“I put my heart and my soul into my work, and have lost my mind in the process.”

- Vincent Van Gogh

You are one of the elected few receiving The Quotedian twice today. Once, in its email form (should be with you since a few minutes), and a second time here, using the substack newsletter platform. In other words, you are a star reader of the Quotedian and one of my hand-selected guinea pigs ;-). Any feedback regarding this experimental mean of delivery would be highly welcome (andre@quotedian.com or quotedian@ahuwy.com or even simply press on the button below). Now on with the show …

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s Quotedian is a story of suffering. Not only because it reviews some of last week’s very painful market action, but also because I started it on Sunday afternoon/evening with the idea of introducing some improvement of readability (formatting, font, etc.) and still have it not finished Monday morning shortly before lunchtime. It did not help that I closed the mail window without saving a draft when I was done with about 80%. So, today’s Quotedian will focus on some key points, will talk less about today’s action (the US is closed anyway) and is mainly thought of as a test for many excellent improvements to come. Thanks for staying tuned …

Last week started with an absolute bloodbath for stocks and bonds on Monday, which on any other occasion would have been enough to provoke at least a short-term bounce. However, we got very little to nothing of that, as investors continued to liquidate positions in the face of hawkish central bank activity and rising inflation/recession fears. It was a week where we got a “surprise” 75 basis points hike from the Fed, a true surprise 50 basis points hike from the Swiss National Bank and a surprise failure from the Bank of Japan to increase the trading band on their 10-year JGBs, which immediately sent the Yen lower again.

This meme made the rounds over the weekend and pretty well sums up last week’s equity price action:

A slightly more sophisticated look however would be this:

From the stats above we could also deduce that our long China (FXI), short India (PIN) trade should be working pretty well. Let’s check:

Yes, not bad indeed, with a close to eight percent relative performance spread. It is probably worth highlighting the small absolute performance of the Chinese stock market, given the carnage witnessed in other markets since late May.

In terms of (equity) sector performance, there was also nowhere to hide. Even, or especially, the mighty energy stocks, which is the only sector to show a positive year-to-date performance, saw a major reversal last week as recession fears lead to violent profit taking. I think the following table showing the 25 best-performing stocks in the S&P 500 so far this year together with their performance last week is pretty illustrative of the brutality of the reversal:

On the bond side of things, as irony would have it, did the (temporary?) top in yields coincide precisely with the Fed hike, in other words and translated into bond prices, sell the rumour and buy the fact. Here’s the chart of the 10-year US Treasury yield:

Credit spreads continued to widen over the week, though maybe the reprieve on the interest rate risk side of things led to a stop in the selling of the largest High Yield ETF (HYG):

Moving into currencies, there is a lot to talk about and I mentioned it on Friday – we have not seen such dramatic moves in major currencies for a long time, but it usually means that things are not quiet right. The Yen continues to be the best example of this. The (purposedly?) failure of the BoJ to remove yield curve control is leading for the pressure to vent somewhere else, namely the Yen. Just consider the following chart:

So, that move down of the JPY (up for the USD on the chart) from early March to last week is an 80% annualized move!! On a G-7 currency!!! It’s massive and means something. Maybe it means the BoJ’s ignorance or it may be quite the contrary and the BoJ is trying to weaken the Yen to improve regional competitiveness (versus China)? Whatever may be the case, watch this space…

Ok, what else? Ah yes, this will not make me many new (crypto) friends … a few weeks ago I ‘joked’: “last chance to buy Bitcoin above 30,000”. Well, I’d be tempted to joke “last chance to buy Bitcoin above 20,000” today, but on second thought, I will not. It’s bad enough as it is.

Commodities then. Finally the oil price (dog) reacted to what oil stocks (tail) had been advertising via sell-off: if a recession is indeed to come, this can also only be a headwind for energy consumption and hence current price levels may be elevated, even considering the geopolitical situation. Plus, record long oil position of speculators (blue line in bottom clip in chart below) was also indication of what the pain trade would be (down):

So, all in all it was a super tough week for all investors and we all happily went into the weekend. However, even on a hot Saturday afternoon, whilst sipping ice-cold Chardonnay on a centric terrace, I got subtly reminded of what the market environment is:

No kidding!

Ok, enough for today – once again my sincere apologies for the ‘late arrival’ of today’s letter.

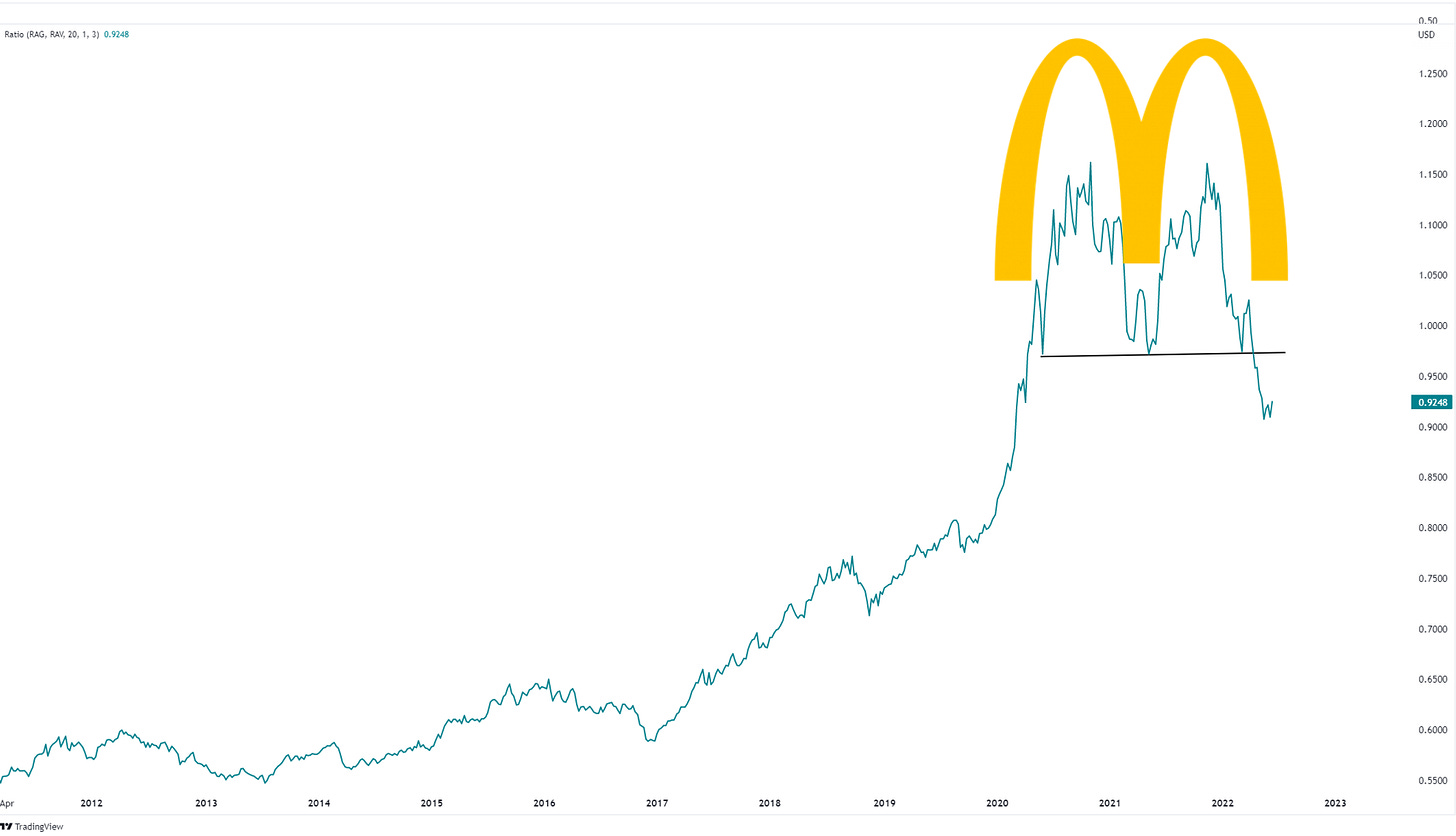

CHART OF THE DAY

Here’s a new chart pattern, overlaid on the growth-to-value stocks ratio (Russell 3000). In short, I’m lovin’ it!

Funny and educational as always Huwy. I am loving it too :-)