Blitz!

Vol VII, Issue 35 | Powered by NPB Neue Privat Bank AG

“Brevity is the soul of wit.”

— William Shakespeare

No, with Blitz I do not refer to last week’s China (PBOC) monetary stimulus ‘Bazooka’, but rather to the shortness of this Quotedian. And, hand on heart, I should not be writing it, as a) it may provoke a divorce from my wife who just about had it from my long night in-front-of-screen-sessions, b) it may also provoke a divorce from my dog, who is jumping from side to side eager to go for his night walk, c) I am really focused on finalising our Q4 outlook and tactical allocation and finally d) not a snowball’s chance in hell that this Qutoedian will live up to the standards you deserve!

But…

I know that some of you really like these monthly statistical tables, so without much further ado, I will just copy/paste those tables and one or the other monthly chart into the relevant asset class sections below, adding sparse comments only from my side.

No need to hit the ‘Like’ button this time around, just promise me not to unsubscribe!

Teaser: Next Monday we are back in full strength and with one or the other spoiler on our investment strategy.

Below the September (red) and year-to-date (grey) performance of major equity benchmarks around the globe:

After a bumpy start (not dissimilar to August’s), most market recovered well, with the notable exceptions of the UK, Japan and Switzerland amongst a few others. Eye-popping of course the the Hang Seng was catapulted to the top position after a 17.5% September leap, that yet still was eclipsed by the CSI's 21% out-of-this-word jump.

On the daily chart, those 21% look impressive:

The monthly chart gives context however:

Here’s the monthly graph on the almighty S&P 500:

Up every month but one (April) this year is quite the feat! In our Q4 outlook we show a stat that when the S&P was up every quarter in the first three of the year, as it is this year, it was also up in the fourth quarter.

In Europe, the STOXX 600, was not able to put in a new monthly ATH, but it seems to be only a question of time:

Japan’s Nikkei is going through a well-deserved ‘pause’ (aka consolidation) after a fantastic bull run since very early 2023:

Those long shadows highlighted though hint to an extraordinarily volatile intra-month period…

Finally, here’s India’s BSE500, which needs no further comment:

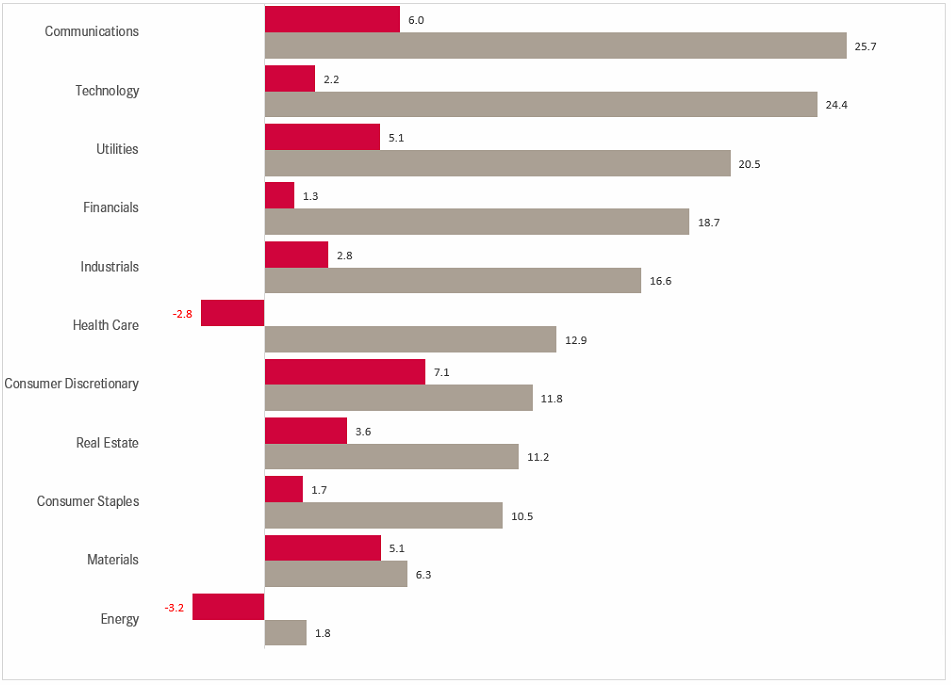

Now, here the performance data of the eleven economic GICS sectors at a global level:

Utilities right behind Comms and Tech is quite the achievement for a sleepy, boring sector! Energy stock definitely did not work so far this year, despite lofty dividend yields and low valuations.

For the total market freaks amongst our readership, here now the factor perfomarnces (US):

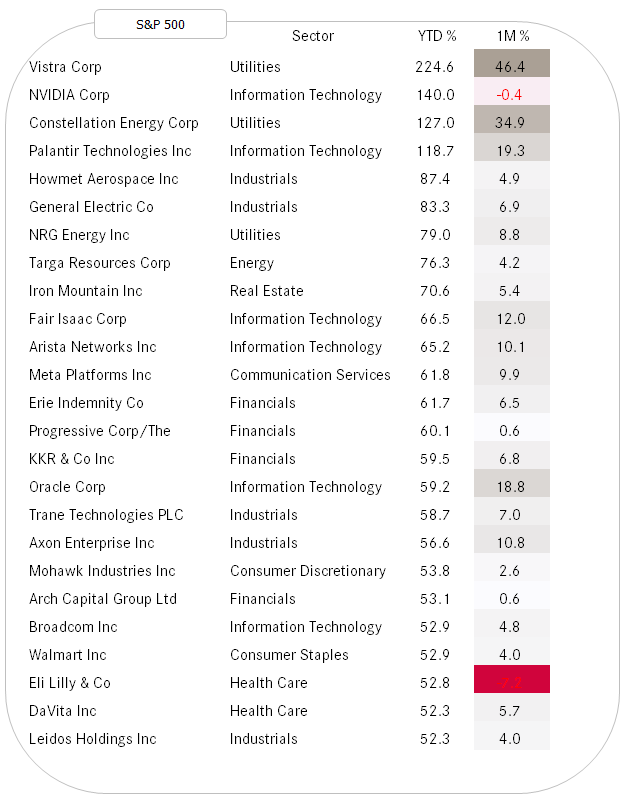

Finally, last but not least, here are the tables of the best performing stocks year-to-date in the US and Europe and how they have done over the past month:

Here are the performance of some of the most important fixed income segments across the globe. Again, red is monthly, grey is year-to-date and everything is sorted top-down by YTD performance:

US yields started the yield at 3.85ish, shot up to 4.50 by April and are back to where they started as I type:

One thing that changed in September is the the US yield curve (10y-2y) is not inverted anymore:

In the FX realm, the USD is roughly back to where it started the year versus the CHF and the EUR, but is surprisingly so still up YTD versus the Yen, despite all the BOJ-induced JPY strength over the past two months:

Another stand-out, the GBP, which had a very strong run starting somewhere in Q2. Here’s the monthly GBP/USD chart:

And here the somewhat volatile (yes, sarcasm alarm) USD/JPY:

One more on the US Dollar Index (DXY), where we expect support to give (dashed) one the geopolitical dust settles:

For the crypto-followers, here the performance of some of the more important digital currencies:

(Nearly) Last but not least, here is how the commodity sectors have performed:

And here some of the more popular individual commodity futures:

Two charts need to be checked here.

Gold, of course:

WOW! (Fiat) Currency debasement anyone?

And then oil (Brent, for example):

Will it hold above the dashed support line? Geopolitics are helping this week …

And this, dear friends, was it already. Told you it’s a Blitz!

But no worries, the next QuiCQ (www.quicq.ch) is following in a few hours’ time! If you’re not signed up for those daily updates yet … What are you waiting for?!

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance