January Barometer

Vol VIII, Issue 5 | Powered by NPB Neue Privat Bank AG

“As goes January, so goes the year”

– Market Adage

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

The January Barometer dictates, that as goes January (for the S&P 500), so goes the year for the S&P 500. Does it work? Click here (—> here) for a closer analysis, but according to the always formidable Ryan Detrick the chances for a good year after a good January are increased. Especially, if January is up more than 2%, as it was (S&P 500 +2.70%):

Of course, this is data mining at its best, but what isn’t ….

Let´s then expand the January Barometer to all asset classes, assuming that as goes January, so goes the year …

Hence, be long everything, except Indian equities and natural gas. Easy!

Let’s check back in eleven months time, if this simple investment strategy was worth anything.

Now, what I am sure will be the continued tone from January, i.e. elevated volatility. Here’s the VIX (S&P 500 Volatility Index) January chart:

Expect many more spike this year, as outlined in our Outlook 2025 “Wild Waters” (click here — here).

Obviously, US President Trump’s announcement of tariffs on the country’s three major trading partners

is not exactly a smoothing factor for markets this first Monday of February...

Hence, even more important then to take a step back, check what January 2025 has brought us so far and what it could mean in terms of the longer-term (monthly) charts.

Alright! Here are the year-to-date (aka January) performances of some of the most popular equity indices around the globe:

Hey! Wait! What??!!

European indices make up nine of the top ten performing indices??!!

How can this be?

Europe is not the definition of a sinking Island? Perhaps, but not today. Here is the definition of a short-term opportunity:

Same chart, versus the longer-term reality:

Ok, time for some longer-term (monthly) stuff.

The almighty S&P 500:

Closing above 6,030 (dotted line) here is important or else the January Barometer may become very broken…

As hard as it is to be bullish this tarriffying Monday, if we zoom in on the monthly chart above,

we note that by a tiny margin January was a BORM.

What is a BOMR? Easy! A Bullish Outside Reversal Month meaning that the highs and lows of the month exceed the high and low of the previous month. This, on the S&P 500, has only happened on seven occasion previously with the index return never being negative 12 months later:

The monthly chart of the Nasdaq 100 also continues to look bullish, albeit with futures down nearly 3% this early Monday, it is hard not to see a possible roll-over in the pattern:

US Small cap stocks, as observed via the Russell 2000 index, rebounded from the lower end of their trend channel in January, leaving the uptrend in tact for now:

In Europe, as already allured to, stocks had an excellent month, with the narrow Euro STOXX 50 index up nearly 8%,

leaving the index within striking distance (17 index points or 0.3%) from a new monthly all-time closing high:

The broader STOXX 600 Europe index, which includes Swiss, Swedish and British stocks, broke resistance to close at a new all-time high:

Swiss stocks were up close to nine percent, as measured by the SMI:

Given the defensive nature of the Swiss market, such a relative outperformance may be worrisome, but for now let’s put it down to a much needed rally of the healthcare sector, of which the SMI is very heavily exposed to:

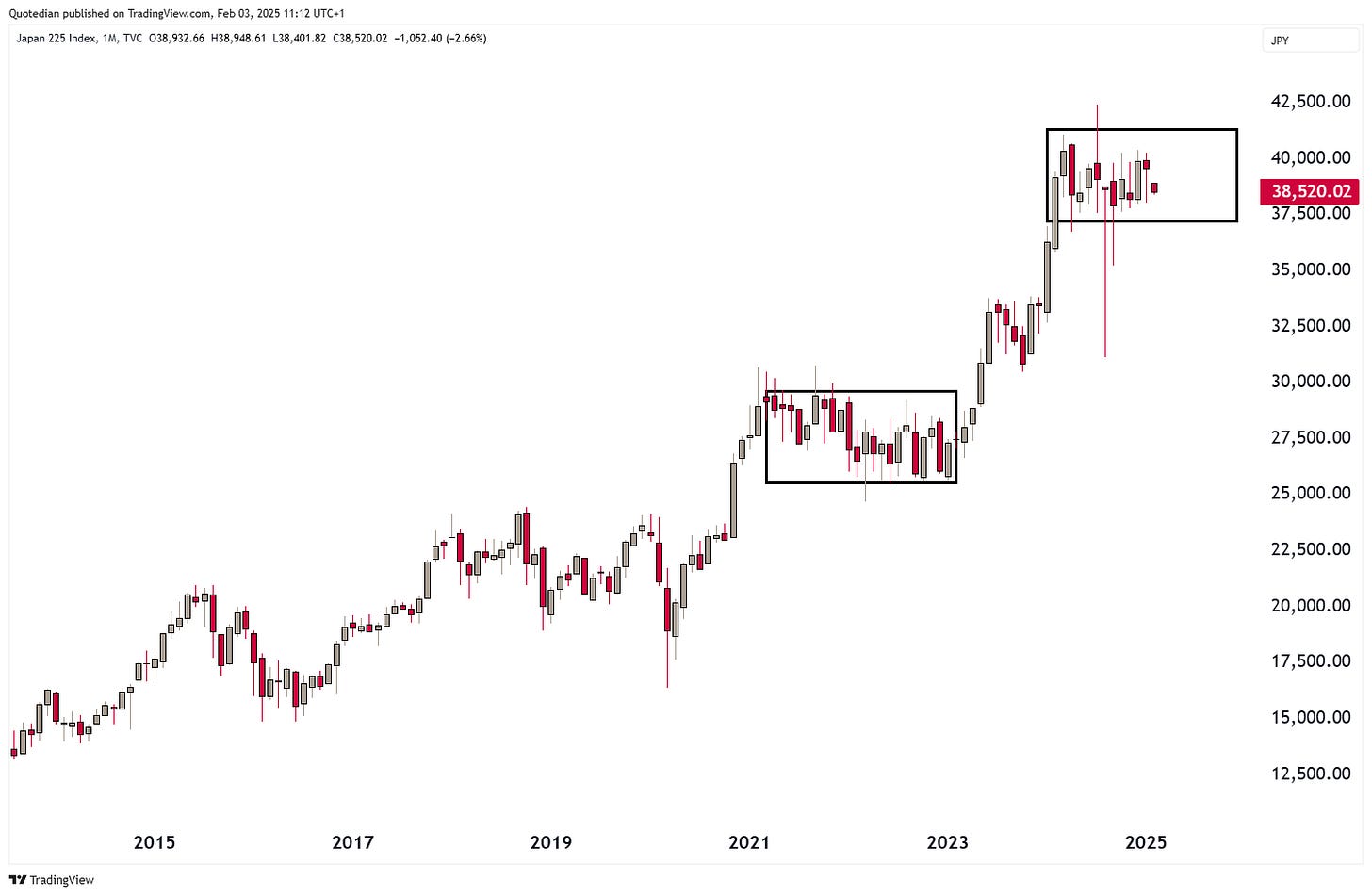

In Asia, Japan’s Nikkei continues in a broad sideways consolidation, which increasingly looks like the 2022/2023 experience:

Chinese stocks (CSI 300) closed down three percent on the month, but at least closed well off their intramonth lows:

We downgraded Indian equities (BSE500) to neutral in early January, a move that turned out to be timely:

With the index now trading below its 10-month moving average and our price target below 30k, it is too early to recommit to this market.

Time to have a look at sector performance in January, which at a global level looks as follows:

Communications (sector formerly known as Telecom) stocks were best performing in January, however, we need to take this sector performance with a pinch of salt, as 60% of the index (proxied via the Xtracker MSCI World Communcations ETF) is made up of four stocks:

Especially META and NFLX had an excellent month, contributing massively to the sector’s performance.

Health care stocks, which we highlighted a bit further up in the context discussing the Swiss market, had an excellent month, but context is necessary here too:

The current outperformance comes on the back of a three-year long relative underperformance, but hey, all trend changes have to start somewhere!

At the other end of the performance gamma, we find technology stocks, which probably suffered mostly due to semiconductor underperformance.

Here’s the relative chart, also for context:

And now let me copy/paste and slightly amend the text following the health care chart above:

The current underperformance comes on the back of a three-year long relative outperformance, but hey, all trend changes have to start somewhere!

Nearly last, but definitely not least, with the first month of 2025 behind us now, it is also time to look at the top performing stocks so far in order to identify possible winners for this year. Because, as you will remember:

Strength begets strength!

Here are the top performing stocks in January (and YTD, of course) in the US (S&P 500):

I must say, Constellation Energy (CEG) took me by surprise, especially as stock was down nearly 20% last week, being one of the big DeepSeek ‘losers’.

And here the winners so far in Europe (STOXX 600):

Luxury stocks (Richemont, Burberry, Cucinelli) seem to be living through some sort of revival…

And finally, to end the equity section, here’s a QuiCQ (typo intended) look at US sector performance:

Time to turn our attention to fixed income markets, where we note that going down the quality ladder (i.e. high yield) paid off in January:

US 10-year treasury yields ended the month roughly where they started,

but not without important intramonth volatility:

Inflationary fears coupled with deficit worries pushed yields up to 4.80% intramonth, before “things” calmed down again.

The Fed decided not to cut rates in January, which was largely approved by the bond market. Probabilities for further rate cuts until year end, as implied by the futures market, have now dropped to below two:

German rates, as a proxy for Eurozone yields, advance slightly in January, albeit were also off their intramonth highs at 2.64%:

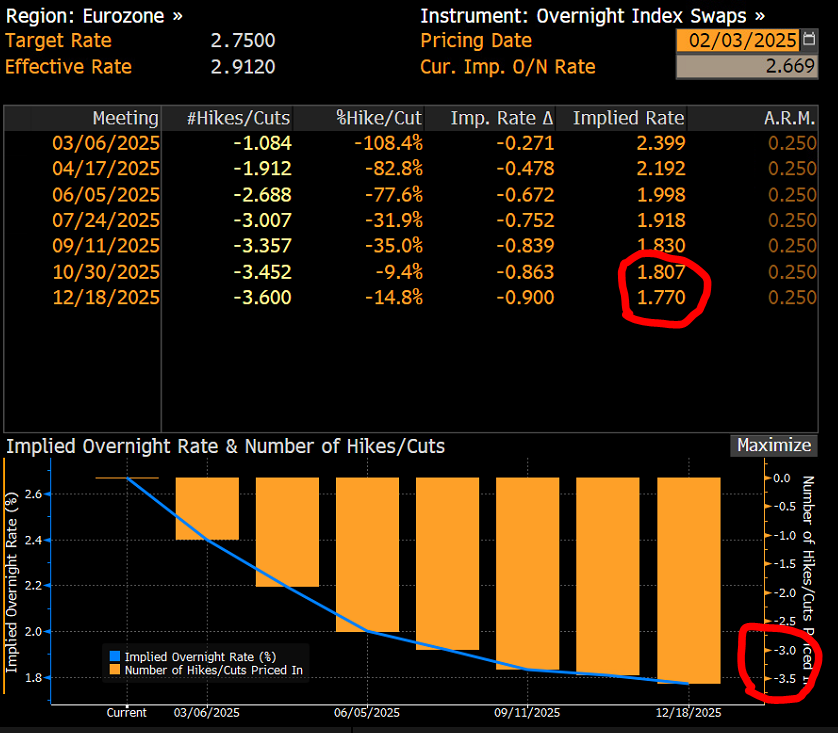

The ECB did cut rates and the bond market reacted as one would expect:

Now, futures markets imply another three cuts (and a bit) into year end, which would imply a terminal rate approximately 1.75%:

The UK 30-year Gilt yield, which hit a very worrisome 5.50% intramonth has dropped back to just above five percent, which has soothed markets and government equally.

Here’s the 10-year version of the Gilt yield:

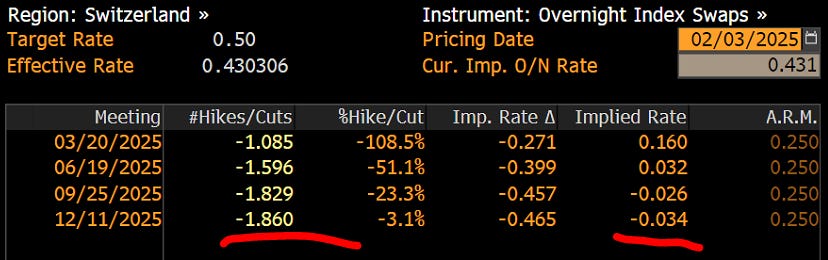

In Switzerland, bond investors got the (very) brief luxury of being able to lock in a yield in excess of 0.5%:

The market is expecting a zero to negative Helvetic policy rate by year end:

Credit spreads continue to trade very tight, despite a small DeepSeek uptick last week:

Here’s another way to look at those credit spreads:

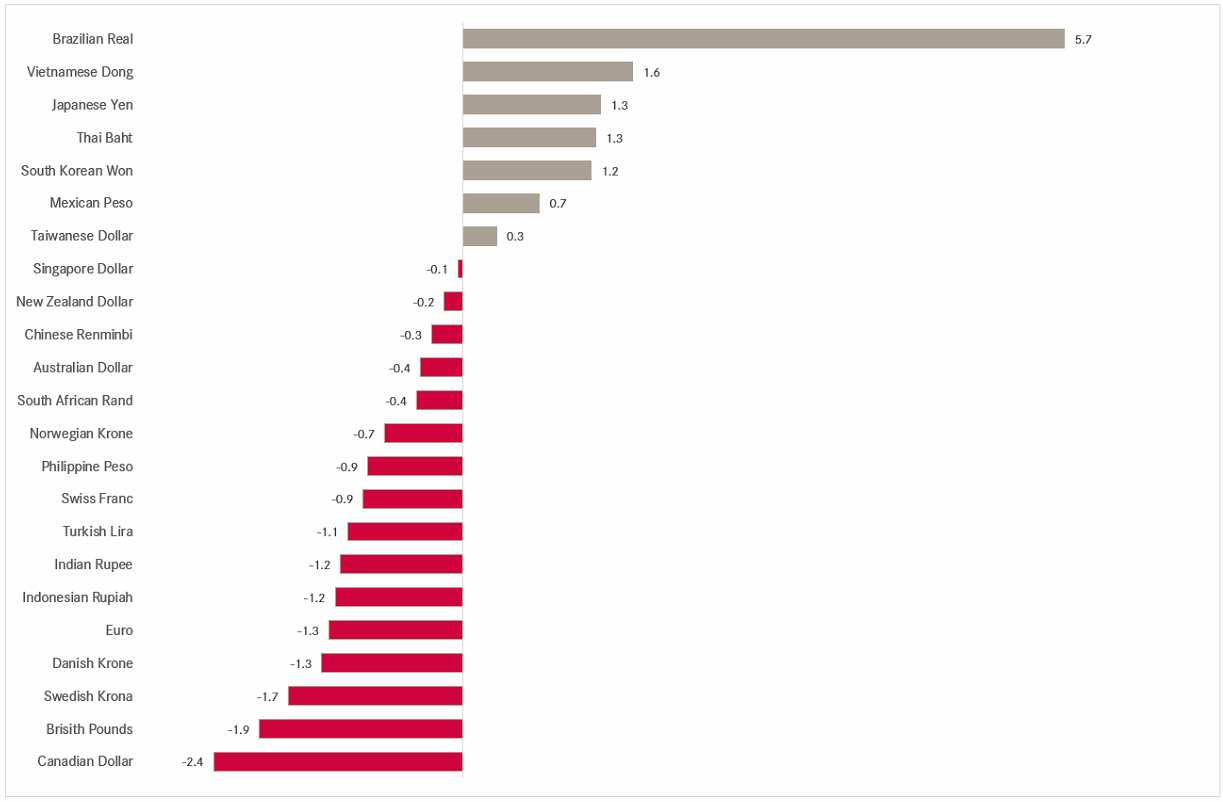

The following table shows performance in % of non-Dollar currencies versus the US Dollar:

The strength of the Brazilian Real stands out, but I suspect that this is more of upwards correction of the BRL in a broader downtrend. Let’s check:

Indeed has the Brazilian currency lost over 30% versus the greenback before bouncing in January.

The January candle (pointed hand) on the EUR/USD chart is very telling:

No ‘body’ on the candle means that the price opened and closed at nearly the same price, but the long upper and lower shadows speak of a lot of intramonth volatility. Let’s have a look at that month then:

WOW!

Currency volatility has, as we expected and outlined in our 2025 outlook, already increased:

However, in the longer-term context we think substantial upside in volatility still lays ahead:

This Monday, the US Dollar is substantially higher against everything, as Trump imposed with (near) immediate effect tariffs on the USA’s three largest trading partners:

The only currency bucking the trend is one of our favourite longs for the coming months - the Japanese Yen:

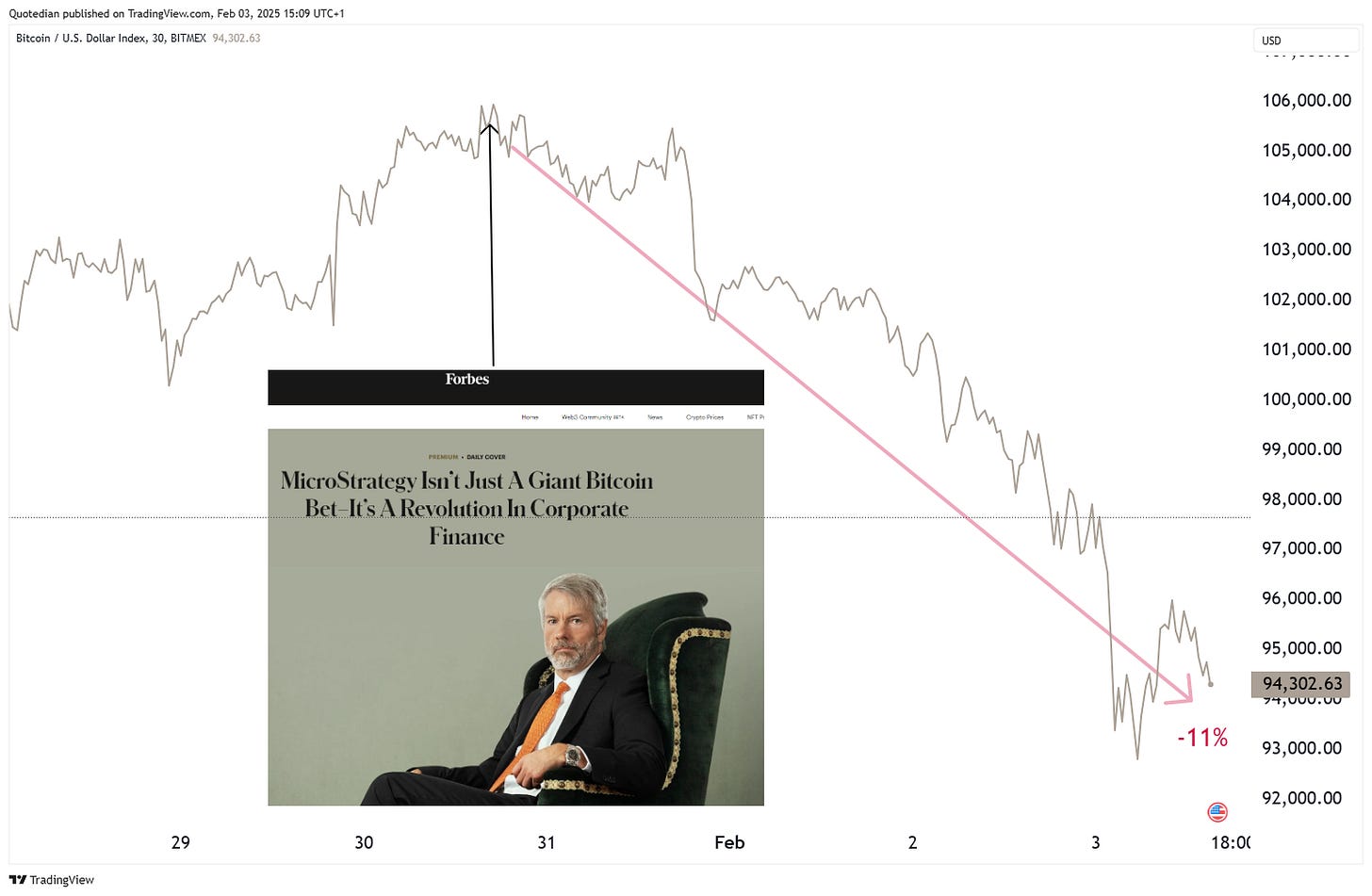

In wonderous world that is the cryptocurrency realm, we highlighted in Friday’s QuiCQ that Michael Sailor’s Microstrategy Inc (MSTR) and with it probably Bitcoin but especially all Altcoins, are likely to be doomed, given the Forbes Cover Curse:

Indeed, did we not have to wait long for Bitcoin to tank. Here is the crypto currency’s performance since the magazine went to print:

Currently I see MSTR itself down 7% pre-open and down about 40% since its blow-off top in November. I think this is still shortable…

Here’s a choice of some cryptocurrencies and how they are trading today:

It’s been a good start to the year for commodities, with all six major ‘segments’ showing gains year-to-date:

Going a step more granular, we also that unless you concentrated your commodity investment in natural gas or zinc, you should have done pretty well so far in 2025:

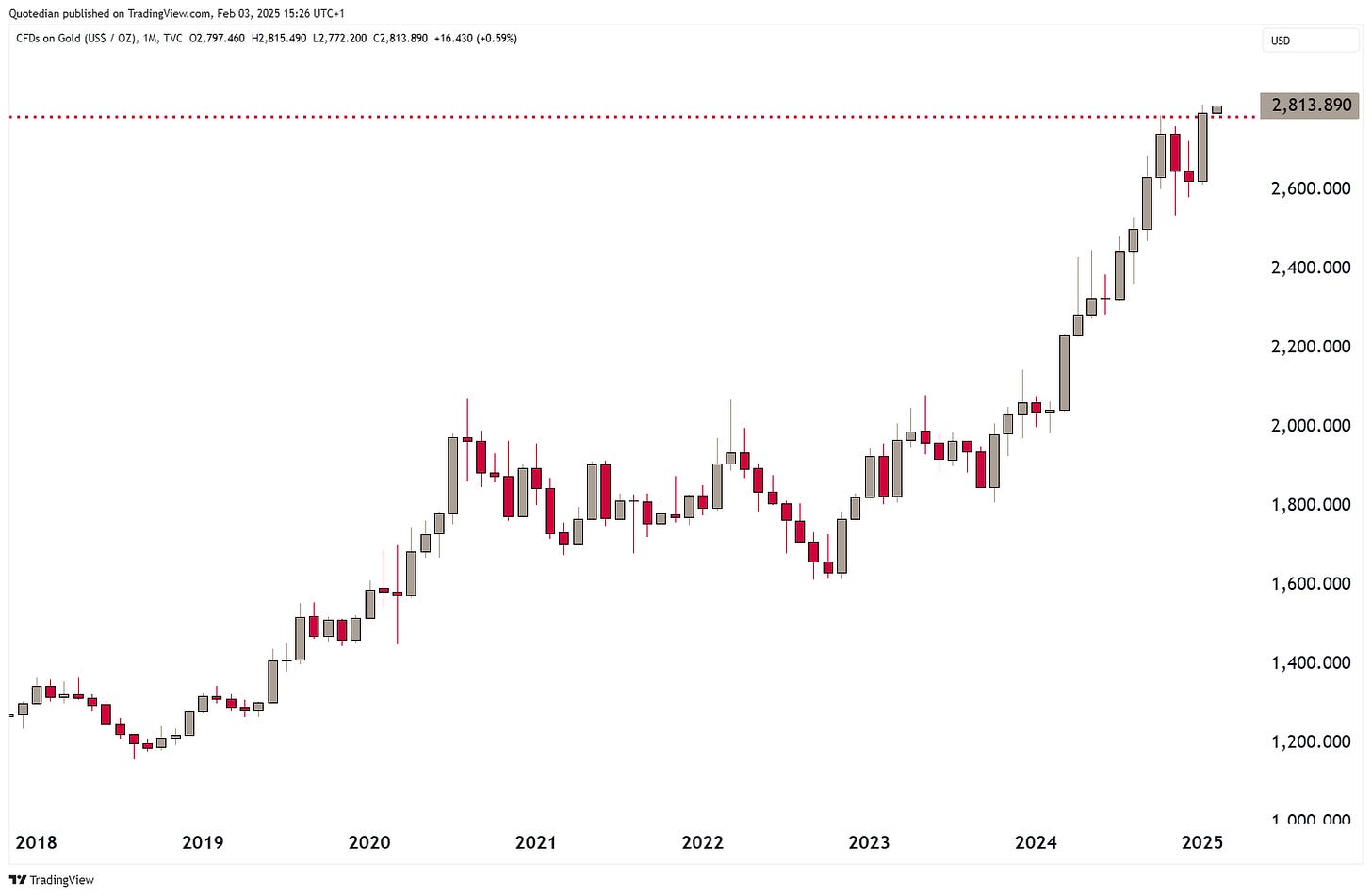

Of course, the commodity most of us are invested in is Gold (and maybe to an extent Silver). Gold broke out to new all-time highs on Friday and is today confirming the breakout with further advances:

The monthly chart for Silver also looks pretty bullish again,

but the daily chart shows better the forming “cup with a handle”-formation (first one to laugh get’s deleted from the distribution list):

Price target on a clear break above $32.20 could be around the $38 area…

Oil is probably confusing everybody at the moment. The initial reaction to Trump’s win in November was to head lower, which seemed right on the back of the “Drill baby, drill” policy. However, over the past two month, this fossil fuel has been drifting higher again:

And that’s all for this issue. Have a great week and make sure to check in on the daily QuiCQ’s!!

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance