Ex-Post (2025)

Vol IX, Issue 01 | Powered by NPB Neue Privat Bank AG

“An optimist stays up until midnight to see the new year in.

A pessimist stays up to make sure the old year leaves.”— Bill Vaughan

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

HAPPY NEW YEAR, DEAR FELLOW TRAVEL COMPANIONS!

This first newsletter of the year is our meanwhile traditional look-back at the year just gone by, which, and I think many would agree with me, turned out substantially better, than expected, espcially during the unfolding Trump Tariff Tantrum in Q1.

Even though Trump did exactly what he had said during the election campaign (blimey, he even called himself the tariff-man!), many were still caught by surprise.

But as so often since the last major bubble burst in 2008 (GFC), corrections have become shorter in duration and depth and the BTFD attitude manifested itself already in mid-April.

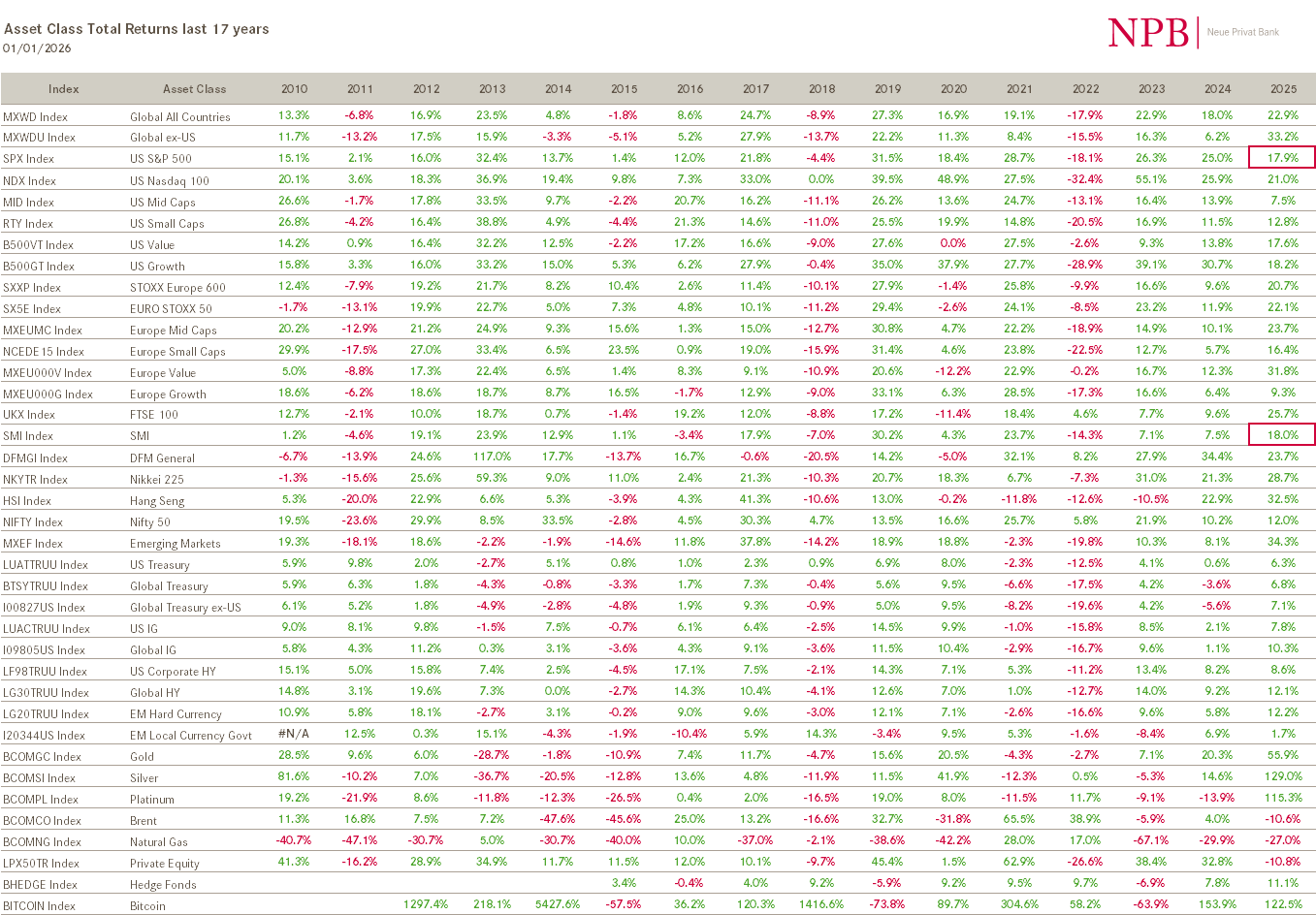

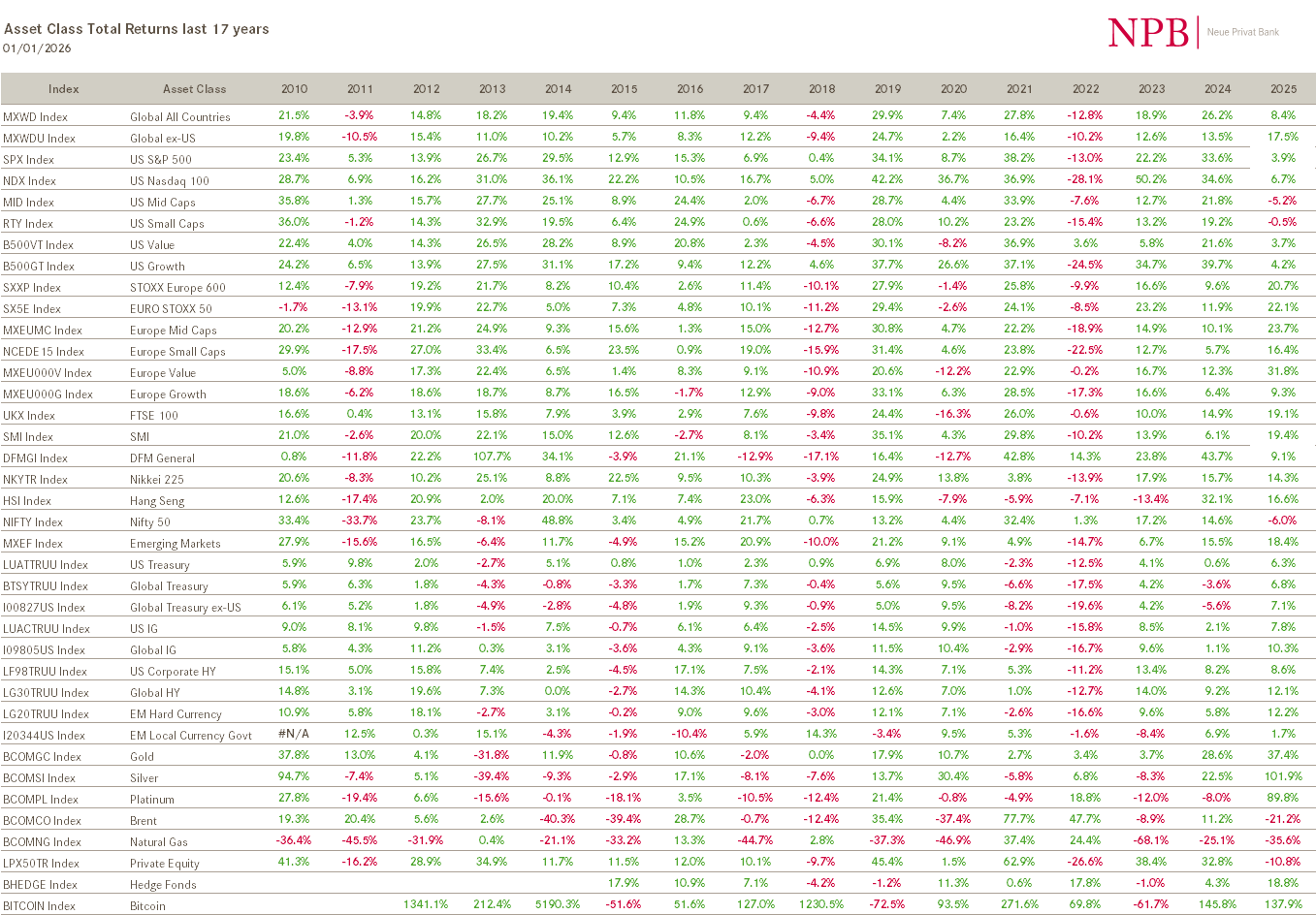

What clearly played a role in 2025 was your (foreign) currency exposure. For example, a Swiss (Franc)-based investor may think that the returns for the S&P 500 and his/her domestic equity index (SMI) are nearly identical at 18%:

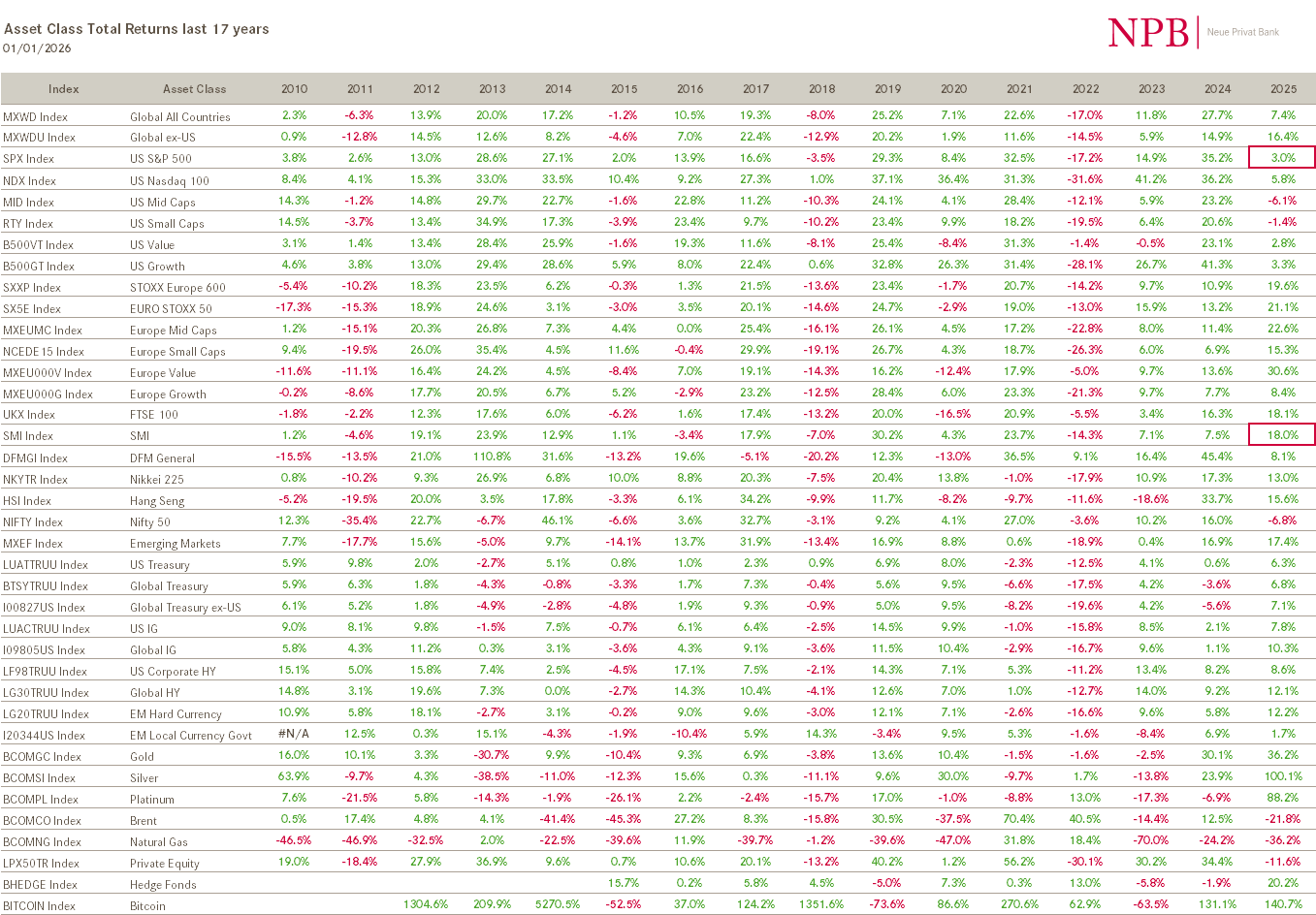

However, if he/she failed to hedge the US Dollar exposure inherited by investing in the US stock market, which by the way also comes at a cost, the returns look pretty difference with the home market outperforming by a factor of 6x:

And just because you asked, here’s the same table again with the perspective of a EUR-investor:

Onwards …

This Quotedian will be more factual than philosophical (aka forward-looking), as we go through our usual performance tables and one or the other long-term, monthly chart.

But also, we will revisit the predictions you made (ha! you had forgotten about that right?!) at the beginning of the year in our second issue of the Quotedian in 2025 (click here).

I asked you to answer then different question, which unfortunately only about 5% of you dutifully answered - shame on the other 95%!

It was multiple-choice format, so the effort was kept to a minium, gals and guys. But fret not, you shall get another opportunity in our second issue of the Quotedian in 2026, which, if everything goes well and hangovers are not too limiting, you should have in your inbox by the end of this week.

With all this having been said and without much further ado, let’s dive right in to this first issue of the Quotedian in its 9th year!

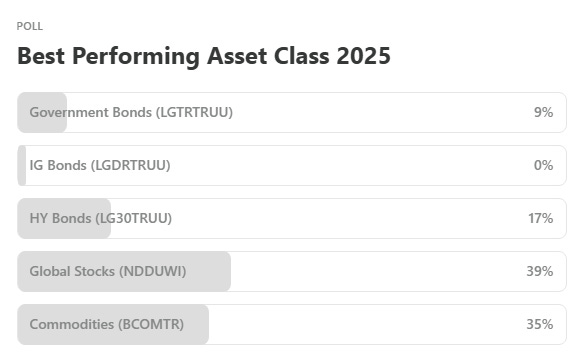

Our first question was regarding asset classes, so let me place it right here, in the deliberations section:

The outcome was as follows:

Government Bonds: 6.8%

IG Bonds: 10.5%

HY Bonds: 12.1%

Global Stocks: 21.1%

Commodities: 15.8%

Hence, I conclude that the 5% that did vote are actually the smart money, as they got number 1 and number 2 right. However, I would also highlight that bonds probably delivered surprisingly good performance contributions, even boring govies…

Ok, let’s look at some of the individual asset classes and see how my favourite 5% have fared …

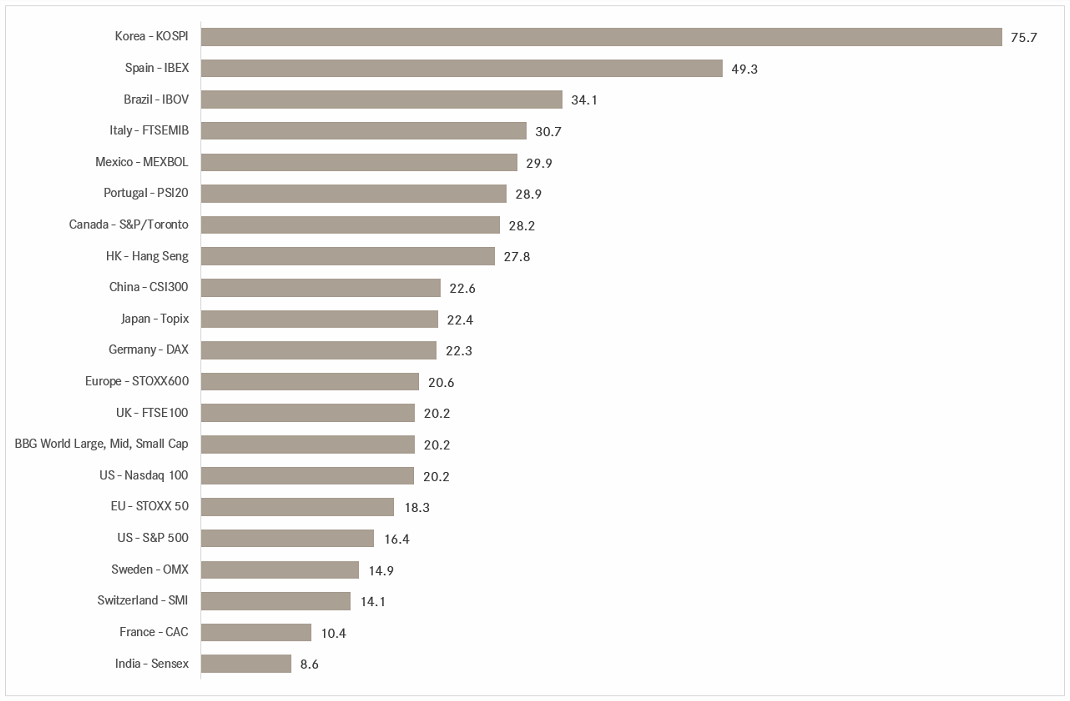

First, let’s have a look at our performance table of some of the most observed equity benchmark indices around the globe (all in local currency):

WOW! Did you see that? 2025 turns out to have been a year for full risk-on! And again, in early April that did not seem like a good value proposition:

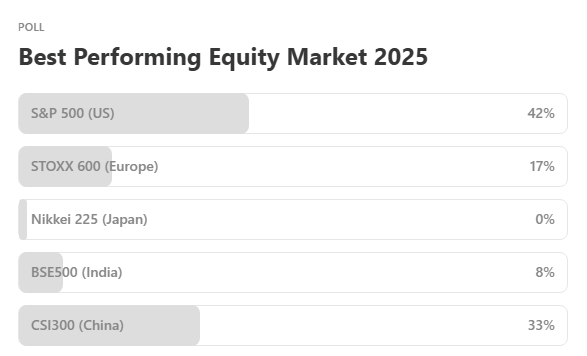

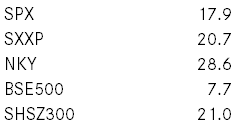

This was our first of three equity polls:

Now, this is of course a bit tricky due to the currency question, but we just take the local currency numbers in this case:

Uh, oh! Nobody voted for the best performing market (Japan)! But at least one third of you got the second best performer (China) right 👍😀

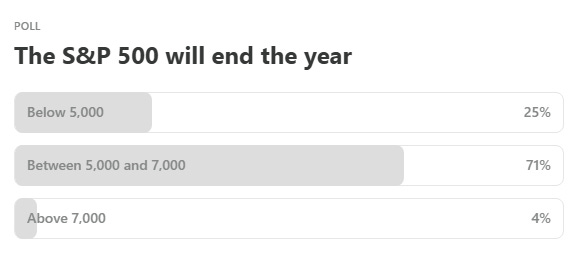

The next question was regarding the S&P 500 and its closing level:

Bravo!

Albeit you nearly got stopped out only a few days ago 😉

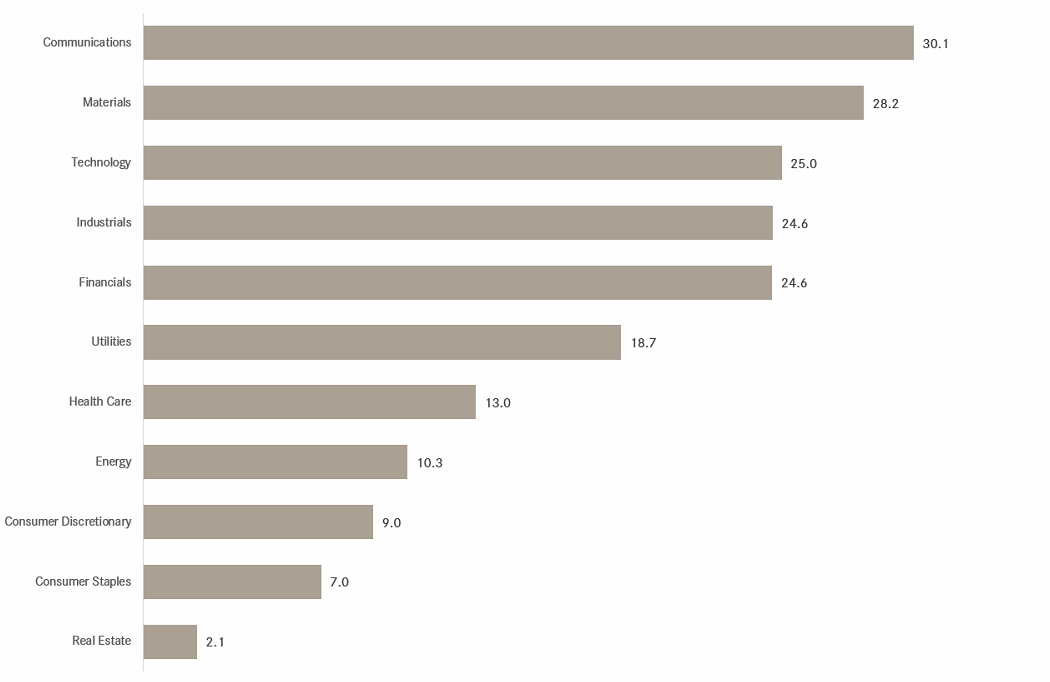

Time to look at sector performance in 2025 on a global basis:

Any surprises here? Ignoring the communications sector, where Alphabet (Google) and Meta make up more than 50% of the index weight (note to self: finally include those equal-weight indices), probably not many thought that materials would end so well. And it is also curious to see that Consumer Staples (defensive) and Consumer Discretionary (cyclical) have such a similar performance.

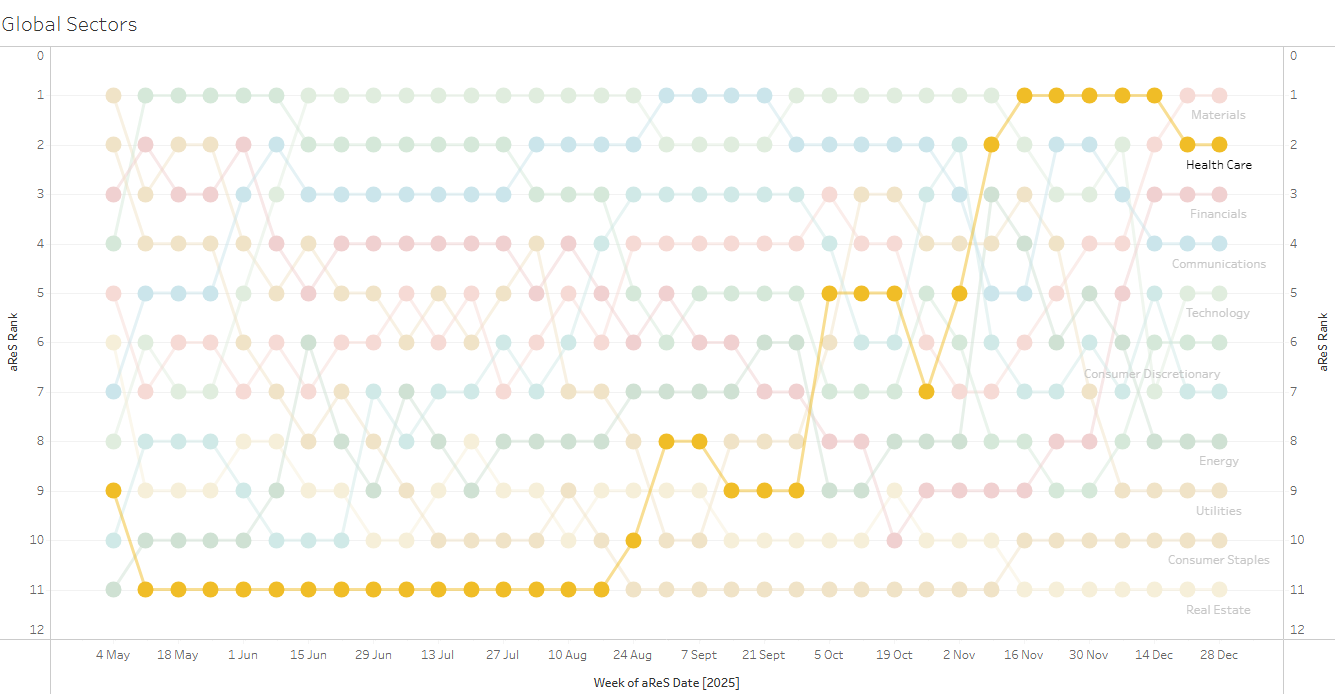

What you cannot see from the table above, but what I will show you with the graph below, is the comet-like ascent of health care stocks after having been bottom performer during weeks on end:

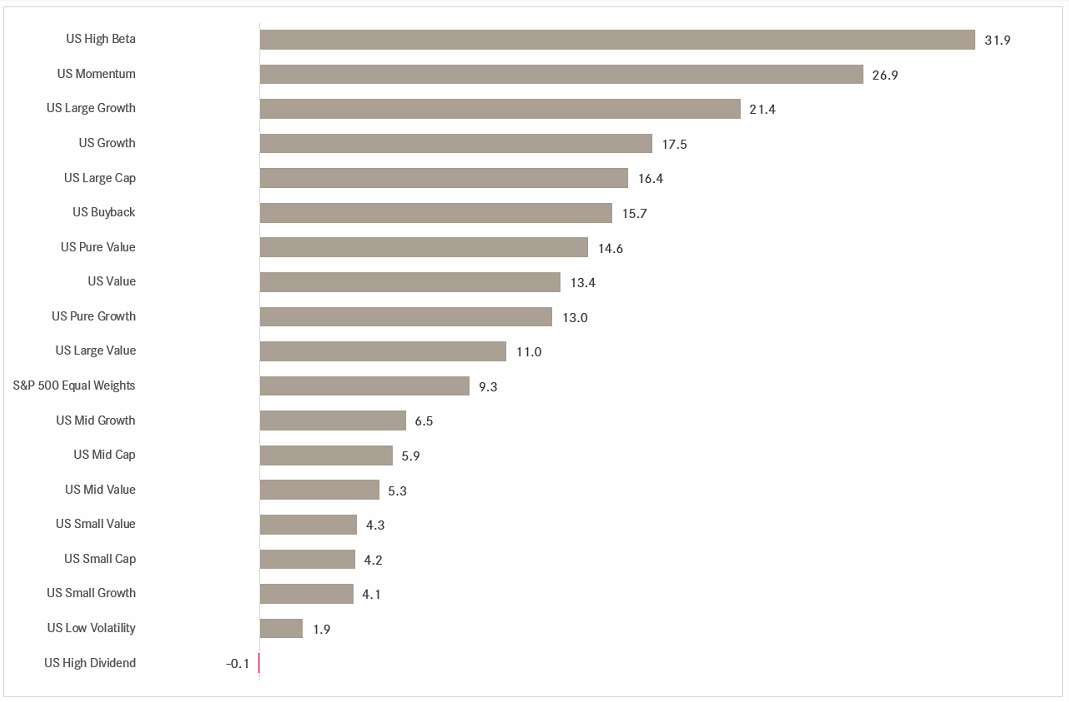

Now, to factor performance, where we will use US data as proxy for global factor performance:

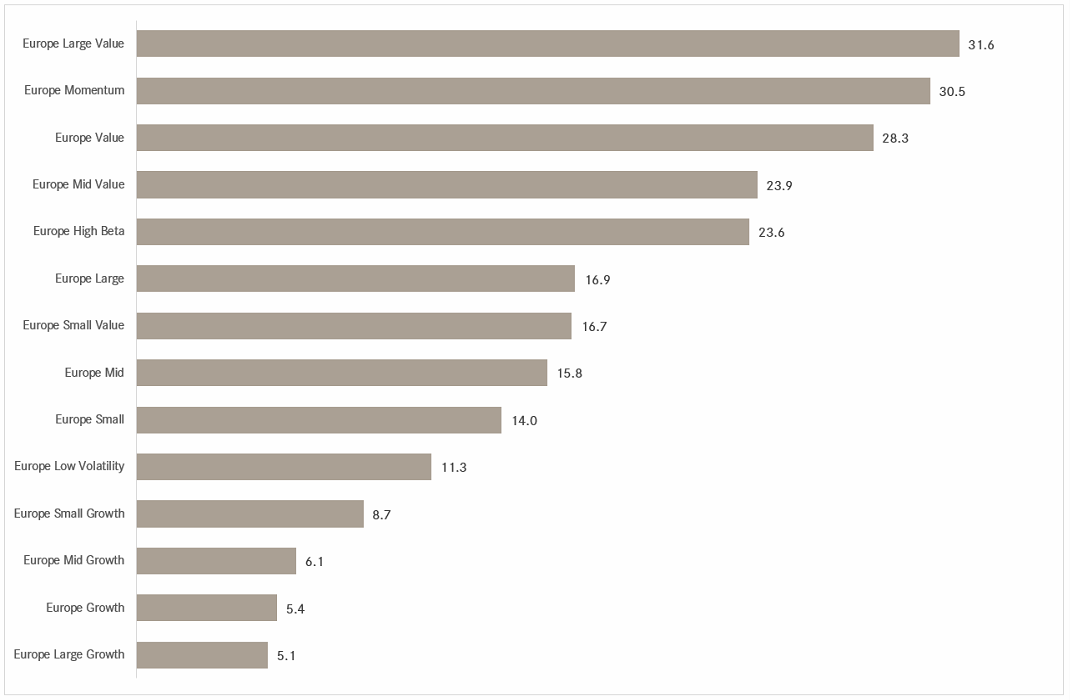

Defensive and small clearly did not work, the latter even catching me by surprise. However, I have a suspicion…let’s check in on European factor performance:

AHA! Here small (and mid) caps did substantially better!

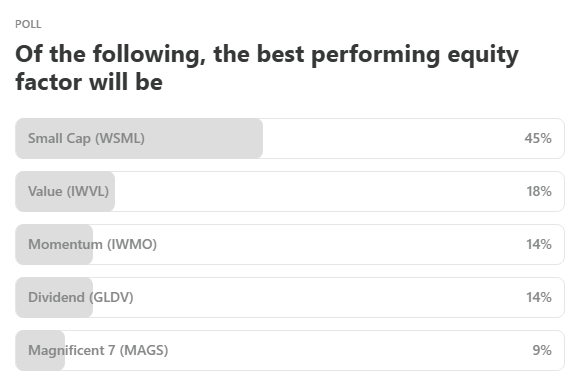

The third and last question in our January 2025 poll then was regarding exactly those factor performances, even though with a bit of a special twist:

Here is the outcome:

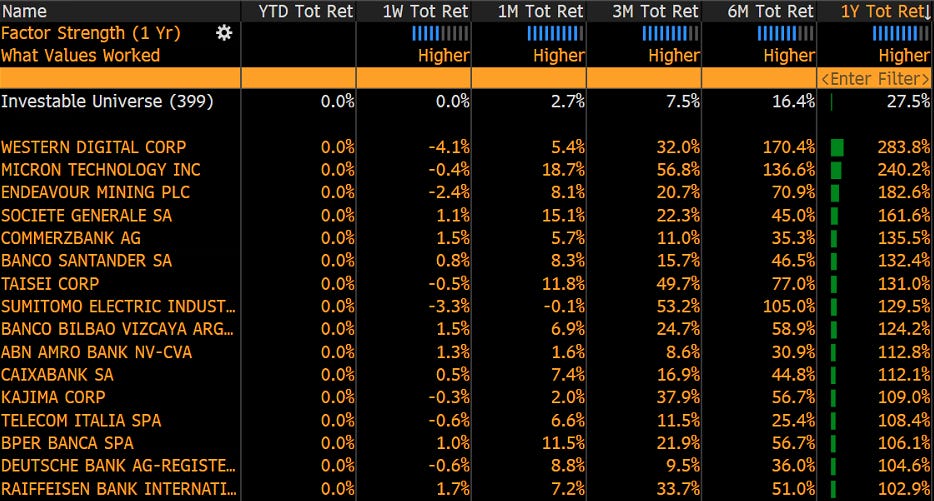

Seeing value stocks outperforming everything else comes as a mild surprise … to put it …. well, uh, … mildly. Let’s check on some of the top performers of this ETF’s constituents:

Ok, makes sense then with quite a few European Banks amongst those top performers, even though two tech stocks (WDC & MU) also sneaked into that value tracker.

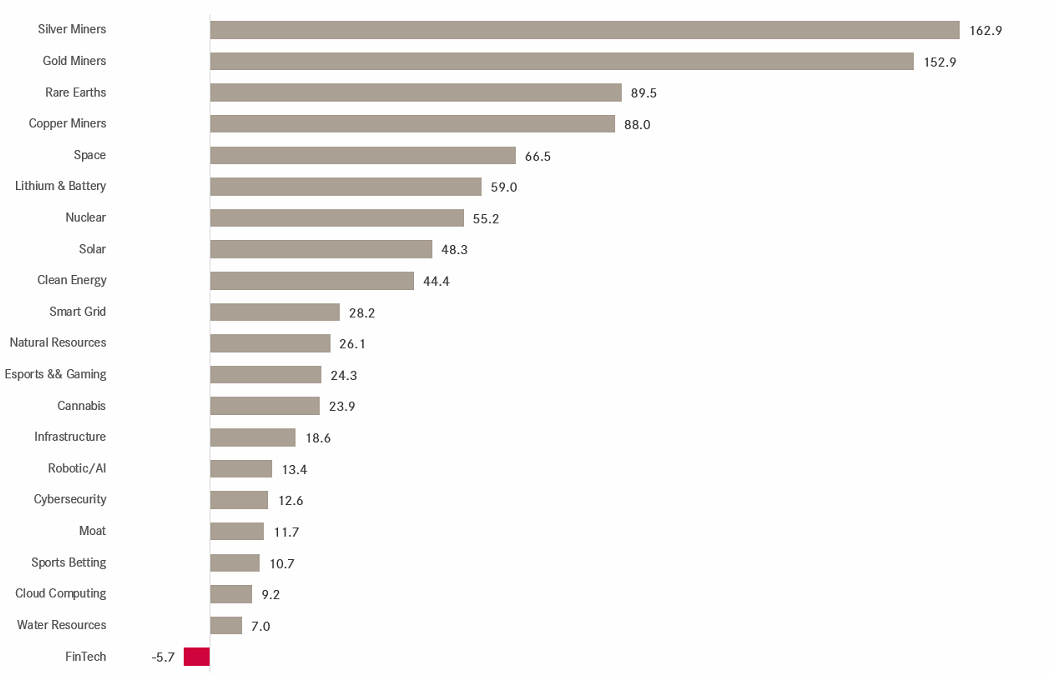

Let’s finish the equity section with a look at some thematic ETF performances in 2025:

I think, the only valid comment here is: No Comment!

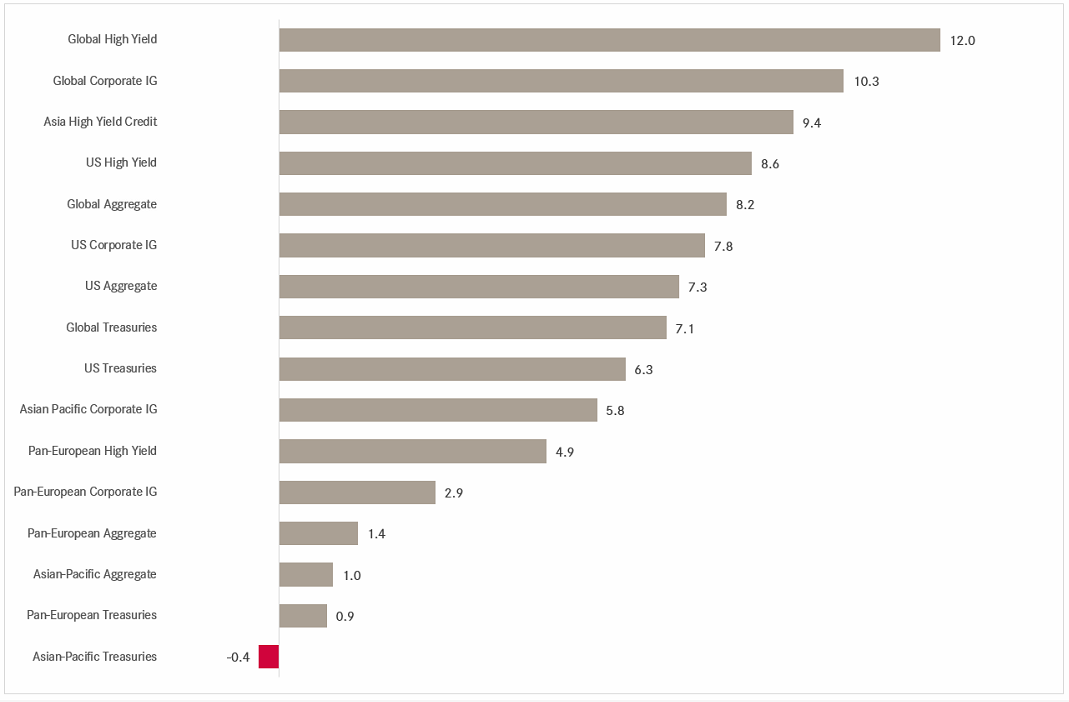

Let’s have a look at different segments in the fixed income market now, which we already know surprised positively:

Phew! Not bad indeed!

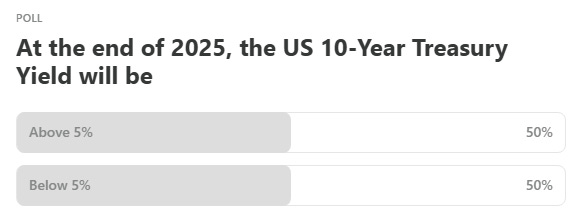

In the rates space, we only had one pollster question:

And my favourite 5% readership was split exactly, but exactly precisely, down the middle. Of course you already know the outcome, but just to be sure:

In all fairness, personally I would have expected the US 10-year treasury to be at least at or above 4.50%, but enough government intervention rhetoric and a independently dovish Fed (ehem, ehem) were able to keep yields low - for now!

We will have a more extensive look at other segments of the fixed income space in our Ex-Ante Quotedian, due in a few days time.

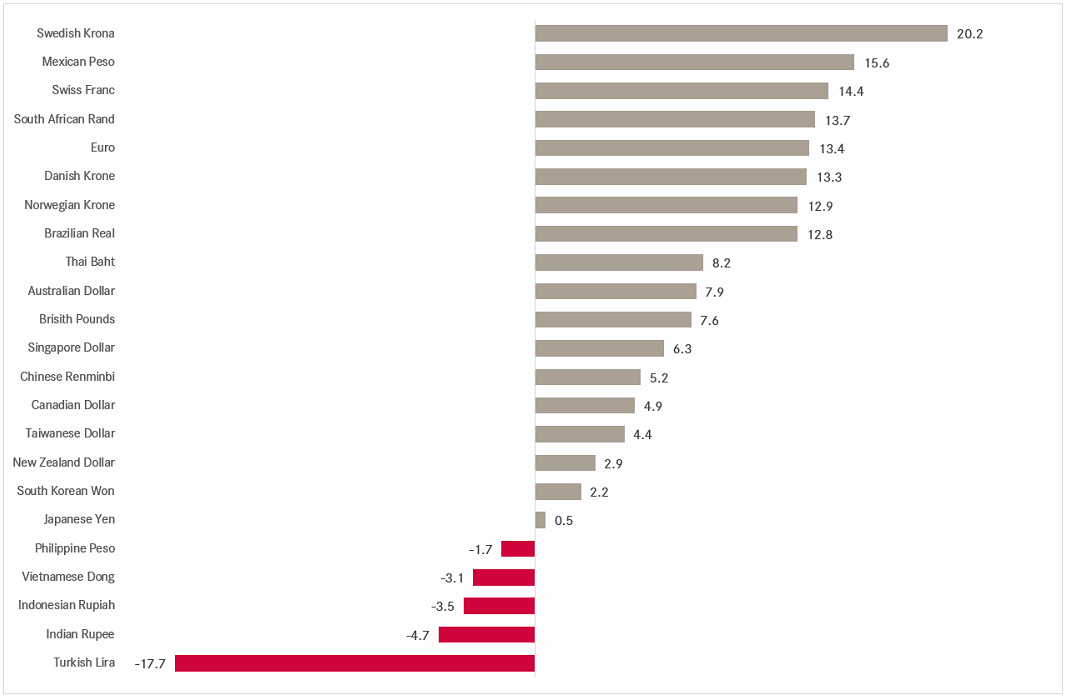

Now to currencies … one of key definers of investment performance in 2025 as we discussed at the outset of the today’s newsletter. Here are the performance of global currencies versus the US Dollar over the last twelve months:

Cleary, with the exception of some usual suspect, it was NOT a good year for the greenback.

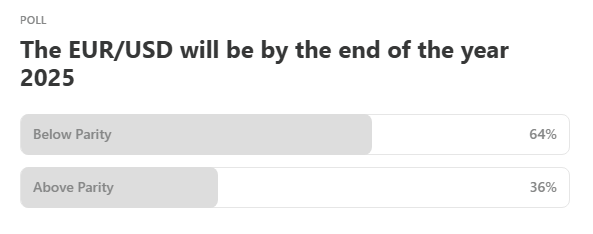

One of our two currency questions was as follows:

This one, two third of my favourite readers got wrong:

However, the following chart probably explains why:

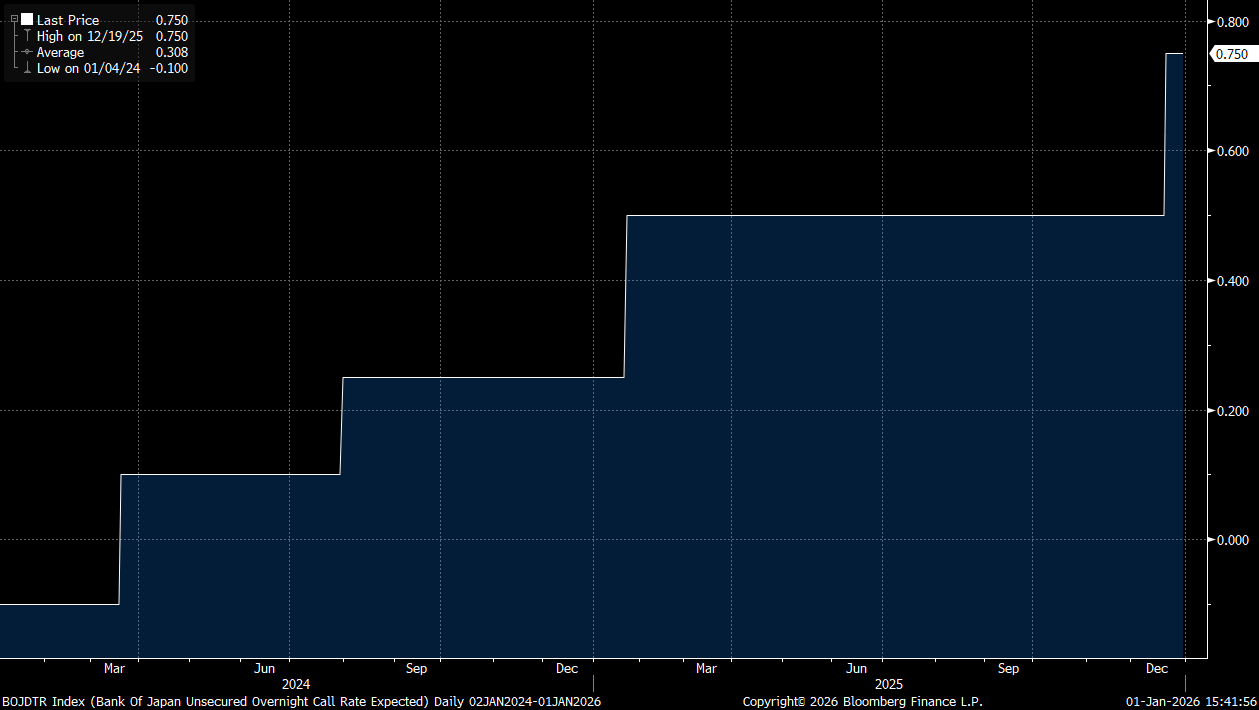

One of the most consensus macro calls for 2025 was that the horrible undervalued Yen,

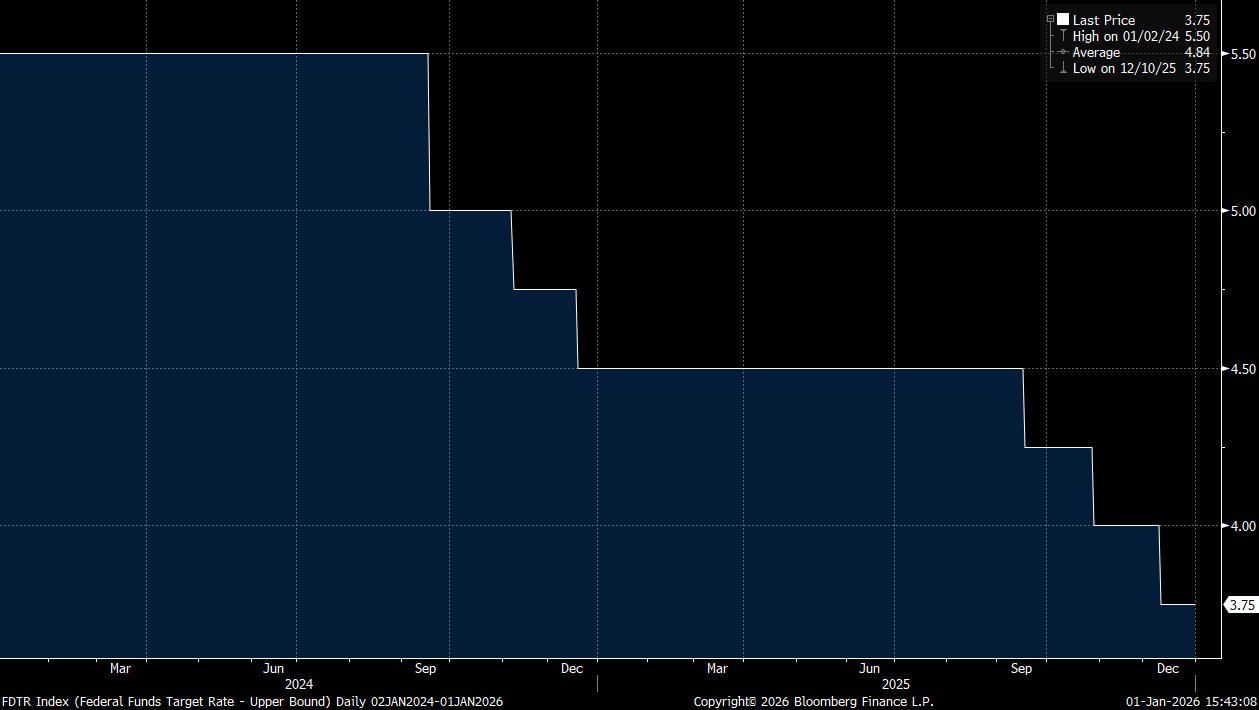

will strengthen versus the USD, as the BoJ is hiking rates,

just as the Fed is starting the second leg of its cutting cycle:

Result?

We all had massive egg on our face,

the JPY is even cheaper,

and the “something has to give” in the following chart is just growing and growing:

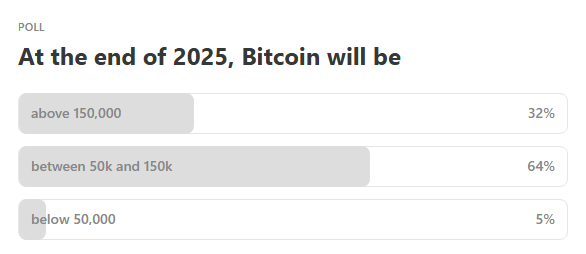

The other currency question in our early 2025 polling was concerning cryptocurrencies:

Benefit of hindsight, that middle range was maybe a tad too wide and too easy - but hey - then you never know with cryptos…

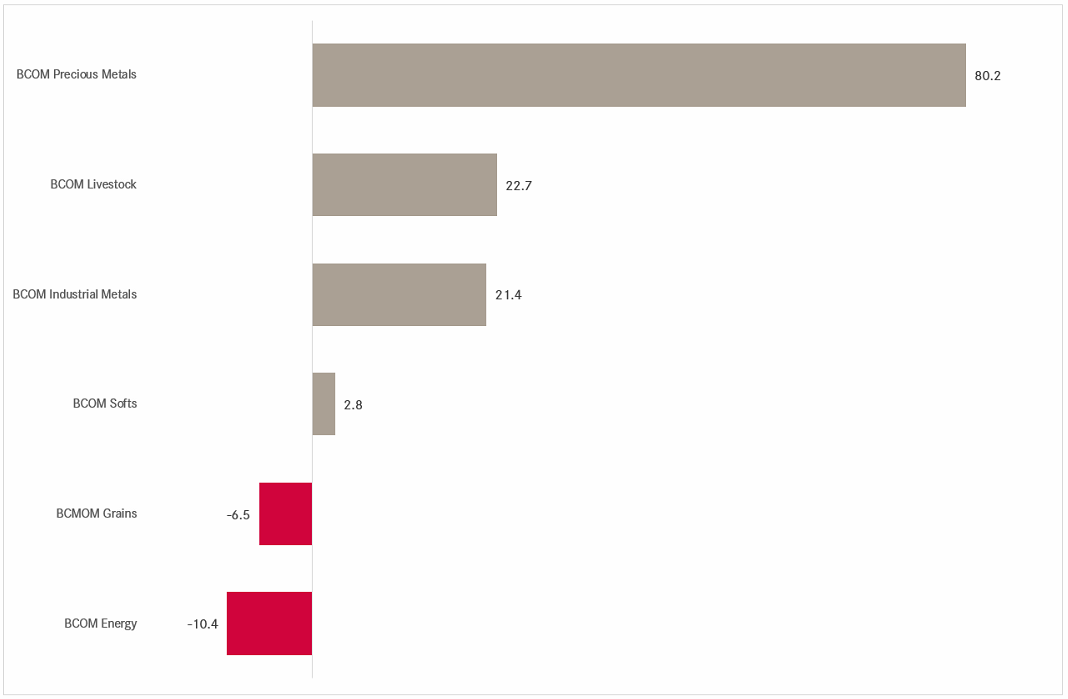

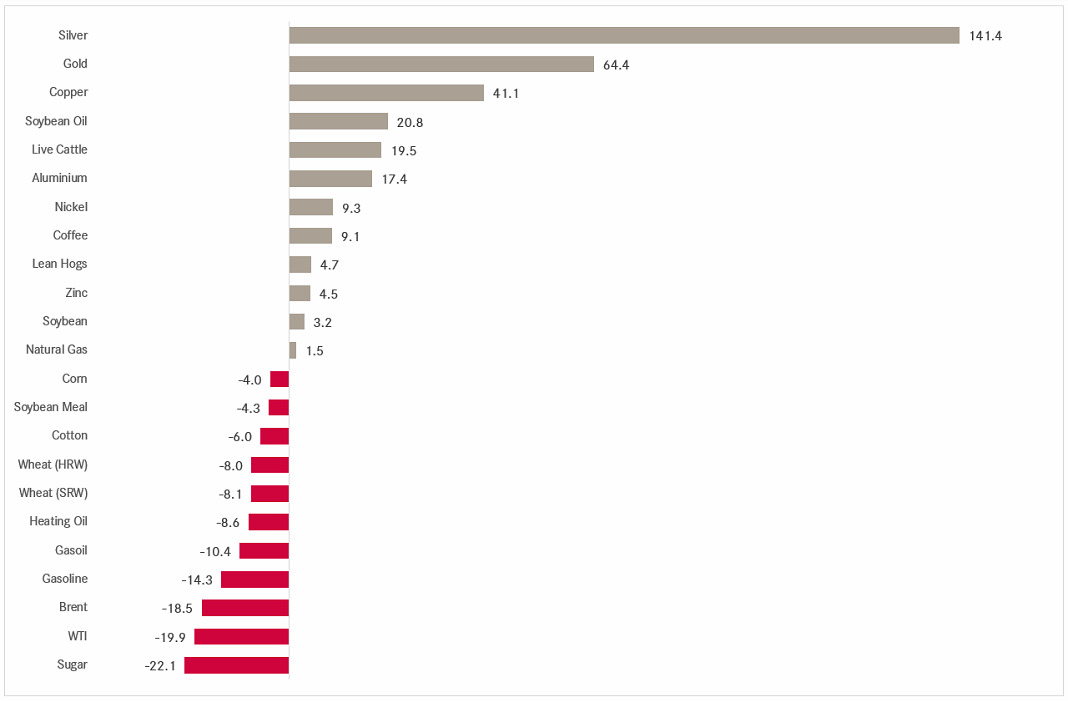

And with that, we arrive at the final and probably most exciting, most polarising and most polarised section: Commodities!

Already the highest level commodity ‘sector’ performance table reveals the polarisation within this asset class:

Precious metals up 80%, energy down 10% for a 90%-plus performance difference!

Here now the 2025 performance breakdown of popular commodities futures:

We had a question on Gold here last year, and considering how wrong we got this one, I don’t even want to think about the failure we would have produced in forecasting silver!

Here’s the Gold chart:

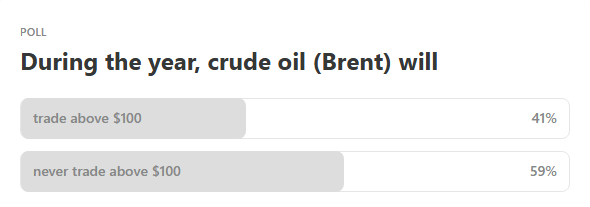

The second question was regarding oil:

Again, probably a bit a too easy question, or, better said, a too easy answer set, but then again, this was about possible extreme outcomes:

Good.

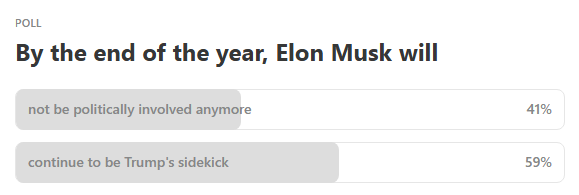

In order not to overwhelm you on this first day of the year with charts, facts and other lies statistics, let’s end today’s Quotedian here. But not before we look at the tenth and last question from out 2025 ex-ante report. It was about these two guys:

And the question was:

Even though I personally thought this would be the easiest to answer (option A), the majority of you seemed to have some ‘hope’ this marriage would last …

Alright, so as mentioned the plan is that the next Ex-Ante outlook should hit your inbox by Sunday latest Monday morning. But before that, scroll down or up or wherever and hit that LIKE button!

Enjoy the rest of the holiday!

André

P.S. The first five to hit the like button still today (1.1.2026) will receive a small gift from me ❤️

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG

Really apprecaite the currency lens here - it's wild how different the story looks depending on where you're sitting. That 6x home market outperformance for CHF investors is a massive reminder that hedging isn't just some technical detail in a footnote. I ran into this same blindspot last year with EUR-denominated positions, thinking returns were solid until realizing half of it evaporated in FX. The small cap divergence between US and Europe was also interesting, especially given how synchronized everything felt earlier inthe year.