High Noon

The Quotedian - Vol V, Issue 103

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

— Warren Buffet

DASHBOARD

AGENDA

For Monday 1/8/2022:

CROSS-ASSET DELIBERATIONS

Today’s letter may end up being a bit longer than average, as we not only have the FOMC week gone by to review, but also we are at month end, which of course means we look back at the market action throughout July. Though worry not, most of the space will be taken up by little, shiny pictures to look at with not too much textual nonsense added by yours truly.

So, let’s dive right in …

Besides the expected 75 basis point rate hike, the Fed threw a bone, or maybe better said, bird seeds, to both forms our our feathered friends. Inflation remarks for the hawks and economic growth concerns for the doves. But probably more important and of direct impact to market action, was the insistence throughout the prepared press release and the ensuing Q&A on data dependency. More or less this is probably the train of thought of the Fed right now:

High Inflation + Slowing Growth

= We are between a rock and a hard place

= Let’s go data dependent

= No more forward guidance

= Let investors decide on the shape of the distribution bell curve

Fine, Mr. Market in his/her/its endless wisdom will eventually set asset prices to their correct levels, with stress on eventually. A good example of the voting machine part in today’s Quote (see above) hence would be last week, with emotional voters bidding up both, stocks and bonds on a weaker economic outlook and the guidance abandoning FOMC. As I said in one of the more recent Quotedians, buying stocks on expectations of a recession and hence looming rate cuts, is trying to skip a beat. Good luck with that …

Having said that, and moving into the market review section, in my view two well-known ‘clichés’ are actually a bit more than just that:

Don’t fight the Fed

Don’t fight the tape

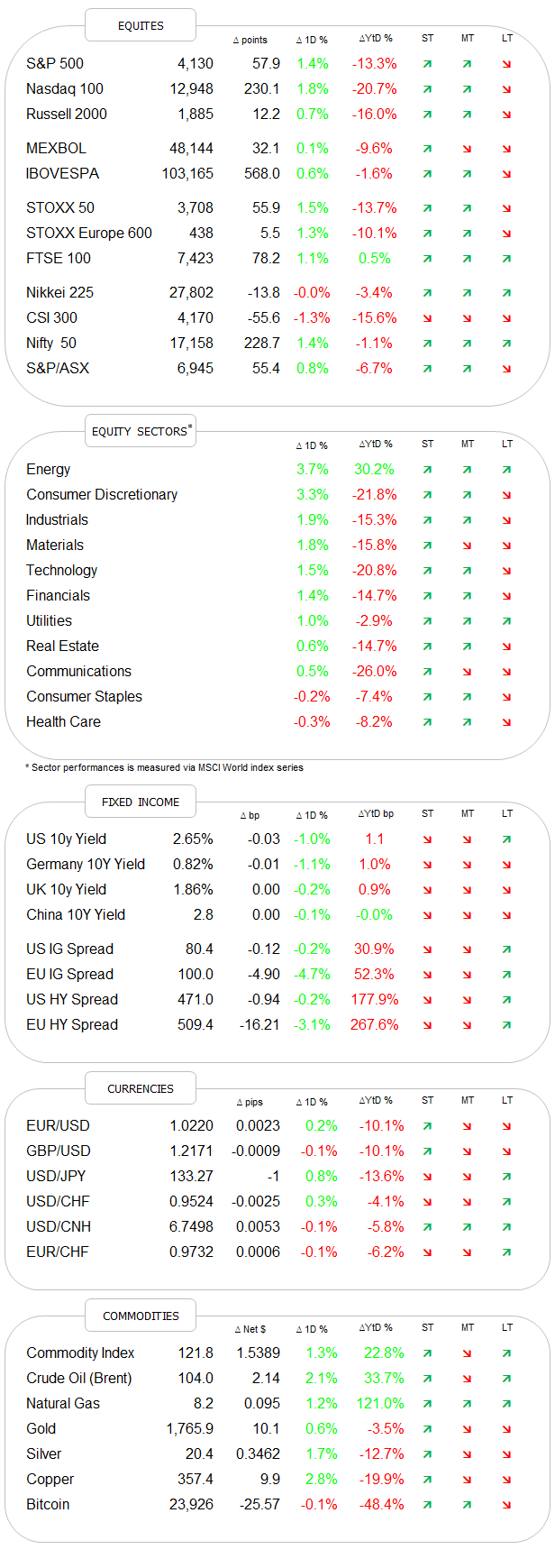

The first one got just a bit more complicated with the Fed refusing to clarify their outlook, so let’s focus on the second, which of course is just an aberration of “the trend is your friend”. And here the ‘problem’ for all the (equity) bears starts. As you can see in the equity section of our dashboard above, the arrows for most markets have turned up for the short- AND the intermediate trend. This means it is becoming a painful rally for all investors with an underweight in their equity allocation.

However, for those of us without Paul Tudor Jones trading capabilities, it is probably safer to continue to play defence as long as the long-term trend arrow remains down.

So, as mentioned, last week most major equity indices continued to rally, providing gains for a second consecutive week:

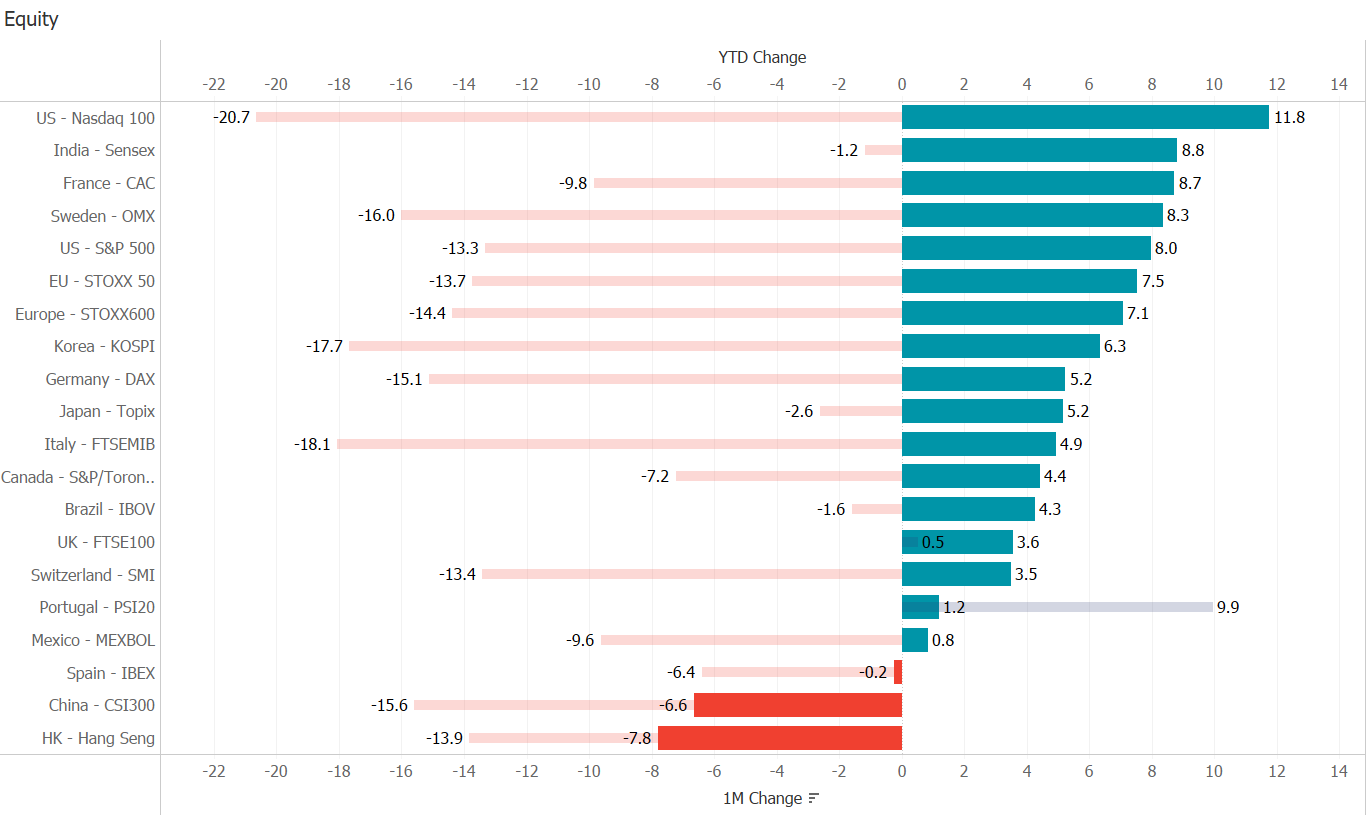

These strong gains over the past two weeks have of course strongly contributed to an overall positive month (fat bars) for equity returns, reducing the year-to-date (thin bars) pain somewhat:

Bucking the trend were Chinese Mainland and Hong Kong stocks, with their recovery rally that started earlier than in other areas, now faltering again. Here’s the CSI 300 for example, down 8% since its recovery high:

In terms of equity sector performance, all eleven economic sectors were up on the week, with energy stocks really blasting it, mostly after some impressive earning releases.

The analogy between today’s fossil fuel stocks and tobacco companies at the start of the millennium remains startling. Oil stocks are dead, long live oil stocks!

Over the month, two of the most punished sectors on a YTD basis saw the largest gains. Only communication stocks failed to snap back (pun intended), as a profit warning from Snap kept the sector from significant advances:

Moving into the fixed income asset class, the first observation is that our defined range has been violated the downside (yields), i.e. as I tweeted on Friday, time to buy bonds, not stocks:

Here’s the chart of the 10-year Treasury yield, with the break of the support zone and where we could even make the argument for a shoulder-head-shoulder top formation with a price target of 2.05% (missing the important volume data for this pattern):

German bond yields, as a proxy for European yields, reached our target zone (red oval) and are now also threatening to break the support zone:

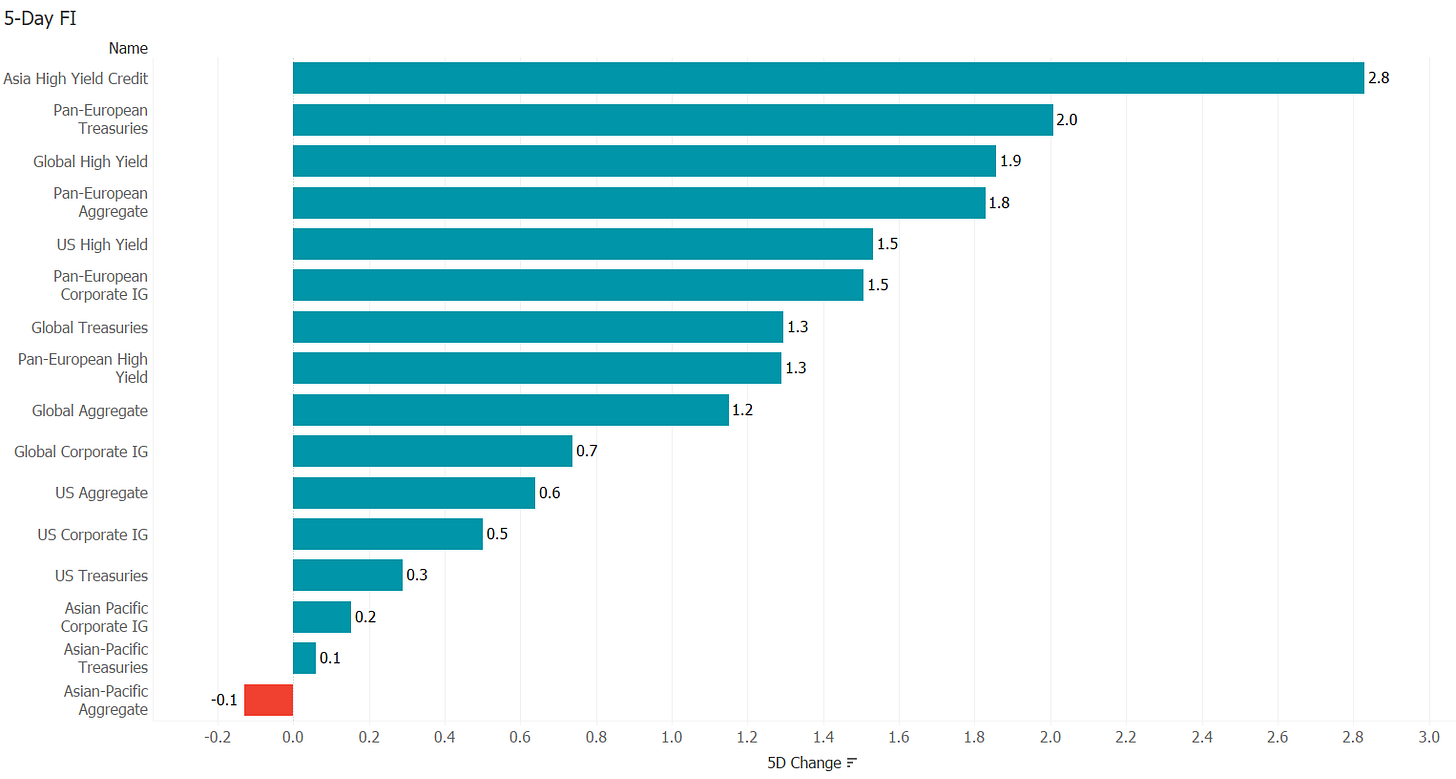

So, all in all, as the following graph shows, it was a very good week for bonds, not only because interest rates (yields) dropped, but also because some of the credit risks abated, leading to a relative outperformance of the high yield segment:

Hence, same as for equities, the last two weeks have been good to bond investors, reducing the YTD pain somewhat, though Asian HY, with a Chinese Real Estate being a heavy weight, continues to look very dire:

In currency markets, the week was in under the sign of the (temporary?) end to the strength of the greenback:

Impressive snapback of the Brazilian Real, but maybe more important that the Japanese Yen finally found some footing and was able to launch some kind of “counterattack”, breaking the most immediate uptrend support line:

The Euro held up, but failed to show advances of similar magnitude to the Yen:

On a year-to-date (thin bars) basis the USD continues to be strong - its path over the coming months will be crucial to most other asset classes;

As a segue between FX and commodities, let’s have a quick look at cryptocurrencies. Bitcoin has been on a roll, and as our ultimate risk-on/risk-off is continuing to flash green, up nearly 40% since the June lows:

Which is petty in comparison to the doubling of Ethereum during the same period:

And finally, moving into commodities, the US Dollar weakness has been a backwind to a rise in the price of raw materials of all sorts:

Gold has not only held above longer-term support, but even started to recover as real yields tighten somewhat over the past few sessions:

Copper is rebounding, now up close to 12% since the recent bottom, confirming the equity rally but in stark contrast to the declining bond yields:

After a few years of having to ‘listen’ to me, you will know to whose message I am inclined to believe (spoiler: not equities, not liquidity-constrained commodities).

Oil prices continue to be a big non-event, though albeit intraday market swings are of magnitude, the general direction is ‘nowhere’:

Alright, it is high time (high noon) to hit the Send button. Enjoy your Sunday!

CHART OF THE DAY

After a very good July for global stocks, the seasonal chart from BofA below shows that August and September tend to be a bit more ‘challenging’ in US mid-term election years. Stay tuned …

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance