┌П┐(▀̿Ĺ̯▀̿)

Vol V, Issue 158

When sorrows come, they come not single spies, but in battalions.”

— King Claudius, Hamlet

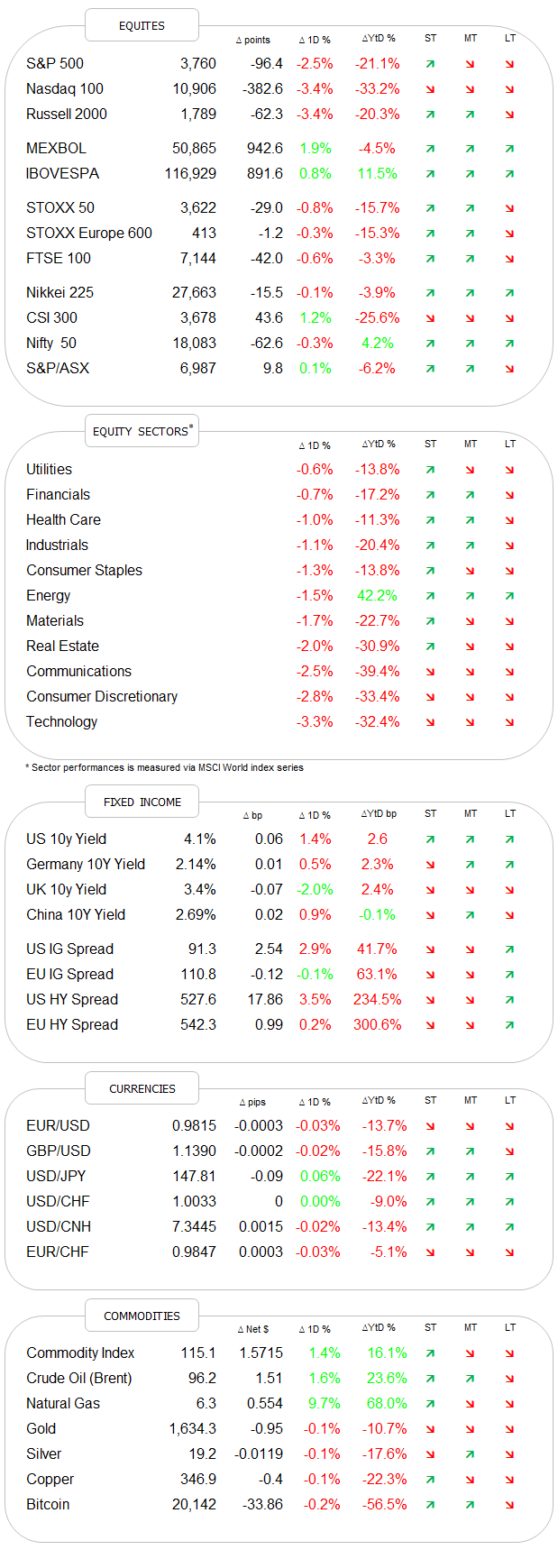

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

No Quotedian was scheduled for today, but given the market price action of the past few hours, I decided to squeeze in a “quickie” …

And to the newcomers to The Quotedian, long-term readers are my witness that the titles for this lovely newsletter are usually not as rude, but I simply couldn’t find a better fit to describe what Fed Chair Powell yesterday did to the Pivot group of investors.

But let’s take it step-by-step … The Fed came, saw and hiked 0.75% as expected. So far, so good. Simultaneously, the FOMC statement was released, which, as usual, was essentially a copy/paste from the previous meeting. Except for the second paragraph:

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

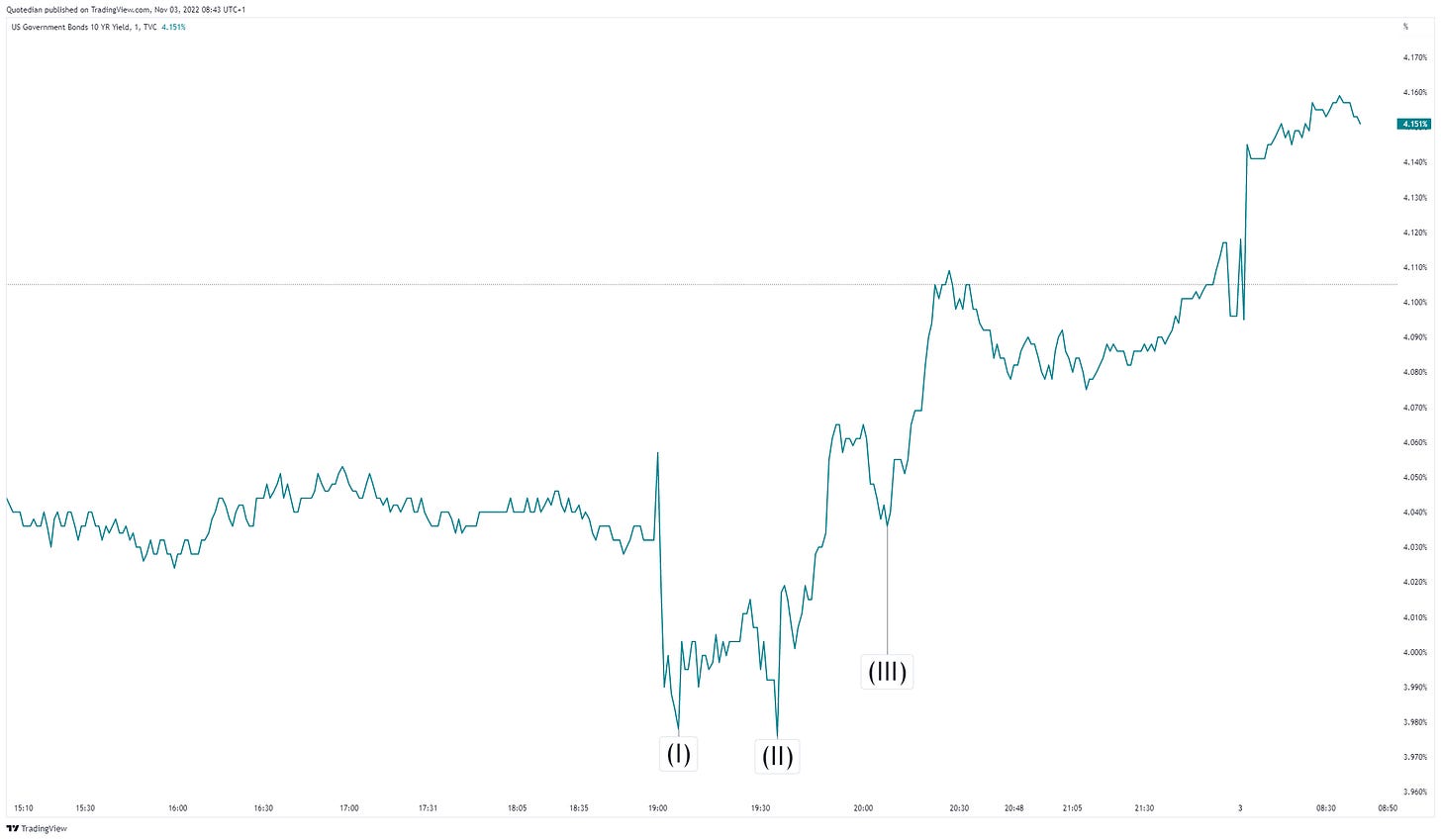

That was a big expansion on the text of the previous months’ and basically means that the committee is aware of the lag of the indicators they watch and will become even more data-dependent. That triggered the dovish rally in stocks on the chart below at (I).

From there it all went downhill. Starting the press conference, comments such as

“The incoming data since our last meeting suggest the terminal rate of Fed Funds will be higher than previously expected, and we will stay the course until the job is done.”

and

''What's far more important now is for how long rates will remain high, and we will stay the course until the job is done''

or

''Risk management is key here: if we were to overtighten, we could use our tools to support the economy later on; but if we failed to tighten enough, inflation would become entrenched and that would be a much bigger problem''

all were not appreciated by market participants as can be seen on the chart starting at (II). Sidenote on the last comment: Such comments sound like a policy error coming (category: inflation is transitory) and probably should be labelled as “Famous Last Words”.

But the true death knell came in form of a comment made by Powell after a reporter misleadingly asked him if he minded that the (equity) market was higher during his press conference:

"…very premature to talk about pausing. We have ways to go".

That was at around (III).

From there on, it was all a bloodbath and you can see the extent on the Dashboard for yourself. Nevertheless, here are some “highlights”…

The S&P 500 has dropped out of its uptrend channel and those having implemented the longs we discussed in this space (this is a trick statement of course, please refer to bullet point number two in the disclaimer), should at a minimum take partial profit:

Zero out of eleven of the eleven sectors in the S&P 500 ended higher, which is not a lot,

and left us with the following market heatmap for the day:

However, bad that looks, the Nasdaq got even more stick and has already nearly completely unwound the whole move up since mid-October:

Remember the long-duration nature of those tech stocks? Well, there you go - keep out.

But, however bad THAT looked, check out Dow Jones Internet Index, here proxied via the First Trust Internet ETF:

Yes, that’s correct. That IS a new closing low for the current bear cycle (and the lowest since the 2020 COVID-panic lows).

I need to press on, but remember two things for your equity positioning:

Duration matters

Nothing ever good happens below the 200-day moving average

Looking at the other asset classes, we can (I have to) accelerate matters, as it is all largely a (mirror) picture of what is going on in equities, i.e. it is all about risk-off.

Fixed income investors had the same experience as equity investors, and their shrinks are asking them:

Here’s the chart on the US 10-year treasury yield, with he equivalent numbering as the S&P intraday chart further up:

This leaves the yield within its uptrend channel on a daily chart:

German yields (futures) are already reacting to yesterday’s non-pivot:

More of the same (risk-off) in currency markets, where everything is lower versus the mighty US Dollar:

So, whenever you think the Dollar (DXY) rally is toast, it turns on a pin’s head higher again:

Time to start wrapping up and let’s do that with following observation:

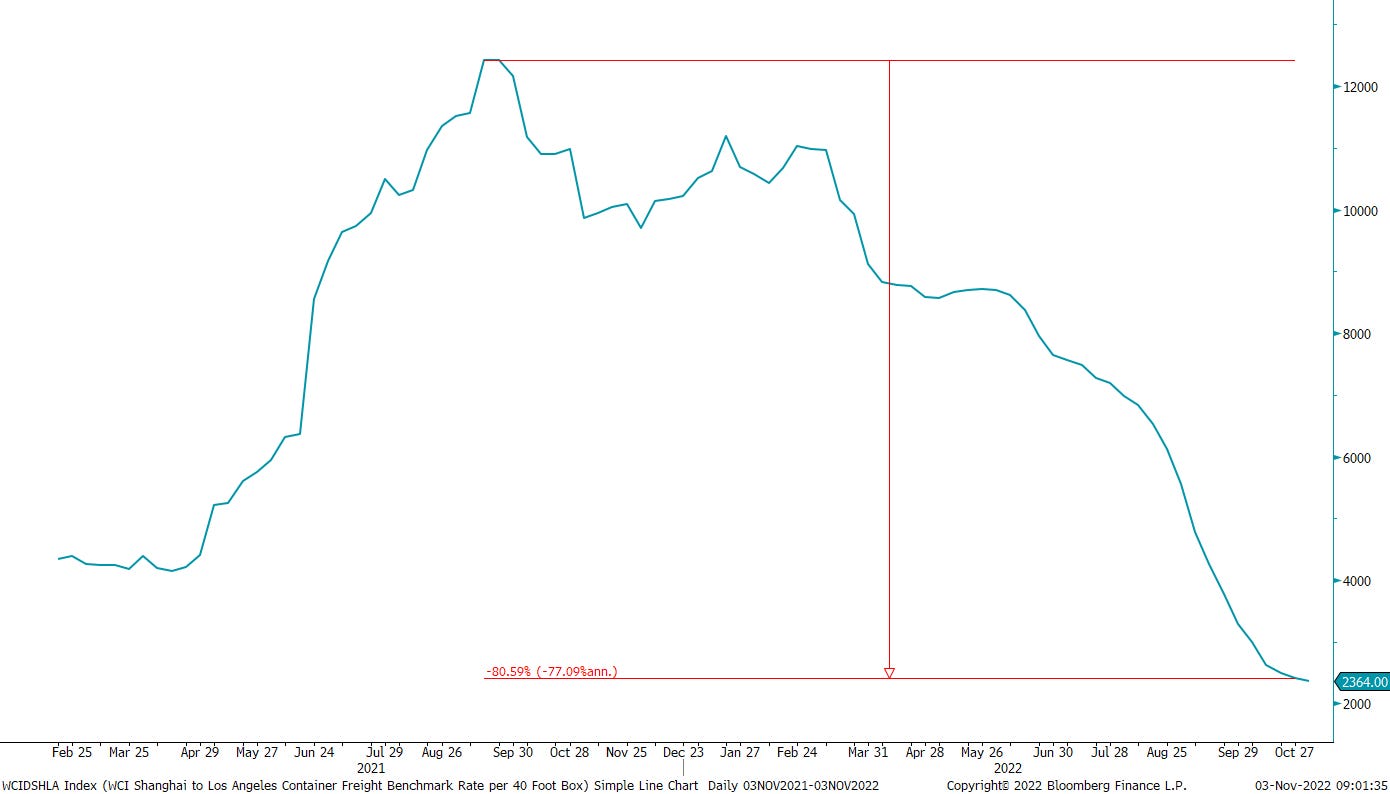

Maersk, the global shipping giant, had results out yesterday and the market did not like them, with the stocks down >5% on the day. But the reality is that the stock is down already 40% from the top, which is substantially more than the STOXX 600 (-17%) for example.

Here a comment from Maersk’s CEO post-earnings release:

“it is clear that freight rates have peaked and started to normalize during the quarter, driven by both decreasing demand and easing of supply chain congestion...With the war in Ukraine, an energy crisis in Europe, high inflation, and a looming global recession there are plenty of dark clouds on the horizon. This weighs on consumer purchasing power which in turn impacts global transportation and logistics demand."

And for context, here’s a chart of the World Container Index Shanghai to LA cost of shipping a 40 ft container.

All this whilst we are facing higher interest rates ahead.

This is a big clue to what your asset allocation should look like for the months to come. To be discussed in a future Quotedian.

Have a great Thursday!

André

CHART OF THE DAY

Back tomorrow!

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance