Back from Break

The Quotedian - Volume V, Issue 87

“Fall in love with people, children, and dogs, but not stocks.”

— Barton Biggs

DASHBOARD

CALENDAR

CROSS-ASSET DELIBERATIONS

Housekeeping:

Please note that you can click on any of the graphs for better readability, independent from the platform you use for reading (smartphones, tablets, PCs, etc.)

Never be shy to leave a comment in the predestined comment section

If you like The Quotedian, show your love by pressing the like button

After a three-day hiatus, I take today as an opportunity to do a little chart speed-round, just to get back into the groove.

Starting with equities, I observe that our dead cat is still bouncing and has further room to do so. We had already identified last week that the 50- and the 200-day moving average are the most obvious targets for this bear market rally:

Despite the significant advances since the June 16th bottom, the short-term arrows are still pointing downwards, given the steepness of the previous decline. I would be poised to think that the rally has some more leg, especially for the next three sessions, as quarter-end rebalancing could further fuel the short-squeeze. Friday will be more challenging then, with a new month/quarter starting and the US heading into a long weekend (4th July).

One point of caution to the current rally (even though it could surprise to the upside, to lure back in many now frightened investors) is that high yield bonds (HYG) are not really following stocks (SPY) higher. This was also a lacking feature in the March equity rally:

One “headline” captured my attention in yesterday’s session:

Former high-flying tech names Meta, Netflix, PayPal, and Zoom, have become value stocks as of today…joining the Russell 1000 Value Index.

More on this in the COTD section.

But the real news from yesterday’s session is probably that the S&P 500 traded in a one-percent range for the first time since April:

Asian equity markets are mixed this early Tuesday, though the overall regional index is printing green as are equity futures on European and US indices.

Moving into bonds, I was watching the musical “TINA” in Madrid on Sunday, which of course reminded me that now suddenly there are some alternatives to stocks as yields have been constantly rising.

Of course are (US) yields off their recent highs, but using a very thick crayon to paint the support line, one could argue that it has not yet broken the previous resistance now turned support at around 3.10ish:

Though in reality, yields can drop all the way back to 2.70% and the secular uptrend would still be far from being in danger.

Similarly, German yields are off their highs, but continue to deliver a very bullish (for yields) picture:

Talking Europe, corporate investment grade spreads are trading at their widest since the Sovereign Debt crisis (if excluding the panic moment during the COVID crisis), a sign of much investors worry about the continents (industrial?) future:

In currency markets, the Euro continues trying to bravely fight its way higher, thought he move is clearly losing momentum. More than rhetoric is needed on the interest rate side to keep on pushing the currency higher, though sadly a drop below parity is becoming more likely:

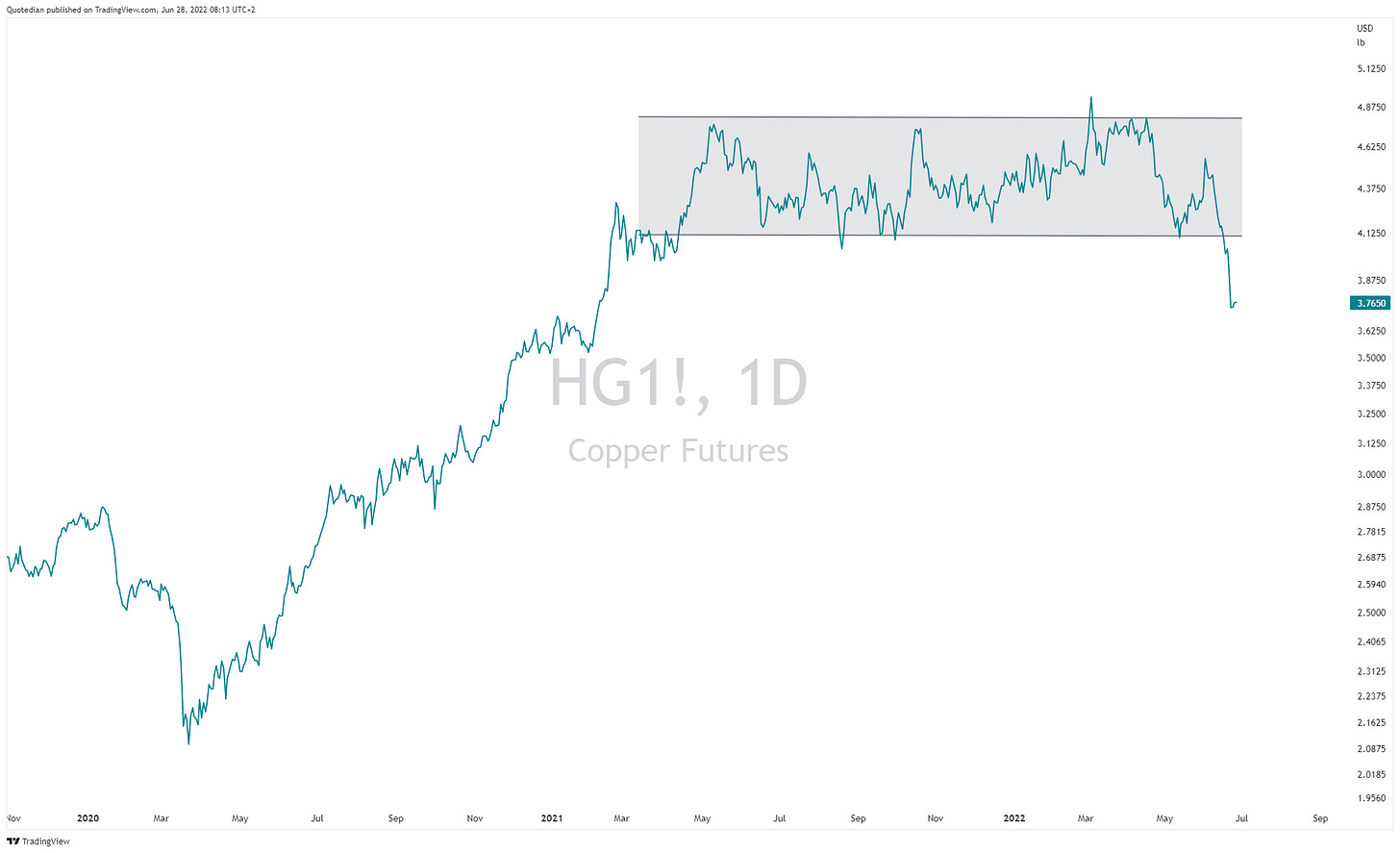

In commodity markets, I am utterly surprised to see Gold trading lower after the G7 proposal on banning Russian gold exports (to be analyzed further). The breakdown of copper out of its trading range was widely commented amongst financial pundits

but not so much the steep sell-off in cotton:

Of course it is structurally less important than copper, but it yet another commodity abandoning (for now) the bull market.

Unfortunately it is time to hit the send button. Back tomorrow!

CHART OF THE DAY

The inclusion of Meta, Netflix, PayPal and Zoom in the Russell 1000 VALUE index took as by mild surprise, but i guess the sell-off has been so brutal that the Price/Book ratios have dropped enough to justify the mechanical inclusion of the previous high-flying tech/growth companies. The Russell 1000 Growth index is still outperforming the Value counterpart by a wide margin (2x), though the ‘advantage’ is quickly shrinking. Stay tuned …