One and Done?

The Quotedian - Vol VI, Issue 52 | Powered by NPB Neue Privat Bank AG

"Guarantees in life are death, taxes and about 75% of companies that will beat earnings expectations. "

— Peter Boockvar

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Wednesday’s lower-than-expected CPI reading, followed by Thursday’s slightly higher (+0.1%) yet below expectations (+0.2%) PPI reading is likely to mean that the Fed will raise rates once more by 25 basis points at the end of the month (26.7.) and then will go back into ‘PAUSE’ mode.

However, do not confuse ‘Pause’ with ‘Pivot’, i.e. rates will remain elevated until something really bad happens.

As one macro advisor I listened to the other day put it, the Fed will only PIVOT if one or several of the following conditions apply:

P = Payroll number with negative reading for three or more periods

I = Inflation back to target (2%) and staying there

V = VIX above 50

O = Oil above $300

T = Treasury dysfunctionalities, or credit events, or funding/repo stress

Of course, there is some tongue in cheek in the above, but also a lot of truth…

With this, on to yesterday’s session and what could be awaiting us today.

But first, make sure to read the following insert:

The good old Quotedian, now powered by NPB Neue Privat Bank AG

NPB’s CIO Office has just released its 2023 Q3 outlook and asset allocation recommendations, together with the accompanying chartbook.

Interested in receiving your own copy?

Contact us at info@npb-bank.ch

Ok, on to yesterday’s session, where stocks rose for a fourth consecutive day and for the first time since April 2022 closed above the 4,500 threshold. Hardly anything stood in the way of the 0.85% daily advance on the S&P 500, except some last minute profit taking at the end of the session:

Breadth was ok-ish, with 350 stocks up and 150 down on the day and nine out of eleven sectors reporting positive returns, with only energy down (let’s call it a draw on health care):

The negative return on the energy sector is entirly attributable to a nearly two percent drop in ExxonMobil (XOM), which dropped after announcing takeover of E&P company Denbury.

On the daily heatmap of the S&P 500 the three and the nearly four and a half percent rips on Amazon and Google respectively stand out:

Amazon was up after initial reports that the company had its best Amazon Prime sales day … ever! Which speaks bands for the the health of the US consumer and probably (slight tongue in cheek) should also be a bullish sign for credit card providers.

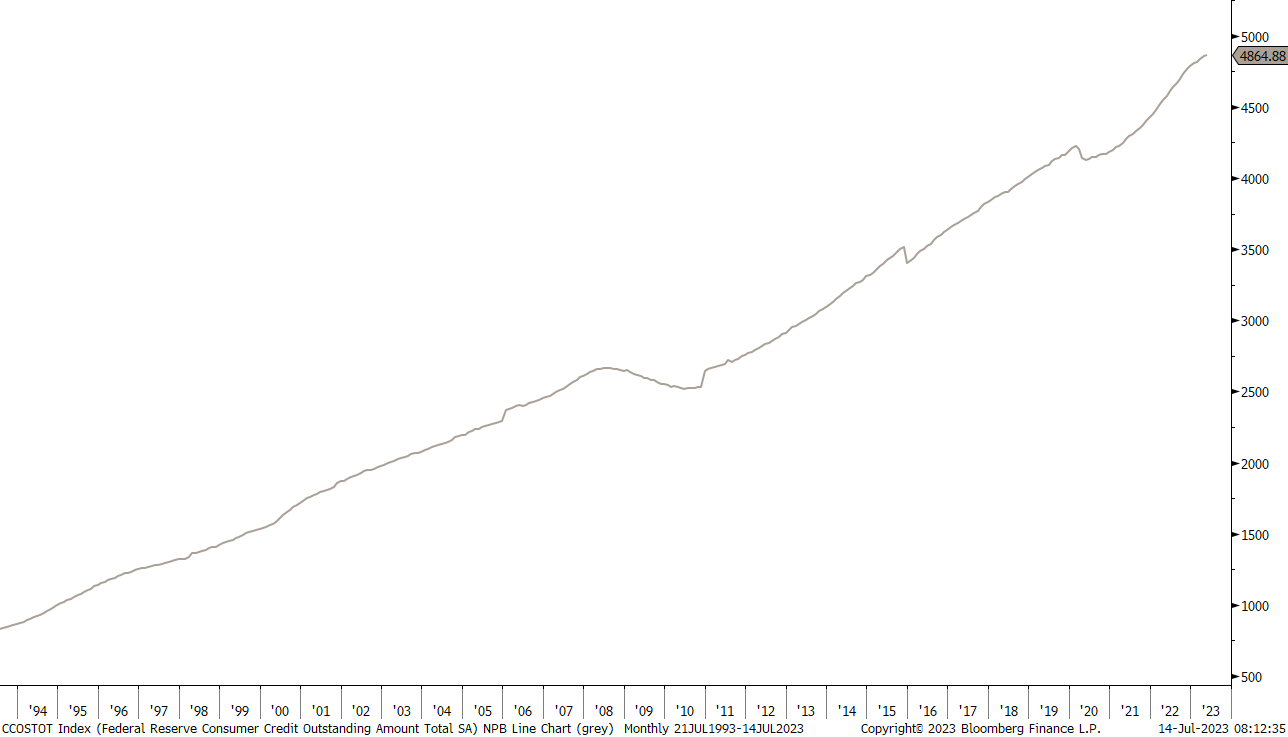

Talking of which, do you want to see the most boring chart ever? Here’s the chart of the Total Consumer Credit Outstanding Amount as calculated by the Federal Reserve:

Ok, quickly back to the S&P, which now seems to have little hindrances on its less than 7%-journey to all new all time highs.

In other news, the S&P 500 is now nearly four percent higher than when the Fed started the hiking cycle in March of 2022:

Asian markets this morning are up nearly across the entire board, with one major exception being Japanese shares, which are registering a small retreat. This ‘correction’ should come at no surprise though, given that one of the drivers (though definitely not the only one) of the strong advances in Japanese stocks has been the falling yen (rising USD/JPY - grey in chart below), which now has reversed:

European index futures point towards a flattish start when cash markets open in about half an hour.

Quickly to rates and bonds, where yields continue to drop on lower CPI and PPI readings. The chart on the US 10-year Treasury yield shows a clear "bull trap” (bear trap on prices), circled red, as after a breakout yields have dropped right into the previous range again:

The US 2-year yield chart seems to have formed a double top at the same time, with short-term bearish implications for yields, bullish for bond prices:

At the same time, the yield curve spread (10y-2y), seems to have put in a double bottom, FWIW:

Let’s press on into the currency space, where the US Dollar is getting hammered on lower inflation and lower yields. Here’s the US Dollar index which now very clearly has broken longer-term support and is reinstating out bearish view on the greenback as outlined in our quarterly chartpack (see above):

This is what it looks like on the EUR/USD chart:

Not bearish…

But some of the real fun happened in the cryptocurrency space yesterday, where a historic ruling, that has sent shockwaves through the crypto world, a U.S. judge has declared that Ripple’s $XRP token is not a security. This decision marks a significant victory for Ripple and a massive setback for the U.S. Securities and Exchange Commission (SEC), which had been embroiled in a legal battle with the fintech company since 2020.

Here’s the chart of Ripple (XRP):

This was also enough to lift Bitcoin out of its multi-week consolidation period, with bullish upside implications:

Let’s finish today’s letter here.

For today, keep in mind earnings season kicks off in the US, with three of the larger banks reporting (see Calendar table above). As mentioned previously, a special focus should lay on tech and bank earnings this season, as both have the potential to either confirm or reverse the current bull market.

Stay tuned and stay safe,

André

CHART OF THE DAY

NOOOWWWW, in the title and in the intro section, we kinda’ assume that the US Federal Reserve Bank may be about to finish the current hiking cycle which started last year.

BUUUTTTT, month-on-month readings have to stay below 0.2% over the coming readings, otherwise the base effect (yoy comp data droping off), could lead to higher CPI readings again. Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance