Is it a Bull? Is it a bear?

The Quotedian - Vol VI, Issue 10 | Powered by Neue Privat Bank AG

NO! It’s a Kangaroo market!!

“Follow the trendlines, not the headlines.”

— Bill Clinton

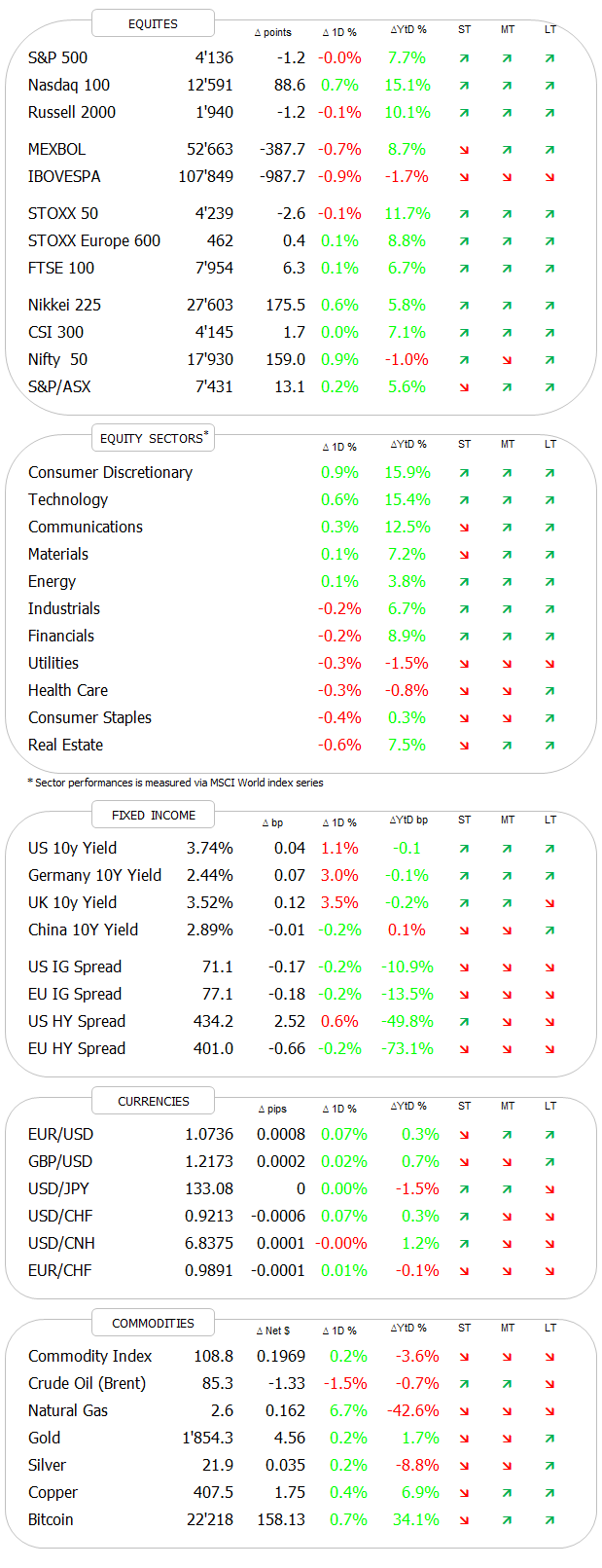

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Just a quick note this morning (a 3 minute read), looking at some of trends (or lack thereof) of the past few hours - and beyond.

After the CPI number came in at the upper end of the expected range, stocks rose, then dropped, then rose again, dropped anew to finally recover into the close - all quite choppy:

Strangely enough, zooming out to a daily chart, we can observe the same kind of choppiness, with no net progress made (in either direction) since June of last year:

This is frustrating bulls and bears alike, and is only keeping the Kangaroos happy …

There were roughly two losers for every winner in yesterday’s session, leaving us with this heatmap:

Sector performance did not make a lot of sense with the long-duration sectors up the same day that yields were up too:

Not shown above is that an index of unprofitable tech stocks, i.e. the longest duration assets in an equity universe, was up 3.5% on the day. Not really a healthy sign IMHO, but rather one of animal spirits at work again.

Asian markets this early Wednesday morning are printing red throughout nearly the entire region, as investors continue to digest the slowing slowdown in inflation, plus there were some hawkish comments from a FOMC member overnight.

European and US index futures are hinting to a lower start to our sessions here too. Equities trading in Turkey restarts today after a week-long closure following the devastating earthquake.

The good old Quotedian, now powered by Neue Privat Bank AG

As fore-mentioned, yields were higher on the day, which intuitively makes sense given the higher-than-expected inflation print. Here’s the chart on the US 10-year yield, now clearly pushing higher again:

Or consider the 2-year yield chart, pressing towards multi-year (15!) highs now:

No wonder, given that the implied terminal rate for Fed Funds has pushed well above 5%:

I will short-cut here today, wishing you a successful Wednesday!

André

CHART OF THE DAY

As it is so difficult to beat a (equity) benchmark, maybe we were just delivered a shortcut here …

Every year the website UnusualWhales.com compiles data on the investment activity by members of the US Congress. Whilst it is not an exact science, a certain pattern emerges when comparing if congress members beat or lag the S&P 500 (SPY):

Of course, somebody then had to brilliant idea to replicate that apparently fail-safe investment strategy and now two ETFs have been launched following congresses ‘trading activity’:

KRUZ —> to follow the Republican trading strategy

NANC —> to follow the Democrats

Some serious good Ticker-naming there!

Let me finish with this all important phrase from the UnusualWhales.com site:

Unusual Whales has reported on political trading and worked on this ETF with the hope of getting the practice banned all together.

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance