Flatlined

The Quotedian - Vol V, Issue 128

“I always believe that prices move first and fundamentals come second.”

Paul Tudor Jones

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

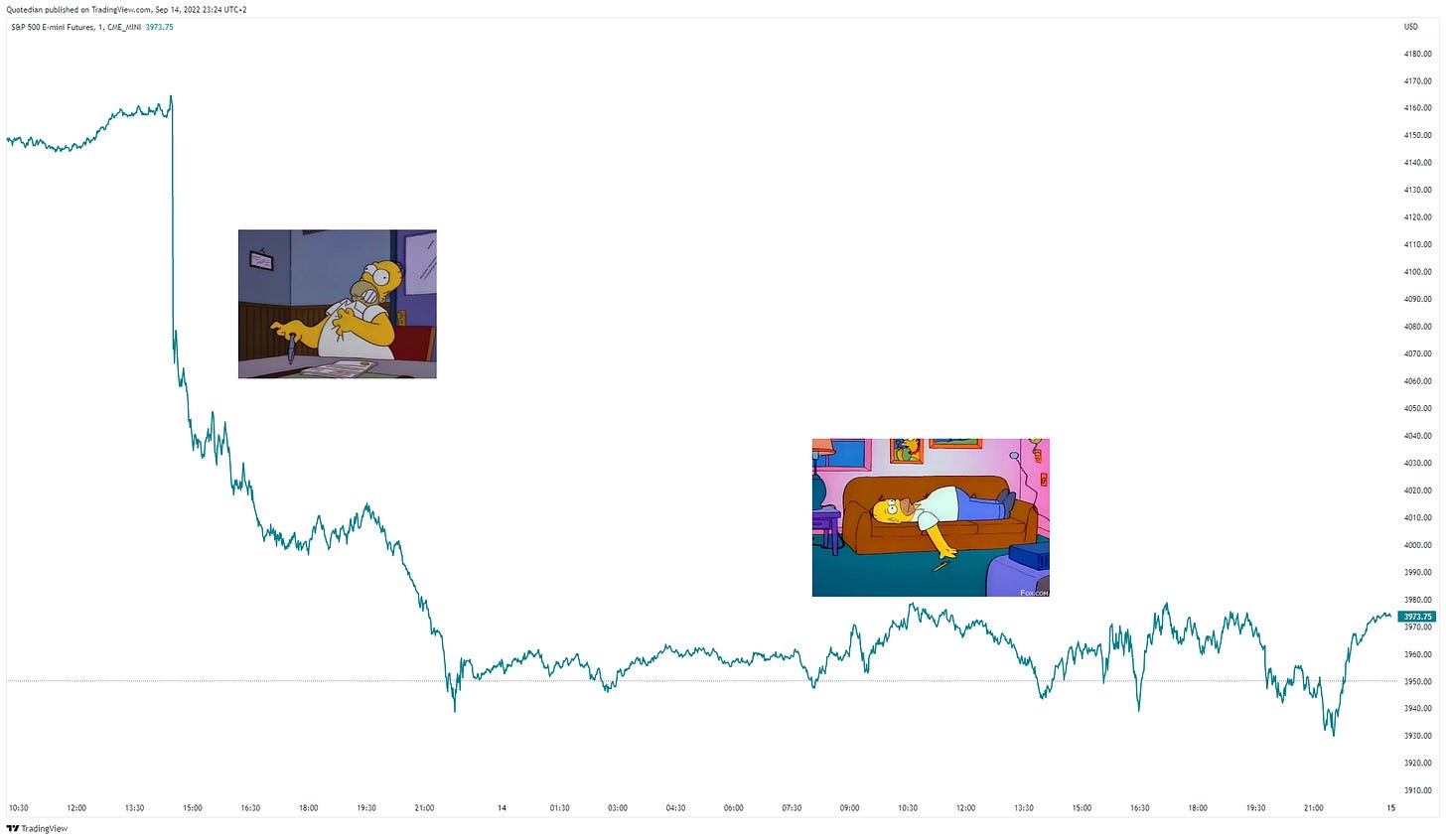

No better way to describe yesterday’s session after Tuesday’s “stroke” than with the word flatline:

As balanced as the performance was around the zero-line yesterday, as distributed was the sector performance with five sectors up, five down and one flat:

Similarly, the number of rising stocks (226) on the day was nearly the same as the one for falling stocks (274). So, overall a session of wound liking and body counting. What could move the market over the coming session(s)?

Of biggest focus is clearly next week’s FOMC meeting and with Fed employees now in blackout period there is little guidance to be expected from that bunch. Oh, wait, they anyway dropped any kind of guidance or reliability over comments a few months ago, so it is probably better they shut up altogether… in any case, they already told us (via Nick Timiraos at the WSJ) that it will be 75 basis points - despite all the sudden chatter regarding a possible full percentage point hike.

But the other news item that has gone largely unnoticed to investors so far (or has it?), is a looming railroad strike in the US. Why would this matter, Mr Quotedian-Editor? The formidable Paul Fraynt at Franklin’s K2 outlet has the best summary:

Looming railroad workers strike in the US is increasing inflation pressures and simultaneously negatively impacting GDP. Rails roads are roughly 10% of the trucking industry in the US but remain key to the functioning of the country. Rail roads in the US not only operate rail roads and trains but also own infrastructure like bridges and depots. Two railroad unions out of 10 remain holdouts in current negotiations. Odds are rising that Friday’s deadline will pass without a deal. Already hazardous materials have been preempted from getting onto containers, for the fear that the strike may strand them midway. If railroad strike takes place, it would cost up to $2bln a day to the US economy. Replacement cost is 460,000 additional trucks a day to make up for that capacity. Amtrak, the passenger carrying railroad, canceled all long-distance ticket sales, starting tomorrow.

Now, has it really gone unnoticed? For sure to most of us, but some sleek investors may have been preparing already, with the Dow Jones Transport index only four percent away from the June lows, whilst the broader S&P 500 is at nearly double that distance. See today’s QOTD…

This morning, Asian stocks are trading as mixed as their European and US counterparts were yesterday, with no regional market to highlight specifically. Index futures are hovering around the zero percent mark on both sides of the Atlantic as I type.

One more on the equity side, before we move on; Nucor, as a US steel producer got ‘nuked’ yesterday (-11%), after warning on their Q3 EPS due to be reported sometime in October. Just one early warning sign, but still worth cocking one’s ears…

Moving into bonds, a visual comparison between at US 2-year bond yields (top) and their 10-year counterparts (bottom) quickly reveals something of importance:

Indeed, the slope of the curve has started inverting again:

But more importantly, one study done on yield curve inversions as a forecaster of economic recessions, which had a 100% track record with no false positives, did not use 10- minus 2-year yields, but rather 10-year minus 3-months T-bill yields:

Now, this one is not inverted yet, but given that the Fed will hike 75 basis points next week and is unlikely to be finished thereafter …

No time to look for the study today, but promise to post a link to it in one of the next Quotedians.

On the credit side of bond risk, there is no clear short-term trend visible, but generally credit spreads remain elevated, as also expressed via the iShares High Yield ETF which is only barely trading above the June lows:

In currency markets, Tuesday's massive US Dollar rally is seeing some follow-through versus the Euro, which trends around the 0.9960 level as I type:

The Japanese Yen however as recovered some of its losses two days ago, after the Bank of Japan (BoJ) apparently had been asking for spot prices in the interbank market, stirring rumours of FX intervention …

Now, dusting off my FX playbook from yesteryear (approximately around 1990 - sigh), investors will now go and test the BoJ’s resolve … stay tuned for a fun ride!

And finally let’s finish off with one observation in the commodity complex, where Natural Gas futures (NG1, the US version) jumped 10% yesterday and are now up a cumulative 17% in just five sessions:

So, what’s going on? One explanation could be that the looming railroad strike, which if ‘executed’, would drastically reduce supplies of coal, forcing power generators to rely more heavily on natural gas as fuel. Another ‘excuse’ for higher prices could be Russia/Putin-with-his-back-to-the-wall related, though for now we stick with the former excuse. Anyway, to be watched closely.

Have a great Thirstday!

André

CHART OF THE DAY

This week it was announced that the Fundsmith Emerging Equities Trust (FEET) was returning money to investors and shutting down. Terry Smitth and his Fundsmith brand have an excellent (performance) reputation, as witnessed by a massive $25 billion asset under management.

It is then this type of news that makes our contrarian antennas rise! Could it be time for relative outperformance of EM vs DM?

Well, not from a trend point of view and we would definitely need a weaker or weakening US Dollar, but maybe, just maybe we are getting to that point of exhaustion after 10 years+ of underperformance. Let’s stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance