My Precious

The Quotedian - Vol VI, Issue 45 | Powered by NPB Neue Privat Bank AG

“Gold is money everything else is credit”

— J.P. Morgan

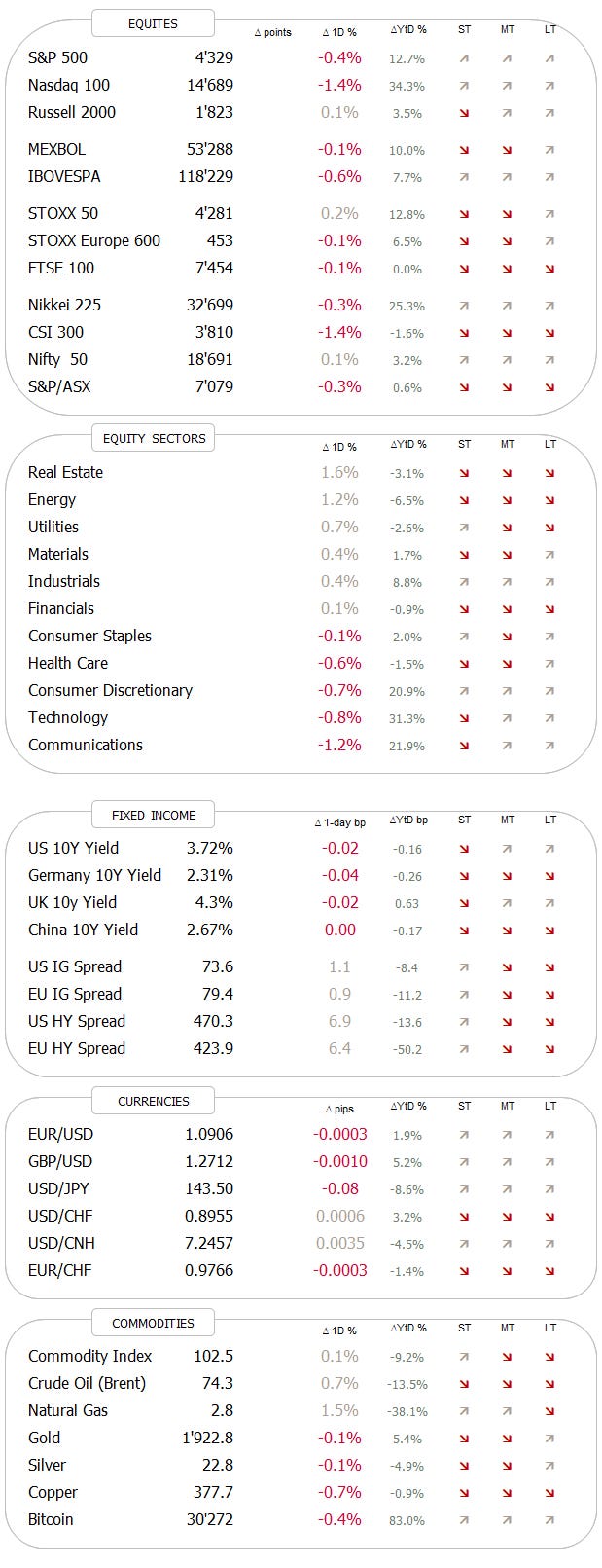

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

And what if inflation is abating because of slowing global economic activity? Just imagine!

Friday saw PMI readings drop around the globe - what was most interesting to me is that Service PMIs saw the larger “drawdowns” in this month's releases. Whilst most of the Service readings remained in expansion (>50) territory, as compared to Manufacturing PMIs which have been in parts in contraction (<50) for months already (see below), they are joining their manufacturing cousins in terms of negative trend development.

Service PMIs are accelerating to the downside - here’s the European experience for example:

Yesterday Monday also gave us the monthly release of the IFO survey in Germany, and business expectations dropped once again

We are not that far away from the completely depressed readings towards the end of the GFC in 2009, however, the DAX just printed a new all-time high a few sessions ago:

These two (IFO and DAX) seem to be at odds with each other. What will give?

The good old Quotedian, now powered by NPB Neue Privat Bank AG

In need to make sense of all this macro confusion?

Contact us at info@npb-bank.ch

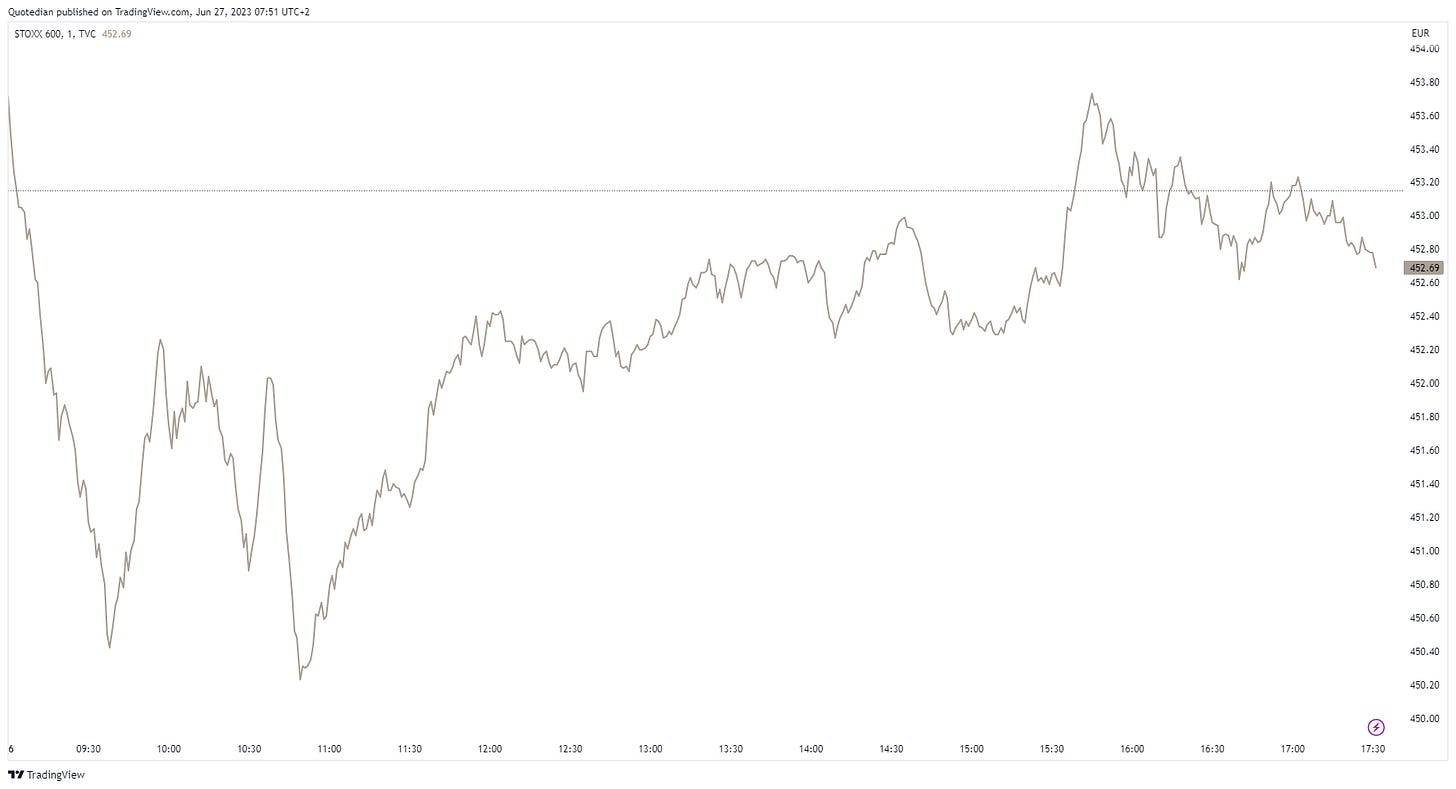

Ok, starting our usual session review with equities, risk-off was “on” (pun intended) during most of the European session, be it partially due to the events over the weekend in Russia, or, more probably due to that weak IFO reading mentioned above.

However, European stocks then recovered later in the session, mostly on the back of a decent opening for equities on Wall Street. Here’s the intraday chart of the SXXP:

The rally in US stocks itself also faded pretty rapidly, as early MEME-stock buying was overshadowed by too major stock downgrades (GS → TSLA and UBS → GOOGL). Here’s the intraday behaviour of the S&P 500 yesterday:

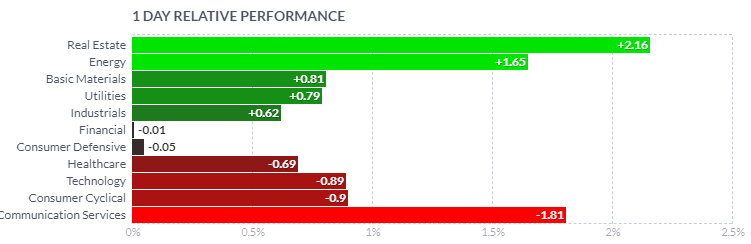

Despite the half a percentage point loss on the S&P, actually more sectors were up (6) than down (5),

and the winners to losers ratio was actually in excess of 2:1, resulting in the S&P 500 equal-weight index ending the day half a percentage point higher!

Yet, the market heatmap was dominated by the losses in some heavyweights, especially Tesla and Google of course, showing that market-cap weighing works in both directions:

Asian markets are having largely a pretty decent session this early Tuesday morning, with Chinese stocks, especially in Hong Kong, leading the winners. One notable exception to the rally are Japanese stocks, which seem to be in for a breather today. No wonder, given the steep rally in place since end of March this year:

European and US futures point to a friendly start to cash trading on both sides of the pond.

Fixed-income (rates) markets were relatively quiet yesterday, with some downwards pressure on rates, especially in Germany, after the benign IFO survey report. Here’s the German 10-year yield:

The most ‘amazing’ observation on the rates market is the continued widening of credit spreads, which now has reached some -84 bp in Germany (10y-2y),

and briefly -102 bp in the US before reversing somewhat this morning:

Probably also worth mentioning in this space, before we had into FX, the Christine Lagarde is kicking off the yearly ECB central banks event in Sintra, Portugal. FWIW.

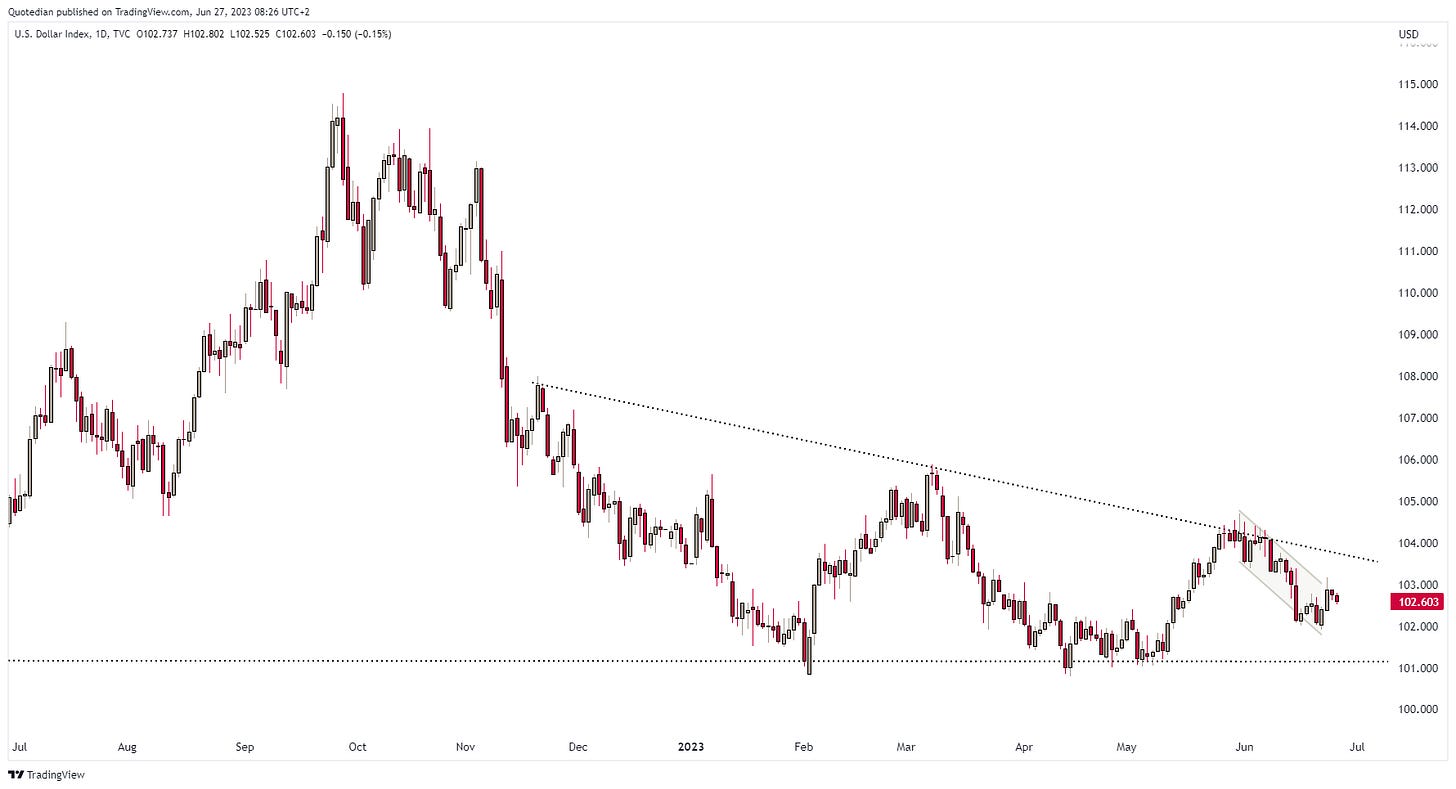

Currency markets seem largely eerily quiet, with the Dollar Index stuck in a 101-104 trading range:

I would only act on a breakout on either side, though the shoulder-head-shoulder pattern on the EUR/USD chart remains intriguing (suggesting a break higher on the DXY chart above):

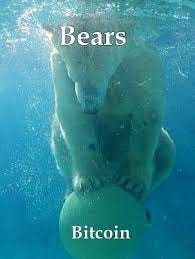

Most action was to be had in cryptos recently and specifically the Bitcoin bears are struggling to “keep the ball under water”:

Finally moving into commodities also brings us the Russian events this weekend. Whilst I would not pretend to a) have any specific insight into what’s going on and b) even if I would, to have the “cojones” to write about it (the next Russian hacker is just a few clicks away), I do think that in most simplistic terms any upheaval in Russia (and there’s a lot) should be a net positive for commodities.

Whilst the right strategy after the Russian invasion into Ukraine was to fade the elevated risk premia, i.e. don’t buy oil above $100 and or sell the DAX below 12,000, all of the risk premia is now gone and the risks for ‘surprises’ now seem skewed the other way.

So far, very little reaction from commo markets on this, maybe proving that my over-simplified analysis is wrong. Here’s the Bloomberg Commodity index:

Oil completely failed to react:

Some metals are showing signs of life, though that may be more China-related. Here’s iron ore for example:

Anyway, high-time to hit the send button. Make sure you do the same with the Like button towards the end of this document ;-)

Have a great Tuesday,

André

CHART OF THE DAY

And now resolving the misterious title (my precious) of today’s Quotedian. We already spoke about how some industrial metals seem to be on road to recovery further up, however, this is not so much true for precious metals.

The chart below shows that Gold (top left), after reaching a new ATH a few weeks ago, is now trading at its lowest since March.

Similarly, Silver (top right) has failed to break to above the highs reached over three years ago.

Platinum (bottom left) is a big, fat nothing-burger.

And, finally, Platinum (bottom right) just hit a new five-years low.

Where are the buying level for precious metals? Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance