Chartstorm

The Quotedian - Vol VI, Issue 19 | Powered by Neue Privat Bank AG

“Listen to what the market is saying about others, Not what others are saying about the market.”

— Richard Wyckoff

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

A real quick speed round of charts today, to position us again after yesterday’s FOMC rate hike. There will be a lot of colourful pictures and little text, so we should get through this pretty quickly and mostly painless.

But before we start, just a short ‘warning’ that chances are high there will be NO Quotedian this coming Sunday. I know, I know, but believe me, time heals all wounds!

And off we go!

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG - Client relevant, not system relevant.

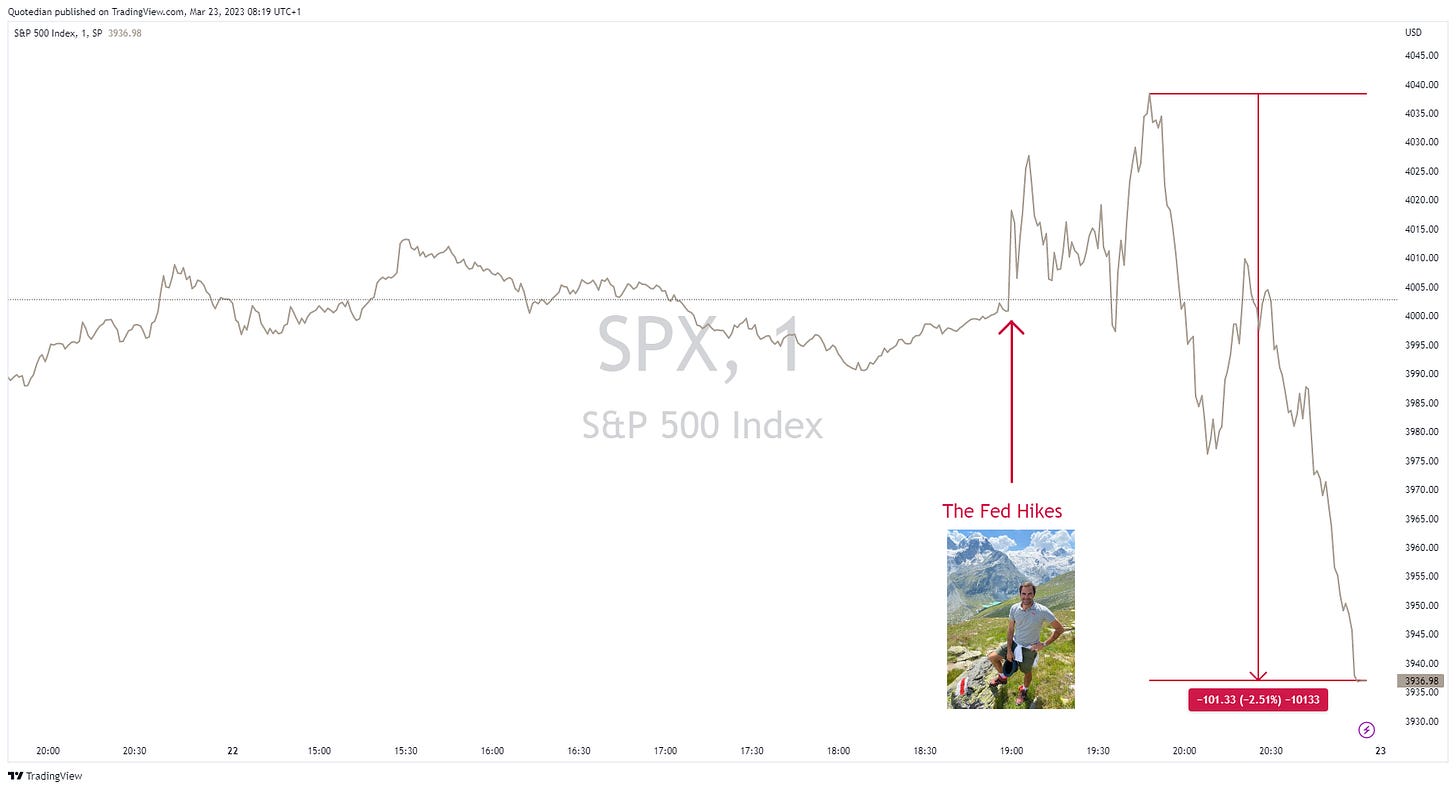

Starting as usual with equities, we note on the intraday chart of the S&P 500 that first investors could not make up their mind about the FOMC rate hike and then towards the end of Powell’s press conference decided they really didn’t like it, dropping 2.5% top-to-bottom in the last hour of trading:

Though maybe the last hour sell-off was more attributable to US Treasury secretay Yellen’s comment “not considering broad increase in deposit insurance”.

In any case, this is what the heat map looked like at the closing:

No need to take about market breadth on the day any further, right?

On the daily chart, the S&P 500 was possibly rejected at an important pivot point (red circles), but held above the 200-day moving average (just about):

The Nasdaq saw a failed breakout, but looks relatively more constructive than its big brother:

Small caps stocks took the biggest hit (Russell 2000 -2.8%) and the divergence between those and the Nasdaq is becoming meaningful and maybe even worrisome:

Europe of course missed the FOMC decision yesterday; futures indicate an only slightly lower opening (-0.2%) for now. Overall, the STOXX 600 Europe chart continues to look constructive, having recently held above the 200-day MA:

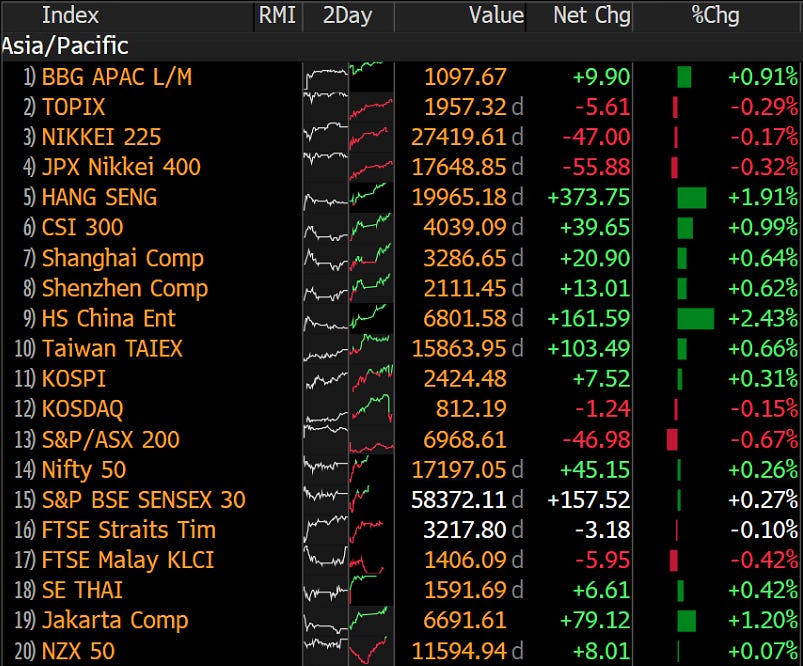

Similarly, Asian markets held up pretty decently this Thursday morning:

Turning to bonds, 2-year US Treasury yields had yet another 25+ basis points intraday swing:

This has basically been the tenth consecutive sessions with such a wild move, where the 200-day MA seems to have been the battleground:

A small wonder then that the bond market’s VIX-equivalent, the MOVE, has come back somewhat, though overall it remains elevated and at ‘distressed’ levels:

Overall, the yield curve steepening process, seems to continue. Here’s the 10 minus 2 year treasury spread:

In FX markets, the US weakened across the board, maybe indicating that market participants are indeed expecting the Fed to have finished their hiking cycle (as opposed to Europe and UK for example):

If that holds true (US finished, EU not), the we should see a stronger EUR/USD, right? Let’s check:

Wooohaaa, indeed!

And GBP/USD?

Yep to that too!

Finally, in the commodity segment and following through on the above logic, we should see a higher Gold price too:

Not looking too bad, but a move above $2,000 is still needed to accelerate the uptrend. The long-term chart shows we are nearly there, but …

Ok, time to hit the send button.

Remember, likely no Quotedian on Sunday due to some travel plans, but we’ll catch up early on in the week and will also have the month-end special the weekend after.

Be good.

André

CHART OF THE DAY

The following chart has been making the rounds (yet again) over the past few days. What better excuse to abuse as a COTD here today too:

I let you work it out for yourself, but given that this chart was drawn in 1875 … not bad indeed. Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance