Irritable Powell Syndrome

Volume V, Issue 160

"I love deadlines. I love the whooshing noise they make as they go by."

— Douglas Adams

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s QOTD says it all - no apologies for sending this Quotedian out a few hours late offered.

Let’s dive right in …

The weekly performance statistic on global equity benchmarks is actually pretty interesting:

Despite Friday’s late rally on Wall Street, US stocks underperformed strongly this week. Clearly, the sell-off after Wednesday’s FOMC meeting, with longer-duration stocks leading to the downside, can be described as ‘irritable Powell syndrome’.

At the same time, it seems it was only a week ago that we discussed how cheap the Chinese and Hong Kong stocks are (basically because it was only a week ago). We concluded that “catching a falling knife” is only for the not faint at heart, but for those with the guts rewards can be Solomonic. And so it was:

The chart above shows a classical bear trap (undercut of support) and then a quick recovery. Zooming out on the same chart, the longer-term constellation would suggest another 10% or so upside, roughly where the downtrend line and the 200-day moving average coincide, which would still leave the chart in a cyclical bear:

But as suggested, this is for astute risk managers only, i.e. investors who know how to take trigger a stop loss…

In general, Friday brought some very interesting price action, and whilst the adages coming to mind include “one day doesn’t make a trend’ and ‘never on a Friday, some of them are well worth keeping an eye on.

BUT, we will observe them on Tuesday morning, to see if there was follow-through on Monday … so, stay tuned!

Sector performance continues to confirm my point that “strength begets strength” on a weekly basis:

Energy and other tangible sectors up, and long-duration (aka intangible) sectors down. Here is the chart of sector performance YTD:

Before turning to bonds, here’s also the usual stat on the Top 25 year-to-date performers in the US and Europe and their weekly results:

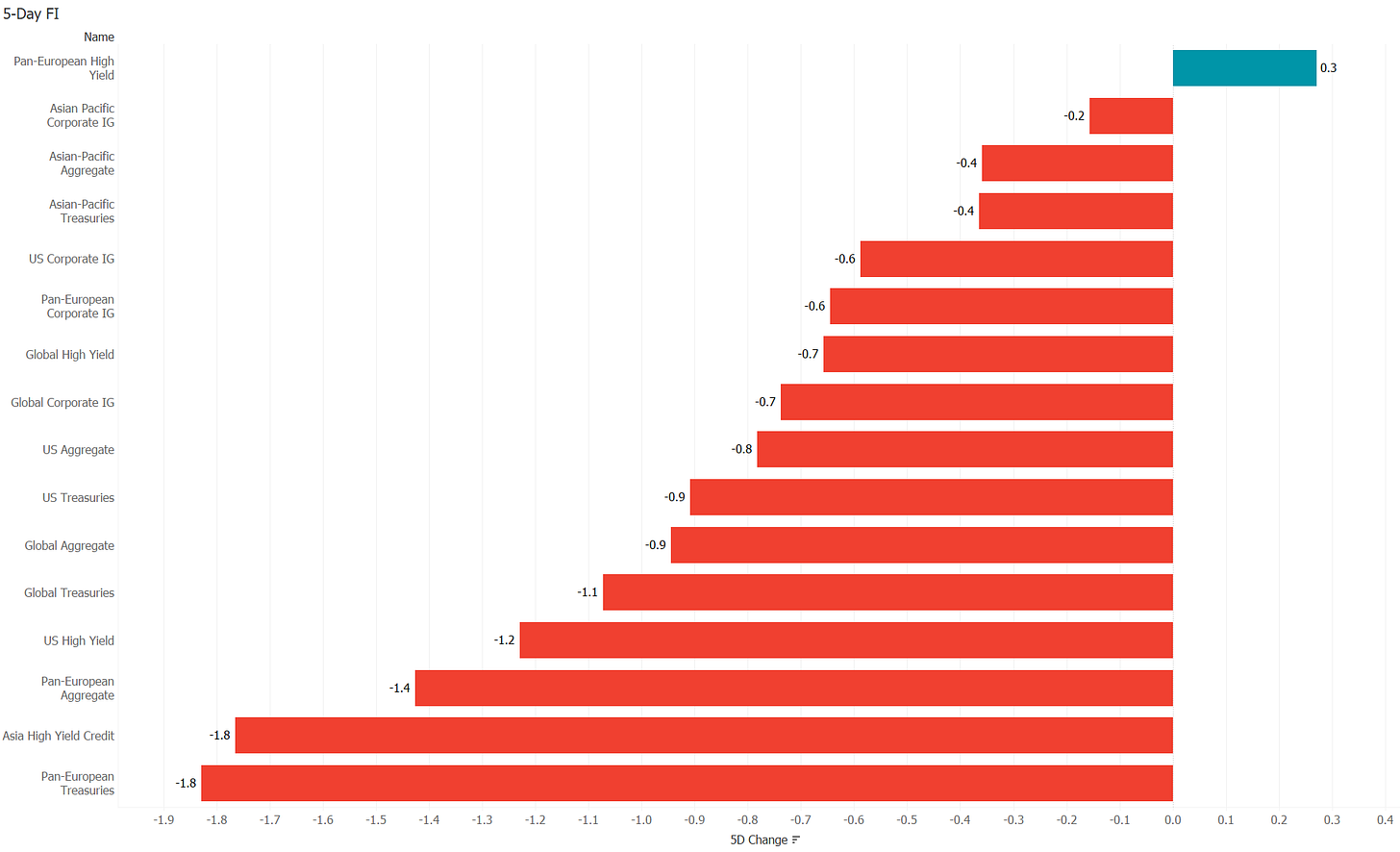

Turning to fixed income, it was another complicated week for this asset class:

The weakness in bond markets came mainly courtesy of yields edging higher,

and to a lesser extent due to a rising credit risk premia:

Currency markets were truly astonishing this week. Looking at the 5-day performance table alone would let you conclude that the US Dollar was weak throughout the week:

But then cross-checking with Friday’s performance table, we realise that nearly all of the strength came during that one day:

This is how those two performance tables look on a chart (DXY):

Finally, with the US Dollar having weakened in to the week’s end, it comes to little surprise that the commodity complex by and large had a ‘good’ week:

In precious metals, the lesser precious (Silver and Platinum) stood out, with Silver gaining close to 8%. On the chart it seems that Silver is at important junction:

The other metal that saw a huge rally was copper, up close to eight percent on Thursday alone:

Again, some follow-through is necessary, but the move looks important on the chart:

Time to hit the send button. Tomorrow is US mid-term election, but that should be a subject for Wednesday.

Have a great day!

CHART OF THE DAY

One of the more interesting features of last week was that despite being a very volatile week for stocks and bonds, measures of volatility were actually noticeably lower. As the chart below shows, did volatility (VIX - green line), volatility of volatitly (VVIX - blue line) but also bond volatility (MOVE - red line) decline substantially. Especially the latter is noteworthy, as bond vola had been unusually elevated for the past 12 months.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance