Look twice

The Quotedian - Vol VI, Issue 40 | Powered by NPB Neue Privat Bank AG

“Beware of false knowledge; it is more dangerous than ignorance.”

— George Bernard Shaw

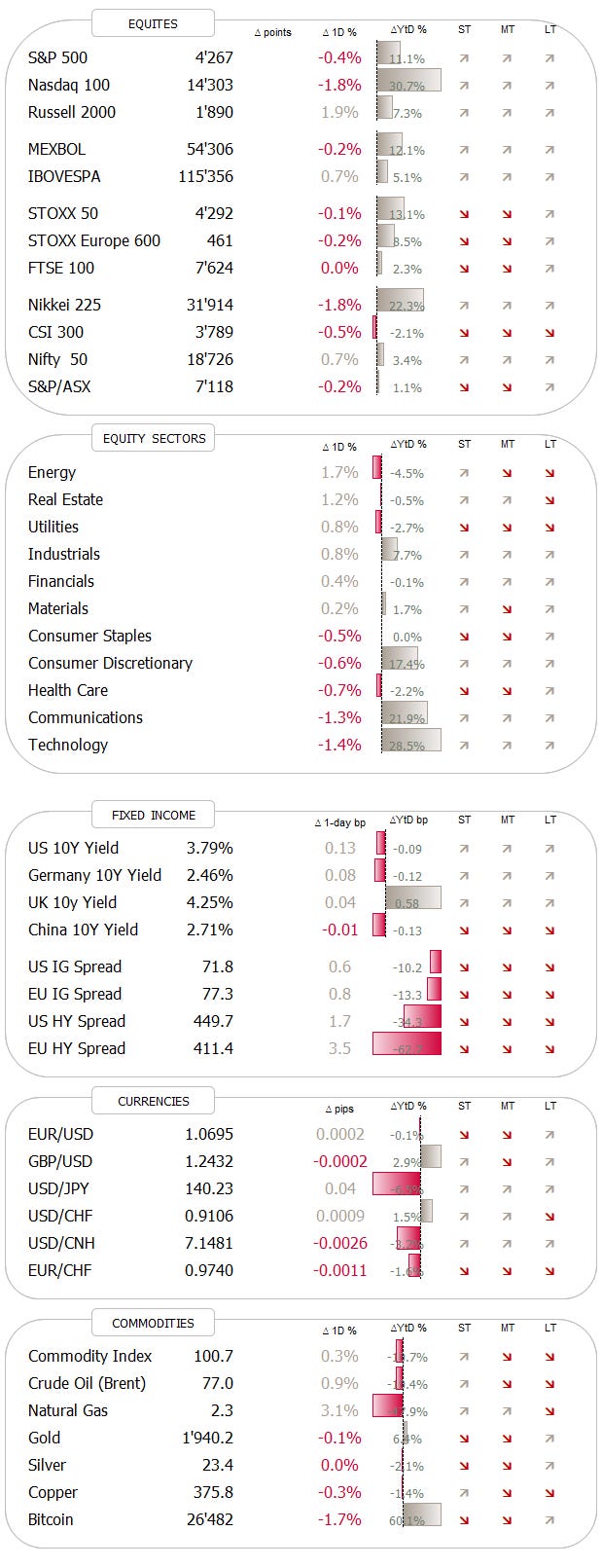

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Just a quick mid-week update, highlighting a few charts that have caught my attention over the past couple of days.

Also, there is a high probability, that there will be NO Quotedian this coming Sunday, due to a pretty restrictive travel schedule.

On we go …

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

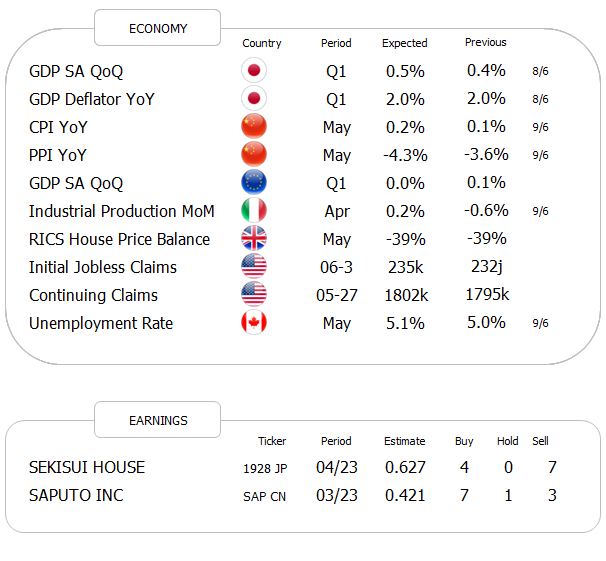

One of the most influencing macro events in yesterday’s session was the BoC (Bank of Canada) pulling a RBA (Reserve Bank of Australia) by unexpectedly hiking their key interest rate by 25bps.

As my friend Paul at Franklin’s excellent K2 alternative outlet highlights in his daily note:

“Canadian central bank cited strength in consumption growth and interest sensitive areas of the economy. Labor market remains exceedingly strong. They are concerned that inflation may get stuck materially above 2%, thus increasing odds of subsequent hike. There is a direct read through to the state of the US economy.”

Amen.

In any case, this put some downward pressure on global stocks, which previously had been ticking happily higher. Here’s the intraday chart of the STOXX Europe 600 index for example:

US stocks also reversed early gains, with the S&P 500 and the Nasdaq 100 closing finally lower on the day, but the Dow Jones Industrial index eking out a small gain, mostly due to a stellar four percent rise in Caterpillar.

AND ….

the Russell 2000 small cap index, which showed a flat year-to-date performance at the end of May, put in another strong session (+1.8%), bring total YTD gains (and hence June gains) to nearly 8%. Here’s the chart:

Zooming out, this starts looking very constructive:

So, some rotation seems to be taking place and as famed technical analyst Ralph Acampora once quipped:

“Rotation is the lifeblood of a bull market”

So, is this rotation also visible at S&P 500 level. Yesterday, indeed, as the Generals (Apple, Microsoft et al.) left the battleground to the soldiers:

Taking Apple, for now Monday’s VR headset presentation seems to have been the “buy the rumour, sell the fact” inflection point:

NVDA is also continuing to consolidate recent gains:

However, Tesla, is in steep uptrend again and a re-visit above the $300 level seems to be becoming more likely again:

Global bond markets were also trading under the sign of the BoC decision, which created immediate upside pressure on treasury yields, not only in Canada, but around the globe.

Below the intraday yields in Canada, Germany and the US. Spot the hike moment:

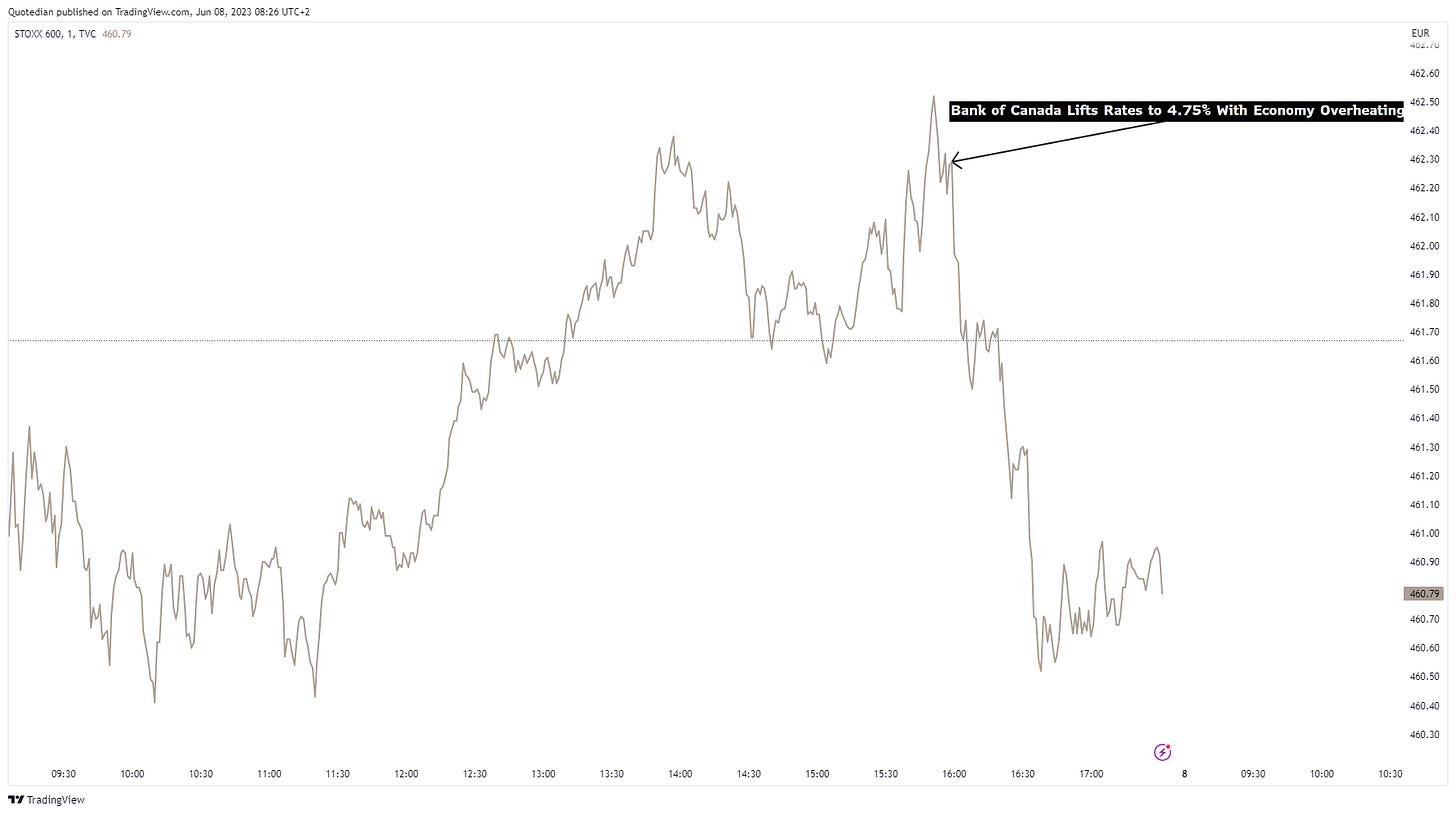

Finally, relative little action in FX markets (outside the CAD), except maybe for Bitcoin and other crpytos, which saw some intense selling pressure within their usual volatile trading framework:

As mentioned, just a quickie today, hope to be back soon.

André

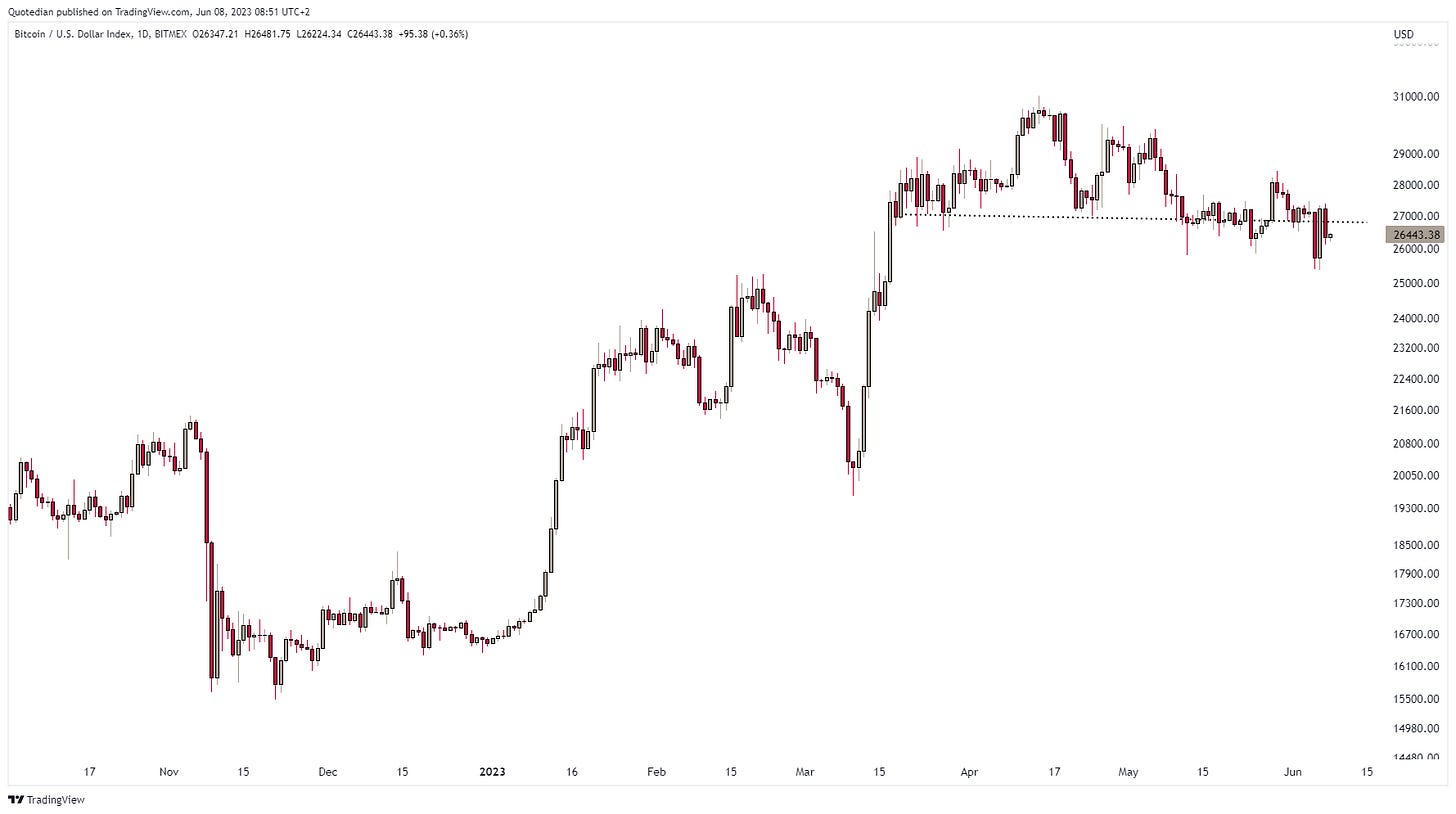

CHART OF THE DAY

Think you missed the rally in Japanese stocks?

Think twice.

Stay tuned (and long Japan) …

P.S. Not short-term advice ;-)

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance