Evolution, Not Revolution

Vol IX, Issue 08 | A NPB Original

“It is not the strongest of the species that survives, nor the most intelligent, but the one most adaptable to change.”

— Charles Darwin, “On the Origin of Species”

Housekeeping

Before we dive into this week’s market review and deliberations you may have already noticed a few, slight changes taking place in, at and around your all-time favourite financial markets newsletter 😉.

First of all, we are dumping the asset class structure (equity, fixed income, FX, commodities), replacing it with just one huge, completely random ‘Deliberations’ block.

But fret not, the ‘TL;DR’ (Too Long; Did not Read) section at the beginning will tell you what the second, deliberations part is all about.

And for those of you who are just constantly screaming: “Show me the money!!”, we’ve got the ‘Squaring the Circle’ section at the end, which intends to give you some savvy investment advice. Which in turn and of course immediately triggers following disclaimer:

Finally, our (nearly) daily publication, The QuiCQ (click here), will eventually be re-branded into The Quotedian - Daily Edition, though for now the two lists will be run separately.

With that out of the way, here we go!

Rotation out of tech into energy and consumer staples stocks continues

Mag 7 are giving up market leadership as FCF tumbles

Equity markets look ripe for a correction

Continue to overweight non-US markets

Bond rally about to stall?

US Dollar continues to be structurally weak

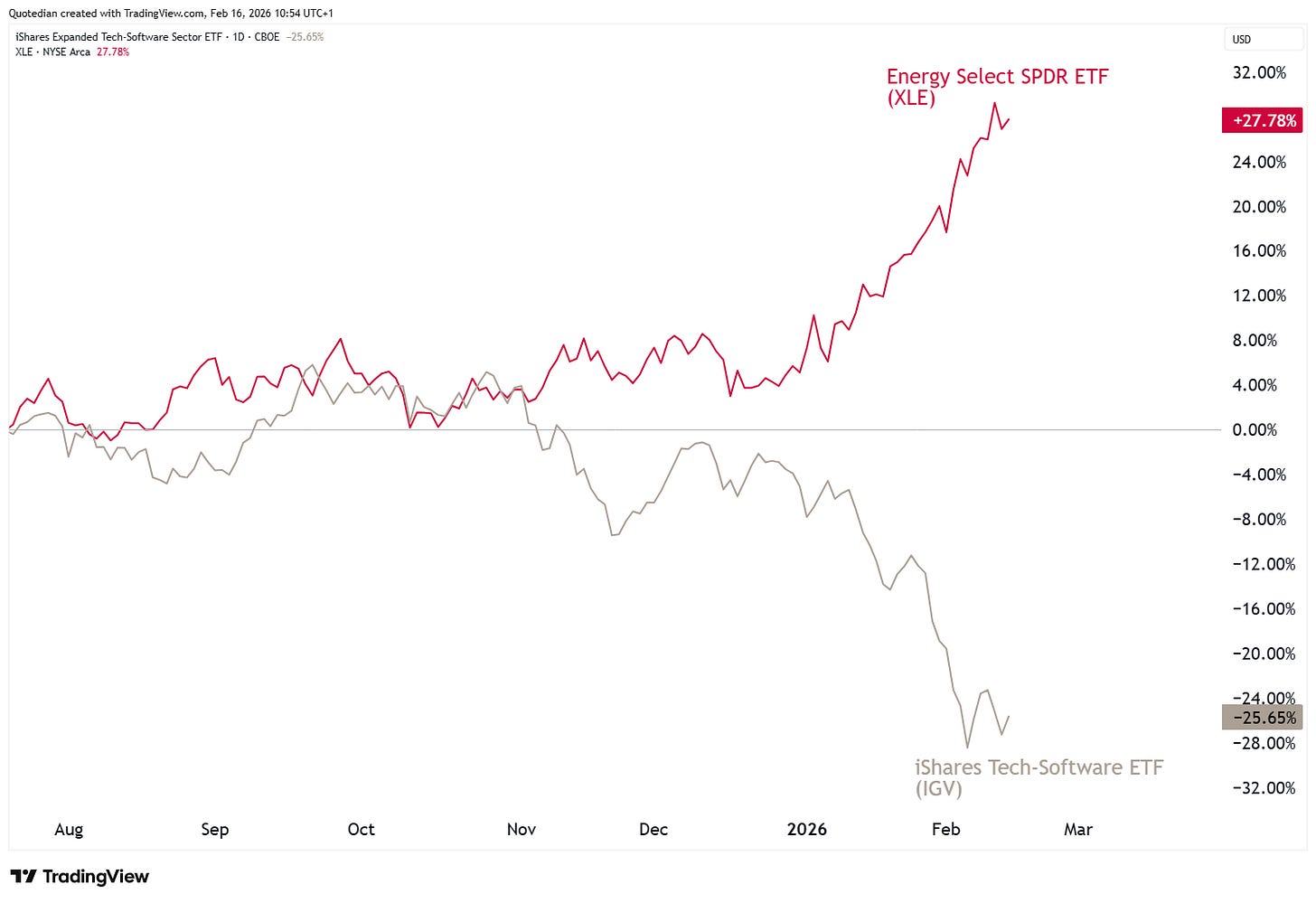

One of the big themes of this year has been “From Bits to Atoms”, as the rotation out of software stocks (IGV - grey line) into oil stocks (XLE - red line) continues:

On a stand-alone basis, the software ETF (IGV) is in the vicinity of long-term support levels AND is wildly oversold:

So, may it be worthwhile trying to catch that falling knife?

Perhaps.

Though for the time being, it seems that contagion into the broader tech sector is real threat. Here’s the Nasdaq-100, which seems to have a similar set-up as February a year ago:

24,000 to 23,900 seems to be key support zone here.

The Mag 7, which are NOT your Mag 7 of a few years ago thanks to all that AI-induced spending spree,

are breaking down versus the broader market (below - ratio of Mag 7 / S&P 500 equal-weight index):

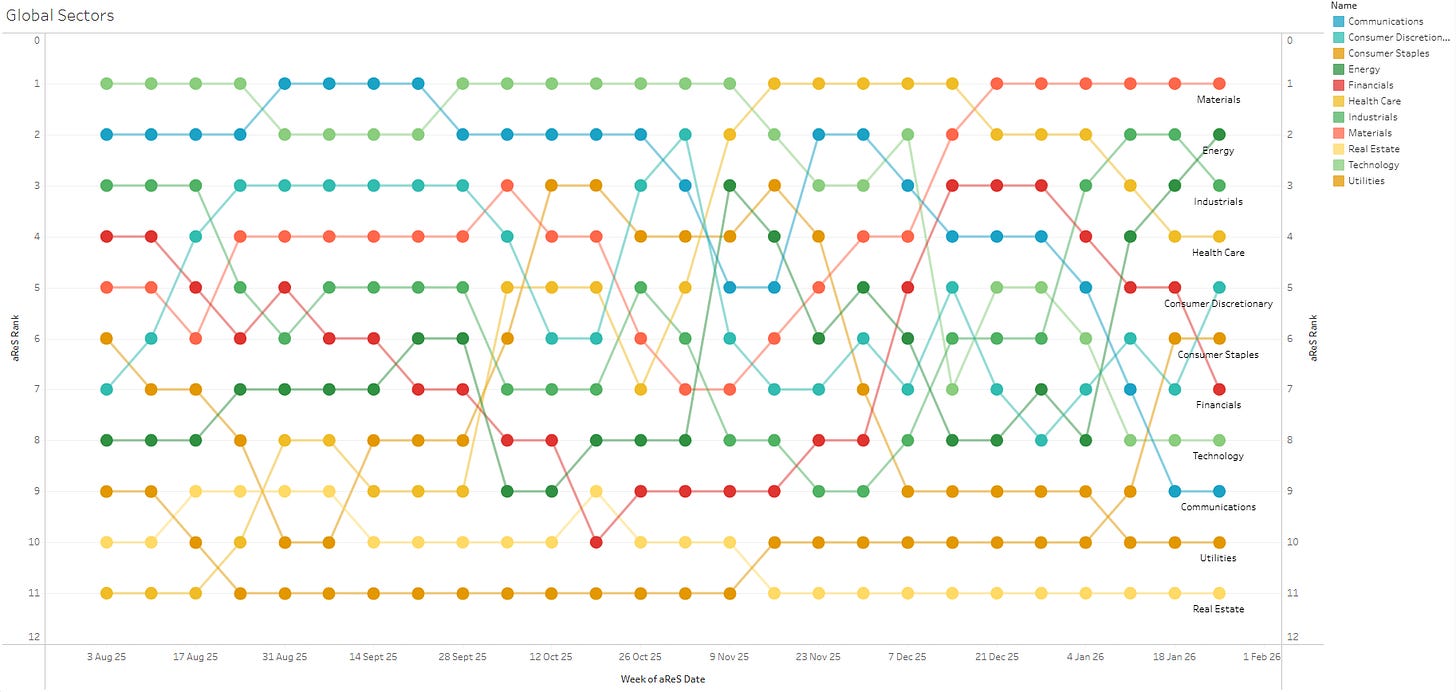

But, BTW, all that AI spending is actually pretty decent for end-users, such as me. Remember that relative strength model (aReS) I have been showing in this publication over the past years. It used to look like this,

and involved downloading data from Bloomberg into Excel, uploading the Excel sheet into Tableau Public and was rather on the ‘fidgety’ side.

Five minutes invested into prompting Claude (Anthropic) gave me a fully interactive version with all bells and whistles, including an automated data update on a daily basis:

WOW! Just WOW!

Anyway, back to markets, where we see in the above WOW-table that consumer staples stocks have been climbing sharply in ranking over the past weeks. That is of course another sign for caution as investors seem to be positioning themselves more defensively:

Especially versus consumer discretionary stocks is that rotation very pronounced:

Seasonality is also not very helpful over the next two to three weeks:

Is Bitcoin (red) then trying to tell us something?

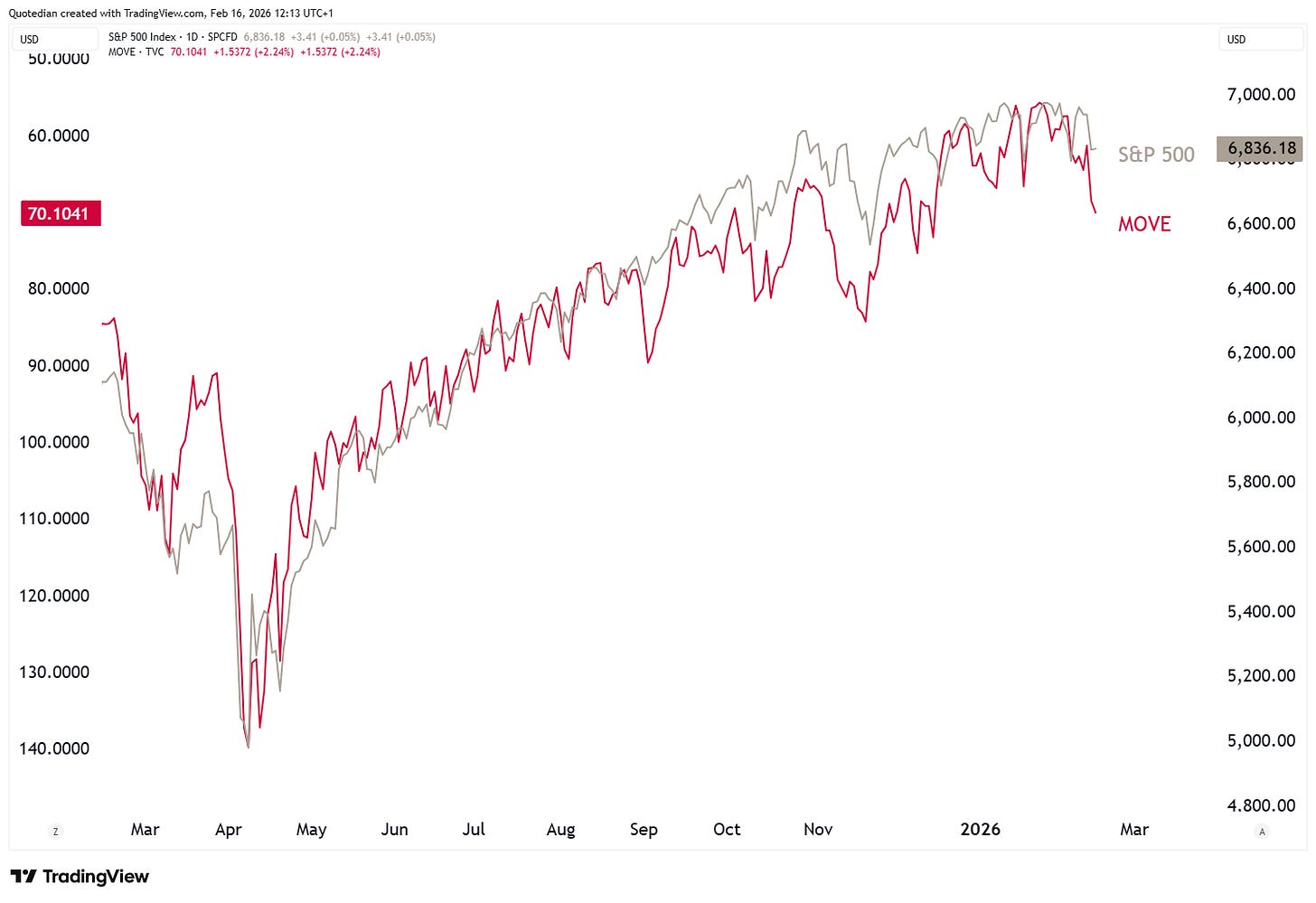

Volatility remains elevated on the S&P 500 (VIX) and the Nasdaq 100 (VXN),

but probably not elevated enough (yet) to argue for an immediate bottom.

Worse, bond volatility (MOVE inverted - red line) has also been pickup up over the past few sessions:

But, under the leitmotif: “There is always a bull market somewhere”, Japanese stocks have continued to behave well since the snap election a week ago,

and Brazilian stocks are continuing in a quiet, very overlooked bull market too:

And talking of Japan a moment ago, a blow-off top for JGB yields could have been put in place in January:

A top that also coincides with a top (for now) in the USD/JPY rate:

Rumour has it of course that the BoJ/MoF was inquiring about USD/JPY rates around that January top …

Staying on the US Dollar for a moment, the following front-page of The Economist,

usually a contrarian indicator, has so far failed to put a bid under the Greenback:

But one currency that definitely has found a bull trend is the Chinese Yuan. Not only versus the US Dollar,

but especially also versus the Japanese Yen, which may be politicised over the coming months:

US consumer price inflation (CPI) surprised to the downside last Friday,

and Truflation (click here and here) says inflation is even lower:

This has been pushing treasury yields lower,

and bond prices correspondingly higher:

Longer-term, our consolidation triangle on the Tens remains intact, hence I do no expect a substantial drop below 4% (stop loss below 3.90%):

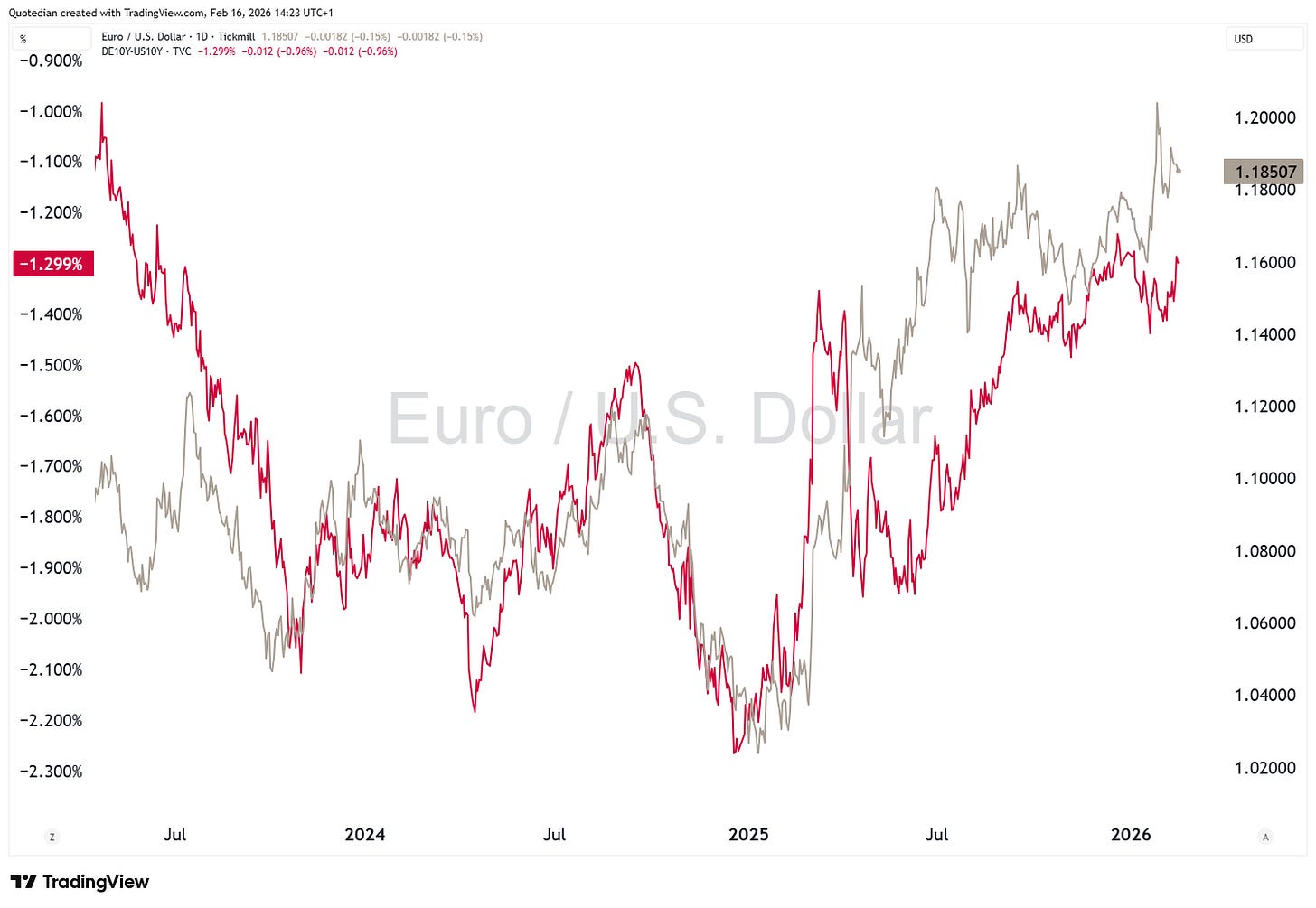

European yields have come lower too over the past two weeks, but not to the same extent as their US cousins, making the interest rate differential (red line - lhs) between the two economic zones widen again and probably putting a floor under the EUR/USD (grey - rhs) rate at the same time too:

In commodity markets, oil (Brent) has been in an uptrend since the beginning of the year, but is now struggling to stay above US70 the barrel:

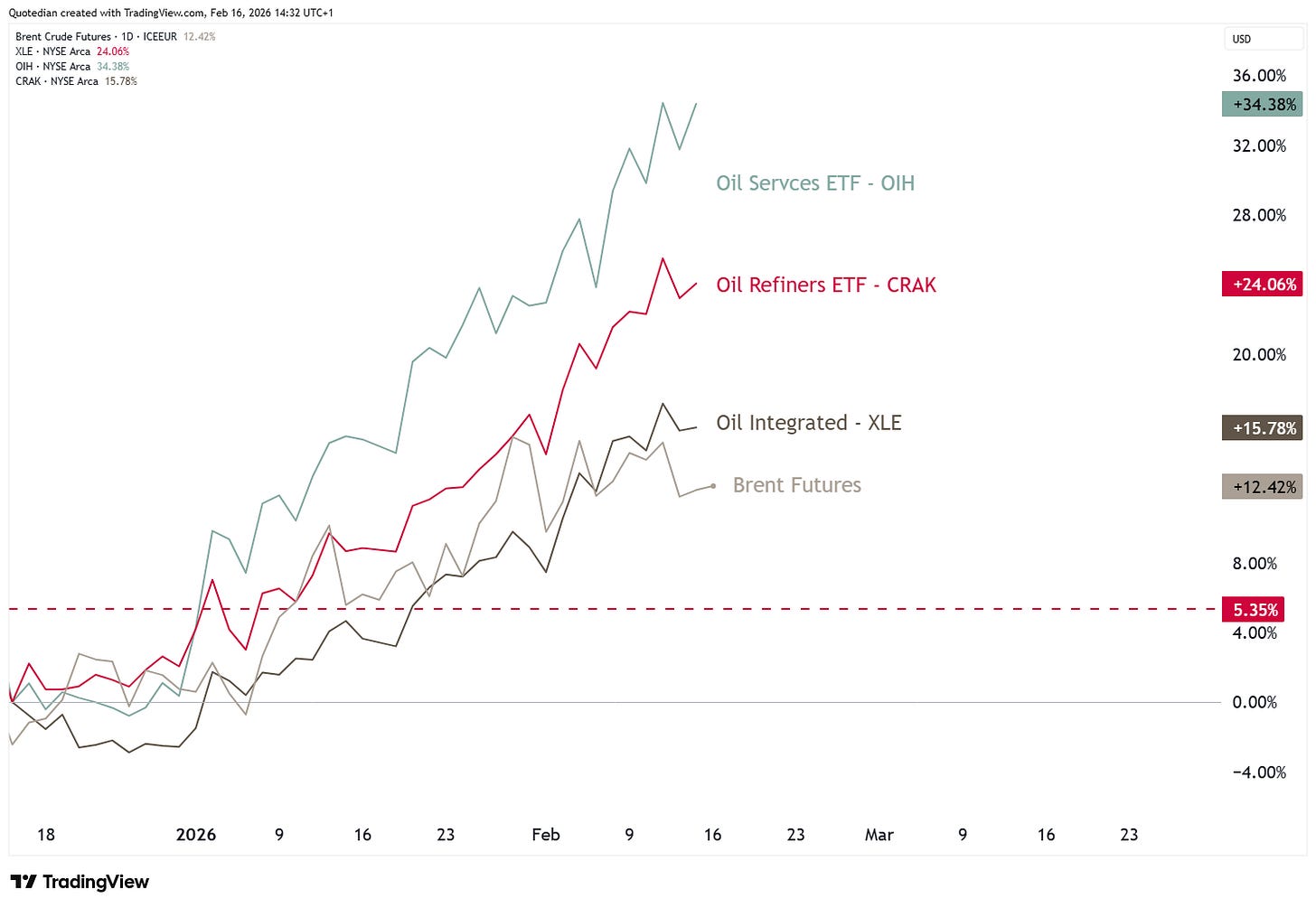

Nevertheless, that 15% increase in oil prices since mid-December has been disproportional well for all type of oil stocks:

Gold (and Silver) continue to be in a consolidation phase, which could last at least a few more weeks, if not months:

Monday is a US holiday (Presidents’ day). Markets closed.

This week look for Empire Manufacturing (17.2.) and Durable Good orders (18.2.) in the US; plus FOMC minutes of last meeting are out on Wednesday too.

Inflation numbers due from various Eurozone member states should be a non-event

Several companies reporting earnings - am interested to see those of Palo Alto Network (PANW) as guidance for the internet security sector after AI-related software sector sell-off. Worth buying into the numbers?

Continue to buy Brazil and Japan stocks on dips

Bond rally close to an end?

That’s all for today - make sure to sign up to our daily updates, if you have not done so yet.

May the Trend be with you!

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by NPB Neue Privat Bank AG

This strongly resonates with my own experience. Performance rarely comes from entirely new ideas, but from many small improvements: better data quality, more robust execution, and consistent process discipline. The cumulative effect is often underestimated.