Bear Bank Run

The Quotedian - Vol VI, Issue 16 | Powered by Neue Privat Bank AG

QOTD

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Just a real quick Quotedian, a quickie so to say, after yesterday’s run on bank stocks.

The S&P 500 tanked close to two percent and here’s the index’s heat map:

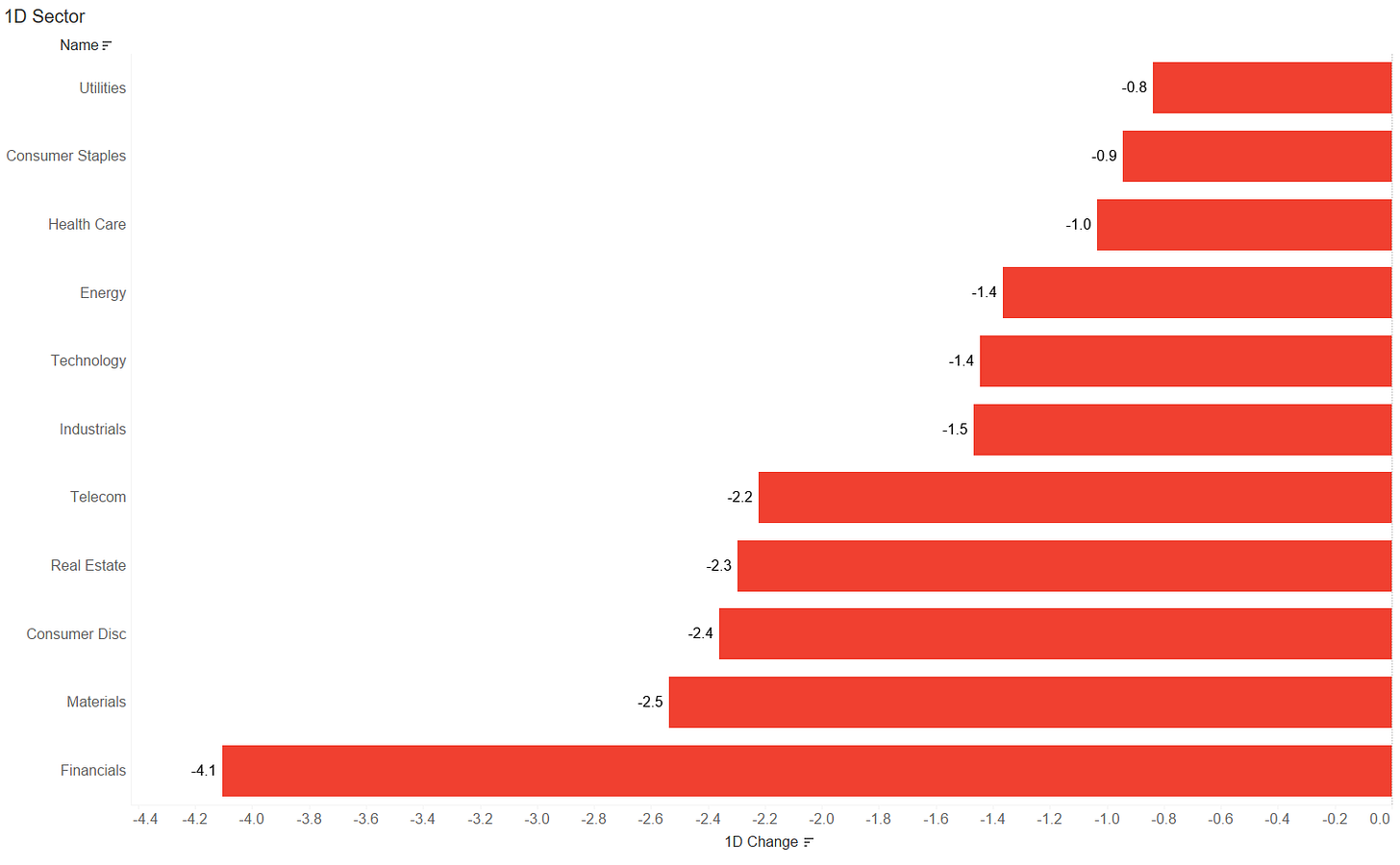

Not a nice picture, but the US sector performance quickly reveals where the real pain was taking place:

In other words, a dedicated banking index such as the KBW index, saw it’s worst day since October 2020:

So what triggered this bank run? I would say there where several smaller detonations followed by a big bang event during yesterday’s session.

It started with Silvergate Capital, a smaller sized bank, strongly exposed to the cryptocurrency market. The stock had been down already 98%(!) before announcing, in short, that they are closing shop. That did not keep the share from dropping another 42%:

Maths are a wonderful thing if you are on the right side of them.

Then beleaguered Credit Suisse announced that they had a small delay in releasing their results due to a SEC request … go figure.

The stock was down over 6% at some stage during Thursday’s session, but then recovered most losses to end down 2% ‘only’:

But then the “Big Bang” came via a US bank SVB Financial, a Silicon Valley based lender, announced a shock capital increase and their shares plunged 60%:

As the name would imply, does the bank mainly lend to the VC/PE world, and the announcement was somehow equal to that 500-pound Gorilla in the room that nobody wanted to address…

The good old Quotedian, now powered by Neue Privat Bank AG

Today, Asian indices obviously are feeling some heat

though European indices are down relatively ‘small’ only.

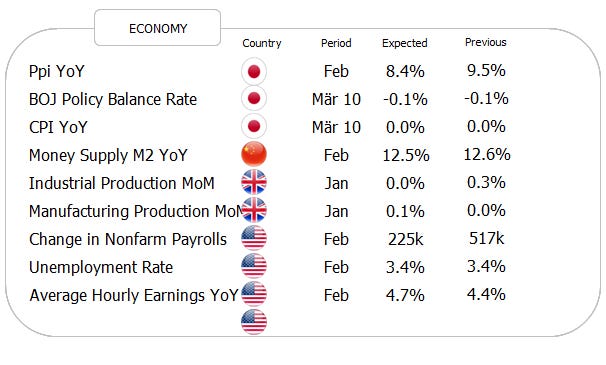

One news on today’s agenda that lost a lot of its thunder due to the banking woes, was Kuroda’s last BoJ meeting as governor of the same instituition. The bank unsurprisingly left monetary policy unchanged - focus is now on the next meeting with newly incoming Kazuo Uedo replacing Kuroda.

But one item on today’s agenda that will definitely not drown in amongst other news, is the release of the non-farm payroll number in the US. If other job related numbers, such as weekly jobless claims, ADP or god-knows-what are still ever so slightly correlated to NFP (in other words, if NFP is not too ‘massaged’) than the number should come in weaker than expected with a possible downward revision of last month.

If so, it will be interesting to see the markets reaction. Is bad news (low NFP) equal to good news (Fed stops hiking earlier), or, is bad news (low NFP) bad news, as the market realises where the economy is heading towards (hint: it’s starts with R and ends with ecession).

Anyway, just thought events warranted a brief, 3-minute update. If all goes well, see you on Sunday afternoon!

André

CHART OF THE DAY

European banking stocks (red) finally are about to catch up performance wise with their US peers (grey) on a five year horizon:

But looking at some chart over one year only, maybe there is still a hedge to be done on European banking stocks?

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance