“Bear markets make fools of bulls and bears alike”

— Michael A. Gayed

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Well, that was a Turnaround Tuesday gone wrong …

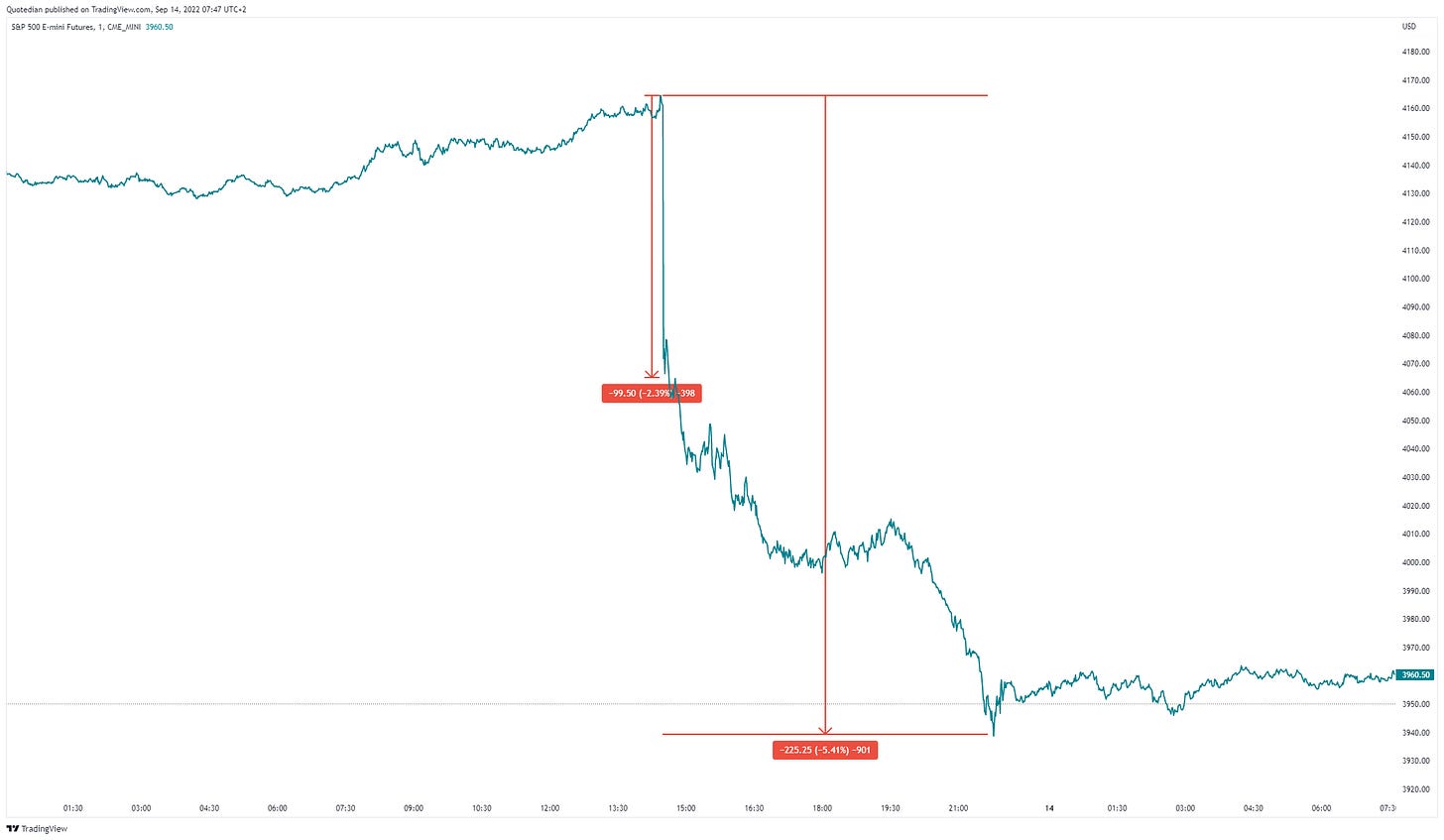

O. M. f-ing G! What market mayhem one little vertical dash can make! Turning an expected inflation reading of -0.1% into a reported reading of +0.1% caused this:

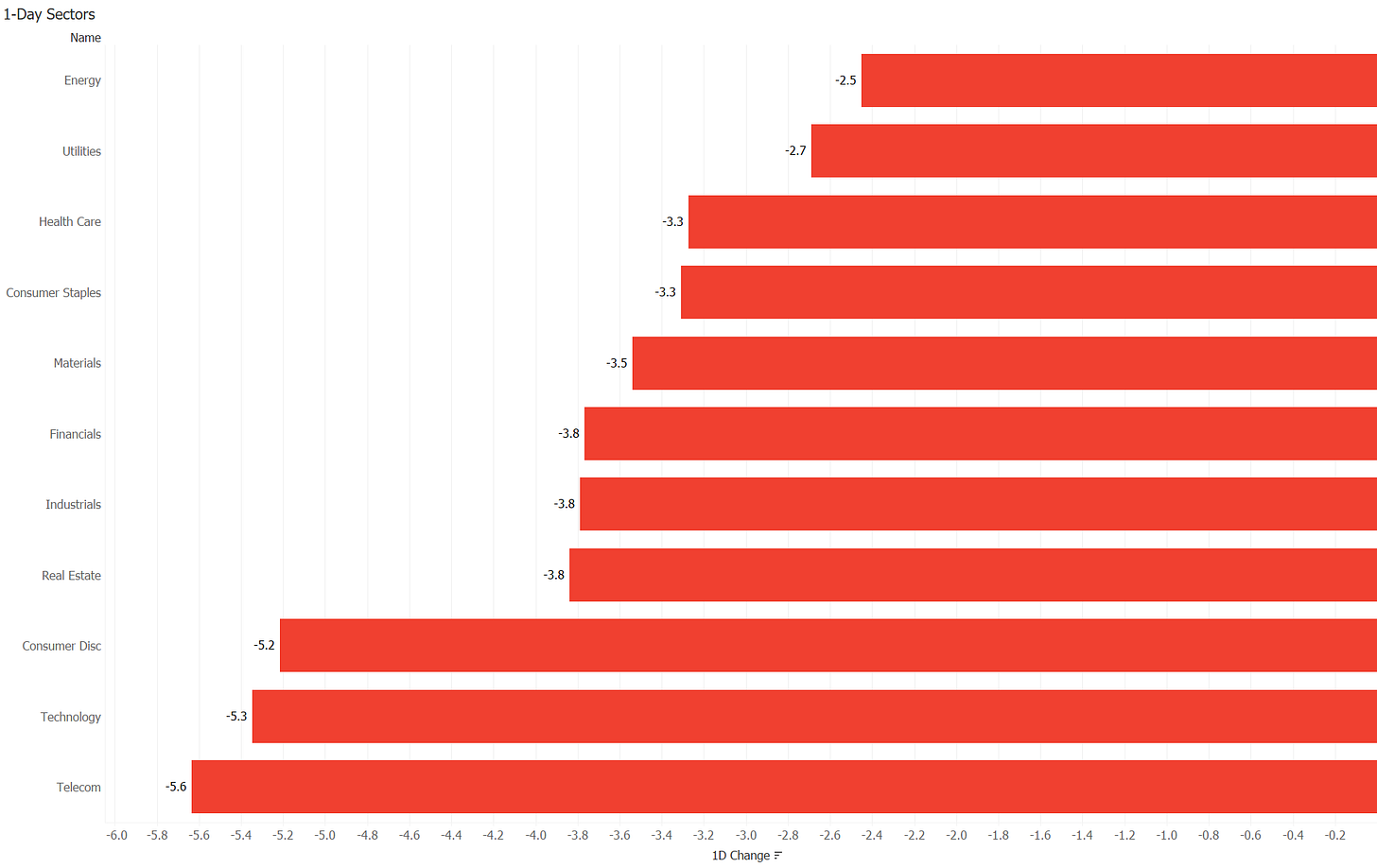

You just know it has been a tough day when the best performing sector (energy) on the S&P 500 shows a negative reading of -2.5%:

And then looking at your P&L sheet for the day you may find some comfort in that there was really nowhere to hide with exactly five stocks up in that same S&P 500 index (which has 503 constituents) - or not.

Yesterday’s sell-off came right at a time when many were getting a bit bullish; just the same as everybody was looking for a complete market breakdown exactly a week ago. But that brings me to the runner-up in today’s competition for the QOTD:

Nothing good happens below the 200 daily moving average

— Market Adage

That’s just a tried and tested true statement - never forget it. As discussed many times in this space, risk management should be of focus in a bear market and a bear market it is until proven otherwise.

Anyway, let’s have a look at a few more charts, though in a less structured manner than usual. Starting with the inflation number itself, Bloomberg’s John Authers had a good chart up this morning, explaining why so much shock, even though only the mathematical operator changed on a very small number as described above:

Except for core “core inflation” (red line), which stayed elevated but below the March highs, every other core reading hit new highs for the current cycle. This is what I tried to explain yesterday: Energy prices have fallen enough to bring in a lower inflation reading, but stickier prices like housing (OER - Owners’ Equivalent Rent) are just starting to pick up and will keep the secular tailwind on inflation going for the months (years) to come. Well, I was wrong in that lower energy was not low enough, but otherwise, the concept stands ;-)

In any case, bonds did not like the number, with the 10-year Treasury yield jumping 13 bp in a split second:

But yields jumped along the entire term structure, and more so at the shorter end, not only provoking a curve flattening, but breaking the steepening trend that had been going on:

Equity index futures (S&P 500 minis - ES) dropped by two percent immediately, and then continued to drop another three …

A similar fate awaited the EUR/USD currency pair which was hammered right below parity again, where it still hovers at the current hour:

Ok, zooming out a bit, an argument that bulls could make is that key support levels (black dashed lines) held up … just about. The bears would counter that we have an island reversal formation (yellow highlight) with negative implications:

I will not argue with either, but observe the tactical and strategic lines in the sand (see today’s COTD).

On the bond side, those uptrend channels in yields, which were under threat yesterday, are fully back in play. Here’s the 10-Year US Treasur yield as proxy for all others too:

In currencies, the EUR was not the only currency to suffer under the mighty Dollar, as the Japanese Yen (a country where the central bank and the ministry of finance still see inflation as transitory - sigh) dropped to below 140.00 again:

Let me cut short here for today, as the follow-through or lack thereof will be interesting to observe today. Or in other words, let me end before saying more silly things and getting even another truckload of egg on my face …

Have a great Wednesday!

André

CHART OF THE DAY

Immediate (tactical) support and resistance I would place at 3,875 (-1.5%) and 4,111 (+4.5%), whereas on our ‘inverse traffic light’ long-term chart, we keep RED at 3,640, but probably can move down (light) GREEN to 4,322:

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance