Don't Panic

The Quotedian - Vol VI, Issue 35 | Powered by NPB Neue Privat Bank AG

"Life is hard. Then you die. Then they throw dirt in your face. Then the worms eat you. Be grateful it happens in that order."

— David Gerrold

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Don’t Panic.

This words are written in large, friendly letters in The Hitchhickers’s Guide to the Galaxy.

All is good with The Quotedian. I just had a shortened work week, full of travelling and driving, which kept me from posting updates. It also means I am just now catching up with most of my emails and generally had less time for market research. In other words, today’s issue of your all-time favourite newsletter will also be a bit shorter, especially in terms of descriptive text.

So, without further ado, let’s dive right in…

The good old Quotedian, now powered by Neue Privat Bank AG

DON’T PANIC!

NPB is your reliable partner for all aspects of asset management and investment advice, be you a private client, an independent asset manager or institutional investor.

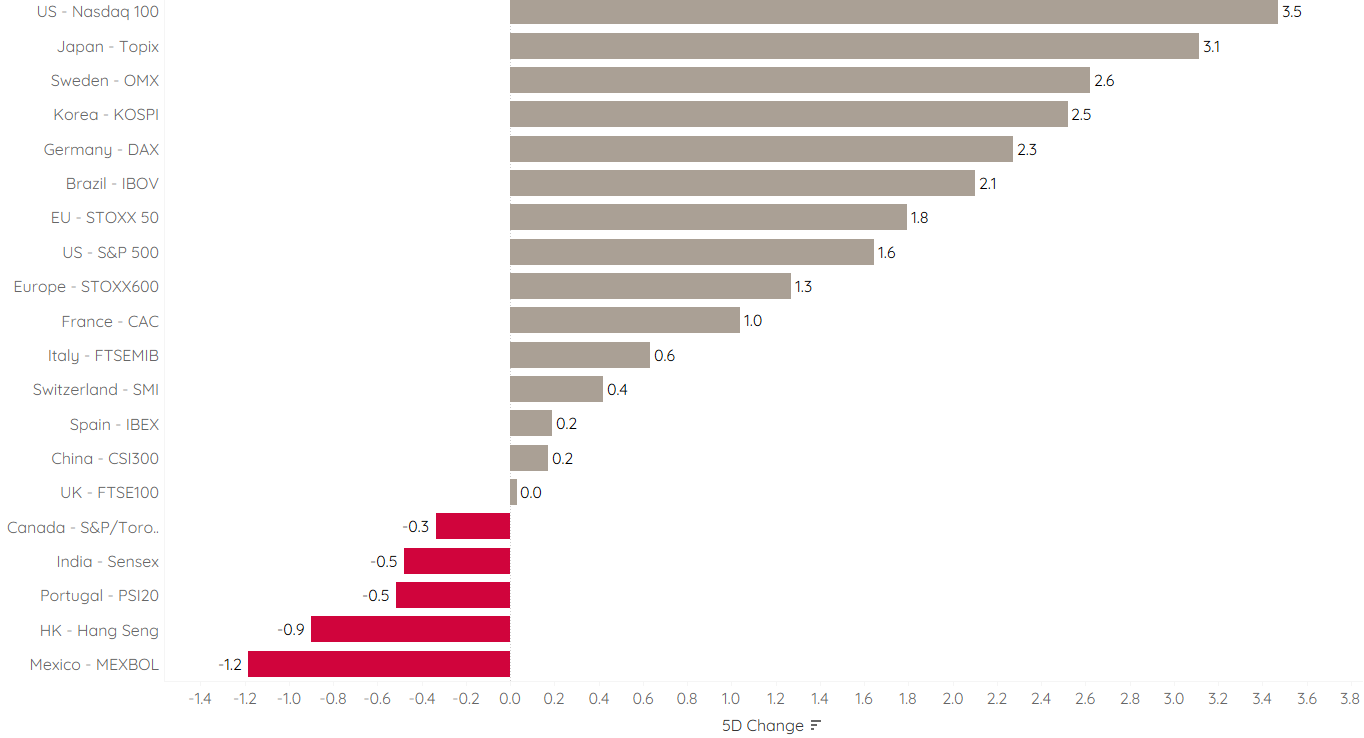

Starting with equities, undoubtedly it was a good week for stocks:

This comes as a mild surprise, as especially the US debt-ceiling issue is far from being resolved and has possibly catastrophic implications. And this is even before we start worrying about a looming recession,

an increasingly stretched consumer,

and a bankruptcy filing index that clearly has turned higher:

So:

But the truth is that the most reliable indicator of them all is price, and price is giving a clearly bullish message. Here’s the S&P 500 price chart:

Whilst several points of resistance still lay ahead, the chart has clearly invalidated the pattern of breaking lower (shaded areas) I highlighted a few weeks ago. So let’s take out that eraser and ‘paint’ some new lines:

What stands out now is the pattern of higher highs and higher lows, which of course is the classical description of an uptrend. Nevertheless, 4300 and change need to be taken out to give the “all green” light.

On the Nasdaq, this has already happened:

Germany, a country that is technically in recession taking into account the GDP revisions, just saw its main DAX equity index hit a new intraday all-time high on Friday, before turning lower:

Seeing this you can either scroll back to the ‘investors are rational’ cartoon above, or re-read following Benjamin Graham's classical quote:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

Similarly, in Japan, the Nikkei just hit a new 23-year high:

And with Uncle Warren recently expressing his continued bullishness on that particular stock market … what could possibly go wrong?

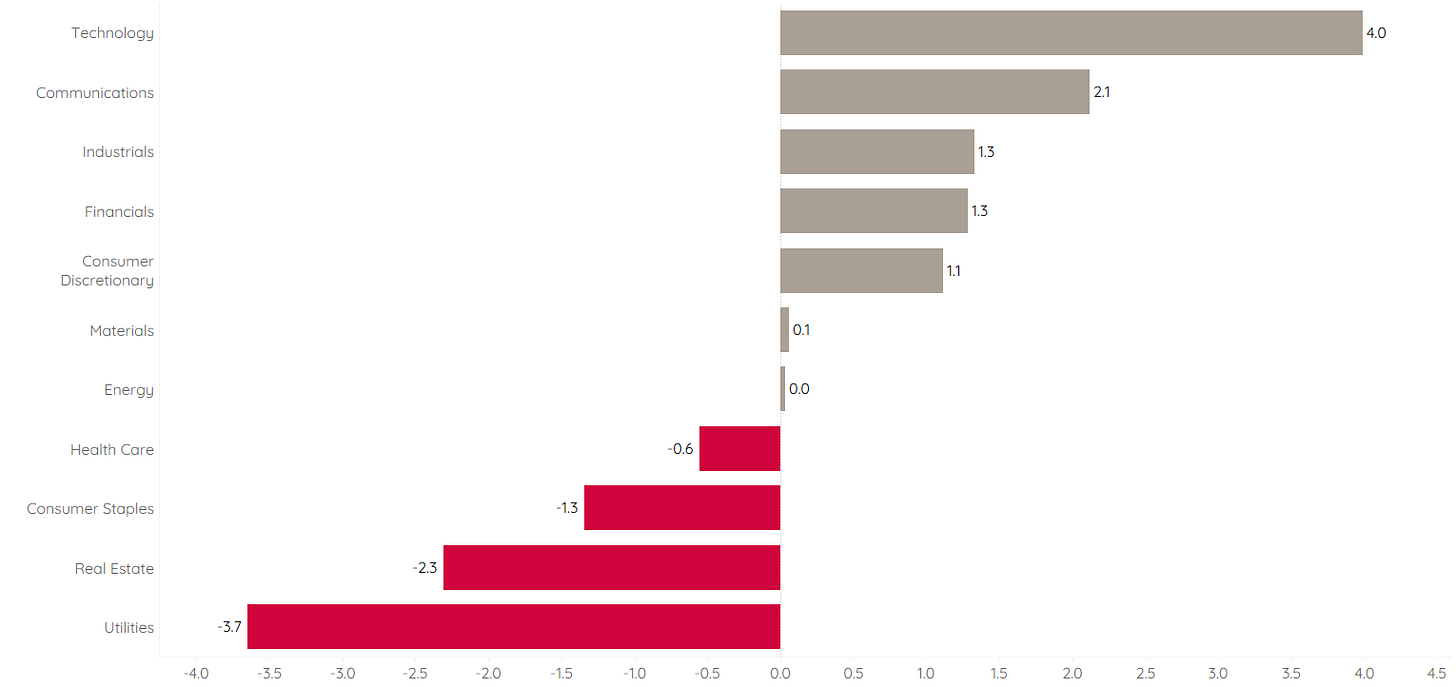

Moving into last week’s equity sector performance, “things” look a bit more mixed:

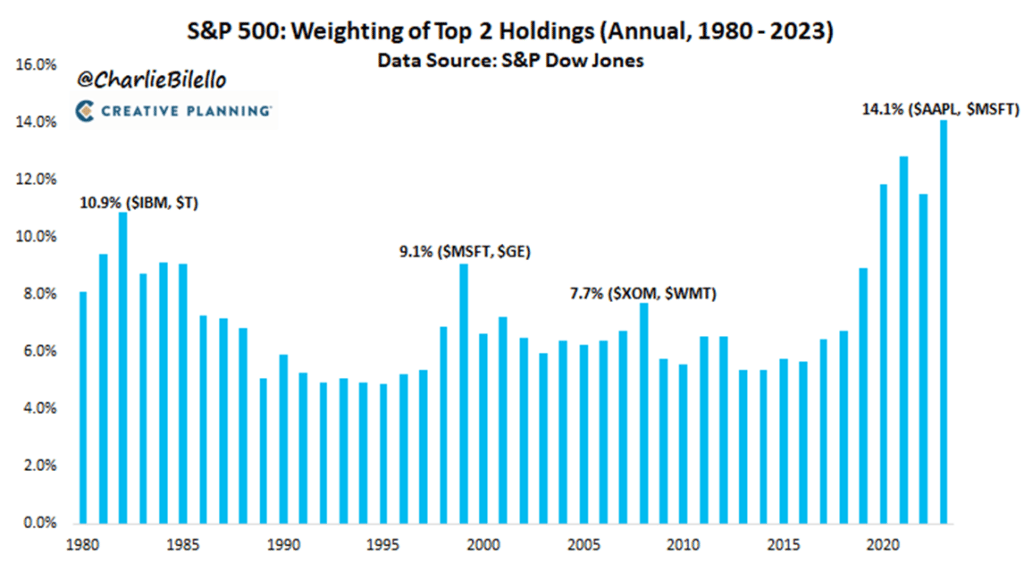

Again standing out is the outperformance by long-duration sectors such as technology and communications. And their most representative … ehhm .. represents, Microsoft and Apple, now make up 14.1% (!!!!!!) of the S&P 500 index:

But those two stocks are not alone in "‘extremeness’. Here are the price-to-sales ratios of the 15 most expensive stocks in the Nasdaq according to that particular ratio:

But hey, strength begets strength, or so they say. Probably a good moment to show our usual list of the year’s top performers and their development over the past five days.

Here’s the list for the US:

Another 10%+ for NVDA and both, NVDA and META are now up over 100% this year … and it’s only May …

As we are positive people, we usually do not look at the other end of the performance spectrum, but just for reference, let’s do this today too. Here are the least performers (optimist’s expression) of the S&P 500:

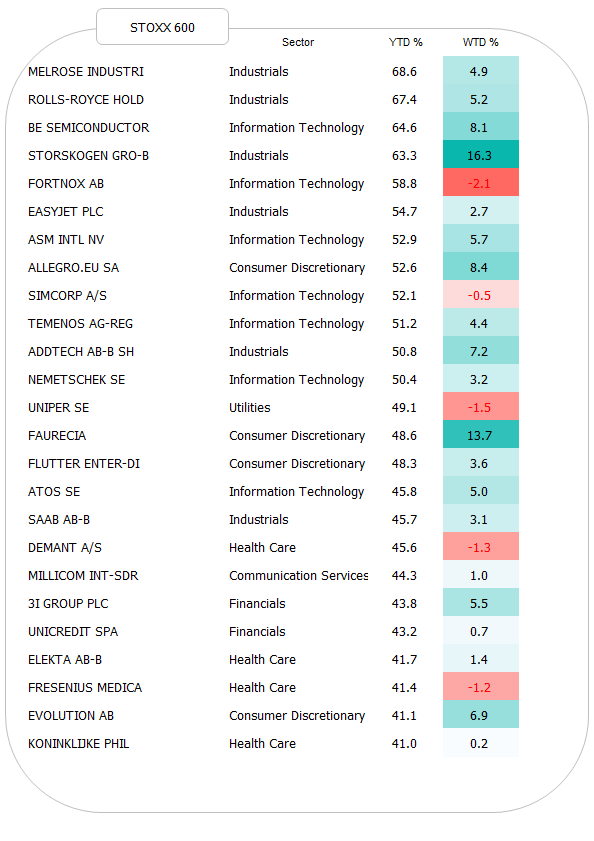

Turning to Europe, here are the winners of the STOXX 600 Europe index:

And here the anti-winners (another optimist’s expression):

Uh, oh! Credit Suisse the worst performer!! Here’s a quick reminder in case you are looking for a stable Swiss Private Bank, with the added advantage of your favourite CIO sitting there ;-)

Moving into fixed-income markets, according to total returns for global bond markets, yields have been on the up over the past five days, again putting the equity bullishness somewhat into question:

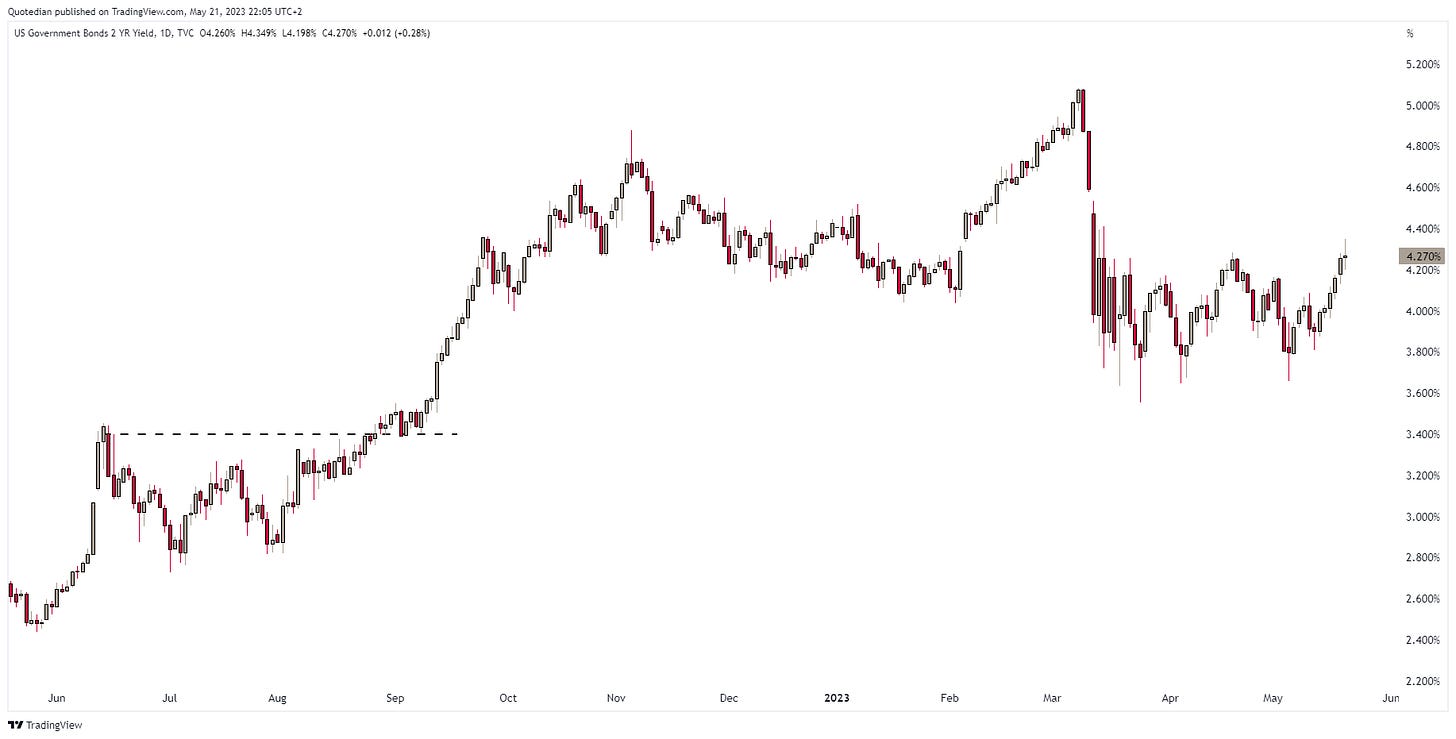

Indeed, did yields rise over the past few sessions, as this chart of the US 2-year treasury would attest:

Though there was a big intraday (yield) bearish reversal on Friday, after a Powell comment (see on chart) hit the newswire:

The 10-year US treasury benchmark yield seems to be heading back to 3.90ish:

It’s European bro, the German 10-year Bund yield, is about to negate our shoulder-head-shoulder pattern:

Marching on, here’s the performance of the Greenback versus other major currencies over the past five days:

Mostly the US Dollar gained, though similar to bond yields, that trend reversed sharply on Friday after the Powell comments:

But overall the chart for the US Dollar (DXY) remains bullish:

The level of 1.05 seems to be on the cards versus the Euro:

Finally, let’s have a look at the commodity space, starting with the major commodity ‘sectors’:

The outperformance of energy stands out here, especially in the face of that meanwhile ‘notorious’ recession …

But the truth is, as the following performance stat will reveal, that the energy outperformance comes from hopelessly oversold NatGas, rather than crude:

Here’s the nearly unbelievable chart of natural gas:

If only we had a clue about market timing. Or trend following. Hey, wait, we do!

Gold must hold at the current levels, or it may get a bit tight for the longs:

Structurally I am stil bullish on Gold, but maybe it is not too late to take partial profit on the GDX, just in case:

Ok, as usual, it is far way too late, so high-time to hit the send button. Off to London in less than six hours, which means the next Quotedian is likely to be out on Wednesday.

André

CHART OF THE DAY

Simple, but essential.

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance