D'oh!

Volume V, Issue 170

QOTD

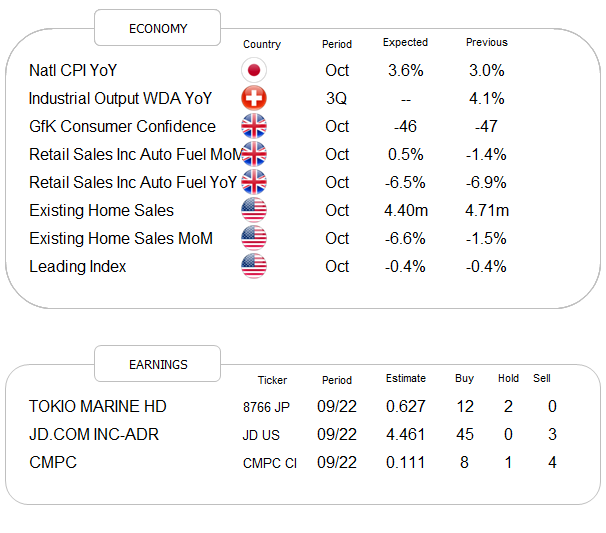

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s title does not refer to the expression of an investor seeing his year-to-date performance update, but rather to what I shouted a nano-second after hitting the send button yesterday, having forgotten to copy/paste the following link into the COTD section. It’s Friday, so take it easy, have a two-and-a-half minute break, have a Kit-Kat, and watch the following commercial (click on the picture below to watch on YouTube):

Brilliant then (initialled released at this year’s Superbowl), and even more brilliant with the benefit of hindsight today!

Let’s stay with the unfolding crypto/FTX shitshow fraud drama for a moment. At a first bankruptcy hearing yesterday, some hair-raising details were revealed by the company’s CEO, who had started his assignment on October 11th … Here are some of the ‘highlights’ (emphasis mine):

Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here. From compromised systems integrity and faulty regulatory oversight abroad, to the concentration of control in the hands of a very small group of inexperienced, unsophisticated and potentially compromised individuals, this situation is unprecedented.

or

This CEO oversaw the restructuring of Enron, which means he has seen some sh.t in his lifetime, but nothing seems to have prepared him for this:

The Debtors did not have the type of disbursement controls that I believe are appropriate for a business enterprise. For example, employees of the FTX Group submitted payment requests through an on-line ‘chat’ platform where a disparate group of supervisors approved disbursements by responding with personalized emojis

WTF?!

Anyway, if you invested into FTX (which luckily you probably haven’t), at least you would be in good company. Here’s a list of early stage investors, including some of the best-reputed Hedge Funds:

Note to self: Maybe there’s a market for outsourced due diligence processes?

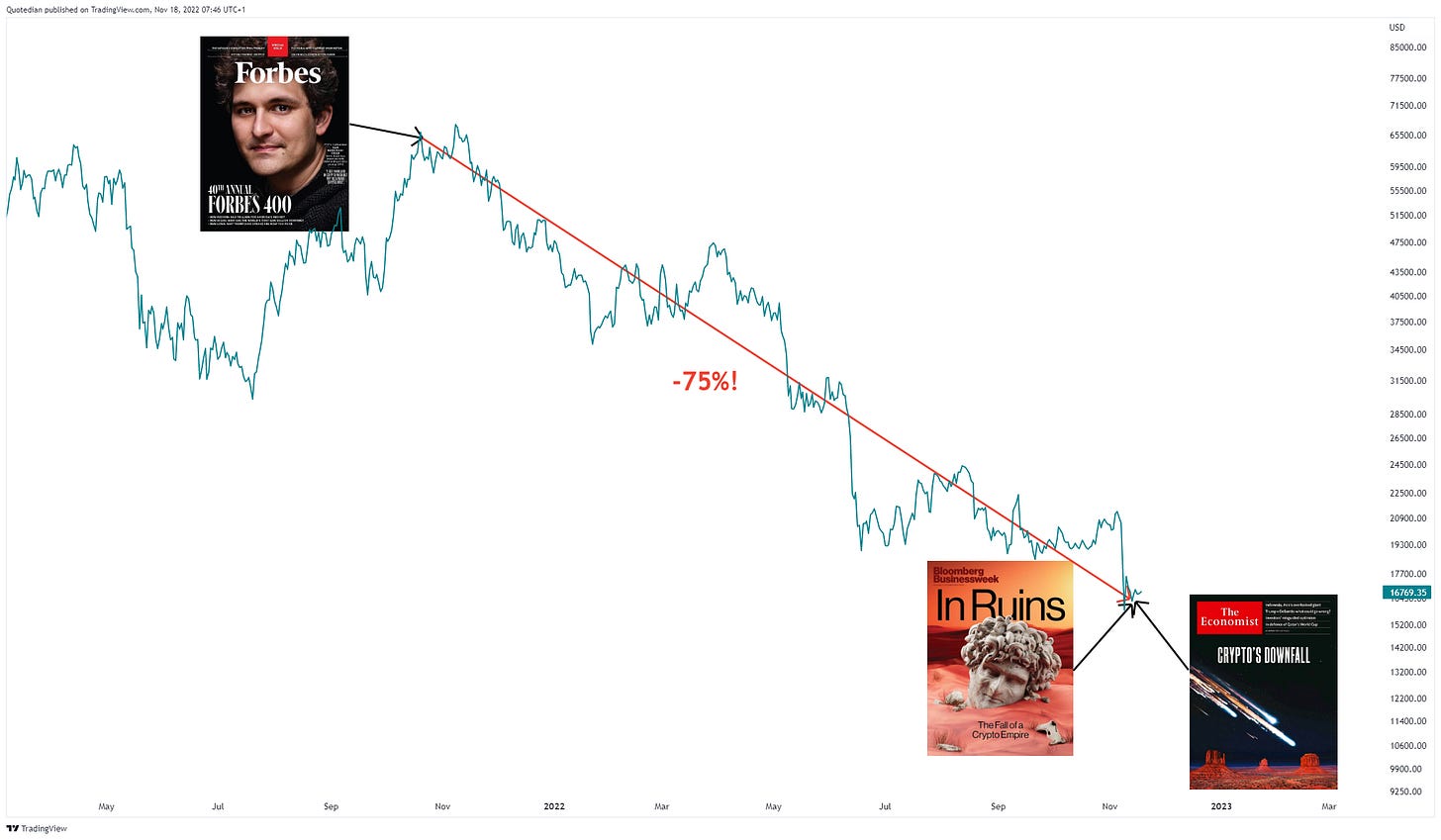

Finally, one of our attentive readers (Merci Olivier!) pointed out more ‘fodder’ for our magazine-front-cover-contrarian indicator. Yesterday’s COTD updated:

Ok, enough crypto for one day, let’s get on with our regular review

Back to yesterday’s D’oh! All truth be told, that D’oh! expression has converted into a tick, showing itself at least once a day, usually right after hitting the send button. The missed video link above was only one D’oh! moment yesterday, I had several others, nearly simultaneously.

For example, I had shown how the VIX was down on an (equity) market down day, which is not usual, but actually happened yesterday again. However, and that’s the second D’oh!, the SKEW (tail-risk) index is diverging from VIX, as is the MOVE (bond vola) index, raising an at least orange flag:

Most of the VIX ‘downside’ is probably explained by markets being relatively calm, independent of direction:

Anyway, stocks closed lower on the day, though given the sharp drop at the opening it could have been worse, as stocks recovered into the closing bell. Here’s the intraday chart of the S&P:

The main reason for the equity (tail) weakness was higher bond yields (dog), which we discuss further down in the fixed income section.

Similar to Tuesday's session, breadth was weak at about 2:1 (losers/winners) and only three sectors out of eleven ended (barely) higher on the day:

Thursday also always sees the release of the AAII’s (American Association of Individual Investors) bull, bear or neutral survey, with yesterday’s report showing that bulls have moved to their highest reading in the current bear market cycle:

Asian markets this early Friday are most reflecting yesterday’s mildly negative close on Wall Street, with most regional markets down about half a percentage point. Index futures are up in Europe and flat for US indices as I type.

As mentioned, bond yields were firmer in yesterday’s session, mainly on the back of hawkish talk by several Fed officials. The Über-Hawk was Bullard (not a FOMC voting member), suggesting that the terminal rate for the Fed Fund rate should be between 5% and 7% (today 3.75-4%). Overall, the 10-year US Treasury yield got a lift from Tuesday lows at 3.65 to above 3.80 (no wonder MOVE remains so elevated), but since then has settled in around 3.75%:

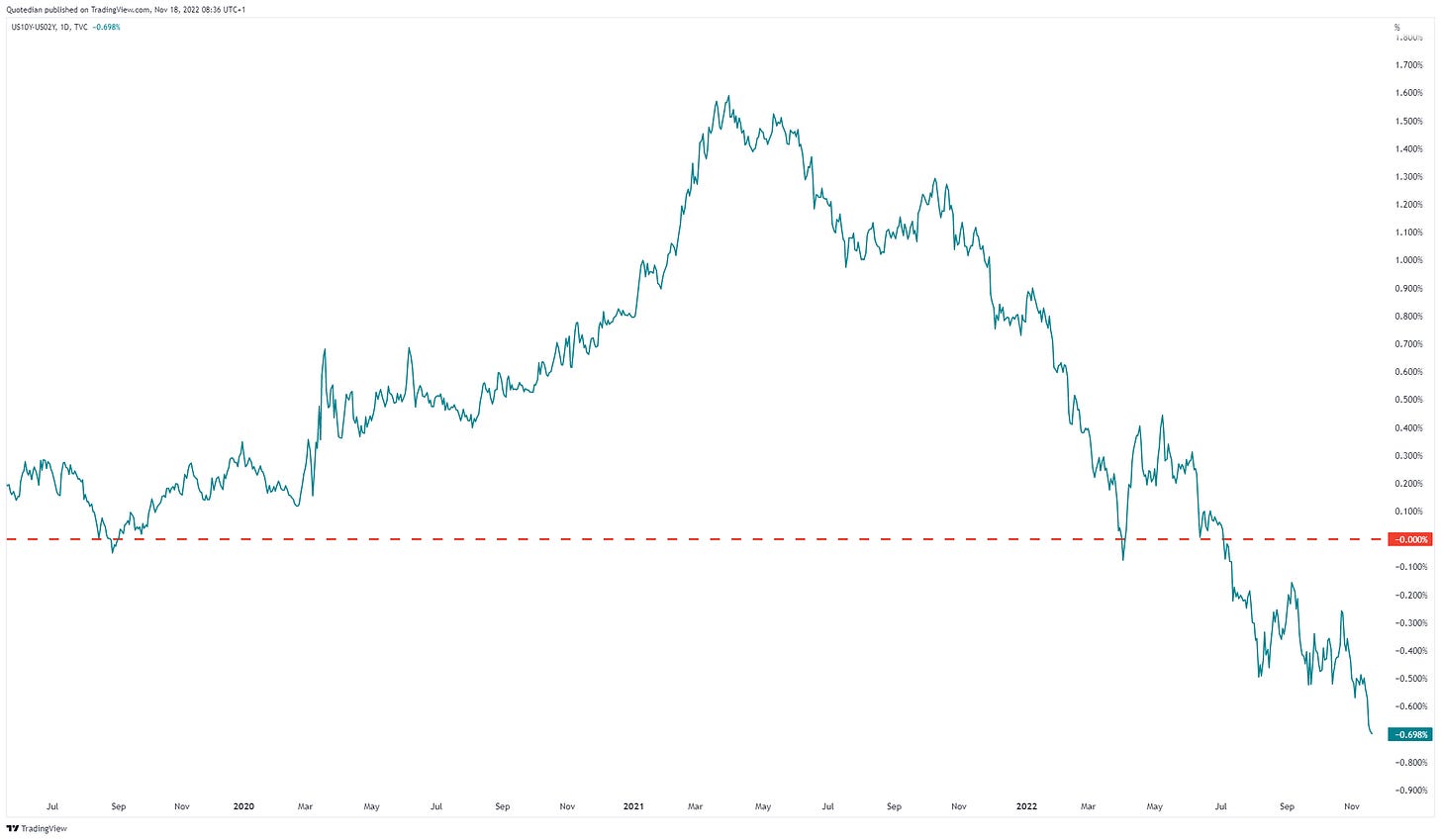

Probably more importantly, the yield curve continue to invert even further, apparently triggering some stop losses limits on early steepener positions:

Here’s another D’oh! from yesterday, as I also wanted to show the Fed’s favourite slope measure, the 10y - 3m rates (I shared an important paper on this a few weeks ago):

Done now.

European rates (proxied via German Bund) are sitting on top of some possibly important support, a break of which could pull yields as low as 1.40 (not a forecast!):

However, some European countries are still looking at very elevated inflation numbers:

Nevertheless, it is encouraging to see that the (internal) European risk premium seems to be abating. Here’s the BTP to Bund spread:

Finally (for today), on the currency side, the US Dollar is still trying to get some kind of recovery rally started, though is failing to get any meaningful traction so far. Here’s the Dollar Index (DXY):

Whilst I think the bid USD rally is over, I would also not jump in selling the greenback at current levels. In the EUR/USD, a pullback to parity or slightly below would seem a good level to reduce $-exposure:

Ok, time to hit the Send button.

Have a great Friday, an even greater Weekend and don’t miss Sunday’s World Cup kick-off game as you are submersed into reading the WE edition of The Quotedian.

André

P.S. D’oh!

CHART OF THE DAY

Did we witness a short squeeze in (US) markets since October 13th? Well, the speed of the ascent would suggest yes, but comparing the S&P’s advance (green line) to the one of the 50 most shorted stocks (red line) in the index would suggest no.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance