Into the Void

The Quotedian - Vol VI, Issue 73 | Powered by NPB Neue Privat Bank AG

“Yesterday we were on the brink of the abyss, today we are one step further…”

— Anonymous

After naming Monday’s Quotedian “Staring into the Abyss” the market gods did us a favour and provided the step off the cliff, allowing to give’s today’s title, which sounds like the cool sequel to a blockbuster movie.

I am waiting for the market gods to humble us any moment now …

Today’s free investment advice: Stay humble and differentiate research from risk management. More savvy advice?

Contact us at ahuwiler@npb-bank.ch

Today will be kind of a quickie update only, with the promise of no Quotedian out on Friday. However, there’s a good chance that the end-of-month edition will be out on Sunday evening and it should be of gargantuan size. So, make sure to get enough sleep over the weekend and ready yourself for a decent Monday morning read.

After a steep sell-off on Tuesday, stocks started by following through on those losses yesterday Wednesday, with following headline hitting my inbox at some stage during the day:

So, maybe let’s start for a change with the European equity session then.

Indeed does the narrow Euro STOXX 50 (SX5E) look top heavy, with the worst news being that the 200-day moving average (MA) was undercrossed several sessions ago:

Possible target range anywhere from -2% to -8% as a first halt …

However, taking a look at the brother STOXX 600 Europe, which also includes equities from far away countries such as the UK or even Switzerland, there are still some signs of hope for an improvement of the technical picture, as support held so far:

But here also the index trades below the 200-day MA - a swift recovery is needed to improve the picture.

Though breadth seems weak, as I measured 45 new 52-week lows on Tuesday versus 1 new 52-week high and yesterday that stat was again a discouraging 44 to 6. Let’s stay tuned …

Let’s turn to the US market, where the intraday chart of the S&P 500 over the past two sessions looks as follows:

On Tuesday there was this “Into the Void” drop with some follow through in the first half of Wall Street trading yesterday, then followed by some apparent bargain hunting. Though however impressive that rebound was, it stalled at the 50% Fibonacci retracement of the entire move lower - it will be a nail biting session today to see which side sees follow-through.

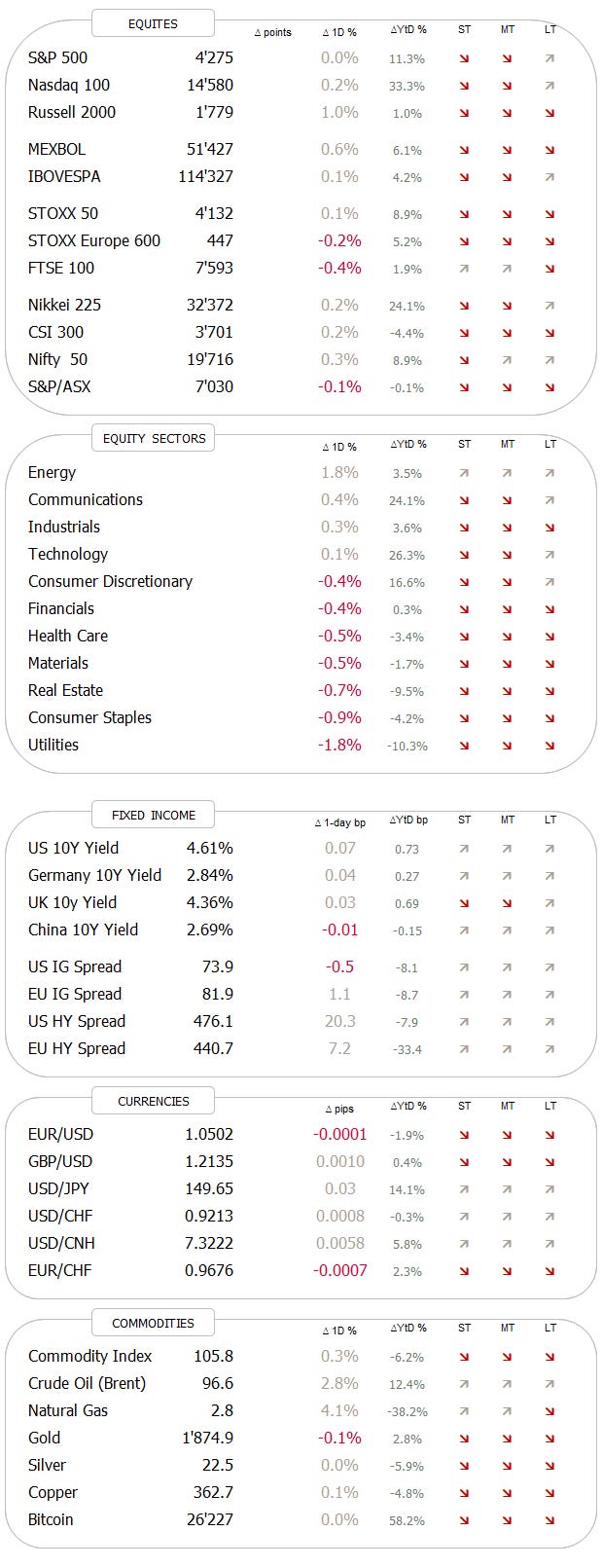

Despite the late rebound on Wall Street, breadth tilted to the negative side, with more slightly more declining than advancing stocks, and six out of the eleven economic sectors down:

Most worthnoty is probably the 4%+ gap between best (energy) and worst (utilities) performers.

Also, similar to the European market, yesterday one stock in the S&P 500 reached a new 52-week high versus 46 stocks hitting a new 52-week low. This how that stat looks like in terms of sector distribution:

Looking at the cart of the S&P itself, we see that our shoulder-head-shoulder (s-h-s)pattern is unfolding pretty decently, with the question remaining will the index find a floor at the 200-day MA (-1.5%) or will the full price target (-3.5%) from the s-h-s formation be reached:

OR,

as an alternative, here’s a very bullish interpretation of what could happen next:

Yesterday, the intraday low of the S&P was exactly on the uptrend line drawn from the October lows via the March lows to today. There, a swift recovery took place, leaving us a “hammer” candle pattern:

“The hammer candlestick is a bullish trading pattern that may indicate that a stock has reached its bottom and is positioned for trend reversal.”

— Investopedia

Only time will tell, and the next few sessions will be interesting to observe. However, we need to keep in mind that it is end of the quarter and buying/selling programs from different sources (pension funds, risk parity investors, CTAs, etc.) may lead to short-term distortions.

AS a last note to the equity section, Asian stocks have a negative tilt to them this morning, with especially Japanese stocks down in excess of one percent as I type. Chinese, Korean and Taiwan stocks are working hard to hold on to tiny gains.

Index futures in Europe and the US are flat.

And now to the rates dog that is wagging the equity tail …

At the danger of repeating myself ad nauseam, the trend on yields is and has been crystal clear on nearly any time horizon for the past two years. However, I anyway put a small arrow on the chart of the 10-year US treasury yield just to help you recognise that trend:

And just in case, here is what that move means in %-terms:

Here’s the close up on the daily candle chart:

We will try have a deep dive in the next issue of the Quotedian which carries the working title “The Perfect Storm”, but as a teaser:

An economy with twin deficits, which is facing a slowdown and possible pick-up in unemployment but sees its long-term bond yields rising, is normally attributed to an emerging market economy …

To return to our “Into the Void” thematic again, and showing you the chart that interest investors, i.e. the one of bond prices, here’s the chart of the popular iShares 20+ Treasury bond ETF (TLT) once again:

Let me zoom out on the same chart to show a shocking number:

Yep, down nearly 50% in just over two years… not nice.

I spoke about capitulation in the last Q, which indeed may be coming to fruition on a short-term time horizon, but longer-term, I have yet to see many investors decisively reducing their 40 in the 60-40 allocation model most still drive …

German yields, as proxy for Europe, are also breaking higher at the longer end of the term structure:

But on both sides of the pond, short-term yields are flat or even a tad lower, leading to that feared steepening of the yield curve.

Here’s the German version of the bear steepening:

To finish the fixed income section, it seems that credit spreads are finally reacting somehwat to what’s going on in equity markets:

Again as a short teaser, with what is going in the US in terms of debt at the moment, the Dollar should be lower, but its not. Quite to the contrary:

Another day up, another day a resistance broken - a strong Dollar to this extent is usually not an excellent sign for everything else …

In commodities, time to run a victory lap, as oil continues to shoot higher:

After a quick retest of the 20-day moving average, WTI turn around yesterday and in one session went to exceed key resistance (dashed line).

The crack spread is blowing out, which is a sign of an important dislocation between supply and demand:

Maybe we should add some refining stocks to our portfolio, which we can do via the Vaneck Oil Refiner ETF (CRAK):

But more on this later, as time has come to hit the send button.

Have a good end to the week, month and quarter!

André

I mentioned further up the fact that any big movement over the coming two days in any asset class should be taken with a grain of salt.

Which reminded me of a “fascinating” stat I saw from JPM via the FT the other day.

According to my dear friends at JPM, trading volume on zero-day-to-expiry options (often just called 0DTE), now accounts to 50% of total options volume:

This 0DTE options are known to some sarcastic bastards inclined people, such as me, as “lottery tickets”. Reset necessary?

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance