Damage Report

The Quotedian - Vol VI, Issue 77 | Powered by NPB Neue Privat Bank AG

“Bear markets don’t determine who’s right. They determine who’s left.”

— Jon Boorman

First things first - apologies for the radio silence over the past nearly two weeks. Apart from being extremely busy at the office, I also had a few days off last week, which made editing this fine newsletter a bit challenging.

And talking about editing, in the last Quotedian “Tape Action” on the 12th of October we polled on the future publishing frequency. Here’s the poll and the results:

Thank you to all of you who voted and especially to those who also made the effort to cast their vote via email and left some additional feedback. The participation rate was close to 20%, which is really not bad when compared to previous polls held.

So for now we go into twice-a-week publishing mode and see how that goes. For those of who voted for a short, daily letter, please hang on in there and let me know what you most appreciated about the daily publishing frequency … I have a plan B in the back of my head …;-)

The good old Quotedian, now powered by NPB Neue Privat Bank AG.

Contact us at ahuwiler@npb-bank.ch

The past two weeks have been rather wild in financial markets, with many asset classes a bit all over the place, but with a generally underlying “risk off” tone. Let’s get ourselves up to speed!

For stocks, October is living up to its reputation of being notoriously volatile. The last five days have been not kind to equity investors:

But there’s light at the end of the tunnel (and yes, we are hoping it is not an oncoming train about to hit us). Remember these two charts from our Q4 CIO Outlook published two weeks ago:

In other words, we are now close to a seasonal buy signal for stocks and a sell signal for volatility - fingers crossed!

Let’s look at some charts now, starting with the S&P 500:

For some strange reason, that shoulder-head-shoulder pattern (black arcs), which we kind of filed away a few weeks ago, suddenly seems of some relevance again. The price target from the pattern counts down to 4,075, which would be another 4% or so from the current level.

The Nasdaq 100 has held up better and is arguably at a critical junction, i.e. key support:

A recovery from here and a push above 15,200 would be extremely bullish for this index, but let’s take it step-by-step. For now, support needs to hold.

It is quite a different story for small-cap stocks, which have broken support at 1710 already and are quickly approaching a multi-year support zone at 1,650ish:

It follows then that a Nasdaq 100 (NDX) to Russell 2000 (RTY) ratio chart must look horrible:

Indeed! 30% performance difference alone this year (red arrow).

One reason for the performance difference could be that small-cap stocks generally hold more debt and are paying a much higher price for that debt now. And large corporations listed in the Nasdaq may, in general, have high(er) cash reserves, which they can place at a much better rate now. Point in case, Apple:

According to their financial statement, the iPhone maker had USD166 billion in Cash and Cash equivalents. With T-Bill rates well above 5% … go figure!

But not all large-cap stocks have been fail-safe over the past weeks. Two of the world’s richest man, have seen their massive fortunes shrinking after presenting luke-warm earning reports.

Here is Tesla for example:

And here, as a good segue into European market observations, is LVMH:

the stock is down 10% since its earnings report on October 11th, and down nearly 30% from its all-time high set back in April of this year.

This has also impacted the market indices. Here’s the chart of EURO STOXX 50, which seems to be sitting right on top of an important support zone:

The broader STOXX Europe 600 index does not look much better, with the March lows having been undercut during last Friday’s session:

Next support is only about 2% away - but that most hold there, or …

Ok, time to look at fixed-income markets …

In our Q4 outlook we recommened to start increasing bond duration somewhat, which looked like an excellent call for about three days, but then blew up in our faces as yields started marching quickly higher again. Here’s the chart on the US 10-year treasury:

However, we still believe strongly in this call, as we think a cyclical high (low) for yields (prices) is at hand and indeed, since reaching the ‘magical’ 5% mark yields have softened lower again. Interestingly, if we add a simple overbought/oversold indicator (RSI) to the chart above, a negative divergence between yield and indicator becomes apparent and may signal a turn lower in yields:

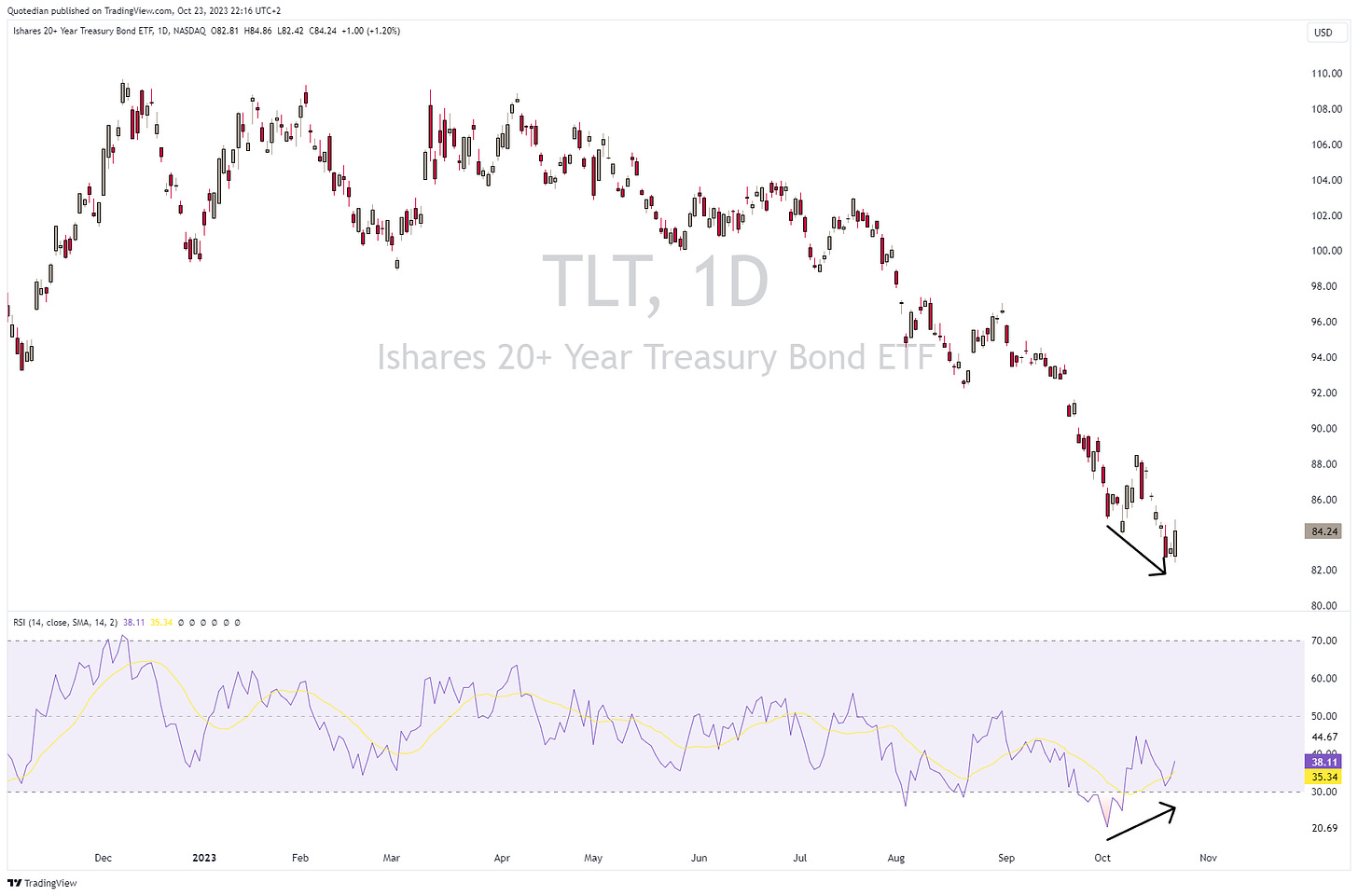

In terms of prices, and using our old iShares US Treasury 20+ ETF friend as a proxy, it looks like this:

However, it would be important that the VIX-equivalent for bonds, the MOVE, also heads south again to support stronger bond prices:

European rates, here proxied via the German 10-Year Bund, did unlike its US-cousin not make a new cycle high last week, but rather saw its cycle high at the beginning of the month:

Our call to improve credit quality of the fixed income part of your portfolio is however proving to have been quite timely, as credit spreads have been widening on the back of softer equity markets:

Given a year-end equity rally could lay ahead, this would offer another opportunity to further improve credit quality.

In currency markets, the US Dollar’s strength since finding a bottom in mid-July has been astonishing:

Though on the Dollar Index (DXY) chart, it now seems that the ascent of the Dollar Wrecking Ball may have been at least temporarily halted:

And the USD/JPY-cross right below 150 (BoJ intervention level) continues to be an absolute nail biter:

And then, there is Bitcoin. Did anyone notice that the cryptocurrency is up 26% over the past month and 17% alone in the last week?

I heard very little chatter about this - more upside ahead?

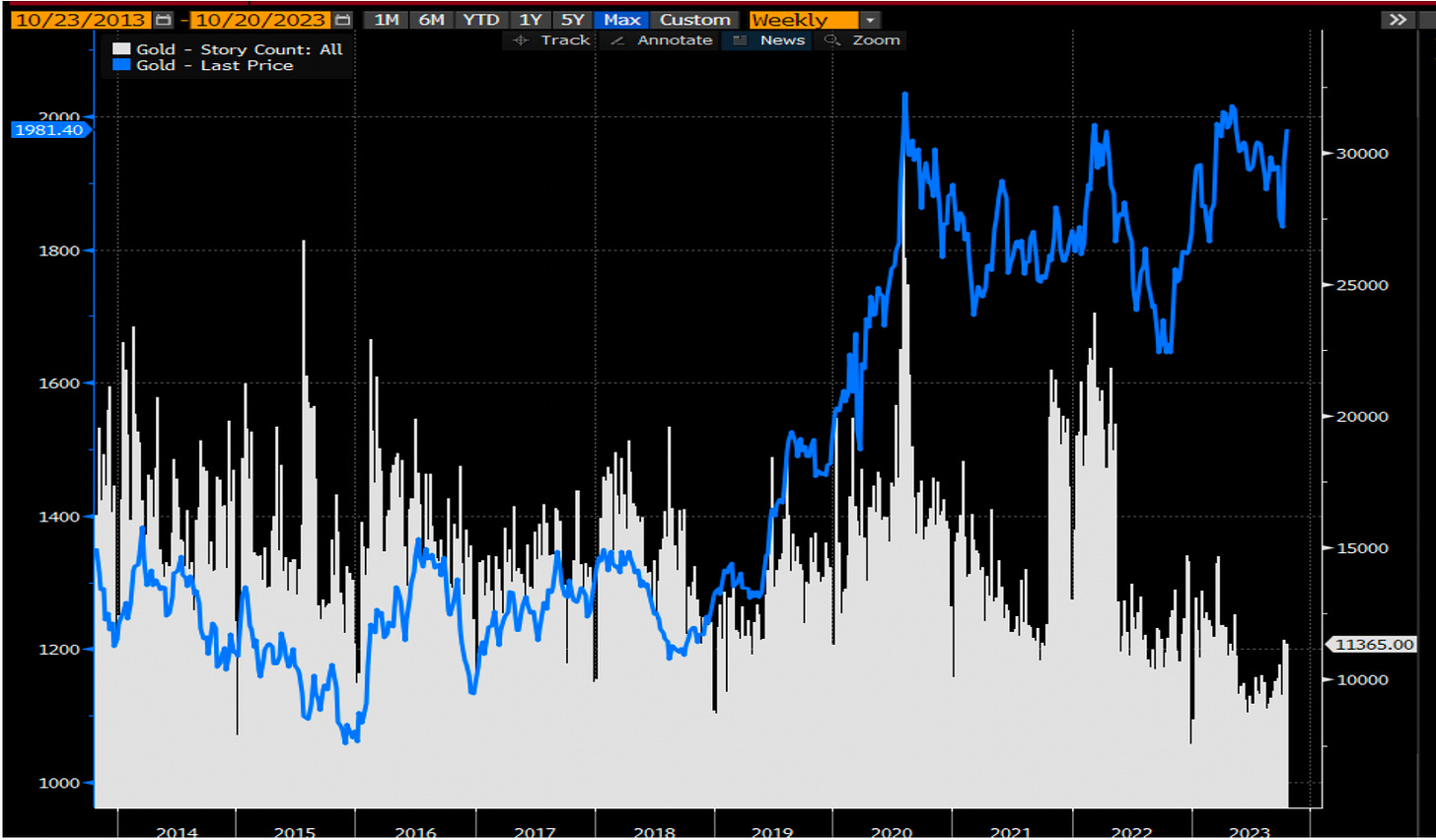

And talking about big but uncommented moves - did you check gold lately?

That is also a nearly 10% move in just a few sessions!

Zooming out on this chart, we notice that Gold (blue line) is less than 4% from an all-time high away and nobody is talking (white histogram) about it:

Ok, time to hit the send button. Some big earnings ahead today and the rest of the week, but also do not forget to keep an eye on the chart in the COTD section just below.

Stay safe,

André

Make sure to keep an eye on Japanese yields as the BoJ is apparently bringing yield curve control (YCC) to end. Japanese investors get not the most yield at home than they have over the past decade. Nominally, 0.84% does not sound like a lot, but could still trigger reptratiation of overseas assets back to the land of the rising sun. Stay tuned …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance