It's (not) the economy, stupid!

The Quotedian - Vol V, Issue 107

“All the proof of a pudding is in the eating.”

— William Camden

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Ever wondered where the expression “the (stock) market is not the economy” comes from or what it actually means? Well, no better time than the current environment to grasp the full understanding of the adage. As economic data around the globe continue to deteriorate, stocks should be lower, bonds should be higher (yields lower) and commodities probably a notch lower too. But they are not. There’s your pudding …

Hence, this is why we think that “price makes news, not the other way round” or as the slogan of The Quotedian goes “Looking for the forest? Listen to the trees!”. So, let’s listen to some of those trees …

Yesterday’s session was indeed defined by bad economic news out of the two largest economic blocs: First, Chinese (retail sales, industrial production) data disappointed to such a degree that the PBOC (People’s Bank of China) actually decided to cut two of their key interest rates. This is of course causing the “funny” effect equivalent of accelerating (rate cut) whilst at the same time hitting the breaks (continued COVID lockdowns). Second, US data showed industrial (Empire Manufacturing) and housing (NAHB Housing Market) contraction.

But off they went, with investors pushing equities higher yet again, with markets on both sides of the Atlantic advancing about half a percentage point. The worst that can be said about yesterday’s session is probably the low participation, being after a quick visual observation apparently one of the lowest volume days (S&P) of the year. Everything else was pretty bullish:

Breadth was about 3:2 (advancers/decliners), and 9 out of the 11 economic sectors gained on the day:

The market carpet of the S&P then shows of course a decisively green tone:

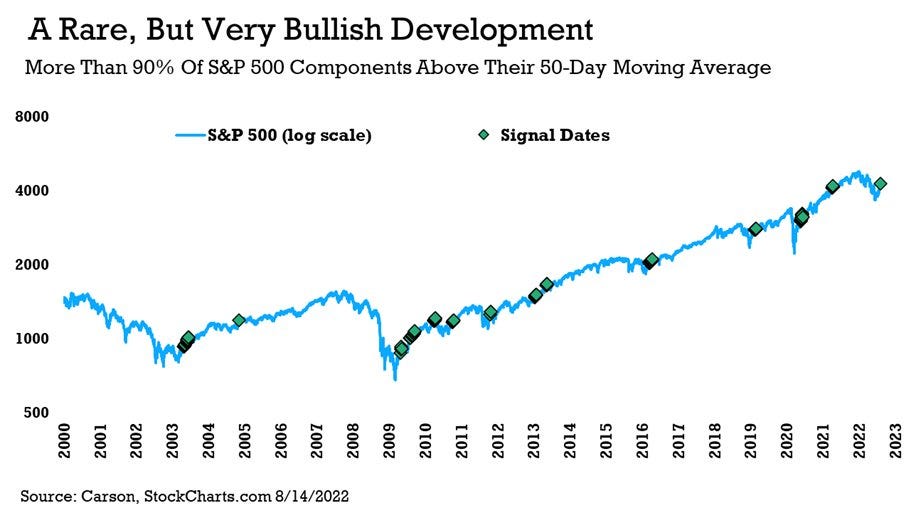

Spoiler alert: But the most bullish news probably came in form of a breadth thrust - check the ‘Chart of the Day’ section for details.

This morning, Asian markets are mixed, with Japanese, Chinese and Hong Kong stocks flat to small down, whilst most other regional markets are eking out some gains. Index futures are up in for European markets and flat for their US counterparts.

Let’s move on to bonds, where yields DID react somewhat to the horrible Empire Manufacturing reading (-31 versus +5 expected - albeit notoriously volatile) and the NAHB Housing Index suggesting a housing market contraction (49 versus 54 expected). The US 10-year yield faced a quite substantial 10 bp drop from the intraday high at 2.86 to just below 2.76 before recovering ever so slightly again:

The shift was pretty much across the entire length of the curve, leaving the 10-2 segment as about inverted as it already was.

Little to write home about regarding the credit risk aspect of fixed income markets, though there was a tiny divergence between rising stocks yesterday but slightly wider credit spreads. But again, hardly noticeable.

Moving into currency markets, there was some decent movement in the EUR/USD cross-rate, though the precise motivators for the move remain a question mark to me. The currency pair dropped nearly a whole big figure top to bottom, bring the FX rate to the vicinity of the lower end of its short-term trading range:

The 1.0115 level seems a key, with a break likely provoking a retest of the multi-year, July 14th low below parity.

And finally, in the commodity space, we saw a biggish sell-off in crude oil yesterday, mainly on the weaker economic data out of China and the US. Brent for example dropped four percent between yesterday and today’s early trading activity and is trading (just about) above key support. Interestingly enough though, CFTC-data is showing that speculators (lower clip, blue line) are exiting the long crude trade, whilst commercial hedgers (lower clip, green line are piling in - usually a bullish signal:

Time to hit the send button, but once again, let’s make an effort to grow The Quotedian community, by sharing this document, and especially by hitting the ‘Like’ button at the end of the mail.

Have a great Tuesday!

CHART OF THE DAY

A rare, but quite bullish signal came actually not yesterday, but already on Friday in the form of a breadth thrust, as more than 90% of the S&P 500 constituents now trade above their 50-day moving average. Today’s COTD show previous occasions of this signal. Stay tuned …

LIKES N’ DISLIKES

Coming back soon!

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance