Lost In Transition

Vol IX, Issue 07 | A NPB Original

“The only constant in life is change.”

— Heraclitus

There was no Quotedian yesterday due to a very specific reason:

Exciting changes are coming to the Quotedian and the QuiCQ!

For once, there is no sneak peek preview, but if all goes well, you should find out latest next Sunday/Monday on what your new, shiny, inimitable and all-time favourite newsletter will look like 🫶🏻.

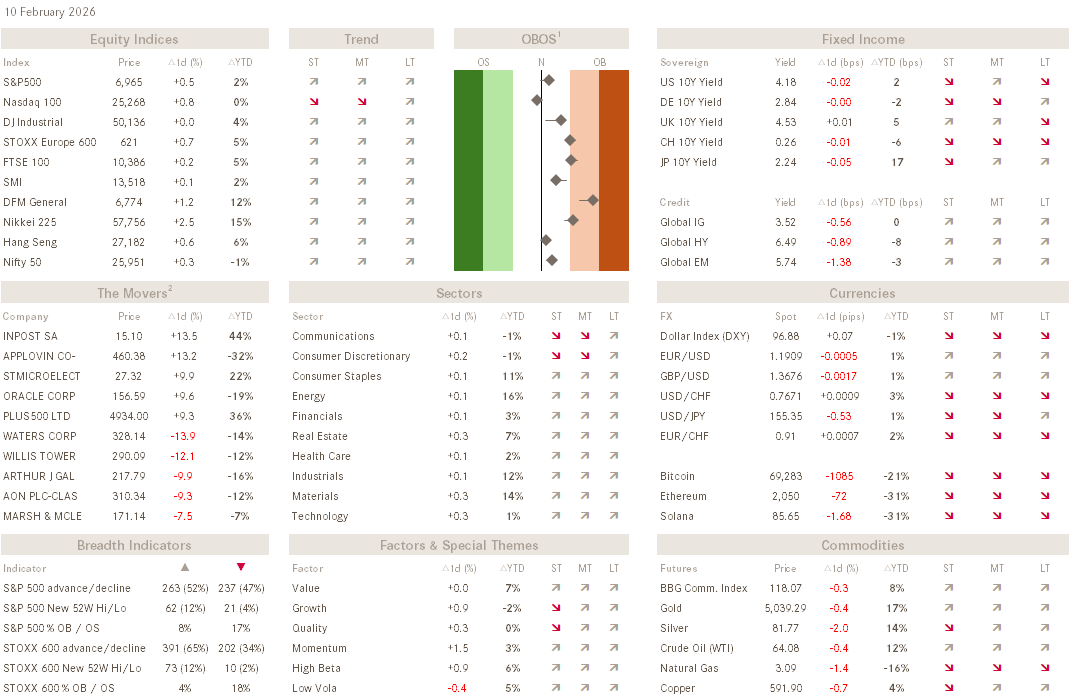

In the meantime, here a quick update on some of the recent market happenings. In no particular order:

Remember that ragging bear market of last week? Here’s the S&P 500 Monday through Thursday:

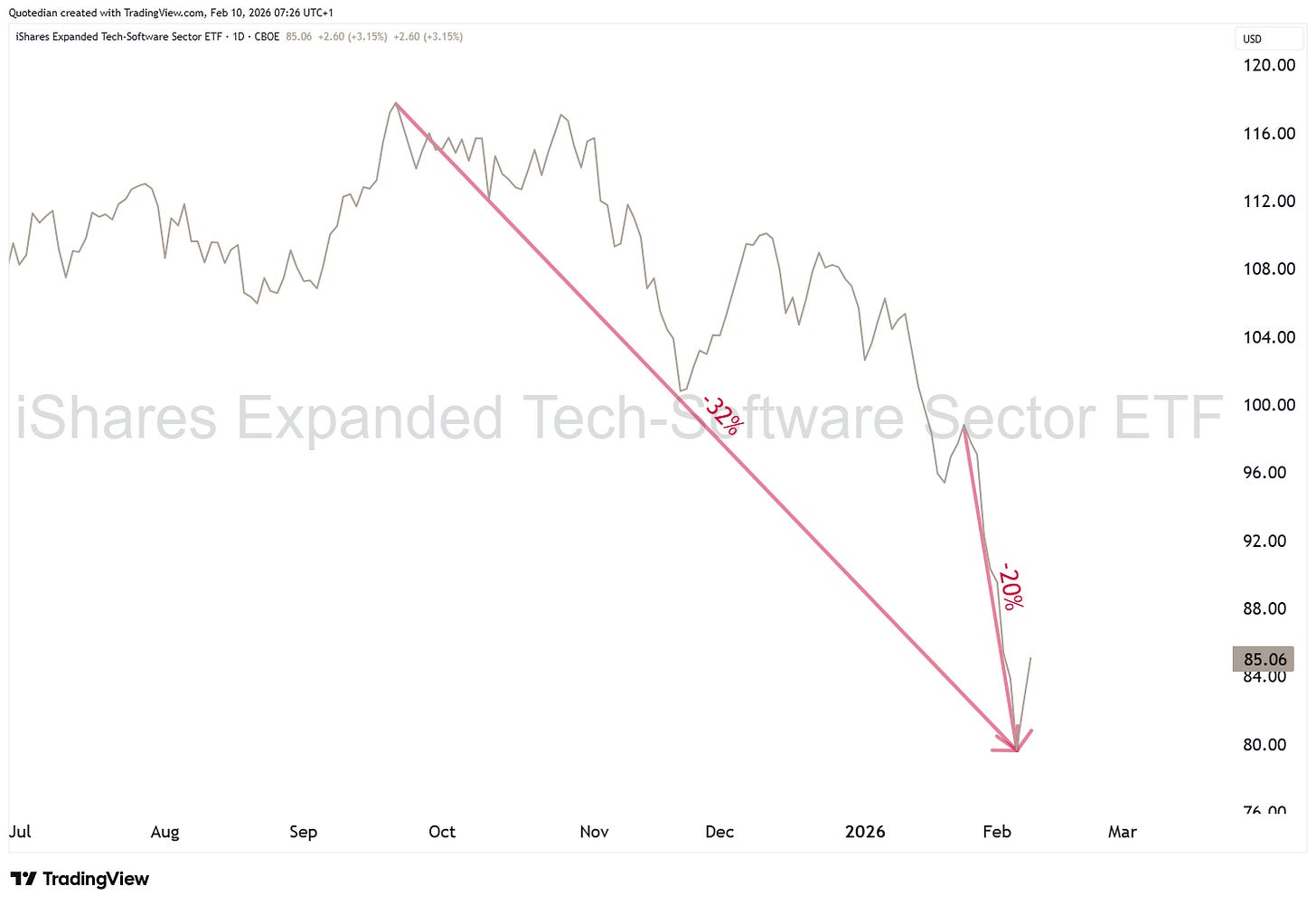

This “sell-off” was of course ignited by a (truly gruesome) sell-off amongst software stocks, accelerated by the release of a new set of Claude apps by Anthropic,

which eventually swapped over into semiconductor stocks too:

So, what happened to that 3% drop on the broader S&P 500?

Aaaand, it’s gone! Actually, this index closed less than a quarter percentage point from a new all-time CLOSING high…

Worse, or better actually, the Dow Jones Industrial is already ticking in new ATH after new ATH:

And even better, the new ATH on the Industrials are confirmed by new ATHs on the Transport stocks, giving a screaming Dow Theory buy signal:

Especially that latest move higher in the DJT (lower clip), seems to confirm our 2026 outlook (click here) of growth being higher than suspected.

And one more comment on US stocks: The equal-weight version of the S&P 500 (RSP) has been marking new ATH also for the past two sessions, leaving little doubt where the market is heading over the short- to intermediate term:

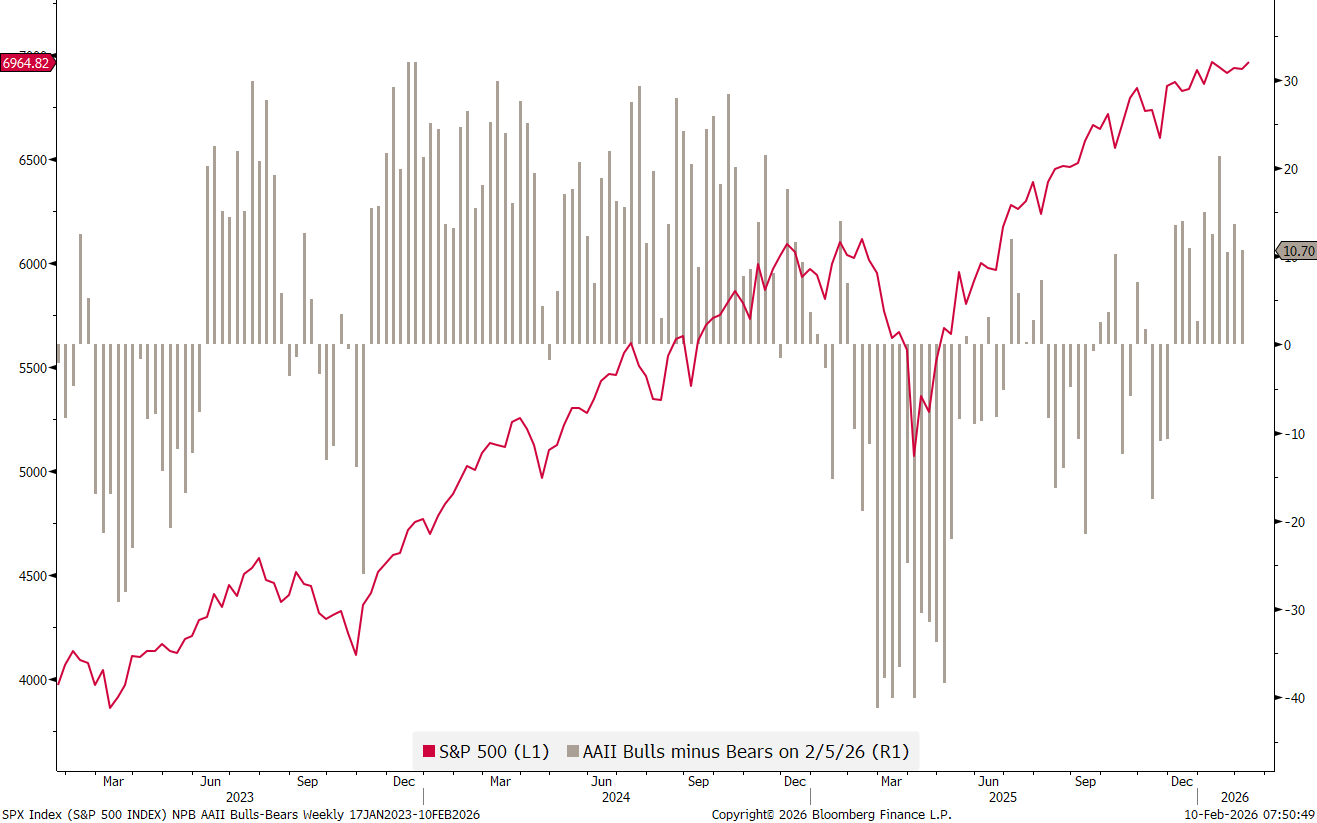

Only sentiment

and positioning

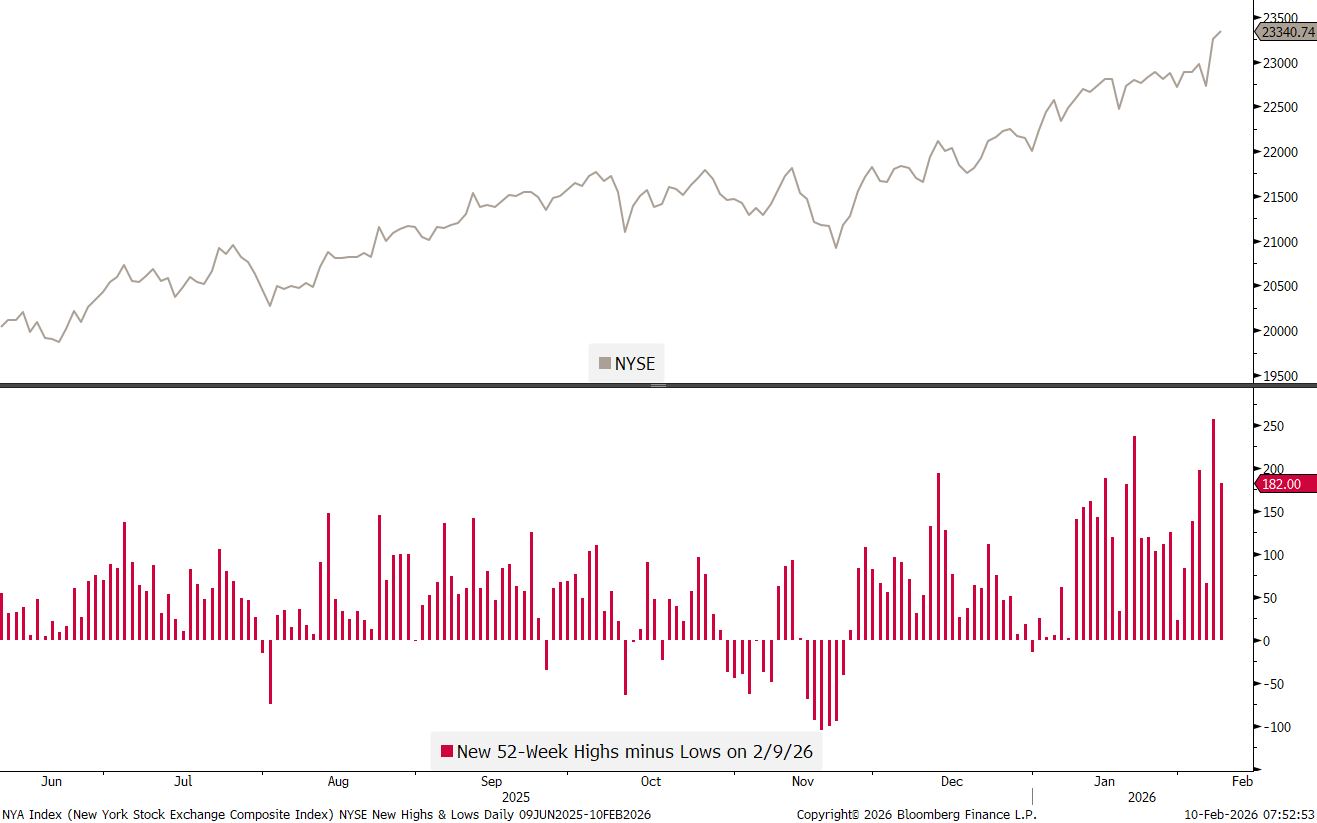

are of slight concern, but probably not enough to counter very strong breadth as measured by NYSE new highs minus new lows

and advancing minus declining stocks on the same index:

Hence, for now, keeping it max. KISS:

“The trend is your friend, until the end when it bends”

Japanese capital markets are of focus also this week, with stocks jumping higher after PM Takaichi’s landslide win in the snap elections:

But the really good news here is not necessarily the upside acceleration in equities, but the lack of further weakness in the Japanese Yen,

and the relative calm surrounding bond yields:

The fear of course is that Takaichi with little internal political resistance over the coming years may probe too much fiscal largess, but again, for now the market seems to be pretty cool about it.

Staying with yields for a moment, it seems now that the Jeffrey Epstein scandal is poised to bring down its first major political leader. Which is of course not surprising, but as fate would have it, amazingly it could be the head of British PM Keir Starmer that could roll. Amazing and/or surprising because he seemingly has no direct involvment. Yet, here are the bets on Polymarket that Starmer will be out by mid-year:

Odds are trading at 70%!!

No surprise than that the Gilt market has been upheaval over the past few sessions:

The GBP/USD cross has been on a 10 big-figure round trip over the past few sessions, up 4 then down for, then up 2:

Finally, let’s have a quick glance at the commodity complex with a special focus on the precious metals.

In Gold, for now price action is taking place within that consolidation triangle I highlighted a week ago and if this should hold up, no major move is expected until the first half of March:

No major move within a $500 range, that is …

Whilst fundamentally I prefer a move out of the triangle to the upside, just in later march seasonality gets a tad negative for the yellow metal:

Silver, a remain a bit less constructive, unless it moves above USD 90 again:

Looking into the week ahead, some focus will be on tomorrow’s NFP numbers out of the US:

Alright, that’s all for this week. Look out for the changes to come to a Quotedian near you soon, and, as always …

MAY THE TREND BE WITH YOU!

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG