Opposing Forces

The Quotedian - Vol VI, Issue 46 | Powered by NPB Neue Privat Bank AG

“Anyone who isn't confused really doesn't understand the situation.”

— Edward R. Murrow

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

One of the wisdoms an investor usually learns early on in his/her career is to:

“Don’t fight the Fed”,

originally coined by famed investor Marty Zweig.

The other piece of advice usually also given along the way to the aspiring investor is to:

“Don’t fight the tape”,

stemming from the time when stock prices where communicated via a ticker tape,

and meaning that prices usually tell the truth.

Well, here we are, where we have pretty bearish central bankers (The Fed) and pretty bullish price behaviour (The Tape).

Let’s dive right in (but only very, very briefly as we are heading into and early meeting).

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Contact us at info@npb-bank.ch

Opposing force #1, “The Fed”, can be expanded to all central banks, which are currently meeting up in Sintra, Portugal for the European version of the August Jackson Hole meeting. Jointly, they all sounded pretty hawkish yesterday. From ECB boss Lagarde saying that the central bank probably won’t be able to declare the end of its historic cycle of interest-rate increases anytime soon to other ECB officials are pondering options to accelerate the reduction of the institution's €5 trillion bond stash - all this was not really risk-on friendly. Today, Powell, Lagarde, Bailey as well as representatives from SNB and BoJ are scheduled to speak. All should continue to sound pretty hawkish with the exception of Ueda-San at the BoJ.

And then, there’s the tape. Not only did indices rally strongly yesterday, but participation was broad. Consider this screen, which identifies stocks reaching new 52-Week highs and lows, I like to look at a daily basis. This are the stocks reaching a new 52W low yesterday:

And these are the stocks reaching a new 52W high:

The tape has spoken.

And this is how yesterday looks like on the heat map:

The daily chart on the S&P looks pretty constructive, with prior resistance acting as support now:

Even the embattled small cap stocks (Russell 2000) are trying to put a pattern of higher highs and higher lows into place and is only a few percentage points from an important resistance level away:

European stocks (STOXX 50) are approaching our “lid-level” again. Sixth-time lucky?

This morning, Asian stocks are largely exhibiting strength, led by Japan’s Nikkei 225 (+2%), which is roaring back from a 5%-breather pause:

Due to fore-mentioned time constraints we leave it at this shortened Quotedian today. I still hope there was the one or other thing of interest in there and if not, the delete button is only a finger-stroke away ;-)

Happy investing.

André

CHART OF THE DAY

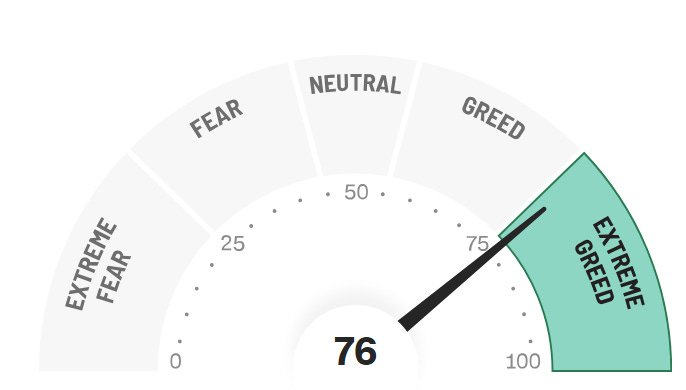

As today’s subject was opposing forces, here’s some more stuff to confuse the sh heck out of you. Whilst (equity) action as discussed above looks more than constructive, we are also getting some loud and clear warning signs. Here’s the CNNN Fear and Greed indicator for example:

Or here is Morgan Stanley’s Global Risk Demand Index (GRDI):

As usual, stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance