Ouch!

The Quotedian - Vol V, Issue 135

Le Roi est mort. Vive le Roi!

— Traditional proclamation made following the accession of a new monarch in various countries

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today should make for a fun letter, albeit probably a bit a lengthy one. Besides the usual weekly review, and boy, is there a lot to review, I will also have a short … little … brief … rant deliberation about the supposed death of a certain allocation model. But even before that, I have a conundrum to share with you (conundrum is that fancy we use when there is something we do not understand - possibly because it is above our intellect level…). Here we go:

How can the shortest Quotedian ever, get the most likes???!!!

Obviously, there’s a message for me there … 😢

At least I get some comfort from our poll that in reality, you did miss my daily deliberations on Friday. Why else would you have voted 96% yes, with the remaining 4% voting yes too?!

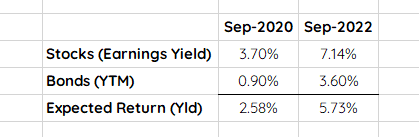

Ok, now let me share something I have been thinking about a lot recently. I have been reading and hearing a lot lately about the supposed death of the 60/40 allocation model. The 60/40 refers of course to 60% of your assets allocated to equities, and 40% allocated to bonds. This has been a very popular approach over the recent decades, as bonds supposedly offset equity losses during volatile times for risky assets. And it kind of worked, most of the time at least. Until it went horribly wrong this year. With stocks (MSCI World) down 25% year-to-date and bonds down 19%, also year-to-date, a quick, back-of-the-envelope (aka Excel) calculation would show a 20% drawdown for this year:

Ouch!

So, let’s see what else there is if we do not want to invest in the traditional 60/40 strategy. In other words, what are the ALTERNATIVE INVESTMENTS

Private Equity —> the same risk as equity, but more volatile (yes, yearly mark-to-market does not count as low volatility) and less liquid. Actually, a lot, lot, lot, lot less liquidity than public equity

Private Debt —> that is covenant light fixed income, i.e. riskier with less liquidity

Hedge Funds —> that is mostly public and private equity and fixed income, but more expensive. Ah, and yes, lousy liquidity.

Real Estate —> Ok, a possibly true alternative, but a would have a question or two about market timing here (expensive + rising interest rates). And did I mention the horrendous liquidity yet?

Commodities —> also a true alternative, but careful: no coupon and no dividend, i.e. no cash flow. And whilst liquidity is better than for all of the above, it is not a market all of us have access to.

Others —> Art, Cars, Wine … perhaps, but I would not be surprised to see a strong correlation between those and let’s say … stocks

What have I forgotten? A lot probably, but please inspire me by leaving your suggestion in the comments section:

Coming back to the death of 60/40, I would argue that 60/40 WAS dead but is likely to have a second life or after-life or reincarnation or whatever you want to call it. Going back to our envelope, consider this:

Aha! More than double the yield to be had now than two years ago (and we are not even considering non-IG bonds)! Please note that I am not advocating for the market drop in stocks or the rise in yields have ended (yields may be close to an interim top, stocks still have way to go), but only that the opportunity set is now much more attractive than one or two years ago.

In conclusion, my points are:

Nearly everything is either debt or equity

Don’t be lazy! If markets are expensive, hedge and or reduce and be patient. Reallocate amongst sectors, buy value, shorten the duration, etc. etc. And of course, read The Quotedian!

Anyway to Friday and last week …

Ouch again!

Despite a late rally in excess of over one percent during the last hour of trading, the s&P still closed the day 1.7% lower:

It missed the June 3,636 low by only 11 points (0.3%):

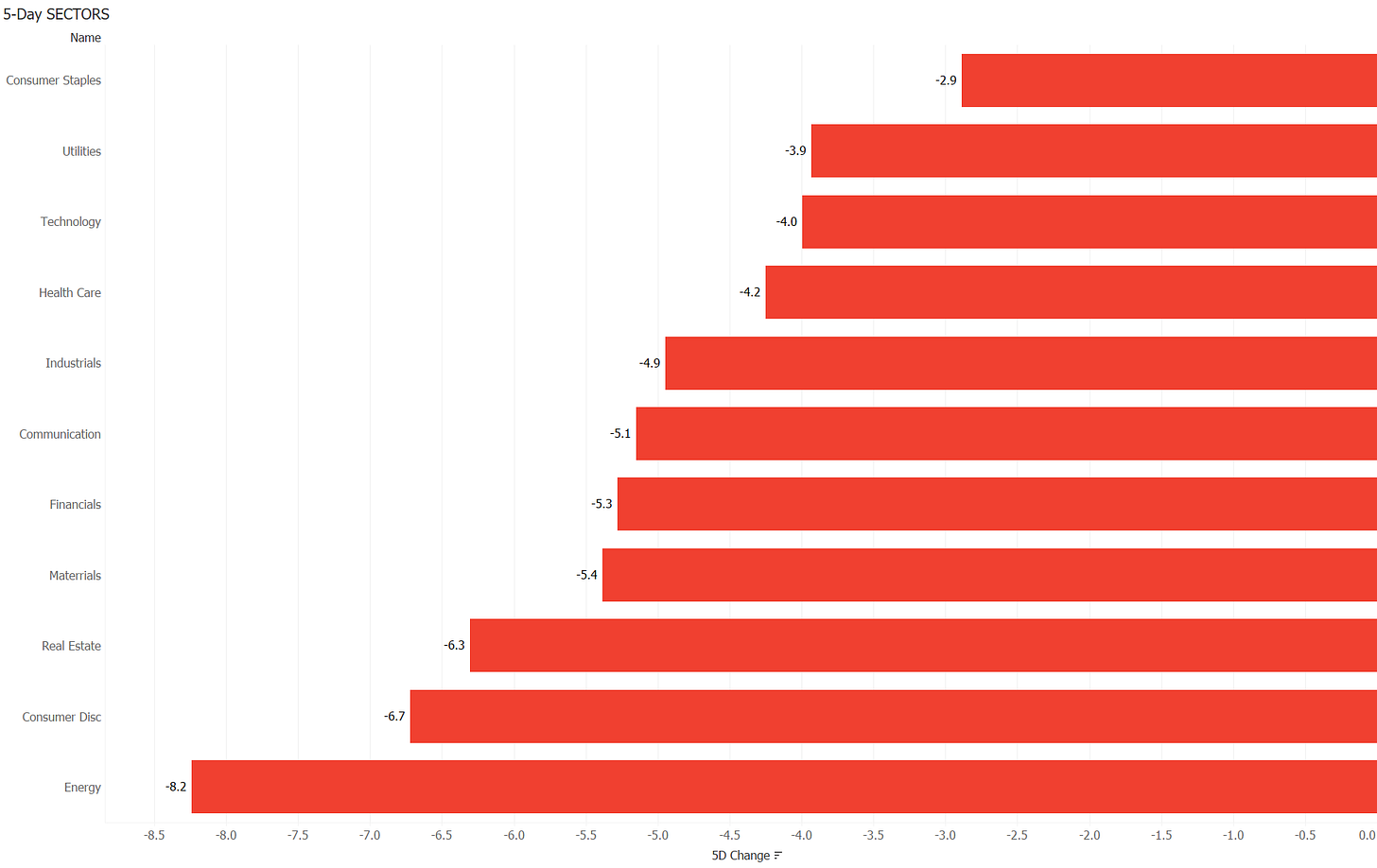

Breadth was once again pretty much a shit-show, and all eleven economic sectors printed lower, with Energy stocks tumbling an astonishing 7%:

Before looking back at the performance for the entire week, make sure to remove any sharp objects you may have close by (and maybe also close the windows, just in case):

Remember how we spoke at the beginning about the Fed’s intention to bring down inflation via the wealth effect? Eh voila!

Sector performance also speaks for itself, with the most defensive sectors dropping the least (but still dropping):

Switching over to the bond side, ‘things’ don’t get much prettier:

Of course is the negative performance made up of a) globally rising yields as central banks (ex-BoJ) continue to hike their key interest rates and b) credit spreads also widen as investors reassess their risk appetite.

Again, not making a major market call here, but at least on the bond side, Friday had the small of climax to it and I would not be surprised to see somewhat lower yields over the coming weeks.

The US 10-year treasury yield for example but a shooting star candlestick formation on the chart:

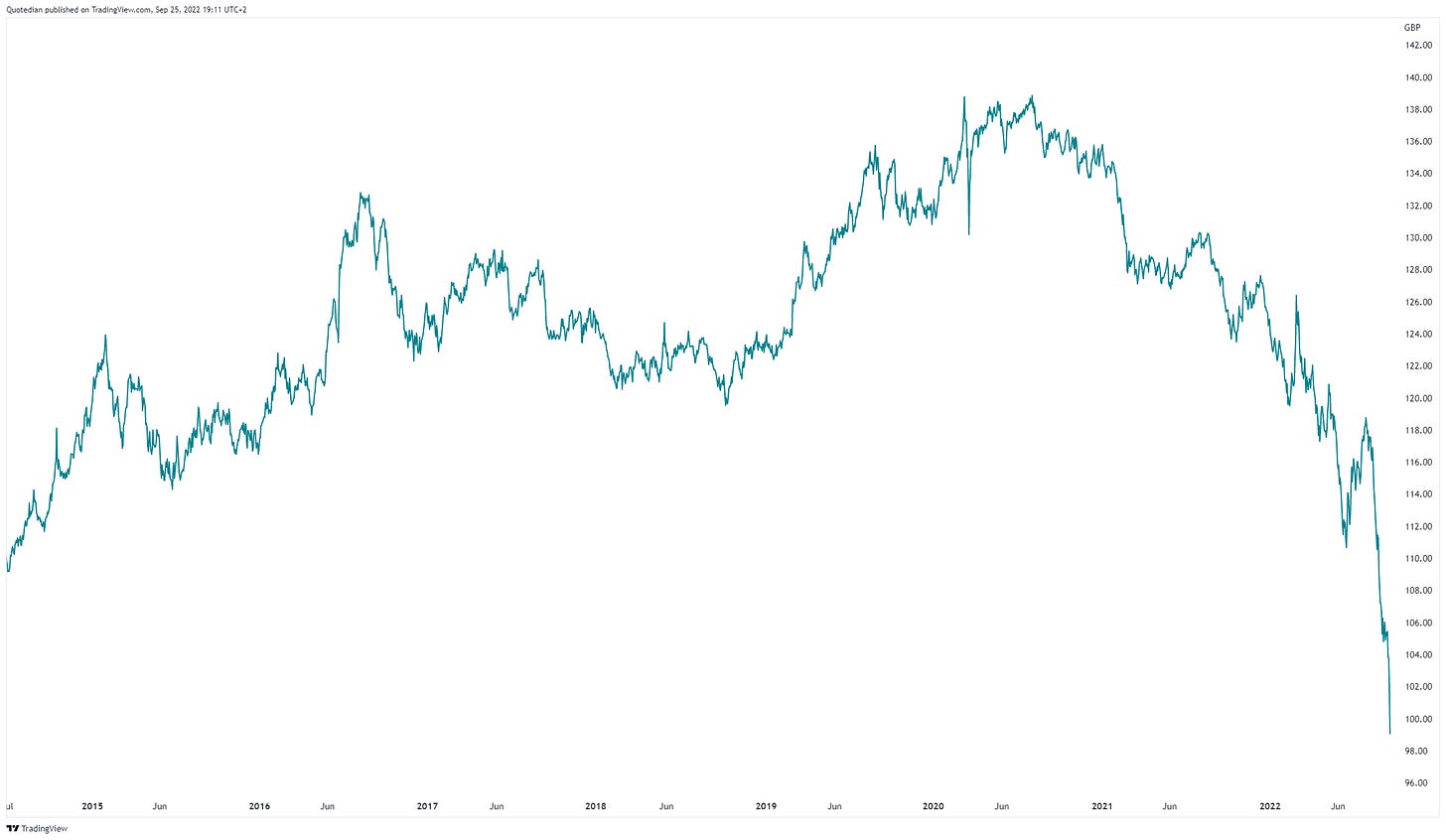

Or consider the bloodbath on the UK Gilt market:

Let me show you that capitulation in UK Gilts in terms of price, instead of yield, just to make the extent more comprehensible:

Ouch! (I say that a lot recently).

As fore-mentioned, Credit Spreads are widening and have reached new cycle highs in investment grade and high yield:

Switching into currencies, for long-time readers of The Quotedian it will come to no surprise that the US Dollar is hitting new highs against nearly everything as the flight to safety continues:

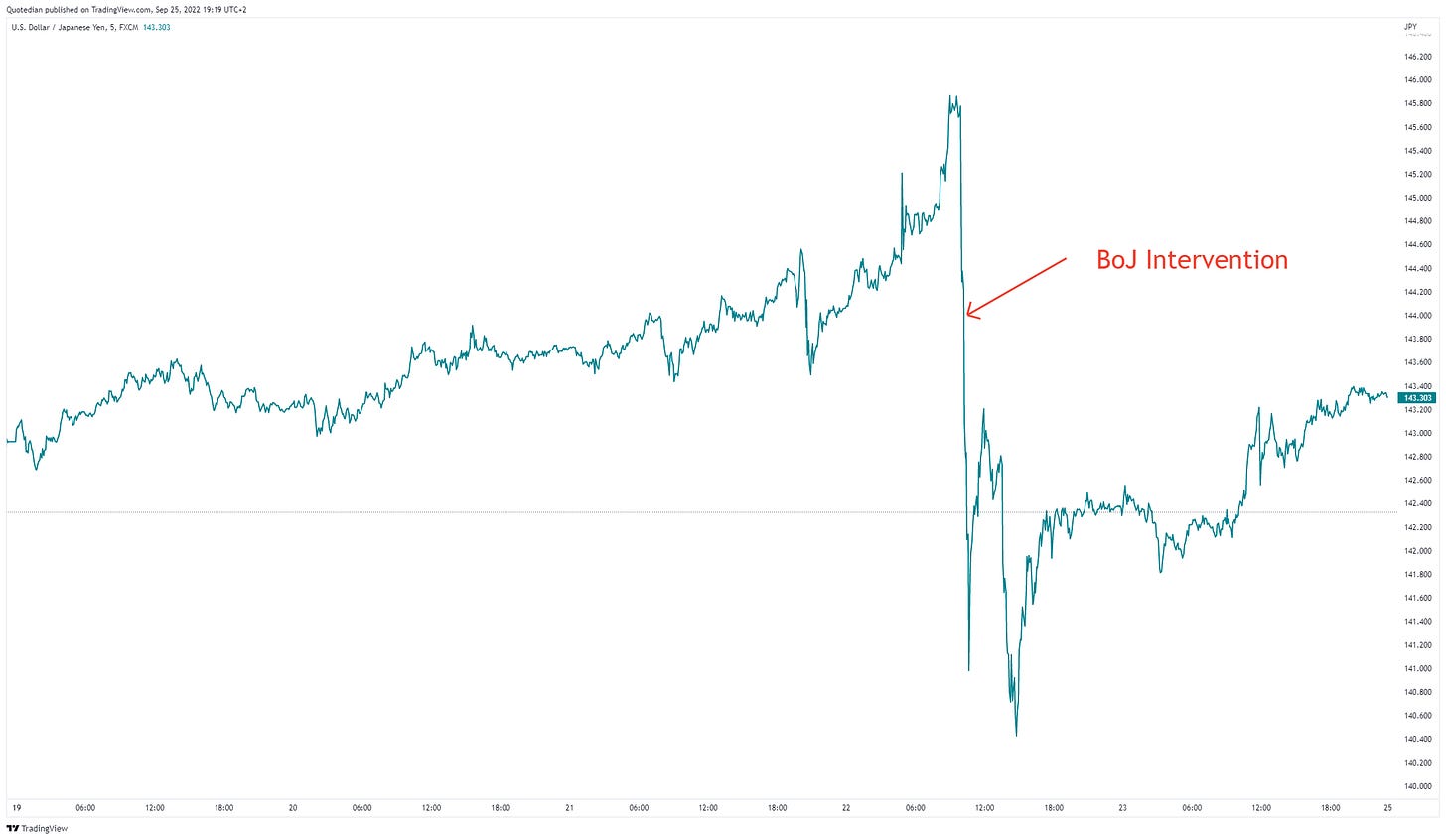

On the surface the Japanese Yen held up well, but only after the Bank of Japan, or better said the Japanes MoF, intervened into currency markets on Friday:

But as you can see from the above chart, investors are already on the way to test the BoJs/MoFs resolve … this should remain fun.

The Euro also saw some heavy, heavy selling after some devastating PMI reports for the Eurozone on Friday:

A short-term bottom may be at hand below 0.96, but the prospects remain very dire for this currency. Very dire.

Unfortunately, time has come to hit the send button, so let me just print here quickly the 5-day performance table for commodities:

I should have some interesting commodity stuff up on Tuesday tough, hence, stay tuned!

Have a great Sunday and a good start into Capitulation Monday!

André

CHART OF THE DAY

As described in the deliberations section, stocks as measured by the S&P 500 avoided taking out the June lows on Friday.

Not so High Yield bonds, which are well below their own June lows. Here’s the iShares iBoxx High Yield Corporate Bond ETF (HYG) for example:

Canary and coal mine spring to mind…

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

I'm new in this world and would like to hear your opinion on ETFs, as I invest in the S&P 500 ETF every month, should I stop now or just continue with my "strategy"?

Btw, really enjoying reading your posts, I‘m learning a lot.

Well you forgot venture capital (which I don't think it is a good idea right now) and also you can leverage 10x and buy btc (only bad ideas come to mind🤣)