No, but yeah, but no, but yeah

The Quotedian - Vol V, Issue 139

“May the flowers remind us why the rain was necessary"

— Xan Oku

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Well, that was a welcome rally, if only because we were all starting to run out of red ink!

Was it the UK government’s U-turn on its budget proposal,

Credit Suisse’s determination to fight another day,

the increasingly visible (temporary?) pivot of the US Dollar,

or just the general mood that had moved too negative,

that pushed markets higher?`Who cares, at last we can use some of that black ink again! 😂

But let’s go and have a closer look!

Starting with equities, as mentioned in a recent Quotedian, if a trendline is just about broken, draw a thicker trendline!

On a more serious note, there are two lessons in the chart above:

Often, when a trendline is broken, it is a good idea to wait for two or three sessions for confirmation, even though it may mean giving up some $$$

Whilst the recovery back above the trendline is encouraging, the pattern of the candles remains one of lower lows and lower highs, the very definition of a downtrend.

In other words, the next few sessions could be crucial for the intermediate trend of stocks. Make sure to stay tuned …

Looking under the hood of yesterday’s rally, we see broad participation (97% advancing stocks!) on decent volumes with all eleven sectors printing green:

This left us we a beautifully green market map, where even the Musk-haters got their day in the sun:

What is there not to like? And apropos Musk-haters … the egocentric billionaire is not making a lot of friends recently, having turned an entire country against him on a dull Monday. This snippet from Bloomberg sums it up:

The rally in European stocks was of a more timid nature (+0.7%), probably not least due to previous experiences, where Wall Street gave up on gains after the European closing bell. There is plenty of more work to do on the chart, but a start is a start:

In that context, European index futures are up strongly this morning as I type, partially on the back of that strong US close, partially on the follow-through witnessed on Asian markets:

The Asian equity strength itself is of course partially based on the template given by Western markets the previous day, but in another part due to the dovish hike by the RBA (Central Bank of Australia). A 50 basis point hike by the RBA was expected, but the CB decided to hike by 0.25% to 2.60% only. Of course, this immediately triggered hopes for central banks pivots again, and if not a pivot, at least a pause …

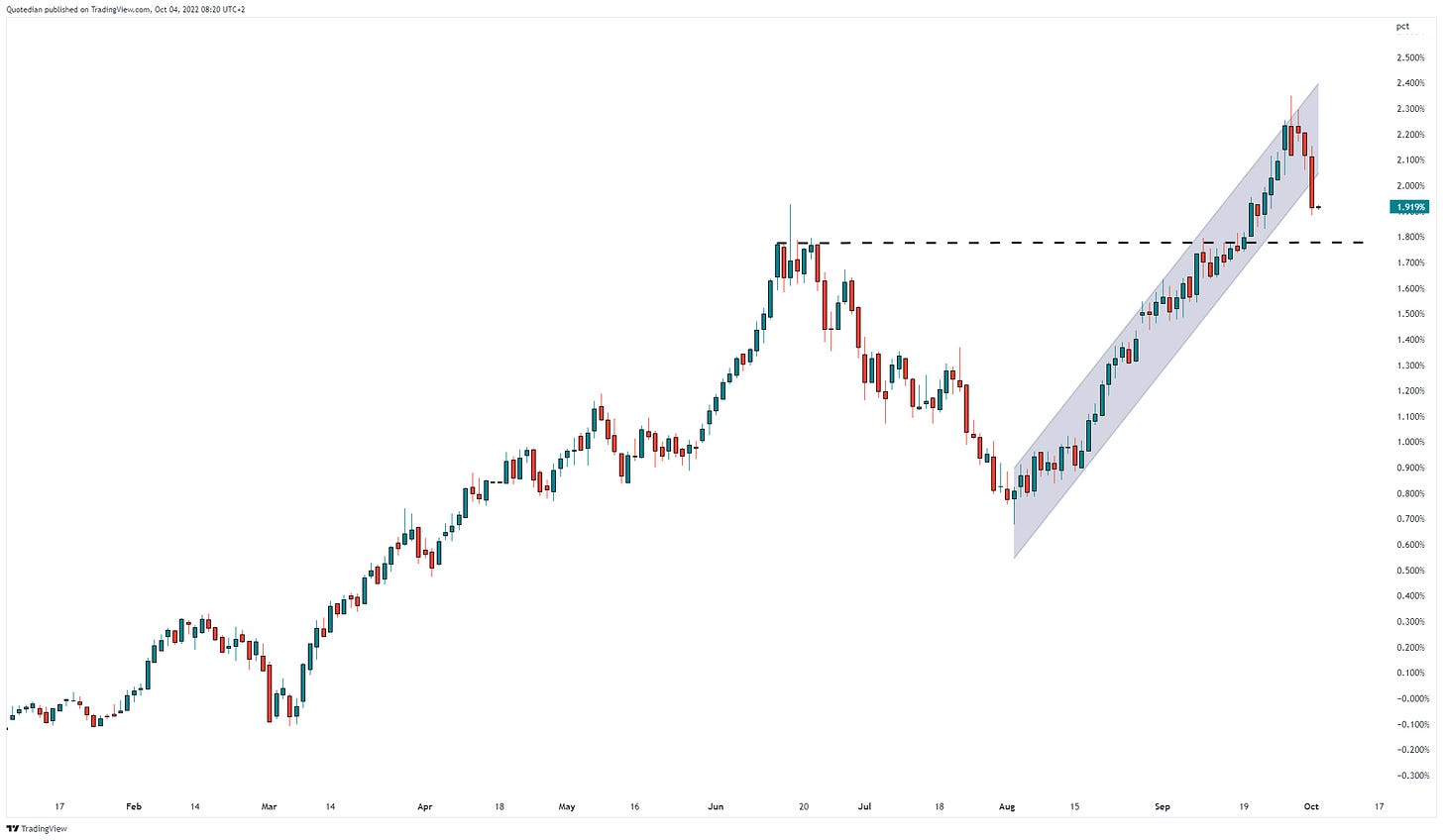

This brings to fixed income, where some kind of at least temporary reversal is apparently indeed taking place. Not huge, but probably enough to put some more fuel under the equity rally. Here’s the US 10-year yield chart:

The German Bund also looks like it could retest at least 1.80%, which is previous resistance now turned support:

Turning to currency markets, we have already had a first look at the recent turn lower in the USD Index, here it what it looks like on the EUR/USD cross:

Somewhere just below parity would be the first target, only about a big figure to go …

We’ll cut the FX session short here, with the light promise (light promise = it may happen - or not …) of a cool trading idea tomorrow.

In the commodity space then, Gold is definitely drawing some attention - or maybe not, as everybody stopped looking. At least I did not see any reference to that 6%-rally in less than a week:

Pssst. Let ‘em keep looking the other way 😉

And even better and less observered, Silver!

Of course, are commodities generally doing better with some kind of $-pivot (uh, start hating that word) under way;

Time to hit the send button - have a great Tuesday my friends!

CHART OF THE DAY

The chart of hope remains this:

So far so good. Stay tuned and hit that Like-button!

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance