Holy Smokes!

Vol VIII, Issue 16 | Powered by NPB Neue Privat Bank AG

“Habemus Rallyum”

— The Quotedian, May 2025

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Apologies for this week’s briefness … still suffering from a heavy travel schedule over the past weeks.

It is probably an age-related thing, but my wife and I still get the giggles when we think that an American has been elected Pope (Spanish: Papa) —>

As mentioned in Friday’s QuiCQ, it is around the 19th second of the clip above where they sing “Papa Americano” … and click here if you would like to listen to a slightly longer remix of the song, or, click here if you want to watch a review of yesterday’s El Clasico (oops, that must have slipped in without me noticing :-) )

Ok, forgive me this little intrusion, and of course does this weeks’ title not only coincide with the papal conclave of last week, but also with what has been going on in (equity) markets over the past two months or so. And of course, we got more white smoke out of the chimney on Friday, as a tariff agreement was trumpeted (nice word play, eh) and the world is holding its collective breath regarding further fumes following the Sino-US trade talks in Geneva over the weekend. And, last but not least, we may even get some white smoke out of the kinetic war beacon, as Ukraine's Volodymyr Zelenskiy is set to meet with Vladimir Putin in Istanbul on May 15 for direct negotiations.

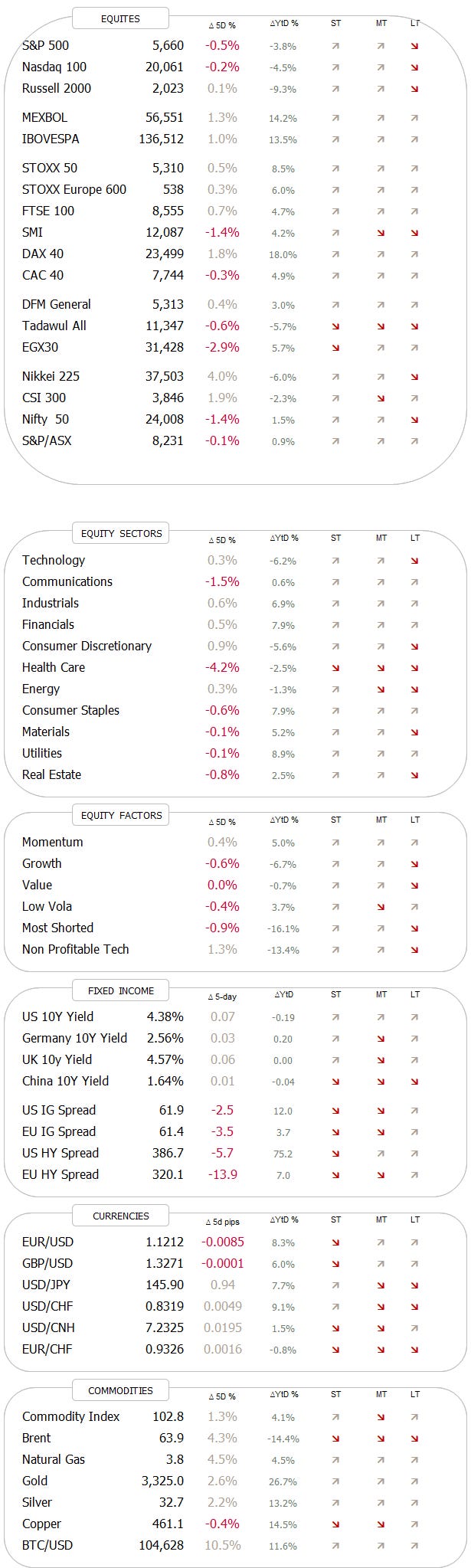

Equity markets have been quite the rollercoaster so far this year, with the S&P 500 missing the “official” bear market status (a drop of 20% or more) by only a few tenth of percentage points:

Unless you measure on a intraday basis, in which case the S&P 500 had dropped 21.4% from peak to (intraday) trough by April 7th. But as usual, the real stunner comes from the speedy recovery of the stock market, which is this morning (S&P 500 mini Futures) above the 61.8% Fibonacci retracement level and scratching at the under end of the 200-day moving average:

But mind you, that still counts for a three percent year-to-date negative performance, with a top to current drawdown in excess of six percent.

Quite unlike the German DAX index, which on Friday hit a new all-time high!!

The Dax then is leading the overall European market (STOXX 600) higher, which though has not quite yet reached a new ATH:

But with the index solidly above its 200-day moving average and only four percent to go to such an ATH, it seems a question rather of when than if…

Whilst the Dax is up close to 20% YTD, lagging markets include Switzerland’s SMI (+4% YTD), now under its 200-day moving average again:

UK’s Footsie 100 is up ‘only’ 5% also this year, though the chart looks substantially more constructive than the previous one just observed:

A bit more than 3% to a new ATH there.

Over in Asia, Japan’s TOPIX index has had a massive 20% run since the April 7th closing low, putting the index right back in range and in position to change resistance for a breakout to new multi-decade highs:

The Hang Seng Index in Hong Kong is also rallying hard and closely following the pattern we identified a few month ago. Our target of 26,000 should be hit in the coming weeks:

India’s BSE 500 index is celebrating the peace truce with Pakistan with a four percent rally and a closing above the 200-day moving average:

Bullish.

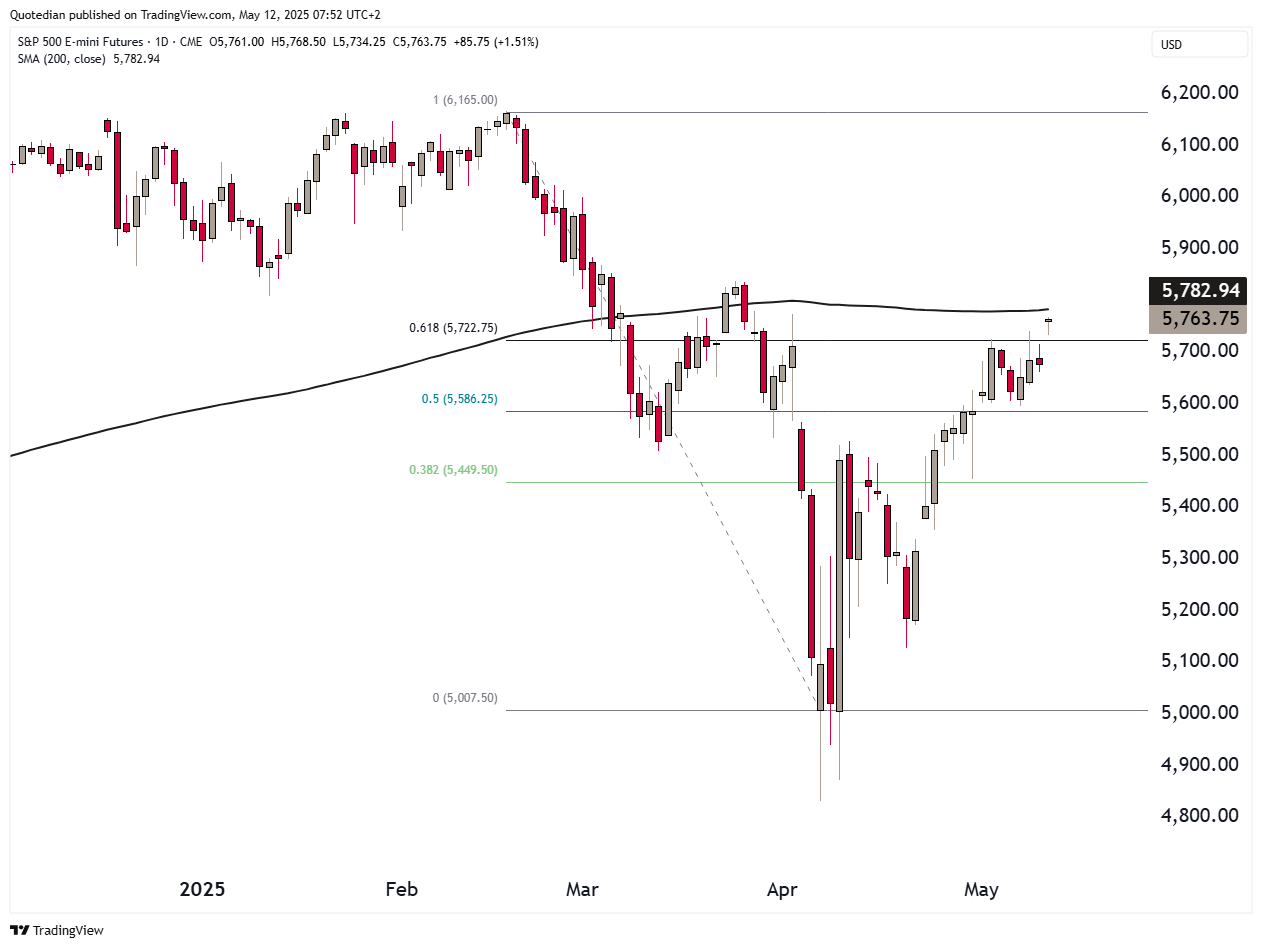

One more thing before we have a look at the best performing stocks … with markets recovering either nearly all of their TTT™ losses, even trading above the Liberation Day levels or at new all-time highs, don’t be fooled, this is not your last year’s bull market. Sector leadership has completely changed as our aReS-model shows:

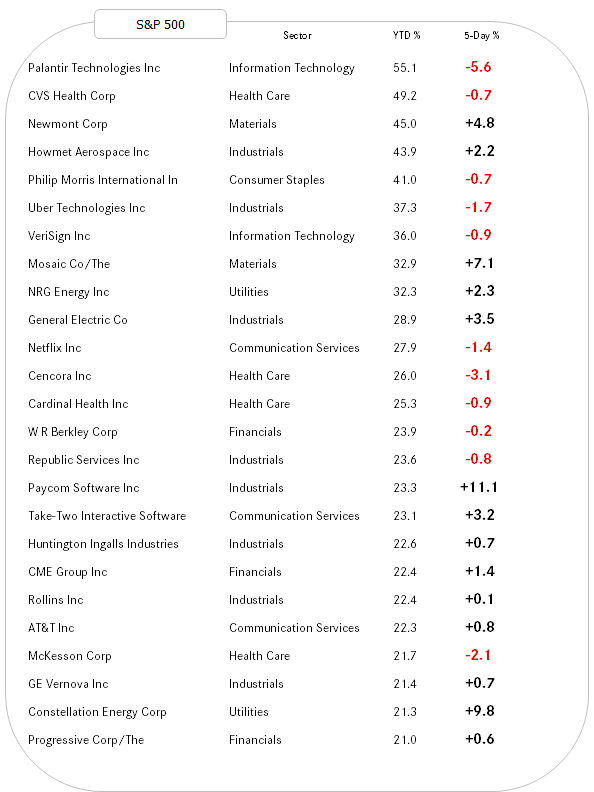

Now it is time to review the best performing stocks this year in the US and Europe and how they have fared over the past five days.

Starting with the US (S&P 500):

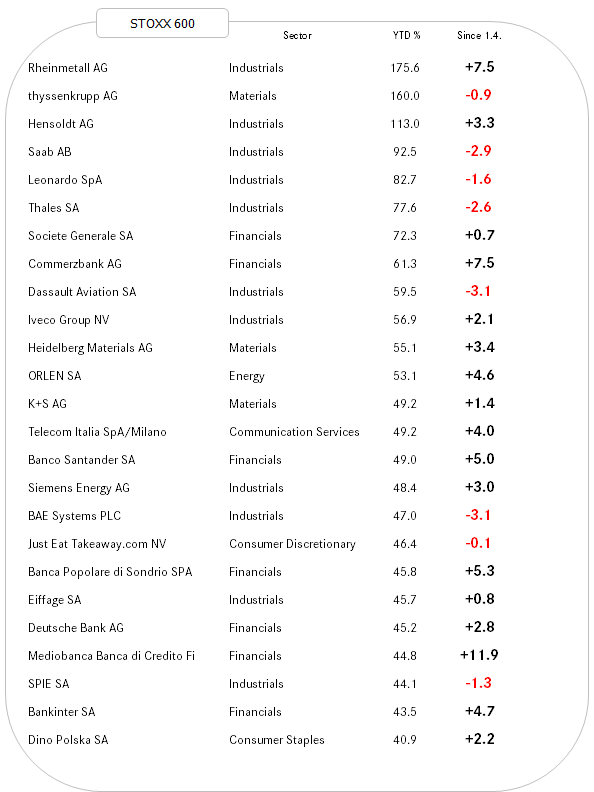

And now Europe (STOXX 600):

Notice something?

Exactly!

The 100%-plus winners are now in the European list, not as in the past few years on the US list. ExodUS anyone?

US yields have been quietly picking up again, as the outlook for the economy is not quite as bleak as expected only a few weeks ago. Here’s the US 10-year Treasury yield:

Zooming out on the same chart, I expect the longer-term range (dotted lines) of 3.90ish to 4.70ish to hold - for now …

Yields in Europe are also picking up again on the back of a possible ‘end’ to Trump’s Tariff Tantrum (TTT™):

I would expect the long-end of the curve in Europe to move higher over the coming months, with the short-end more or less tied to current levels, leaving to a further steepening of the yield curve (10y-2y):

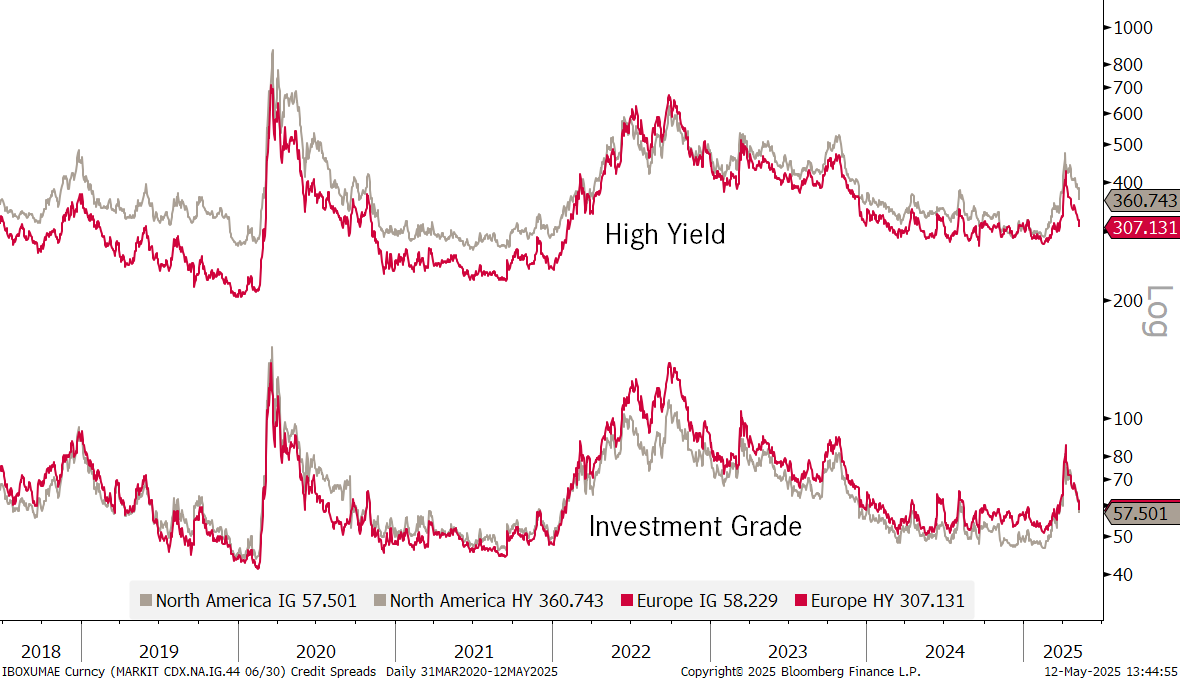

Finally, after having blown out in early April, credit spreads are tightening their way back to ‘normality’:

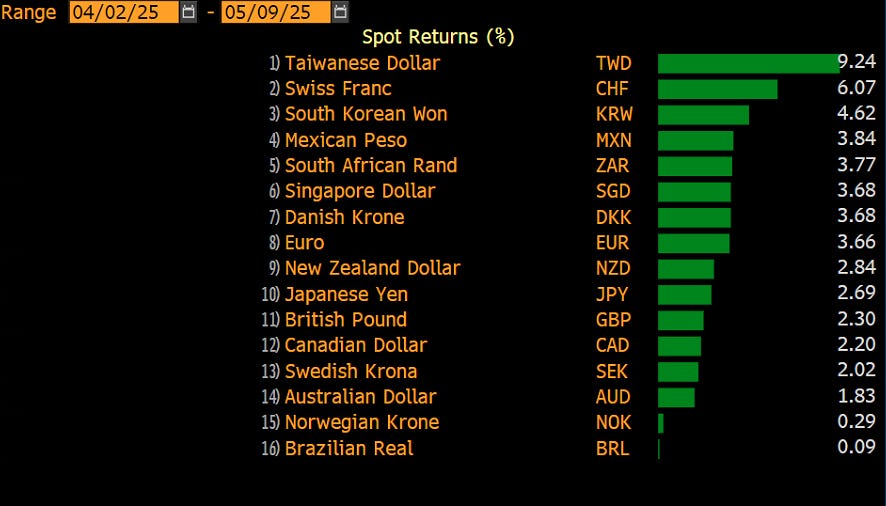

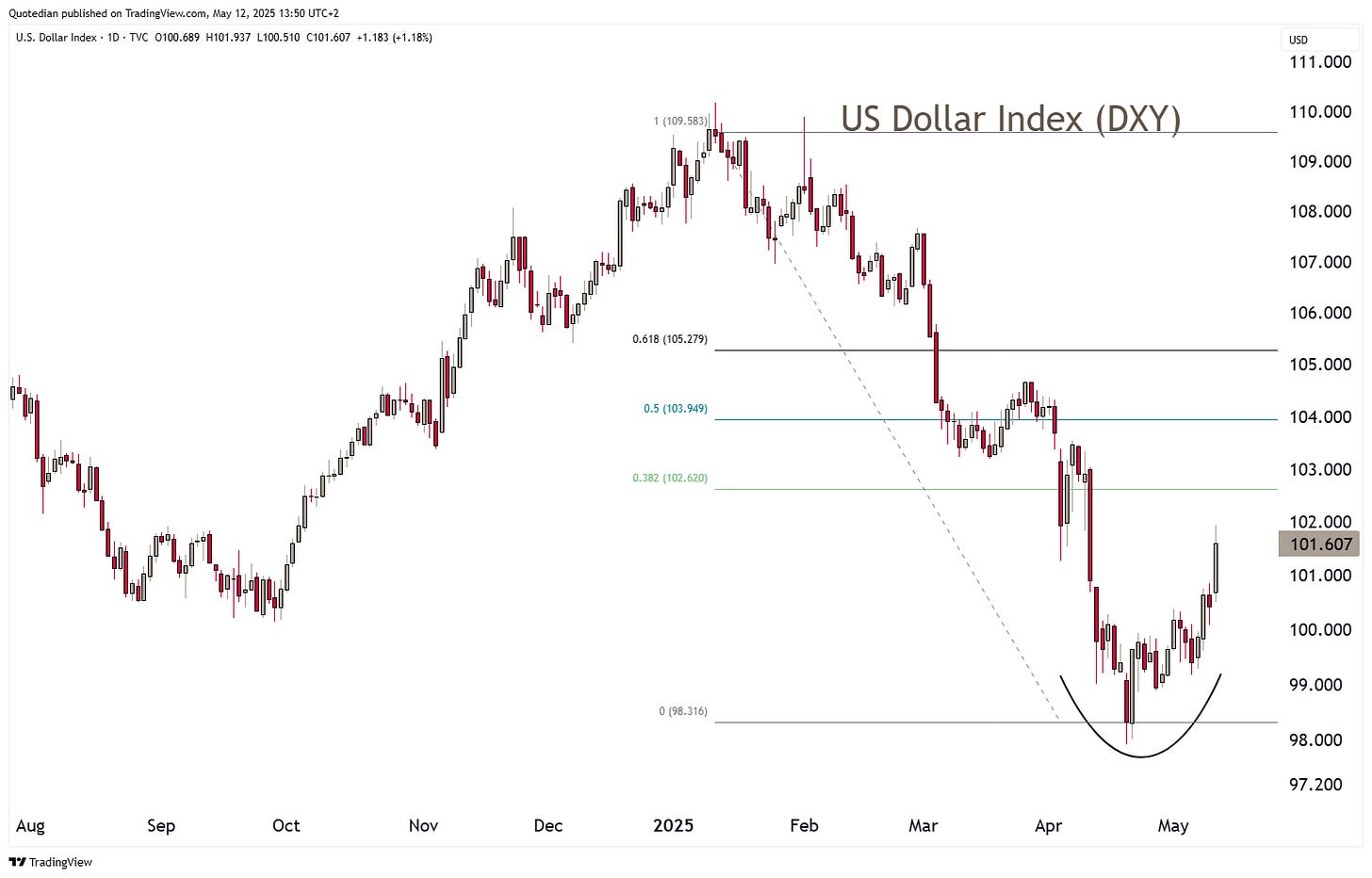

Since Liberation Day, the US Dollar has suffered massively versus most other major currencies:

The Dollar ‘recovery’ since the 21st April has been week (ex today), given the fireworks in equity markets:

But even with today’s substantial rally, the recovery has still not reached the first Fibonacci (38.2%) retracement level, which hints to international asset managers likely still exiting US assets (exodUS).

Today the US Dollar is, on the back of good progression in Sino-US tariff talks, strong enough to have pushed the EUR/USD cross through key support. A revisit of 1.09 is one of my possible targets now.

Versus the JPY, the Greenback is already much closer to reaching the 50% retracement. I would be aggressive buyer of Yen and seller of USD above the 150/151 level:

And don’t look now, but Bitcoin is suddenly scratching at the all-time high (106,200) levels again:

Even though Ethereum is still much further away from reaching a new ATH, the rally seen (70%) has been actually double that of Bitcoin:

Finally, and as outlined in last Friday’s QuiCQ, Gold is likely to have put in a double-top:

Sitting right on key support, a break would mean our reduction of the tactical overweight two weeks ago was very timely.

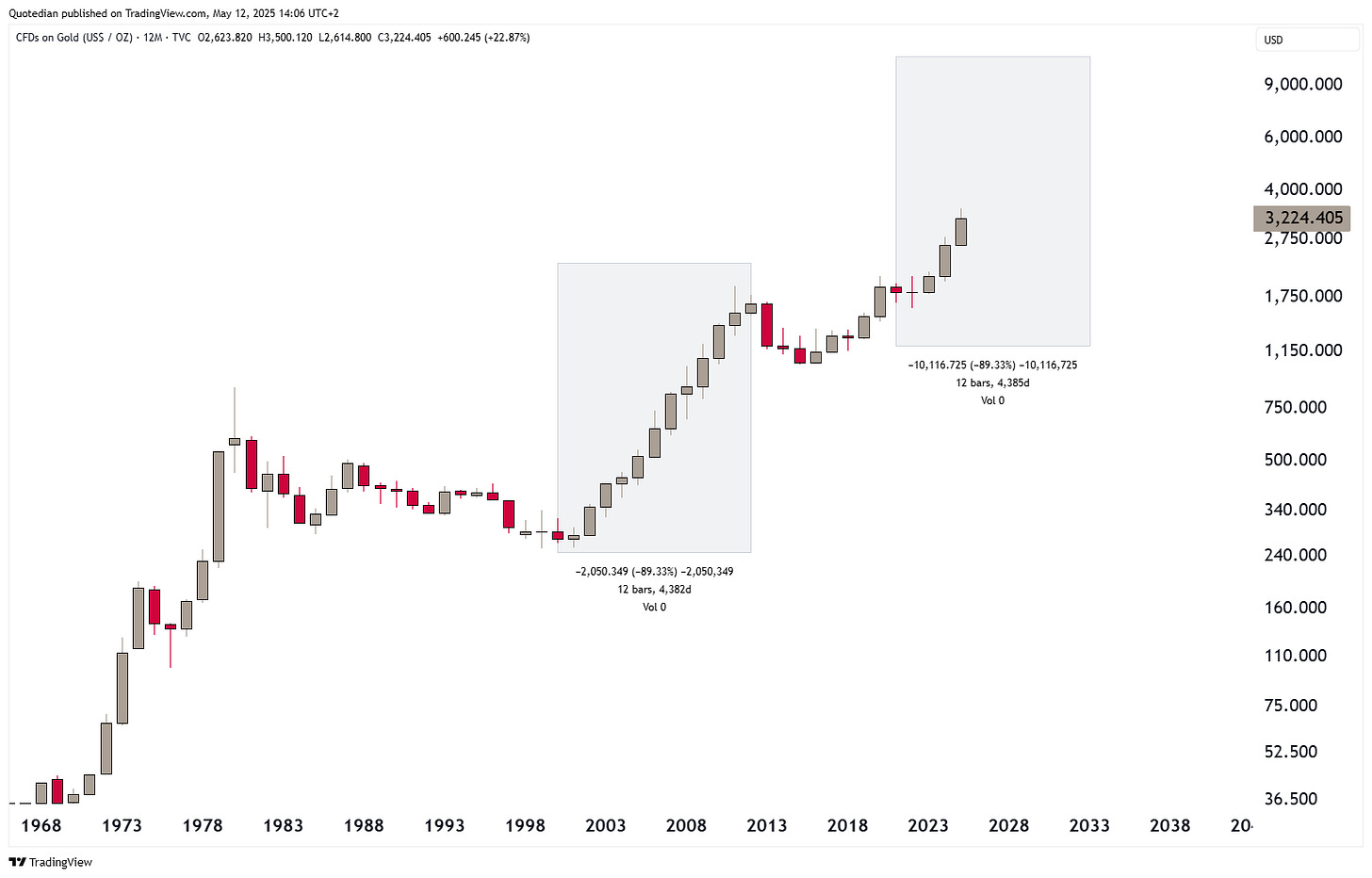

However, keep in mind that we (I) remain very bullish on gold structurally for all kind of reasons, which we have elaborated in the past and my revisit in a future letter. But not least, is this year chart (every candle one year) on the shiny metal:

The last secular rally lasted 12 years. Even in a conservative count we are only in year four now …

One more … finally Oil is also throwing in the recession towel:

As mentioned at the outet - an extremely busy schedule over the past two weeks has left me workwise way behind the curve and I need to keep this short today. But I am seeing light at the end of the tunnel…

"Alright, that’s it for this week. Same time, same place, next week. And don’t say I didn’t warn you."

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG