It shouldn't, but it does

Volume VI, Issue 9 | Powered by Neue Privat Bank AG

“Facts are stubborn things, but statistics are pliable.”

— Mark Twain

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Of course does today’s title not refer to recent UFO sightings and shootings, even though that came in quite handy to the Biden administration which last week was openly accused blamed exposed suggested of having been responsible for the Nord Stream sabotages (read it by clicking here). Nothing better than some pending alien invasion to distract from other blundering.

However, today’s title does refer to the release of the Consumer Price Inflation (CPI) number in the US this afternoon. First of all, it shouldn’t matter because it is a strongly lagging number - even though it is supposed to look at January, most of the data is actually older. Secondly, and at the danger of being called a tin-foil-on-my-head-wearing conspirator, the US Bureau of Labor Statistics (short: BLS) is introducing some very convenient and timely changes to the calculation methodology of the CPI number, which will make comparisons to previous numbers pretty futile. See for yourself:

And here’s the link to the full update on the BLS website.

However, courtesy of Fed Boss Powell, who dumped forward guidance in favour of the ultra-lagging CPI number last year, this latter statistic is now all the rage amongst investors.

It shouldn’t matter, but it does …

Having said that, don’t lose any time guessing what the number might be … just carefully observe the market’s reaction to it.

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

Looking briefly at yesterday’s session, it seemed like a very quiet one - but also one with a very positive resolve for equities as you can see from the Dashboard above.

Both, the Stoxx 50 (green) and the S&P 500 (blue) rose from the beginning right to the end of the session, never really looking back:

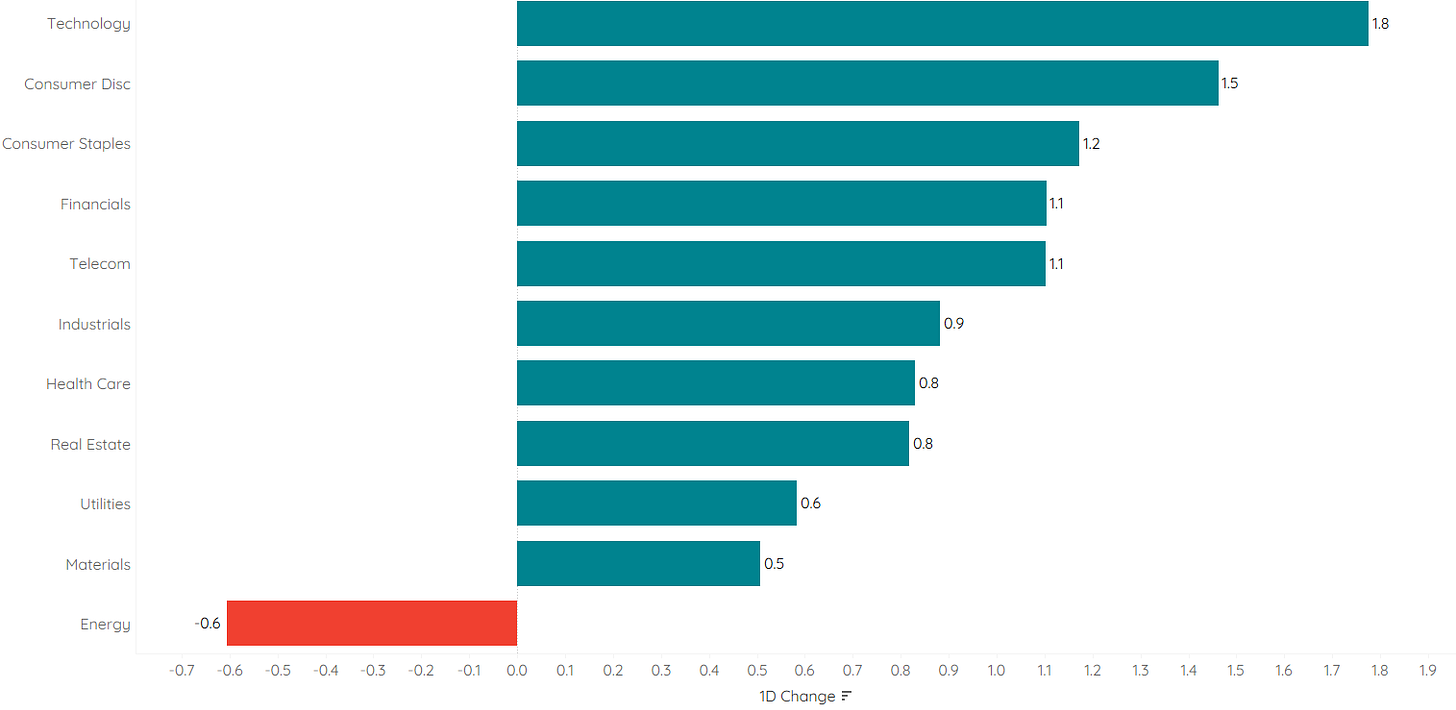

The S&P’s heatmap would suggest that the only sector down yesterday, was the one that was the only sector up on Friday:

Let’s check that with the sector performance chart:

Indeed!

Overall the participation in yesterday’s rally was very decent, with close to 90% of stocks in the S&P 500 up on the day. For the STOXX 600 that number was just north of 70%.

Given everything that is going on, it may be counterintuitive for stocks to continue their ascent, but with trend well defined and such a broad participation it is difficult and painful to stand in the way of the trend … climbing the wall of worry then?

This early Tuesday most Asian equity benchmarks are trading a tad firmer, whilst US index futures are printing small red as traders digest some of yesterday’s formidable gains.

Bonds were largely a no-show yesterday, with yields slightly lower at the long-end of the curve and slightly higher at the long end, steeping the yield curve further:

And the very same was true for European yields, here proxied via the German yield complex:

All quiet on the currency front, where not even the official announcement of BoJ’s Kuroda successor, Kazuo Ueda San, could meaningfully move the needle in the currency of land of the rising sun:

Overall, the US Dollar weakened versus most other major currencies, albeit ‘losses’ were extremely limited. Interestingly enough, it was enough to push teh EUR/USD cross-rate back into its trend channel:

Finally, in the commodity space, the price of oil dropped slightly, probably on the back of the rumour that the US will sell 26 million barrels out of its SPR (Strategic Petroleum Reserves) with deliveries expected between April and June. Here’s the intraday chart of WTI:

Let me be my most hateful sarcastic me for a short moment … with the SPR at its lowest in over 40 years a) should that not be a big support to oil prices as the US should ‘restock’ and b) the US should ‘restock’ if they continue with their current war path against hhhmmm some non-cooperative countries. Just saying…

In other news, it came as a surprise (at least to me) that Lael Brainard, number two at the Fed, has been summoned to Washington today, where she is likely to be knighted as Biden’s top economic advisor. Good on here (she acutally deserves that), but of course this will leave a vacuum of adult FOMC members at the Fed…

Ok, it’s shortly before nine, and with a four minute read you are up-to-date!

De nada :-)

André

CHART OF THE DAY

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance