False Signals

The Quotedian - Vol VI, Issue 23 | Powered by NPB Neue Privat Bank AG

“Ignoring the signs is a good way to end up at the wrong destination”

— John D. Rockefeller

DASHBOARD

Due to technical issues we cannot provide the usual DASHBOARD today.

AGENDA

Due to technical issues we cannot provide the usual AGENDA today.

CROSS-ASSET DELIBERATIONS

**Housekeeping**

Due to some technical issue I will have to cut today’s Quotedian short today and cannot provide most of the usual statistical tables. Fingers crossed that everything is back to normal tomorrow Friday. And if not, at least its Friday :-)

The probably most important event on yesterday’s economic agenda was the UK inflation report. Headline CPI was at 10.1% not only still double-digit, but also higher than expected (9.8%). A few decimal of percentage points probably don’t matter, but this might:

The chart shows UK inflation (red line) compared to the Bank of England’s official policy rate. This feels like some central bankers don’t seem to want to take the pain and have fallen far behind the curve.

Here’s the same chart, but for US inflation and key policy rates:

Hhhmmmm ….

Coincidently (or not) applying the Taylor Rule model to the UK to establish where rates should be, we note the following:

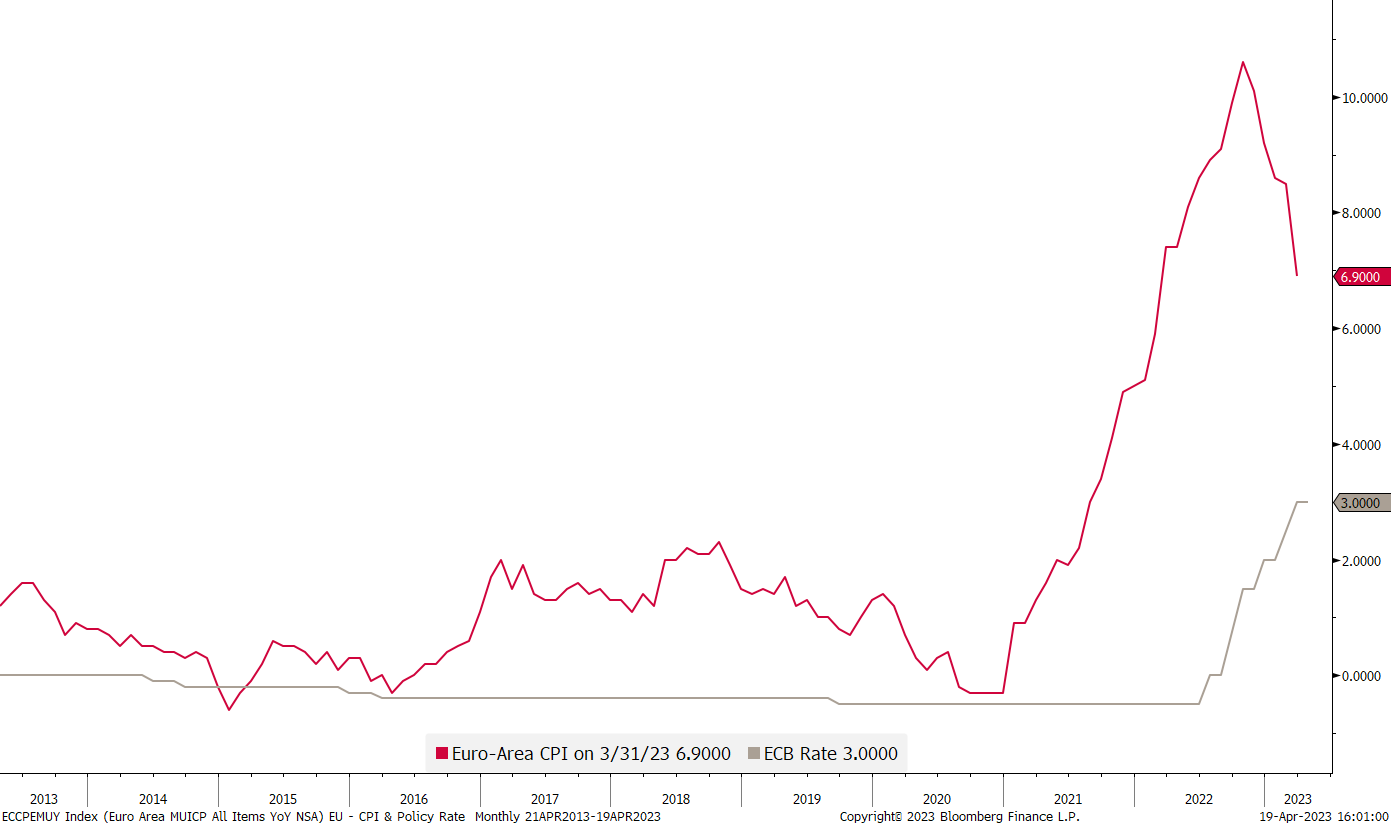

Finally, before going into our market review speed-round, here’s the inflation and policy rate chart for Europe, in case you were wondering:

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

With no access one of our main financial data sources this morning, let me show you here what I wild ride it was for US stocks in yesterday’s session:

S&P 500 -0.01%

Nasdaq 100 -0.02%

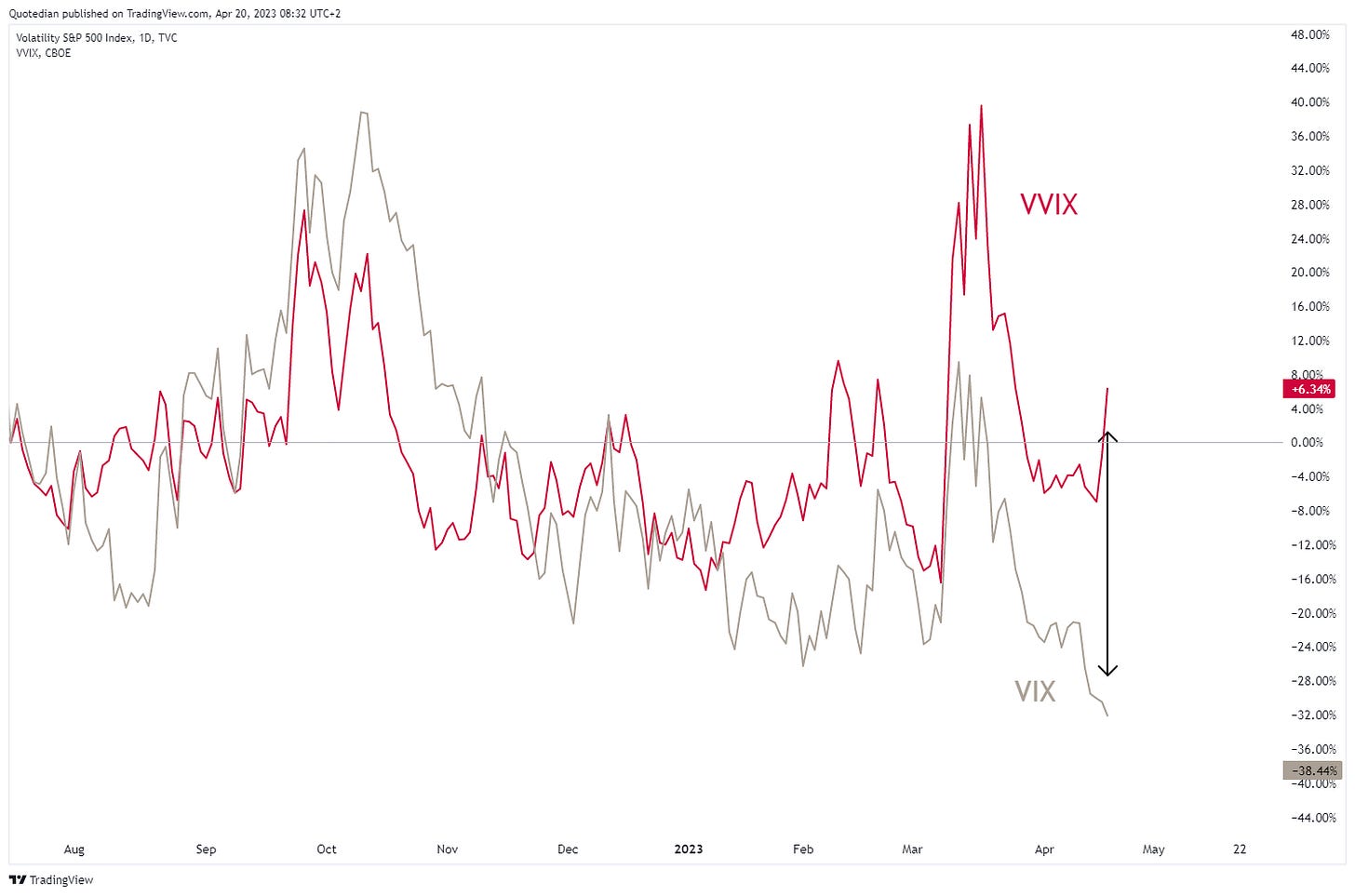

Boooring. Which is also reflect in the CBOE Volatility Index (VIX):

Not only the lowest level since November 2021, but also below its multi-year average.

HOWEVER, zooming in and comparing the VIX to the VIX’S VIX (vol of vol, if you know what I mean), we can observe a divergence building:

Given there was actually quite some action on the corporate earnings side, the indices nothing-burger session is somewhat surprising.

Chip-companies (not Lays, Semis)

ASML and Lam Research both reported staggering earnings, but both retreated on a somewhat more muted outlook.

One regional bank (Western Alliance) rose 24% after reporting a $2 billion increase in net deposit, giving some alleviation to the entire segment, though despite the 4% increase in the SPDR Regional Bank ETF (KRE), the chart still looks pretty much depressed:

A lot of earnings action also after-hours, with Tesla beating top-line expectations, but the stock falling some 6% as price cuts to gain market share have eaten more into their operation margin than expected.

Casino-stocks Las Vegas Sands and Nasdaq (yes, yes, sarcastic basterd me) both made long-gambles (another tongue in cheek) pay off, as both beat earnings expectations.

In the fixed-income space, yields were globally generally firmer after UKs inflation number, but of course especially so on the small island up in the north:

Let’s lose this a direct segue into currencies, where the GBP was one of the better performers on the outlook of a further tightening BoE. Here’s the chart versus the US Dollar for example, where an attempt to an upside breakout seems to be on the books:

Little else to write home about, except maybe that Gold is trading below $2,000 again, whilst Bitcoin also trades south of 30k.

Jobless claims and Homes Sales in the US, PPI in Germany and the release of the ECB minutes from their last monetary policy meeting may spark some interest by investors today.

Quite a bunch of companies reporting today too, with the more interesting (i.e. large) ones including Nokia, TSMC, Volvo, Bankinter, DR Horton, Philip Morris, American Express, AT&T, Union Pacific, Blackstone, Essilor, Lonza, Pernod Ricard, etc., etc., etc.

CHART OF THE DAY

Today’s COTD shows the New York Fed’s Probably of Recession Indicator. We note that at current levels, there has never been a false signal. Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance