Heat Wave

The Quotedian - Vol VI, Issue 60 | Powered by NPB Neue Privat Bank AG

“Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

— Carl Icahn

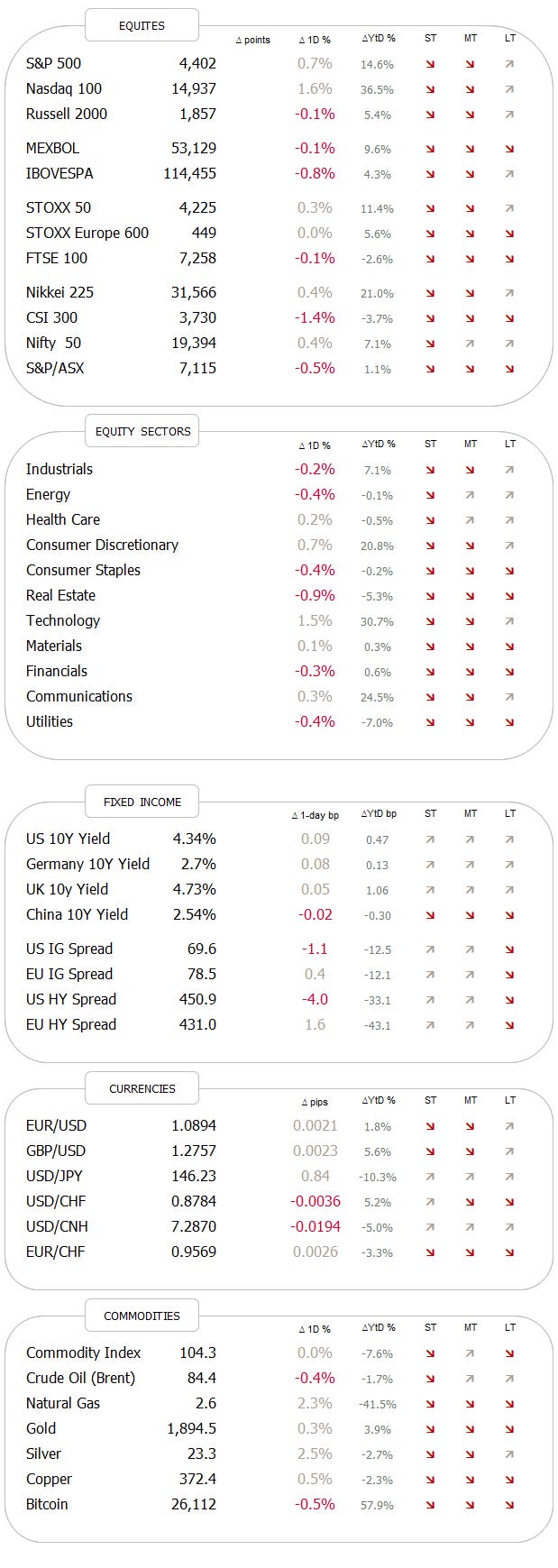

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Unfortunately, my plan to set up a temporary office next to the fridge as depicted in the GIF above was overthrown by the local government (aka wife). Hence, sitting at my home desk under the boiling roof which has been heated at 35 degrees for the past ten hours or so, I will only be able to release a short note today, to avoid a complete meltdown.

And speaking of meltdown, we saw a melt up in a couple of stocks today, after last week’s rather corrective mood and mode.

Especially, NVIDIA, the graphic card chipmaker, turned cryptocurrency miner equipment provider, turned the hottest thing (no pun intended, I swear!) under the AI sun and which is expected to report results on Wednesday afternoon, saw its share price rise close to 9% on Monday, as FOMO spread like wildfire (again, no pun intended). Here’s a chart of NVDA:

But that jump made it actually only the third best performer of the day in the Nasdaq. Moderna jumped over 9%, whilst Palo Alto Networks, a cyber security company, jumped 15% after releasing their earnings on Friday. Here’s a chart of PANW:

All of this provoked the Nasdaq having a very decent bounce of course too:

According to the chart above, odds are high that bears were sent into a trap on Friday, which is a possibility we discussed at the end of last week.

The S&P 500 also bounced on Monday, and arguably so at a level of support (dotted line), though more upside work is necessary to make this chart look more constructive:

Breadth was also not convincing, with 6 out of 11 sector lower and more stock declining on the day than advancing. This would suggest, for now at least, that today was just a bounce in a still prevailing downtrend. Only time will tell …

Asian markets, together with European and US index futures are providing a very mixed picture this early Tuesday morning, but really nothing to write home about.

Many (i.e. me) would argue that stocks are just a sideshow at the moment and bonds are the real deal. A small applause would have to go to equity investors nevertheless, as the had the nerve to bid up stocks on Monday, a day where the 10-year US treasury reached its highest since 2007:

Here’s a close up of the same 10-year yield:

This is as clear a break as it gets and given the speed of the advance in yields (ROC), I believe equity investors are not out of the woods yet. As mentioned in the past, equities in general can digest higher levels of yields, once they get ‘used’ to them, but rapid advances in yield are normally venom to short- to medium-term performance of stocks.

Little to report back from the FX front yesterday, with the US Dollar in general giving back some gains.

The most interesting chart remains probably that of the greenback versus the Chinese Yuan, were maybe some more monetary intervention is going on out of Bejing than the headlines would suggest. The USD/CNH (inverted below) is rebounding from crucial support:

As mentioned at the outset, we’ll keep it short and end today’s letter here (plus COTD, of course).

The economic agenda is light for today and everybody is waiting for the new macro-asset-kid on the block, NVIDIA, to report tomorrow. Seemingly that is much more important than Powell’s speech at Jackson Hole on Friday …

CHART OF THE DAY

NVDA’s results tomorrow after market close are obvious the talk of town. It’s really hard to tell how good the results will be (very good), but how much of that goodness is really already priced in.

Of course, the hype surrounding the company can go on for long, it did so for Cisco around the turn of the millenia, when the company could do nothing wrong.

One of my ideas was to go long volatility on NVDA into the earnings, assuming that a beat or disappointment would push volatility higher, but yesterday the market really preempted that idea.

So, maybe the trade is to go short volatility at current levels, with implied vol (blue) at a 2-year high?

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance