Deja Vu?

The Quotedian - Vol VI, Issue 26 | Powered by NPB Neue Privat Bank AG

"Isn’t it funny how day by day nothing changes, but when you look back, everything is different?"

— C.S. Lewis

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

“Saved by the Bell” could have been the alternative title for today’s Quotedian, as Wall Street’s dive south was only stopped by the closing bell at 4 pm EST. Here’s the intraday chart of the S&P 500:

US banking sector were cited once again as source of investors’ unease and the SPDR US Regional Banks ETF crossed decisively below that “watch out below” level we had defined a few weeks ago in this space:

Back to the S&P 500, where five stocks fell for every stock up and all eleven main economic sector closed lower on the day,

leaving us with following intraday heatmap:

This leaves us with following daily chart on the S&P, which was the inspiration to today’s title, or as Yogi Berra would have put it “this is deja vu all over again”:

Luckily, we got in the first big tech earnings (GOOGL, MSFT) in after the close and they where both beats. This is helping US index futures to print green as I type this morning, but my gut feeling has it that this could be short-lived.

Asian equity markets are surprisingly resilient this morning, with especially the Greater China showing some decent gains. However, this must also been taken in context of the very recent past, where especially Asian tech had already been under pressure for a couple of days, and today seems more like a short-term relief rally rather than anything else. Here’s the HSTECH index for example:

Or the KOSDAQ index:

European index futures are in negative territory about half an hour before cash market are opening.

In fixed-income markets, the trading halt on First Republic Bank at around 1 pm EST,

created a huge run on 2-year Treasury bonds (flight to safety), pushing yields 16 bp lower over a short-period:

This in turn then led also to a curve steepening (10y-2y):

Fed fund futures then also went into full recession mode, adding an entire rate cut into December and expecting now two and a half rate cuts in the second half of this year:

A similar flight to safety seen on the bond side was also witnessed in currencies, where all traditional safe haven currencies (USD, CHF, JPY) showed some of the strongest relative performance.

Technically speaking, is this safe-haven strength coming at a good time for the greenback, which was approaching key support once again:

And equally is Bitcoin profiting from the banking exodus again, after it had a rough patch, mainly over the lack of regulatory advances in the US, over the past couple of days, finding finally a bid again:

And finally, moving into commodities, Gold, for similar reasons to Bitcoin, is trading higher and just below $2,000 again:

Whilst oil, over recession fears, sold off a tad:

That’s all folks, be safe out there!

André

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

CHART OF THE DAY

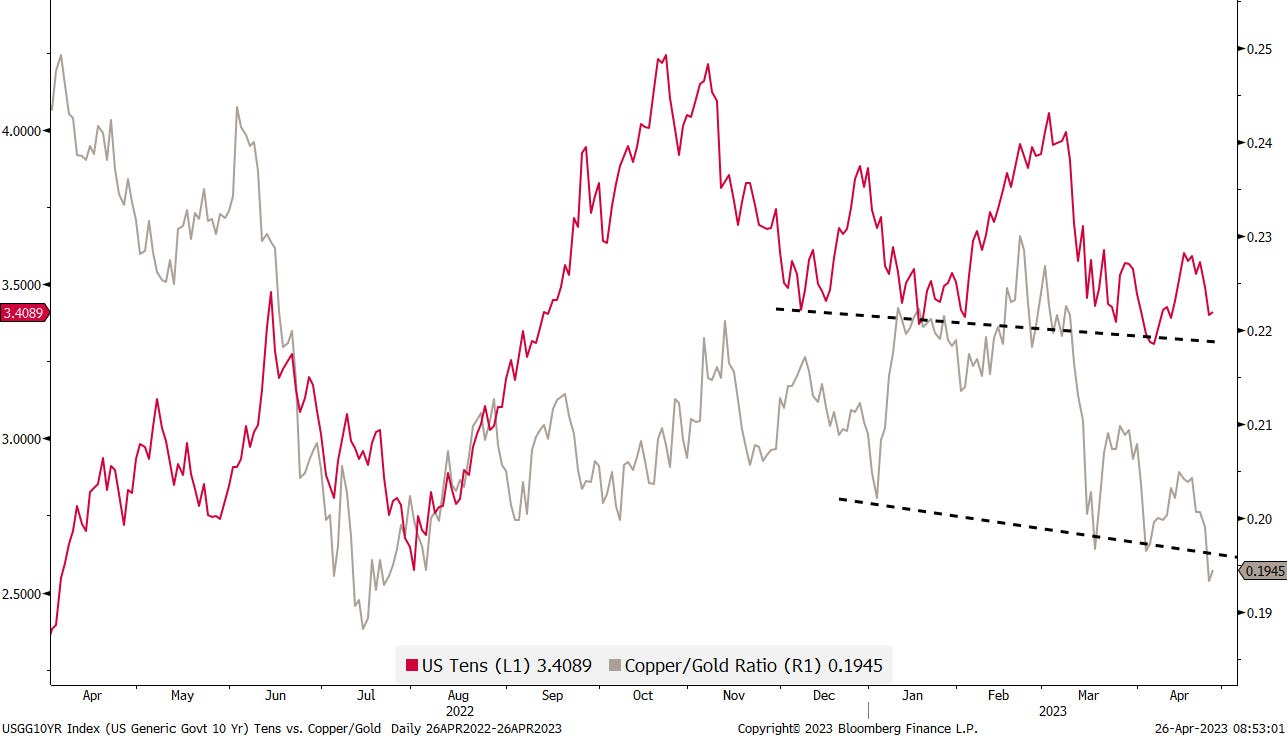

The copper to gold ratio (grey) often has a tight correlation to US treasury yields (10y - red). Makes sense: copper rises against gold means strong economic activity, means higher bond yields and vice versa. Currently, copper is breaking down versus gold as investors continue to contemplate an imminent recession and head towards a golden safety.

In that context, are yields still too high?

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance