Cape Fear

Vol VIII, Issue 26 | Powered by NPB Neue Privat Bank AG

“Rule number one: most things will prove to be cyclical.”

“Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.”

— Howard Marks

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

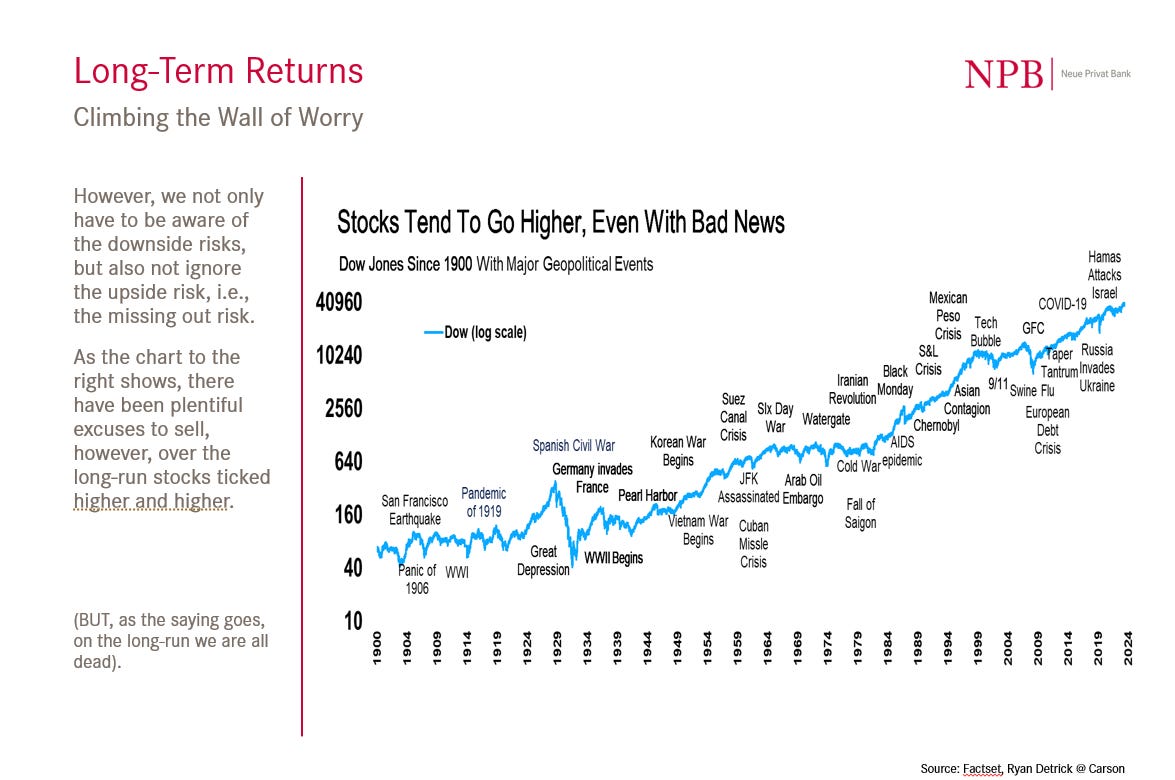

These days I am just putting the final touches on our new investment strategy “Kairos”, to be rolled out to clients showing interest later this week. Thought as an “absolute return” strategy for what we think is an upcoming much more challenging market environment - truly different to what we have become used to since the GFC some 16 years ago - the presentation is of course all about scaremongering. And admittedly, given all the gloom & doom out there, it is overly easy to get very doomy and gloomy … remove all sharp objects in the vicinity. Consider for example just this one slide out of the “Kairos” pitchbook:

It is therefore important to always remember that “fear sells” and the bear argument on markets always sounds more intelligent then the bull argument. Hence, whenever you get carried away by too much negativity when investing, hold this chart in front of your eyes again:

And off we go to this week’s cross-asset review!

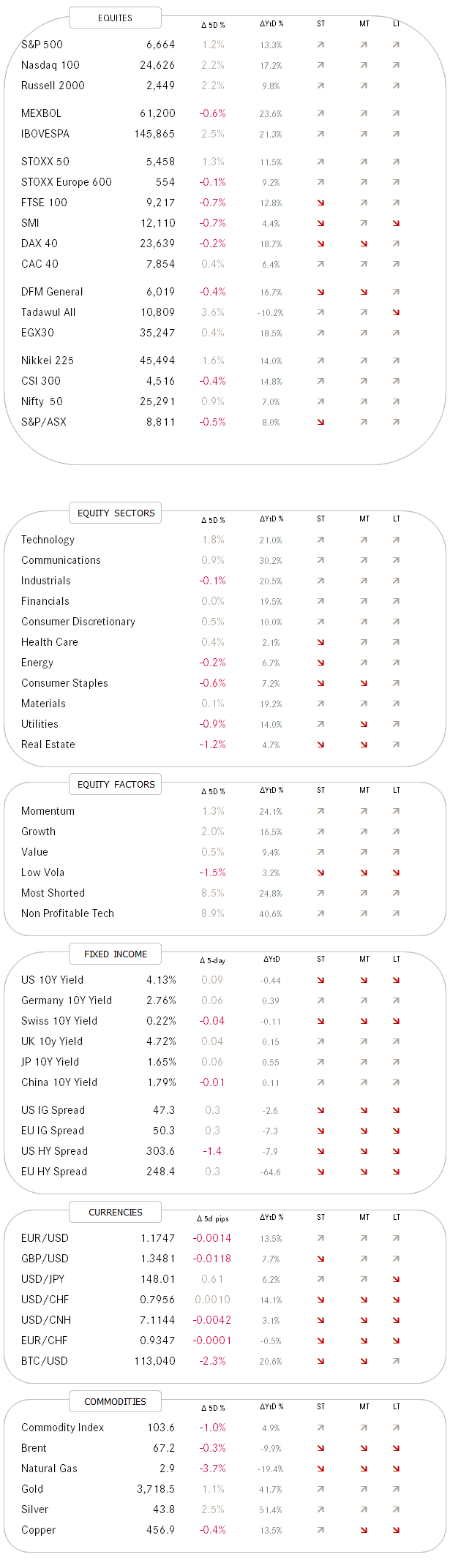

Trends on global equity markets continue to be strong to the upside and despite the previously discuss accumulation of bad news, you should continue to ride that trend, until the end, at the bend …

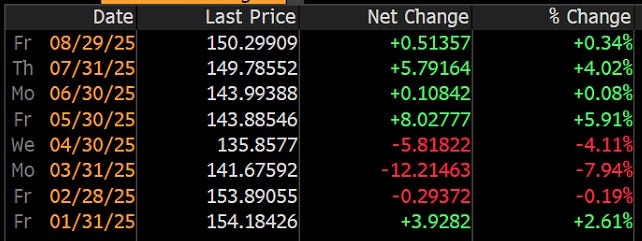

The MSCI World (here proxied via URTH - ishares MSCI World ETF) is running from new all-time high (ATH) to new all-time high:

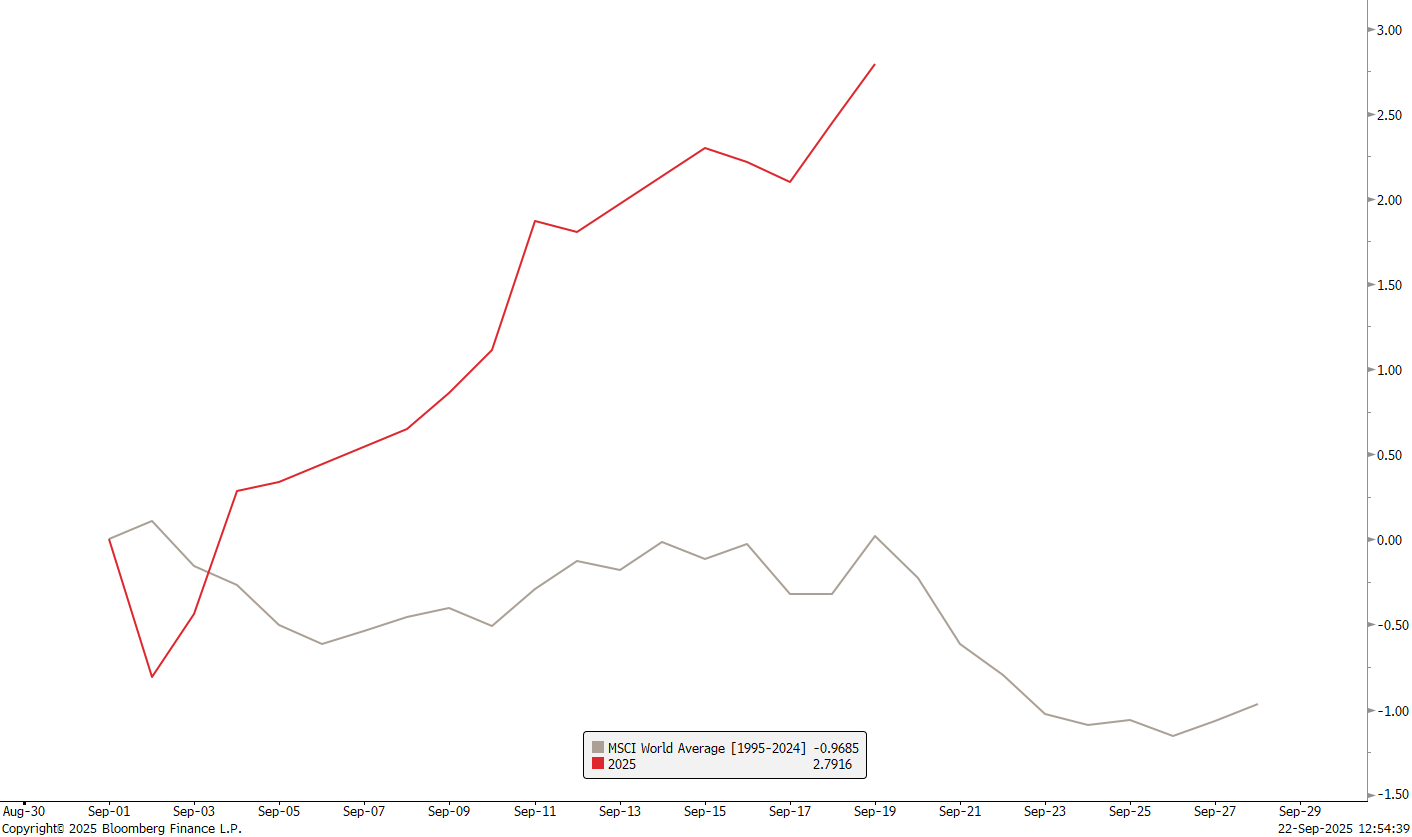

With the index up three percent in September, are global stocks not only about to show the fifth consecutive month of gains,

but is also defying the seasonality “rule”, which dictates higher volatility and a tendency towards negative returns in September as outlined in our previous piece “Wake Me Up When September Ends” (click here):

In the US, did not only large cap (S&P 500),

and tech stocks (Nasdaq 100),

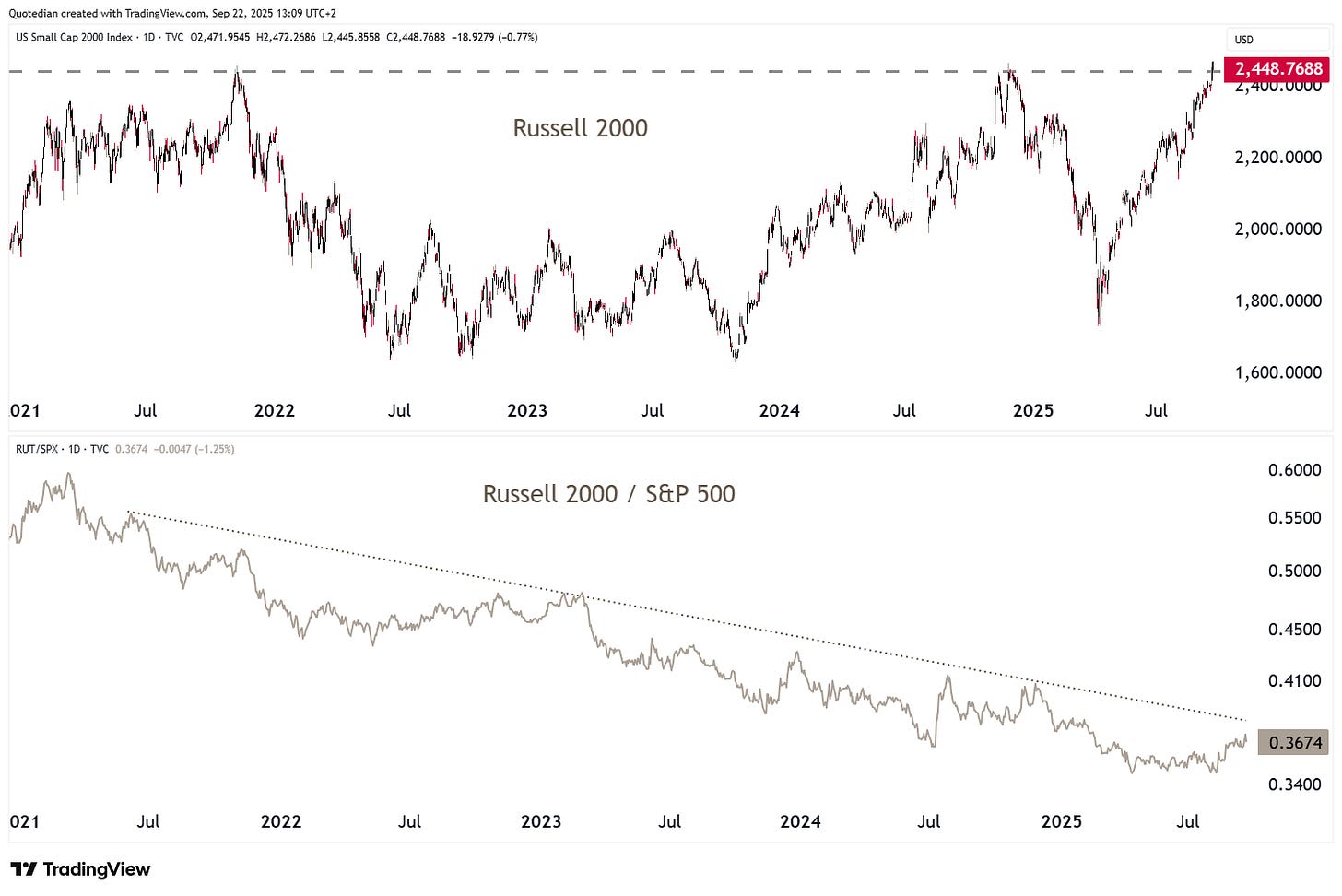

reach new all-time highs, but also small cap stocks (Russell 2000), which was the first new ATH in nearly five years, as we outlined in a chart on LinkedIn (click here or see below):

Technically, the index could be in for a pause now, given the resistance zone on the absolute (top) and relative (bottom) chart. RSI (Relative Strength Index) readings around 70ish on the daily AND the weekly chart are not helpful for an immediate trend continuation either.

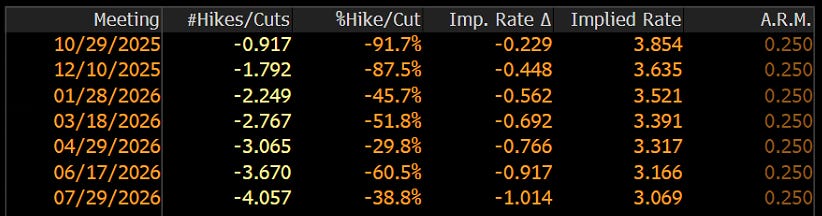

Though of course it will also be important to observe the path of monetary policy in the US. Last week’s FOMC rate cut lifted small cap stocks and should the Fed indeed cut another four times over the coming 10 months as insinuated futures trading, then the tailwind for the Russell 2000 will persist:$

The S&P 500 has seen some contraction in number of shares traded above the 200-day moving average in this last up move:

Such divergences usually have a negative interpretations, but for the calculated optimists among us, we could of course argue that one third of stocks in the index could still join the party, bringing additional upside … CAVEAT EMPTOR.

In Europe, the STOXX 600 is still struggling to make any net progress:

And it’s not only French stocks holding back the broader index,

but also the DAX has now been treading water since May now:

That 23,000 - 22,500 support zone is all important!

In Asia, Japanese equities had a panic moment on Friday morning, as The Bank of Japan announced it will start selling its exchange-traded fund holdings at a pace of about ¥620 billion per year:

However, by today Monday investors somehow realized that these sales would not start until next year, so everybody went back buying again, missing a new ATH by only a few index points:

Hong Kong stocks seem to be preparing a breather in their rally:

In India investors seem to have decided that the US 50% tariff either does not matter or will be lifted. Support at just above 35,000 held well a second test and suddenly stocks are about to make a new cycle high with a move above 37k:

A new all-time high is now less than five percent away, yet we still must remember that the previous ATH was set over a year ago.

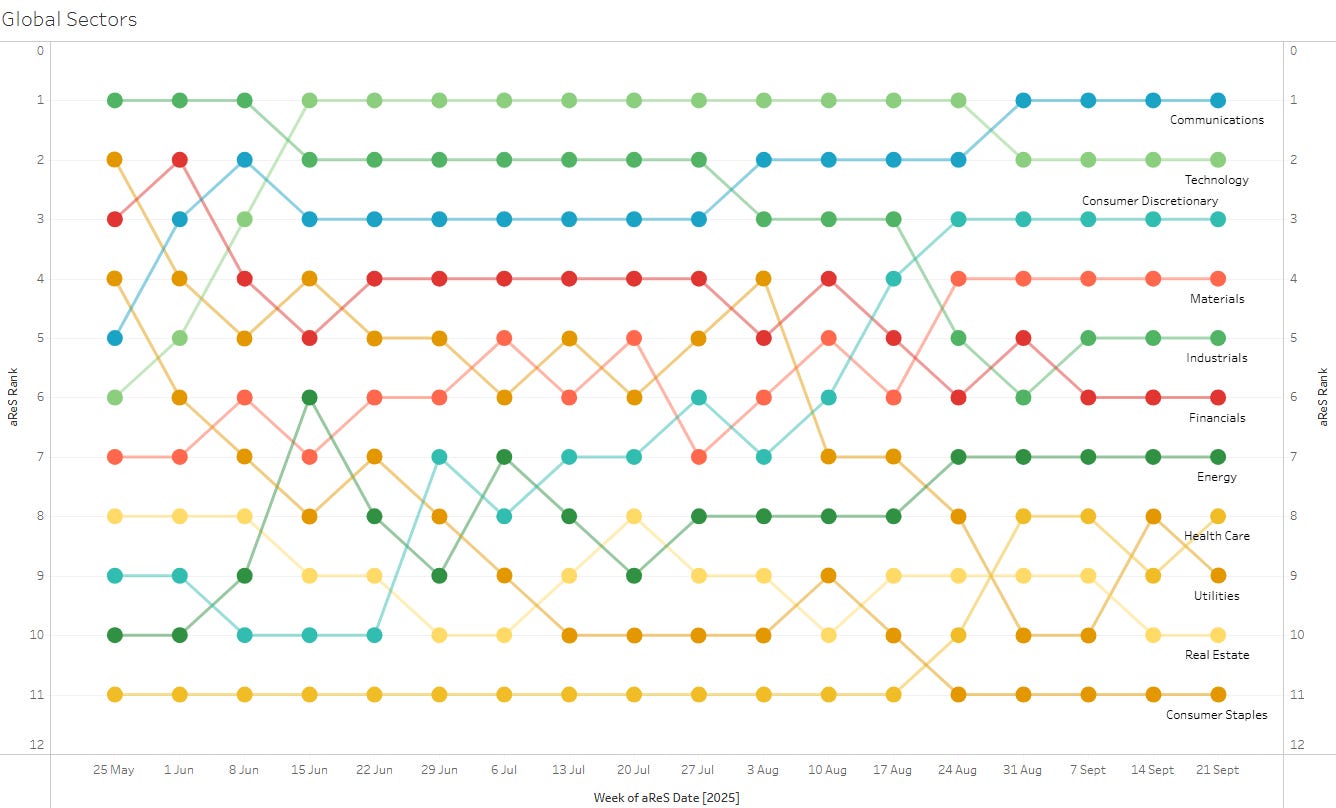

At a global sector level, communication services, technology and consumer discretionary have been working best so far in September:

Energy stocks and the defensive consumer staples a bit less so…

No surprise then to see those sector on top respectively at the bottom of our aReS-momentum model:

Whilst we usually like to buy stocks/sectors that are going up already (‘strength begets strength’) we would not chase after the communications sector here. Two of its largest components are Meta and Google and especially looking at the chart of the latter we realise just how much this stock is overbought:

As we are talking single stocks now and to end the equity section, let’s have a quick look at the best performing stocks on both sides of the Atlantic year-to-date and how they have fared the past week.

Starting with the US (S&P 500):

Painful to see stocks one sold with a 100% gain and now they’re up more than 200%, eh?

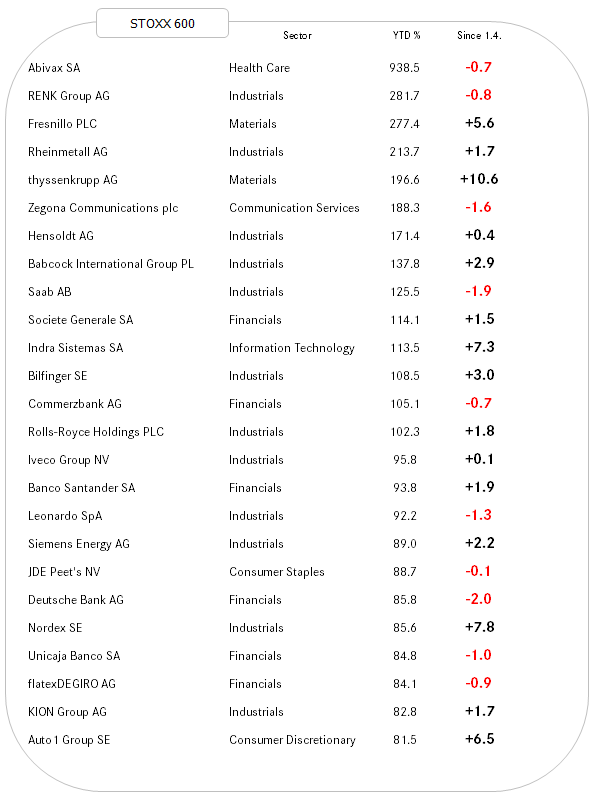

Here’s the European Version:

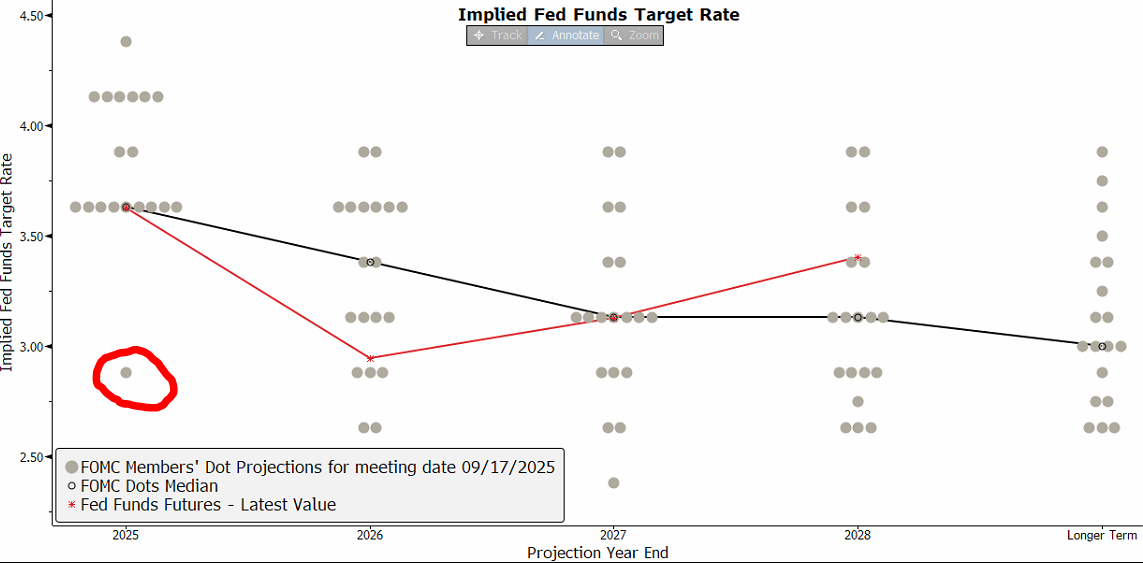

In rates markets, the FOMC cut their key policy rate as expected told so by 25 basis points. There was only one dissident, widely supposed to have been Trump backside-kisser Stephen Miran, who voted for 50 basis points cut. It is then also not so difficult to guess who the outlier on the Dot Plot is:

Hands up those who on the FOMC board who think the US economy is crashing so hard that the Fed needs to cut another five times (125 basis points) by the end of the year!

I knew it!!

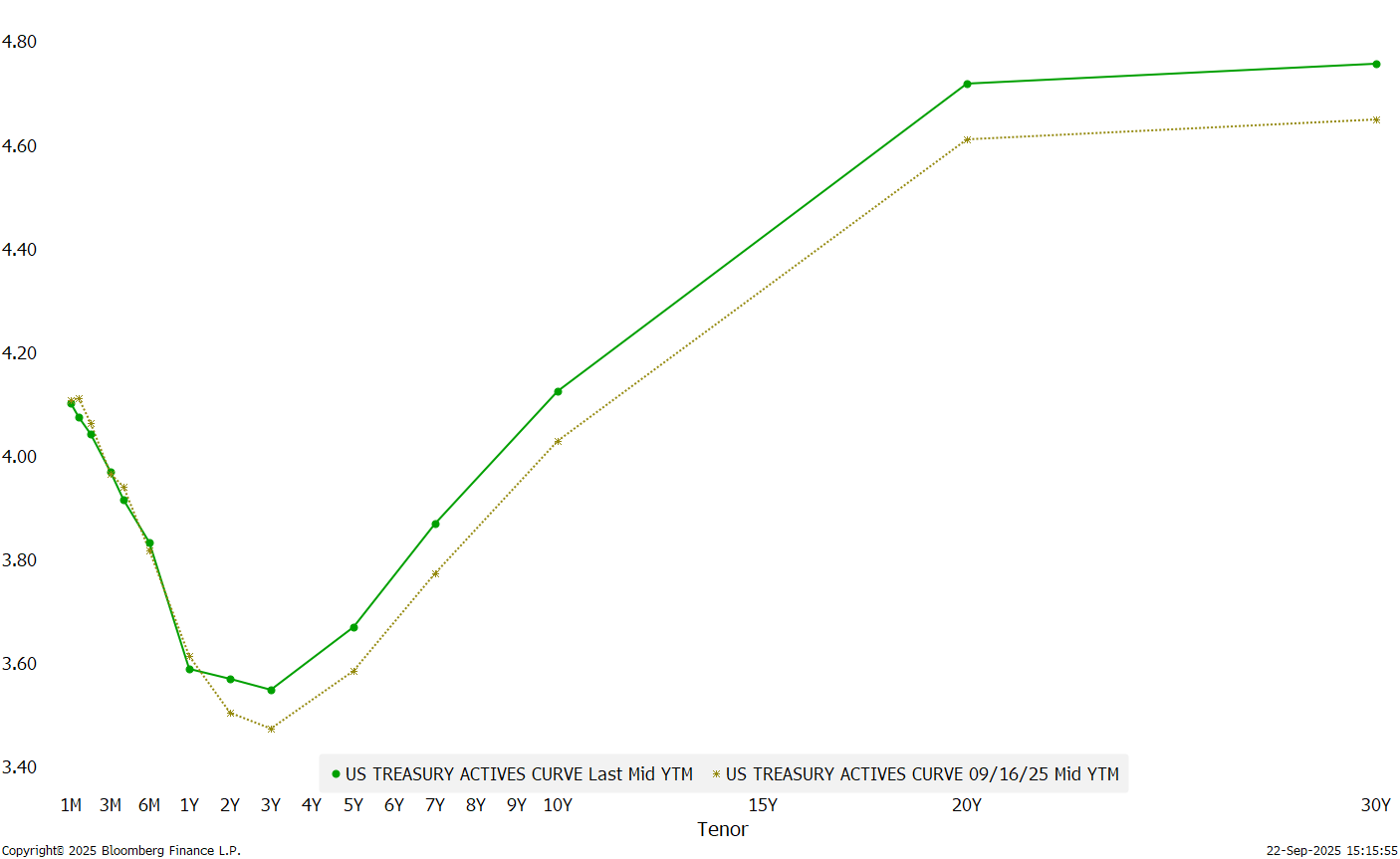

In any case, the bond market applauded for-now-still-in-charge Jerome Powell’s soft, 25 basis points approach to cutting rates, by not having yields run dramatically higher at the long end of the curve. Still though, a certain shift higher WAS observable on the yield curve (green is yield curve today, brown was the yield curve just before the FOMC),

also visible via the 30-year to 2-year treasury yield spread:

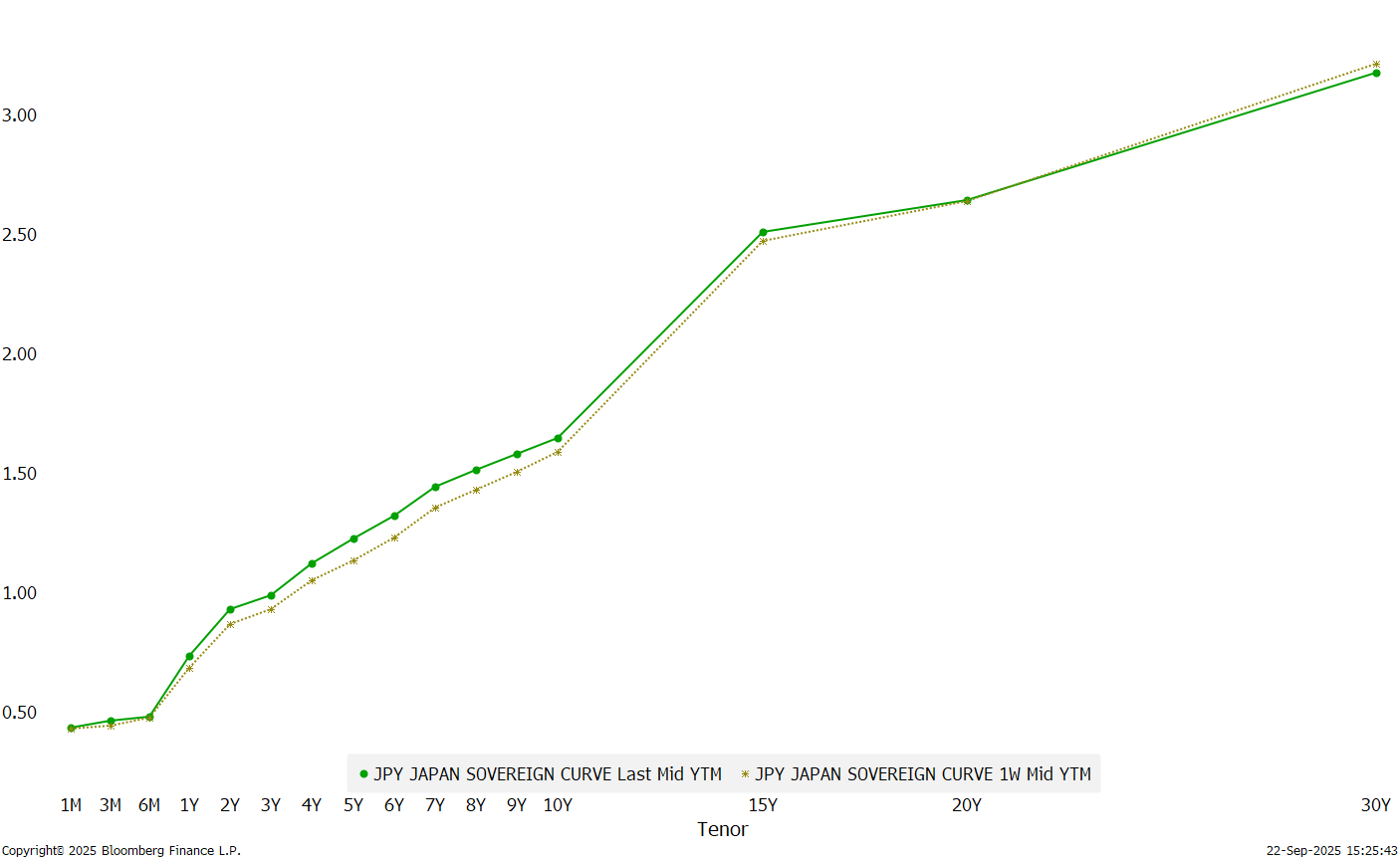

In Japan, the BoJ decided NOT to cut rates, which send 10-year yields higher, but 30- and 40-year yields lower:

Here’s the (yield) chart of the 10-year JGB, which now trades at its highest level since 2008:

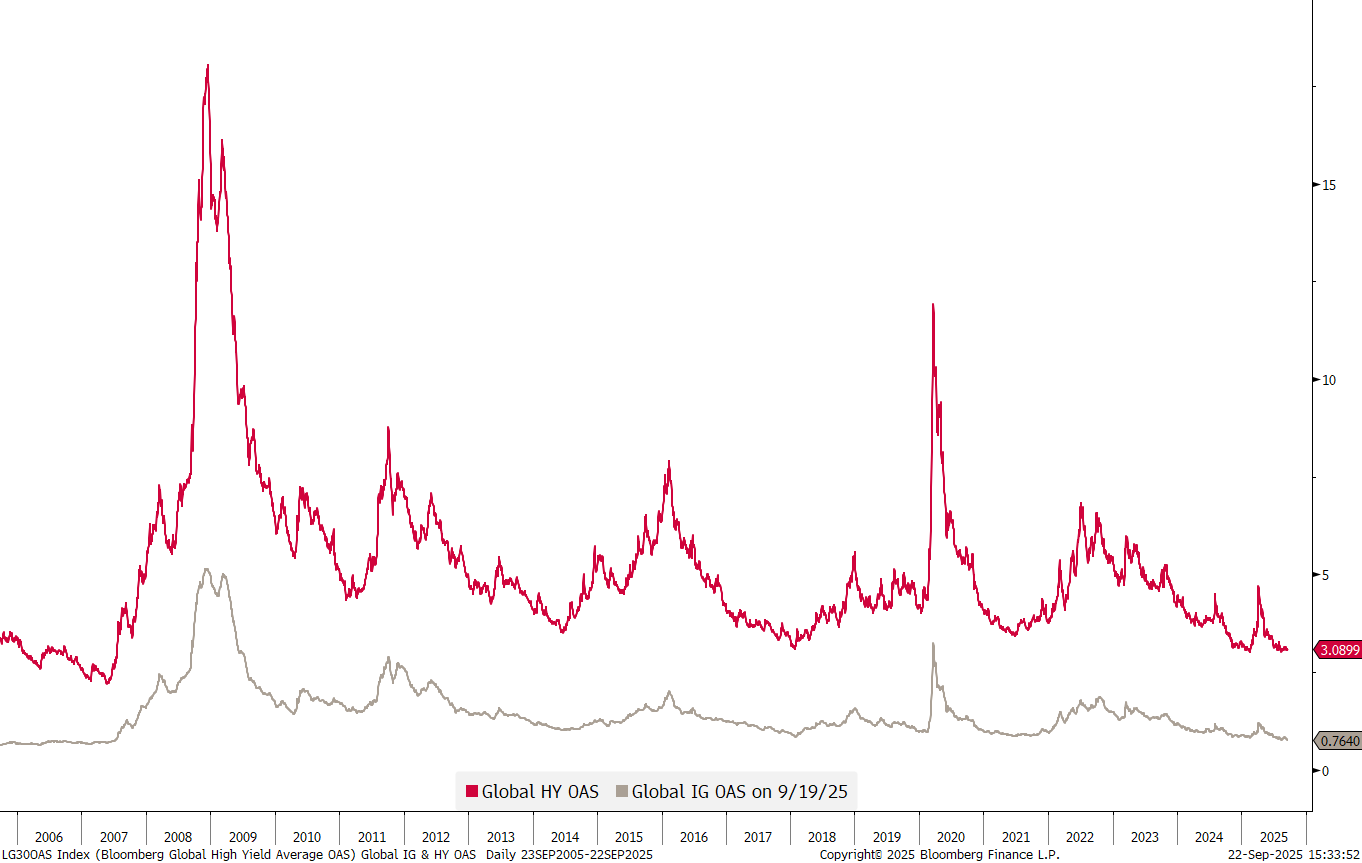

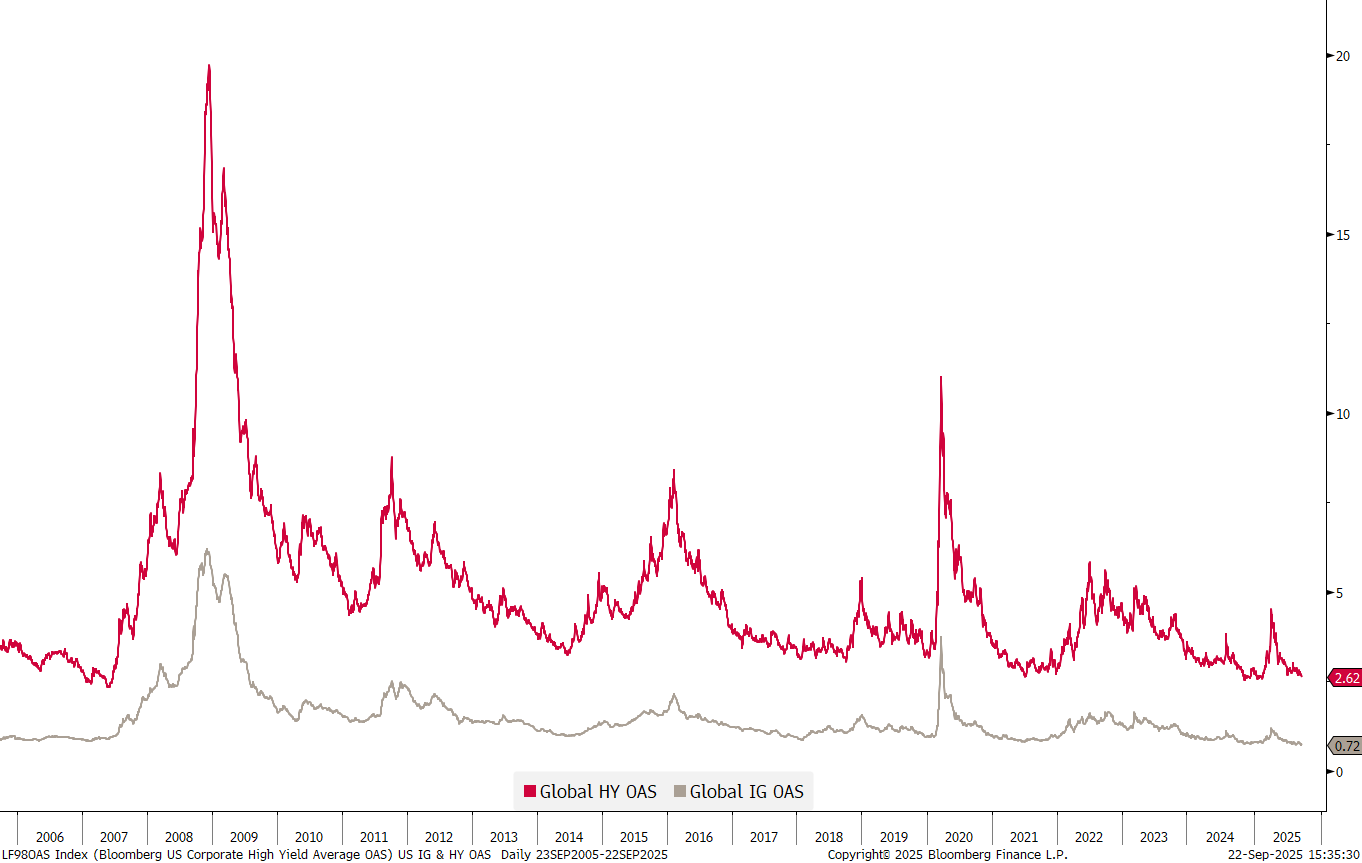

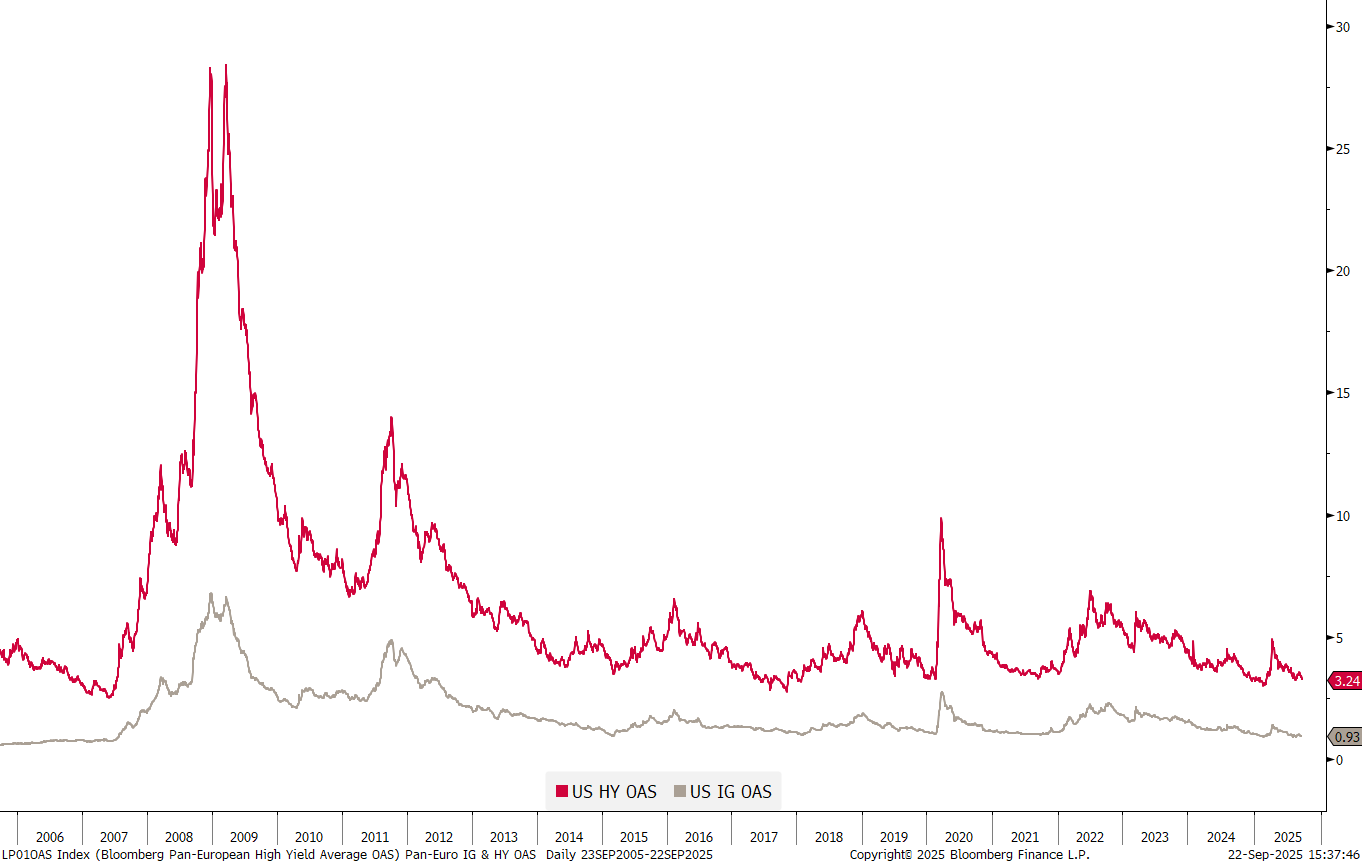

In global credit markets, spreads continue to be razor-thin:

US yields are even worse, especially also on the high yield side:

Pan-European spreads are a tad higher, and hence should be given preference in relative terms:

In currency markets the US Dollar index (DXY) is holding up - just about - which is probably a disappointment given the preceding 12% drop into July:

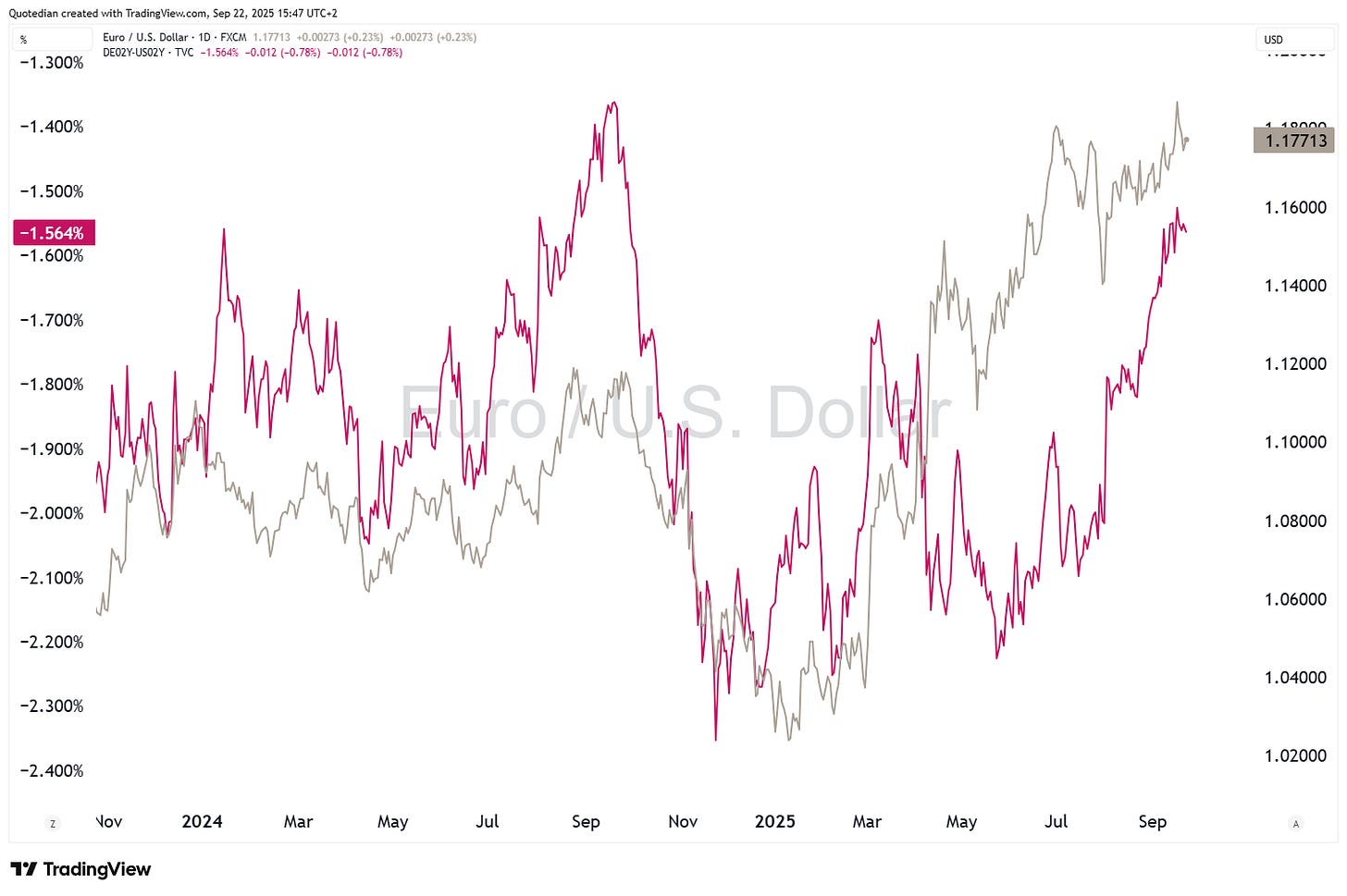

That the ECB has probably arrived at the end of its easing cycle, whilst the Fed has just initiated its second round, will not improve the interest rate differential (red line) in favour of strong US Dollar versus the Euro (grey line):

In cryptocurrency markets, poster-child Bitcoin continues to be stuck between 110k and 120k:

Finally, in the commodity space, all eyes still on Gold which is trading yet again at a fresh all-time high today (22.9.):

The yellow metal is now up more than 40% since beginning of the year, but cousin Silver is up even 50%-plus:

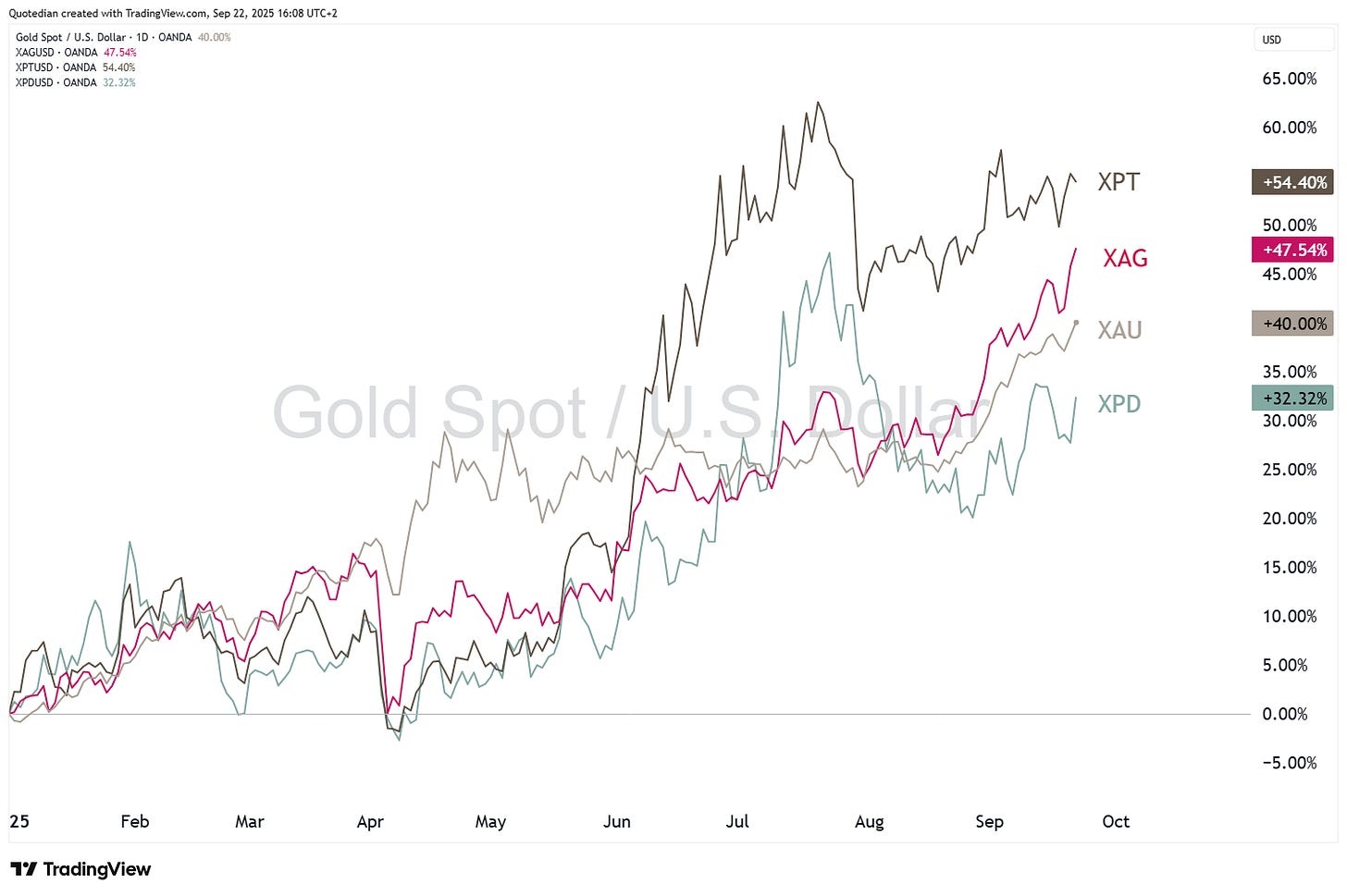

Well, as we’re at it anyway, let’s check on the whole “rat pack” of precious metals and their respective year-to-date peformances:

And the winner is ……. Platinum!!

Staying with metals, but moving to the industrial usage side, copper is still licking its wounds after it had been exposed to too much Trump Tariff Tantrum (TTT) during the summer:

Unless you expect a global economic slowdown, it feels like the red metal may be trading slightly below fair value - i.e. it could be interesting to look at some copper mining/producing companies such as Freeport-McMoRan, Zijin Mining, Antofagasta or First Quantum Mineral or simply a copper ETF, such as the Global X Copper Miners ETF (COPX).

Oil is continuing to absolutely nothing price wise,

The past three years have hence been a bit frustrating for investors bullish on commodities overall:

One, less-observed commodity, that seems to be breaking higher as I type is Uranium (here proxied via the Sprott Physical Uranium Trust price):

Still off its 2024 high at 32ish or its all-time highs in 2007, this chart is looking promising.

Ok, that’s all for this week - if you have any questions or remarks, please do not hesitate to leave them in the comment section:

And, of course, do not forget to hit that Like-Button!!

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG