketing specialist shining brightly…), you get to ‘passively’ invest with one holding in following companies:

insert here

The ETF was launched on May 18th of this year, and guess what happened shortly after the launch?

Correct! It started to underperform (black arrows) the broader market (S&P 500).

Just a blip, or is AI about the face the same destiny as other investments fads, think:

Rare Earth (REMX)

3D printing (PRNT)

Cannabis (POTX)

{insert your favourite failed ETF theme here}

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance