Outrageous

Volume V, Issue 181

"In theory, theory and practice are the same. In practice, they are not.."

— Albert Einstein

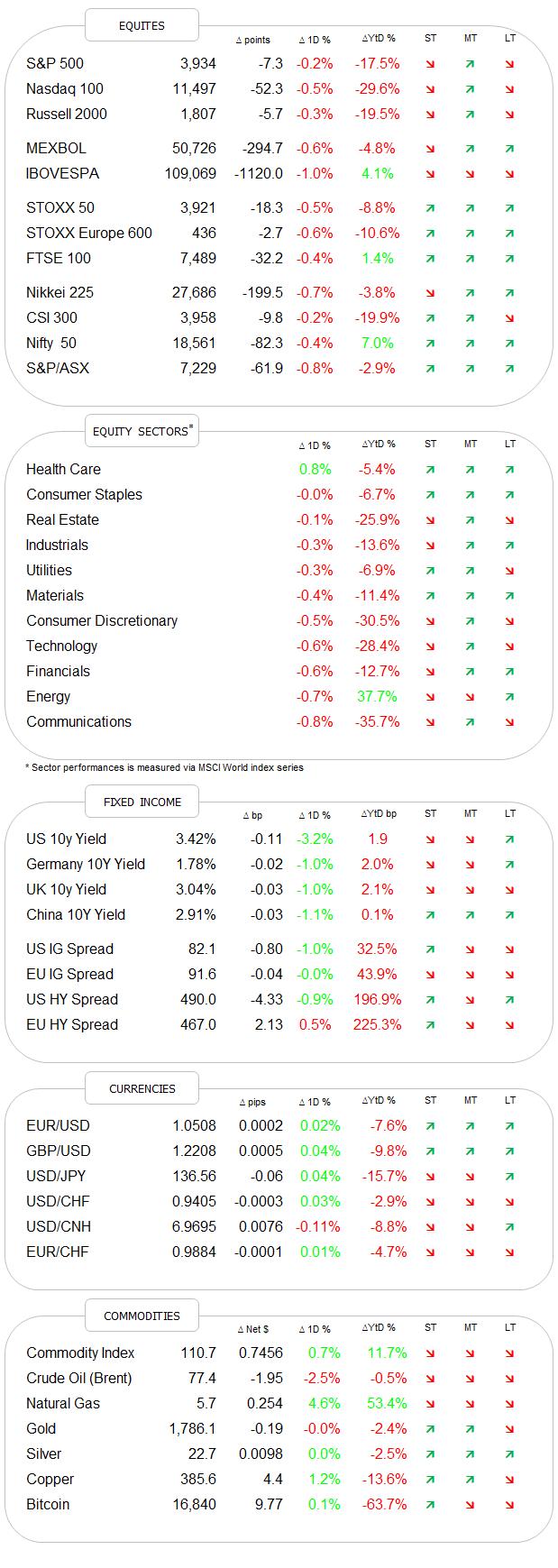

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

In theory, stocks should have ended higher yesterday, given the big sell-off in bond yields and the weakening greenback. In practice, they did not.

Stocks ended the day lower for the fifth consecutive session, and the S&P has been down now eight times out of the past nine sessions. On a more upbeat note though, is the pace of losses diminishing, as is the downside participation.

For example, did yesterday actually three sectors manage to eke out small gains:

And the ratio between advancing and declining stocks was nearly equal (222/278).

The S&P ‘feel’ out of its immediate uptrend channel, but managed to hold above the important 3,900 level:

Hence, the easily recognisable ‘lines in the sand’ now are 3,000 and 4,000 respectively.

European shares (SXXP) have also dropped out of their steep uptrend channel, but overall the chart continues to feel ‘constructive’:

On a slightly more bearish note, this chart shows that in terms of time, we could still be far away from reaching new all-time highs on the S&P 500:

This would actually fit well with my view of a sideways trodding market a la ‘66 to ‘82 (more on this some other day).

Asian (equity) markets this morning are dominated by a 3% advance in Hong Kong shares (HSI), as following headline hit the newswire:

Vietnamese stocks are following the advances, but the rest of Asian benchmark indices are more flattish to negative as I type.

Also flat are European and US equity index futures about one hour before the opening of cash markets.

Most action took place in US yields yesterday, where the 10-year version dropped nearly twelve basis points on the day, and nobody quite knows why. It definitely has taken out our key support level we had been observing and the 100-day moving average (dark line):

Yesterday’s move has also taken the iShares 20+ Year Treasury Bond ETF, better known as the TLT, into an interesting resistance zone:

Taking the ratio of the most widely traded equity (SPY) and bond (TLT) ETFs, a strong point can be made that the odds are shifting in favour of overweighing bonds:

This is much in line with my asset allocation model, where bonds have moved up fast in terms of ranking and are about to take the top spot from equities:

German 10-year yields are still hanging on to their key support zone - just about:

In currencies, as fore-mentioned, the Dollar weakened against most other major currencies. The popular US Dollar index (DXY) continues to trade below its 200-day moving average:

A report by one analyst at Credit Suisse showed that he expects the Swiss Franc versus the Euro to as low as 0.95, which is also the September low:

Perhaps.

Finally, ending today’s deliberations with commodities, it is noteworthy that the price of oil continues to drop, DESPITE all the signs of China reopening:

This is definitely NOT what many strategists had expected.

Here’s the chart of WTI, with arrows and line indicating where and when Russia invaded the Ukraine:

Now, go on and blame inflation on Russia and fuel prices.

Similarly, here’s the year-to-date chart for unleaded gasoline futures (RB). Show me the inflation:

Last but not least, maybe Gold has consolidated enough of its recent upmove and is ready to move higher again:

Time to hit the Send button - have a great Thursday!

André

CHART OF THE DAY

Every year, Saxo Bank, an investment bank specialising in online trading, releases its list of ten outrageous predictions for the coming year. And so they just did for the year 2023. A quick glance at their list highlights a theme that is very much in line with my own thinking: Geopolitical tensions are on the rise (i.e. WWIII has already begun) and any at least half-serious investment framework should also take geopolitics into consideration.

In their own words:

Gone are the days where low interest rates could foster dreams of a harmonious world built on renewable energy, equality and independent central banks. In 2023, world economies will shift into War Economy mode, where sovereign economic gains and self-reliance trump globalisation.

Our 2023 Outrageous Predictions revolve around how countries’ focus on asserting themselves will affect the global economy and political agenda.

And here’s the list:

For the deep dive, click here.

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance