Cheap for A Reason?

The Quotedian - Vol VII, Issue 4 | Powered by NPB Neue Privat Bank AG

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

— Peter Lynch

No, today’s title does not refer to European equities’ PEs (grey) compared to those of their US cousins (red):

Nor to the ever-widening performance cliff between growth and value stocks:

And not even to the ridiculously low valuation of ‘legacy’ carmakers:

But rather I am talking about (equity) volatility, which has dropped so much, that the cost of hedging has dropped to one of its lowest levels in 15 years:

But, “Hey André!”, you will shout at me, “Have you not always wise-cracked that investors should buy protection when they can, not when they have to??!!”

Here’s three things about hedging when vola is low:

You may buy your hedge too early and it loses its effectiveness

You may sell your hedge too late and you lose accumulated gains (ok, you smoothed out performance volatility, but …)

Low volatility can go even lower and may be the signal of "all calm at the equity front.

Check out point three for yourself:

Hence, I concluded many years ago that,

HEDGING IS FOR GARDENERS!

With that said, equity markets are ready to crash now to leave the biggest amount of egg on my face…

But, more seriously, my whole point here is:

If you are so worried about the upside on the stock market and consider volatility cheap, why not sell your equity portfolio and replace the holding with long call options?

Want to find out more about efficiently constructing your portfolio to avoid large drawdowns?

Contact us at ahuwiler@npb-bank.ch

Today’s Quotedian will be slightly shorter as we are eagerly awaiting the gargantuan end-of-month issue planned for Thursday.

Let’s get going then …

The S&P 500 is continuing to deliver new all-time highs (ATH) on a nearly daily basis:

Crazy to think that the current bull-market buy signal was given nearly a year ago! What? Don’t believe me? Check out that Golden Cross (50-day MA crosses above 200-day MA) circled at the very left on the chart above …

And, remember that cup-and-a-handle formation I brabbled about two weeks ago?

Stay tuned …

Could it be that Semiconductor stocks are leading the market higher? Recently, the Philadelphia Semiconductor Index (SOX) broke out on a relative basis to the S&P 500 (SPX):

Good earnings and a positive outlook from Taiwan Semiconductors Manufacturing a few weeks ago sparked the rally in chip stocks and the latest global semiconductor sales figure confirmed TSM’s positiveness with a positive y-o-y print since 2022:

Previous such upturns led to “massive” rallies over the next 12-months in semis 8 out of 9 times, with an average gain of more than 27%. Aaaand, it also pulled the broader stock market higher:

European stocks in the meantime are finally starting to gather speed and momentum too, especially after LVMH’s earnings report last Friday:

Zooming out a bit on the same chart, we come to realize that we are less than 2 percent from a new ATH:

In terms of catch-up potential, the chart of the SMI, about to produce a Golden cross (red circle), looks interesting:

Over in Asia, Indian stocks continue to steam ahead, with the only thing to worry about that there is (apparently) nothing to worry about:

Quite the contrary is happening in China, where the market as measured by the iShares China Large Cap ETF (FXI) is trying to put in long-term triple bottom:

But for now is failing at its first hurdle (red circle):

Meanwhile in Japan … the Topix is continuing its parabolic ascent:

Zooming in a tad, it becomes apparent that the index has been in sideways consolidation over the past two weeks as the earnings season is also getting into full swing in Japan:

And talking of swinging, time to hurdle over into the bond section :-)

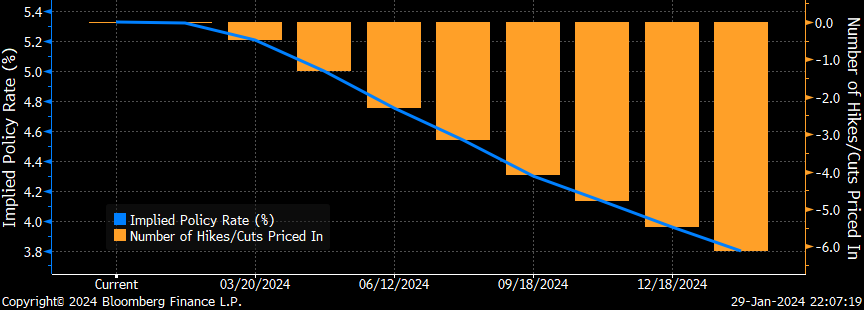

Of course, one of the main events of the week is the conclusion of the FOMC meeting on Wednesday (European) evening. No rate cut is expected for that meeting

and market’s confidence for a march cut has dropped to less than 50%

from close to 85% only a month ago:

This is then also showing in the yield curve which has shifted higher (yellow to green) and steepened:

Here’s the 10y-2y spread view on the US Treasury yield:

For now, our working assumption is that the Tens will not exceed 4.40% over the coming months and a drop below 4.05% may end the short upside correction in yields abruptly:

Similarly, 2.45%ish is unlikely to be superseded on the German Bund yield anytime soon:

If that would happen, a whole new arsenal of assumptions would have to be considered.

In currency markets, relative calm prevails, with the US Dollar having given back some strength it had shown since the beginning of the year

over the past week:

The EUR/USD chart continues to be a non-event for over a year now:

Whereas in Japan, waiting for the BoJ to make up its mind about NIRP to find out the future path of the Yen is very much like Samuel Beckett’s “Waiting for Godot”.

In commodities, just a quick glance at crude oil, which is about eight percent since the beginning of the year:

But given all the geopolitical unrest going on, it probably could be worse. John Authers at Bloomberg had a ‘nice’ chart on this:

Ok, time for me to hit the send button and time for you to hit the share button below, to make sure all your friends & family get to enjoy this fantastic newsletter :-;

See you towards the back end of the week with our first monthly review of the year!

Every quarter the US Treasury announces its borrowing plan for the coming three months period via the Quarterly Refunding Announcement (QRA). We discussed on previous occasions how the US government debt has ballooned to over $34 trillion(!) and it is hence no surprise that how the government refunds its debt (via the treasury department) is bec0ming increasingly important. This is shown in today’s COTD, which depicts the performance of a US 60/40 portfolio (grey line) and the most recent QRA’s (red lines):

At least the last two were utterly important for the overall market direction. Yesterday the Treasury announced its latest QRA, surprising the market with a bit less borrowing than expected, but Wednesday will be more important when they announce the terms structure of how they want to borrow.

Stay tuned …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance