Lying Eyes

The Quotedian - Vol V, Issue 105

“Who are you going to believe, me or your lying eyes?”

— Richard Pryor, Live on the Sunset Strip

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Due to a busy travel schedule next week, this is like the second last Quotedian before we resume the normal, daily schedule again on August 14th. And as we have done for the past few weeks, we will use this Sunday issue to look at the week just passed and some general macro observations and deliberations. So, without further ado, let’s dive right in!

For equities, it was at first glance a rather uneventful week, with most indices moving less than 1% over the 5-day span:

And a brief glance under the hood confirms that indeed it was not too exciting out there, at least from a volatility point of view. Here’s the 5-day intraday chart of the S&P 500:

And the VIX (CBOE Volatility Index) contracted most of the week after a short spike on Tuesday morning:

This is somewhat surprising given numerous geopolitical (Taiwan, Gaza) and economic (ISM, NFP, others) events, which in thinner trading summer months could have led to much more market ‘excitement’.

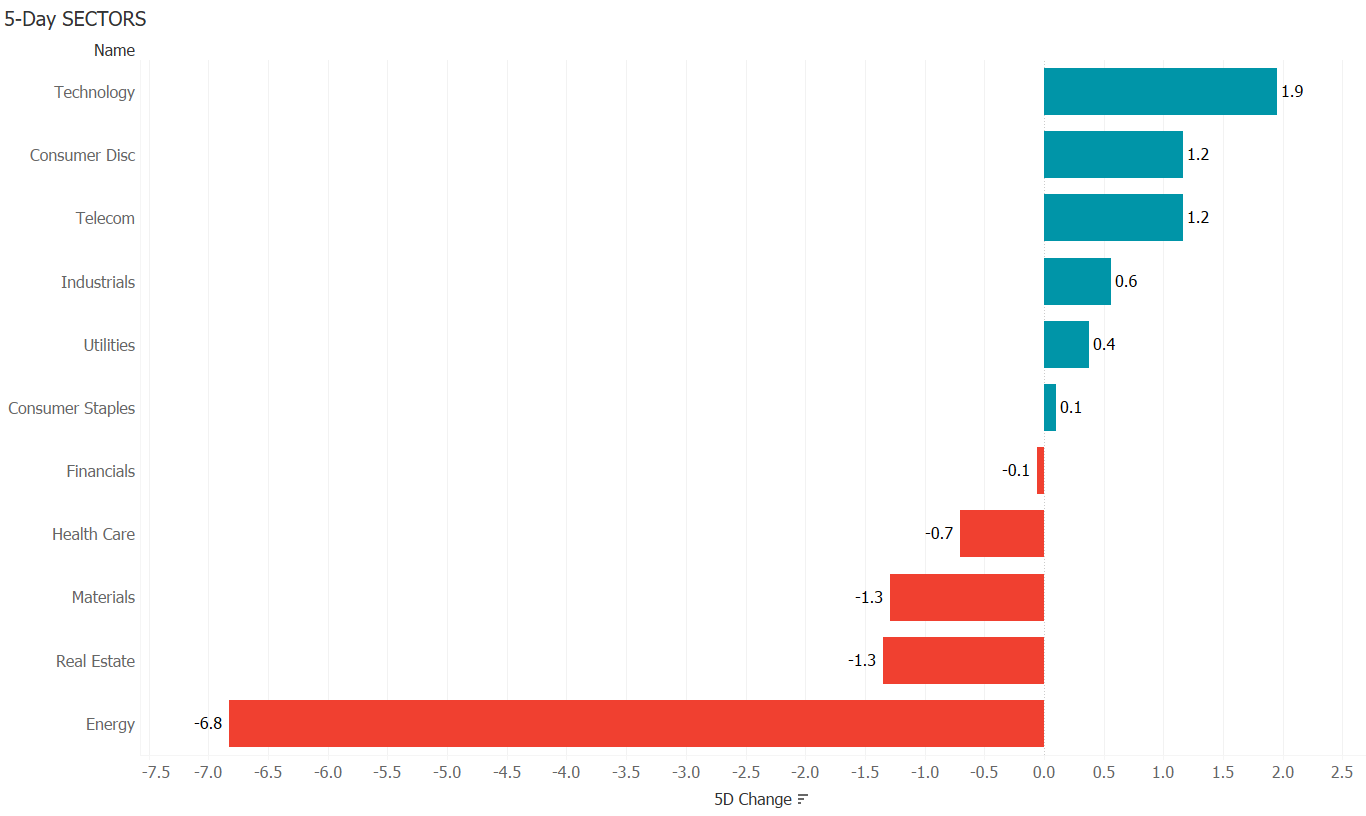

Does sector performance then reveal any important shifts happening throughout last week?

Indeed it is revealed that the most downbeat sectors (tech, consumer) of the past twelve months or so led the advances, whilst Energy stocks got completely hammered. Let’s stay with that last sector for a moment, which despite this sharp down week of course continues to outperform all other sectors with a significant spread over a one-year period:

Our weekly look at the top performing stocks for the year and their performance over the past 5-days confirms this correcting pattern going on amongst energy names, at least in the S&P 500:

Here’s the same table structure for the STOXX 600 Europe index:

Ok, let’s have a look at some equity charts to see if we can identify anything of interest. For example, the S&P is about to breach its pattern of lower lows and lower highs (black line) as we identified last week, and which turns out to be a very important pivot line (purple circles):

Thereafter, 4,229 (green line) would be the “last excuse” for equity bears to hold on, which is the 50% retracement of the entire down move.

The importance of the pattern of lower lows and especially lower highs cannot be overstated. In both previous, major bear markets that pattern held true until it didn’t and signified the death of the bear:

An important remark here on the second chart with the OOOPPSS. The break above the previous lower high stopped then quite precisely at the 50% retracement … just saying.

European stocks meanwhile … well, never mind, forget European stocks. As a matter of fact, the next person to mention a possible outperformance of European stocks versus US stocks will be shot on the spot:

The fate does not seem dissimilar to the ones of Japanese stocks versus US stocks:

Anyway, let’s move to fixed income markets. The weekly performance table speaks for itself - outperformance of the high yield segment on the back of generally stable equities with underperformance coming from the more interest rate sensitive treasury and investment grade segment on strong economic data:

Yield drifted higher over the week, with two main pushes: the first after the stronger-than-expected ISM data and the second after the significantly-stronger-than-expected non-farm payroll number:

What continues to be THE market conundrum, to me at least, is that the equity rally over the past two or three weeks was based on weaker economic data which the market interpreted as that the Fed (and other central banks) will pivot on its (their) hawkish, inflation-related stance and now that economic data is firmer, equities also continue to show relative resilience. It seems that animal spirits, FOMO and BTFD continue to be well alive, and in my albeit limited experience, this tends to end in tears.

Anyway…

In currency markets, it was a good week for the US Dollar against nearly everything else:

Especially Friday’s NFP gave a boost to the USD. Here is the chart versus the EUR for example (dropping line = $ strength):

The washout from the most popular and profitable macro trade this year (long USD, short Yen) seems to have stopped for now (red oval), with 131.20 a point of interest (purple circles):

Alrighty, entering the commodity space and trying to explain the energy equity sector weakness, we observe that the price of Crude has now decisively violated the lower end of its multi-months trading range:

I continue to be an energy bull, given geopolitics and above all ESG-related malinvestments. The current price weakness can IMHO be attributed to two main reasons: 1) recession expectations and 2) over-speculation. Regarding the second, I read somewhere (which, in other words, means, I have no empirical evidence), that the ratio of true hedging to market speculation in oil is about 1:28, which compares to 1:5 relative to other commodities. So, to me, we have entered into accumulation territory, albeit a drop to $70 in Brent during a panic/liquidation moment cannot completely be ruled out.

The long Gold trade at around $1,720 is not working out too bad, though given everything going on, we would expect the yellow metal to trade even higher:

Having said that, looking at the price of Gold in other currencies than USD, we observe much more strength. Here’s Gold versus Euro for example, which is down 6% only from its all-time high (compared to down 12% versus USD) and recently breaking a short-term downtrend line:

So, except for Gold and some selected other few, it was overall a ‘weak week’ for commodities, with some US Dollar strength probably playing an important role:

Ok, the time has come to hit the send button. Make sure you enjoy your Sunday!

CHART OF THE DAY

No comment.

LIKES N’ DISLIKES

Likes and Dislikes will be relaunched in a new format soon.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance