confused.com

Volume VI, Issue 7 | Powered by Neue Privat Bank AG

“Confusion is a word we have invented for an order which is not understood.”

— Henry Miller

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

The cartoon at the outset of today’s Quotedian describes pretty well how much I struggle to write anything coherent about the markets these past few days. I have been thinking quite a lot about what exactly makes it so difficult and came up with two possible explanations: a) sometimes writing more (daily) is easier in terms of following up on a train of thoughts than on a bi-weekly basis and b) markets are even more irrational than usual. The answer is probably a bit of both, but let’s focus on the latter and leave a) to be sorted out by my shrink.

Off we go …

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

Tuesday’s session was a good example of the confused state of the market - or its participants. Fed boss Powell gave a relaxed, but unambiguously hawkish-leaning speech:

Bond yields rose —> correct

Dollar rose —> correct

Stocks rose led by growth —> WTF!

But probably the confused state of markets is completely normal, given all the conflicting signals. Let’s ignore funnymentals, macroeconomics, geopolitics et al for a moment, and just focus on some technical indicators - believe me, it will be enough (my Draghi moment) to confuse us even more.

Let´s start with (equity) trends. Unequivocally pointing higher on all time horizons; unequivocally bullish:

That’s a lot of green arrows!

Though as we established in the previous Quotedian, February tends to be seasonally a “pausing” month - neutral:

Liquidity, as measured by the Fed’s balance sheet minus the Treasury General Account and the Repo Re-Purchases is diverging from the path of the S&P 500,

which, combined with a diverging breadth

could potentially be a red flag.

And then again, leaning to the bullish side, a series of stocks are hitting new 52-week highs and non to very few new 52-week lows:

And one last one for the (longer-term) bullish camp… An interesting study from the fine folks at the Bespoke Investment Group shows that the SPDR S&P 500 ETF (aka SPY) has had 12 green (i.e. up) bars over the past 13 sessions (excluding yesterday’s session):

This has not happened to often … to be precise only 8 times (including the most recent series) since the ETF stared trading about 30 years ago:

Whilst this is not an immediate buy-signal per se, it is noteworthy that this pattern always took place during bull markets …

A few, quick observations from yesterday’s session now:

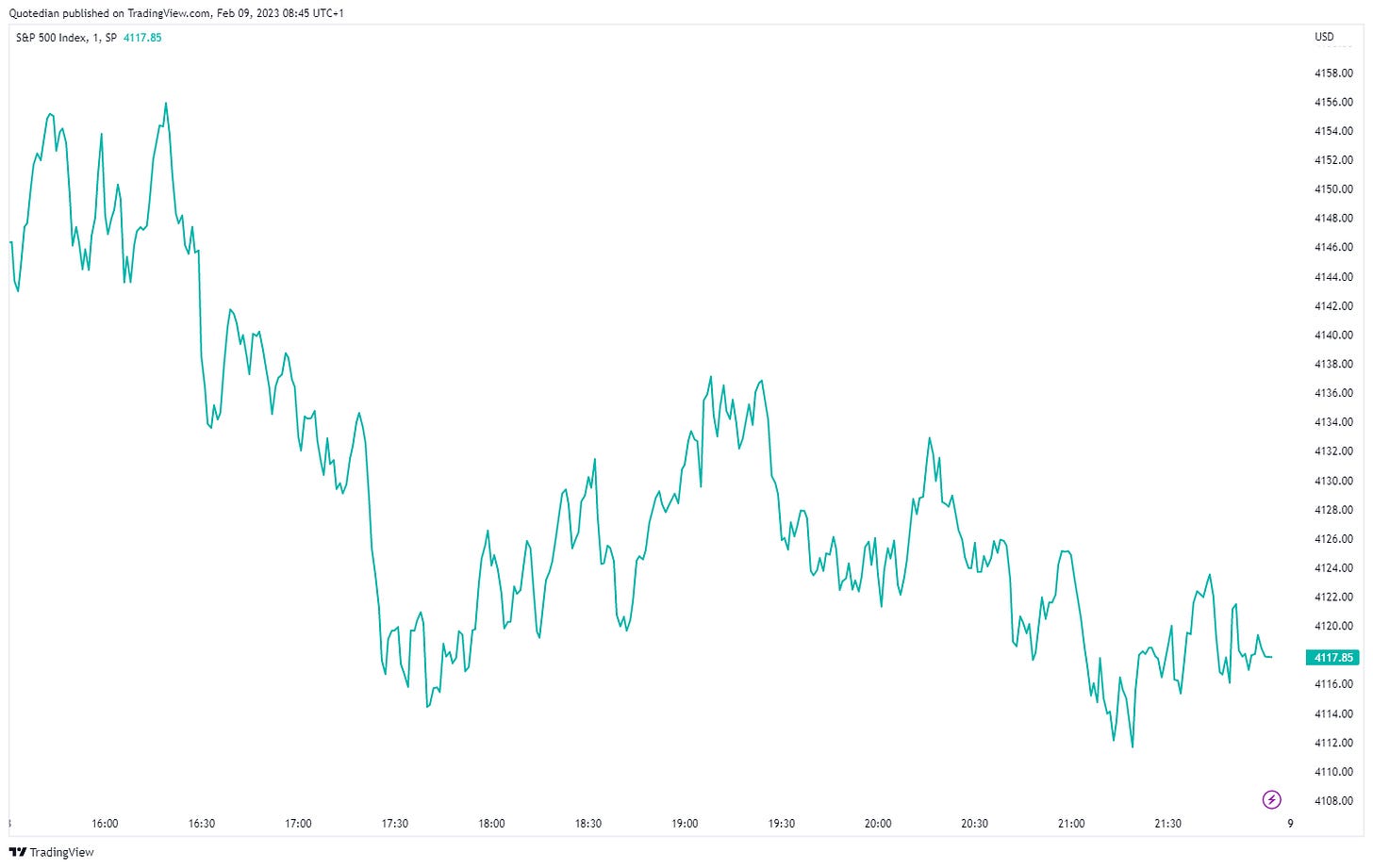

Most of the previous day’s gains were undone, as constant hawkish talk from different Fed members (Williams, Cook, Kashkari, Waller) started to be a drag on investors’ mood. Here’s the intraday chart of the s&P 500:

And here the probably more informative heat map:

standing out clearly, and another reason for the weak market performance, was the 7%-plus drop of index behemoth Google after an unsuccessful AI tool launch. Disney followed up with “bad news” after market close, announcing 7,000 strong job cuts in a major overhaul.

Asian markets this morning are mixed, with the Indian and Japanese benchmark indices trading lower, but some decent gains being registered in Hong Kong and Mainland China. Index futures on both sides of the Atlantic are printing a very light green this early morning.

On the fixed-income side of major asset classes, yields have been pushing higher since Friday’s NFP number, though took a kind of breather yesterday. Here’s the US 10-year yield:

And here is its Eurozone version, proxied by the German Bund:

Notice how the German 10-year yield above is only 20 basis points away from a new 12-year high(!):

One important item on today’s economic agenda, which is though not in the table above, is the interest rate decision due by Sweden’s Riksbank at 09:30. As the brilliant analysits at Gavekal point out, not only is Sweden with its export-heavy economy a leading indicator to the rest of the Eurozone,

but also is the country’s central bank in a delicate situation with inflation running at above 12%

but a housing market that has already collapsed, being a major drag on consumer spending:

In the interest of time I will short-cut here today, omitting comments on the currency and commodity side, but leaving with the promise to catch up on those latest in Sunday’s edition of your favourite newsletter.

Have a great Thursday,

André

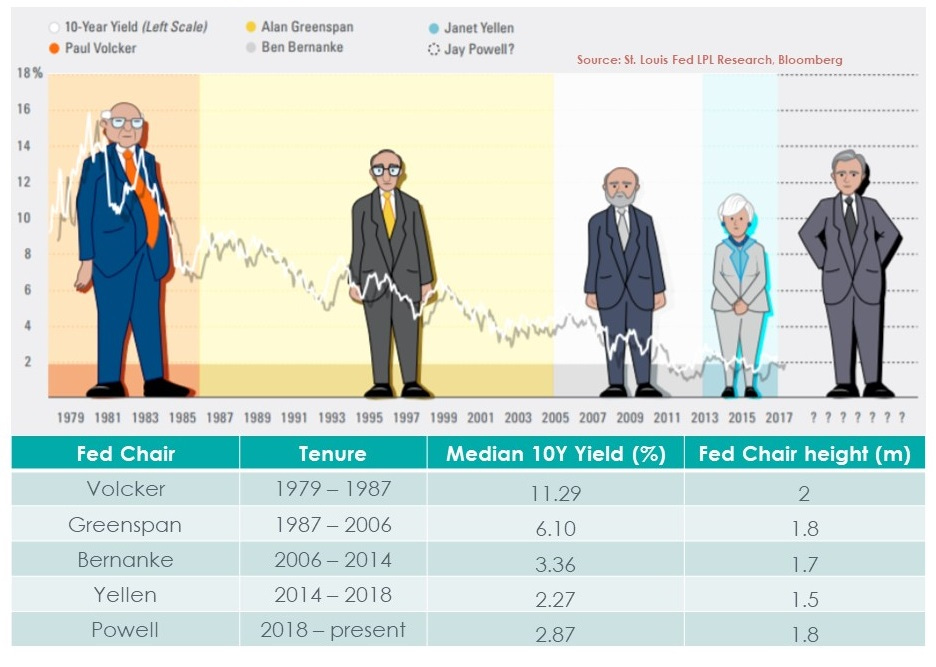

CHART OF THE DAY

Don’t ever say you haven’t been warned:

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance