Escalation

The Quotedian - Vol V, Issue 121

"There cannot be a crisis next week. My schedule is already full.”

– Henry Kissinger

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s Quotedian will be unusually short, but given that hardly anything is going on in the world, that should be just fine (yes, yes, tongue in cheek).

Let’s have a brief look at yesterday’s session, which started with a bang but then rather ended with a whimper, given the absence of US investors who were celebrating Labor Day by not working. And I’ll also try and throw in a few charts which caught my attention.

So, yesterday’s European session started under the sign of geopolitical escalation and there’s no need to mince those words, as it is what it is. Europe’s threat to put a lid on Russian energy prices was immediately countered by Putin by stopping to deliver energy (Nordstream I gas pipeline is offline indefinitely). No energy, no cap.

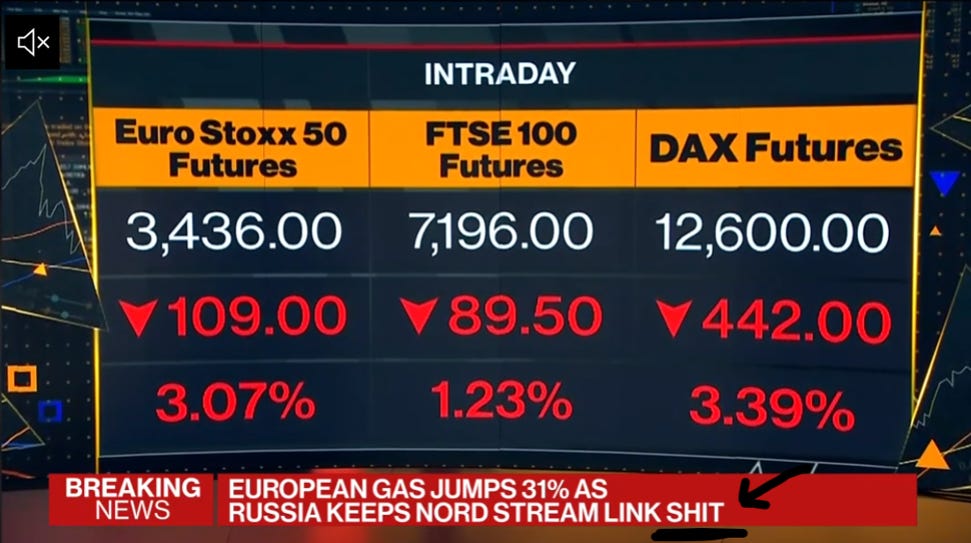

European investors were greeted with this new situation by a deep sell-off in stocks and jumping gas prices. In the case of the former, the DAX took the worst hit, with a three percent drop (the bang) at the opening, though some damage control was done throughout the rest of the session (the whimper):

Regarding (European) natural gas prices, the Dutch December 22 TTF contract jumped over 30% at Monday’s opening, but then settled an intraday price increase of about 15% ‘only’:

This led to a seemingly Freudian slip on one major financial news channel, which was too good not to be tweeted to the followers of @TheQuotedian:

Adding the equity and the gas chart above together, European equity sector performance yesterday should not come as a big surprise:

This morning, Asian equity markets are mixed, with some gains in Mainland China, Korea and Taiwan, which are more than offset however by losses in Japan, Hong Kong, India and Australia.

European equity futures are down about half an hour before the opening of cash markets, whilst their US counterparts are showing small advances.

Looking at fixed income markets very briefly, we take note that Australia’s central bank (RBA) increased its cash target rate as expected by 0.50% to 2.35%, the highest level since 2014:

German yields, as a proxy for the European bond market, hardly budged yesterday. However, rates continue to rise in the UK, with the 10-year Gilt at close to three percent hitting its highest level since 2011(!)

and the curve continuing its inversion process (though there is a slight steepening this very morning):

This serves as a perfect segue into currency markets, where the British Pound found a footing (for now?), as Liz Truss has been elected as the next Prime Minister. The task she has ahead is gargantuan, but maybe all of the bad news is already baked into the Pound?

Regarding the glittering wonder that is the Euro, it took another heavy blow yesterday upon the geopolitical escalation with Russia, albeit it recovered somewhat into this morning and is clinging on just about to support:

Let’s skip the commodity segment for today, but not without mentioning the jump in energy prices in general and crude oil in particular, which is leaving the chart of the latter in a very messy situation:

Have a great Tuesday!

André

CHART OF THE DAY

Last earnings season (Q2) everybody was waiting for the earnings shoe to drop aaaanndd … it didn’t. Earnings held up very well, despite all the headwinds (inflation, higher rates, geopolitics, etc.).

The fine folks at Morgan Stanley now however recently produced the following chart, citing a new leading indicator on earnings they have created, suggesting little goodness ahead. I can only say, stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance