Ay Caramba!

The Quotedian - Vol VI, Issue 67 | Powered by NPB Neue Privat Bank AG

“When America sneezes, the World catches a cold”

— Klemens von Metternich (1773 – 1859)

In chaos theory, the butterfly effect is the sensitive dependence on initial conditions in which a small change in one state of a deterministic nonlinear system can result in large differences in a later state.

Or, simpler, as a Chinese proverb goes:

"The flapping of the wings of a butterfly can be felt on the other side of the world."

We can observe this often in financial markets, where an initial, seemingly unimportant price movement in some small asset suddenly turns into a market tornado. Some examples would include the Flash Crash of 2010 (Dow -1,000 points in minutes), the Swiss Franc Depegging in 2015 (Euro - 30% vs. Swissy in minutes), Brexit Referendum (major market upheaval for weeks) and even the mother of all crises, the GFC, started with some seemingly unimportant subprime mortgage defaults.

One of the most popular carry trades of the past year(s) has been borrowing in Japanese Yen, exchanging those to the Mexican Peso and reinvest there at a higher rate. Since the beginning of September, we have seen quite the sell off in the MXN/USD cross rate,

which all truth being told we had also seen back in March of this year. However, the ‘bleeding’ most stop here, otherwise the JPYMXN carry trade will also further unwind,

possibly creating tornados on the financial globe.

Fearing for your financial assets? We know where to find shelter!

Contact us at ahuwiler@npb-bank.ch

Truthfully, yesterday’s session did not add a whole lot of new knowledge to our task of deciphering financial markets - in other words, it was boring - but let’s have a look at some charts anyway before we head off into our well-deserved weekend.

In many aspects, yesterday’s session was a bit more of the previous day(s).

The S&P 500 traded lower for a third consecutive day, but as on Wednesday was off the session lows by the time the closing bell rang:

Hence, this (possibly important) shoulder-head-shoulder (SHS) topping pattern remains on the cards:

The good thing is, that both key levels to watch are pretty close by and nothing needs to be really done until either gives:

A close above 4,530 (+1.7%) would negate the SHS pattern, and as the saying goes (or at least it does in my mind): “Nothing is as bullish as a failed bearish pattern”

A close below the neckline at 4,360 (-2%) would trigger the SHS pattern target at 4,100ish.

Easy.

Back to yesterday’s session. Breadth was a tad better than the previous day, even though the advance-decline ratio, remained close to 2:3, with most index points lost seemingly coming from heavyweights Apple and Nvidia:

As compared to Wednesday, when only two out of the eleven sectors printed green, yesterday saw five sectors advancing:

HOWEVER, have another look at that table above. At least three out of those five advancing sectors are of defensive nature, suggesting that maybe some rotation into lower beta segments of the market is taking place.

Indeed were low vola stocks the best performing factor in the S&P yesterday:

One day does not make for a drama, but let’s keep an eye on it.

Asian markets this early Friday are also repeating their previous day’s template, with indices falling across the region, with the (usual) exception of Indian stocks. In other news, Hong Kong scrapped Friday’s trading due to a rainstorm alert…

Looking ahead to our session, index futures are trading mixed, with the possibility of slightly higher markets when cash trading begins at 9 am CET.

Yields, after trading flattish for most of the day, came under pressure towards the end of the US session and continued to weaken in the early hours of Friday. Here’s the US 10-year yield for example:

Not sure if this slide in yield was provoked by some Fedspeak, where Lorie Logan said skipping an interest rate hike at the upcoming meeting may be appropriate (though she also signaled rates may have to rise further to get inflation back to 2%.). However, it DID have seemingly a positive impact on European and US equity index futures as described above.

European rates are also trading a bit lower this morning, with the market not clear if the ECB will hike next week or wait until the meeting after.

Nothing to report back from the credit risk side of fixed income, where credit spreads continue to trade largely non-directional:

In currency market, the US Dollar stalled a bit on its recent gains, though a ‘pause’ here should come as no surprise, given the advance of 5% since the July low and the 2% gain since beginning of this month for the US Dollar Index (DXY):

Especially on the EUR/USD cross-rate we are at a pretty convenient place for a consolidation of recent Dollar gains:

Paradoxically the US Dollar ‘weakness’ yesterday did not help oil (which is quoted in USD) to advance further; quite to the contrary crude prices reversed in tandem, with Brent falling below the $90 level again:

But then, that probably makes sense, given that oil advanced 25% during the same time that the Greenback gained 5%…

Let’s keep it shorter today, with time to hit the send button having come upon us at a fast pace.

You make sure to enjoy your weekend and tune back in next week!

André

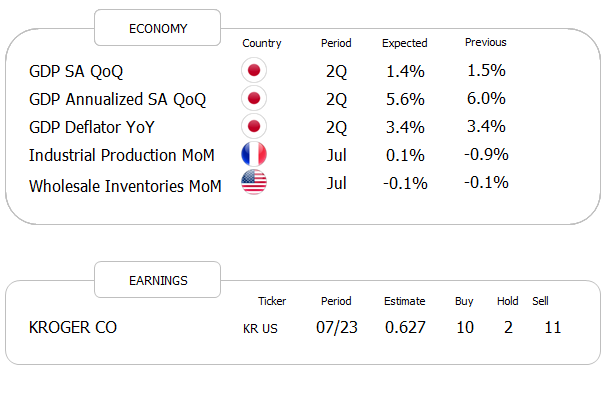

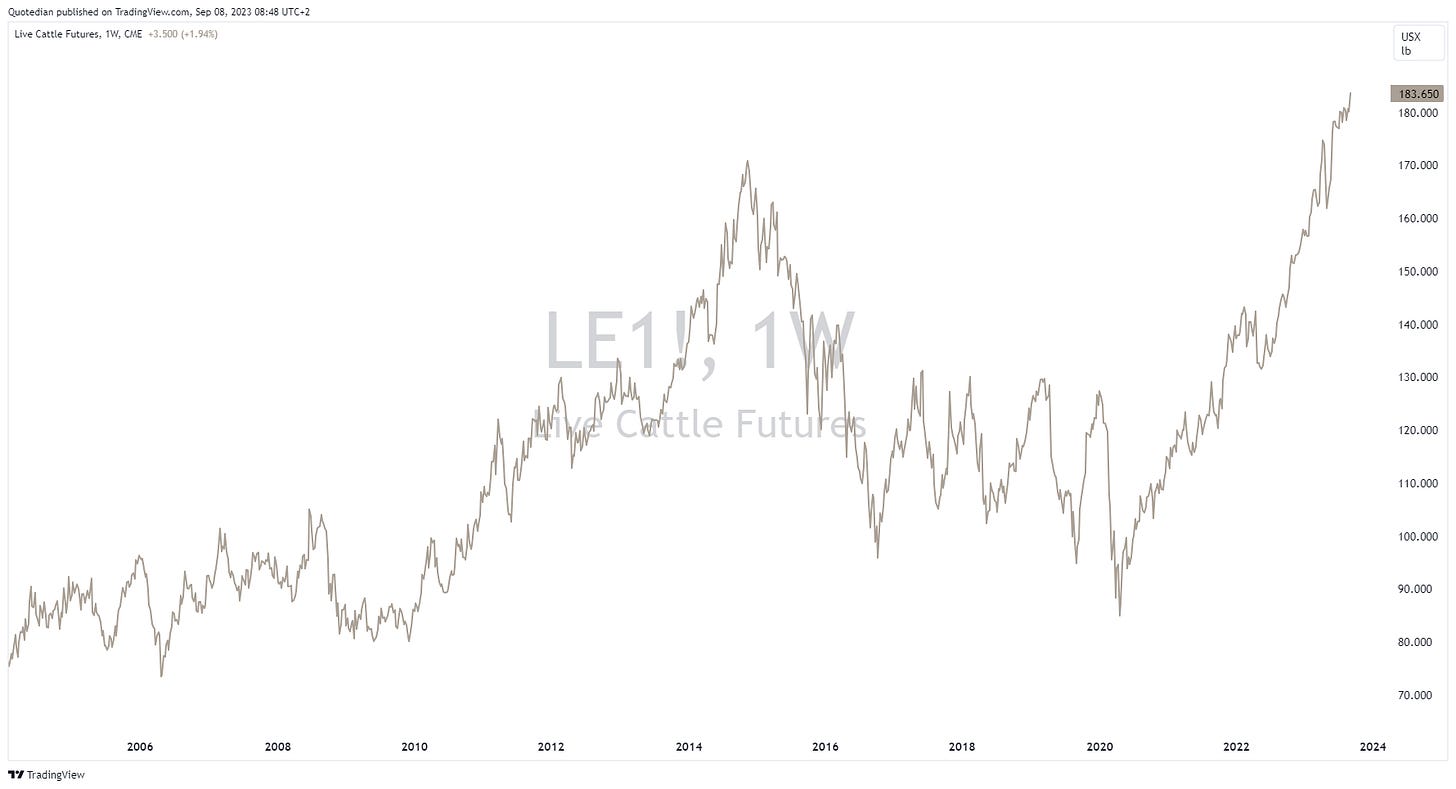

I am pretty bullish on commodities in general, energy and ags in particular.

Now, frozen orange juice and live cattle or not really in the agricultural commodity subindex, but the run up in both has been impressive and they both continue to hit all-time highs after all-time high.

Stay tuned …

Next week, promised…

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance