Overcrowded

The Quotedian - Vol V, Issue 122

“Go the extra mile. It's never crowded there”

— Dr Wayne Dyer

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

I was recently asked if I had any major macro views, to which part of my answer was that it was probably still correct to be in risk-off mode, i.e. err on the cautious side, whatever that means within your accepted risk profile. We had a discussion on this a few weeks ago here (Risk Off! at the beginning of the deliberations section). A recent study by an outlet called found that the most brutal part of an equity bear market came in the last third in terms of the bear’s duration - and our own ‘gut experience’ (Warning: new term!) would confirm that empirical data. Here is the study’s own synopsis:

Bear market declines tend to be back-end loaded, with the largest declines coming in the last third (of time duration) 11 out of 16 times, with average decline in the last third double that of the 1st or 2nd third.

There is a strong argument to be made that we have not yet seen that 3rd third capitulation in the currently ongoing bear…

HOWEVER, I always like to look on the bright and light side of life and therefore ask myself: “What could (eventually) go right?” And in that context, we should not forget that especially the European and the UK market could suddenly get some major M&A backwind. How come?

Well

European (SXXP) and UK (UKX) stocks are seeing one of their lowest valuations (P/E) since the GFC:

In terms of individual stocks, just look at the P/Es of some of names with the lowest valuation:

Now combine this with the fact that both the Euro (green) and the Sterling (blue) are about 15% cheaper than the US Dollar slightly over a year ago

and about 30% cheaper than a decade ago:And lastly, US companies have very strong balance sheets, taking the total debt/total asset ratio on the S&P 500 as an example:

So, to resume, this is not a bullish call, but a call for what eventually could work out to bullish factor, i.e. a very strategic look. Now, let’s put on our tactical goggles again and look at yesterday’s session.

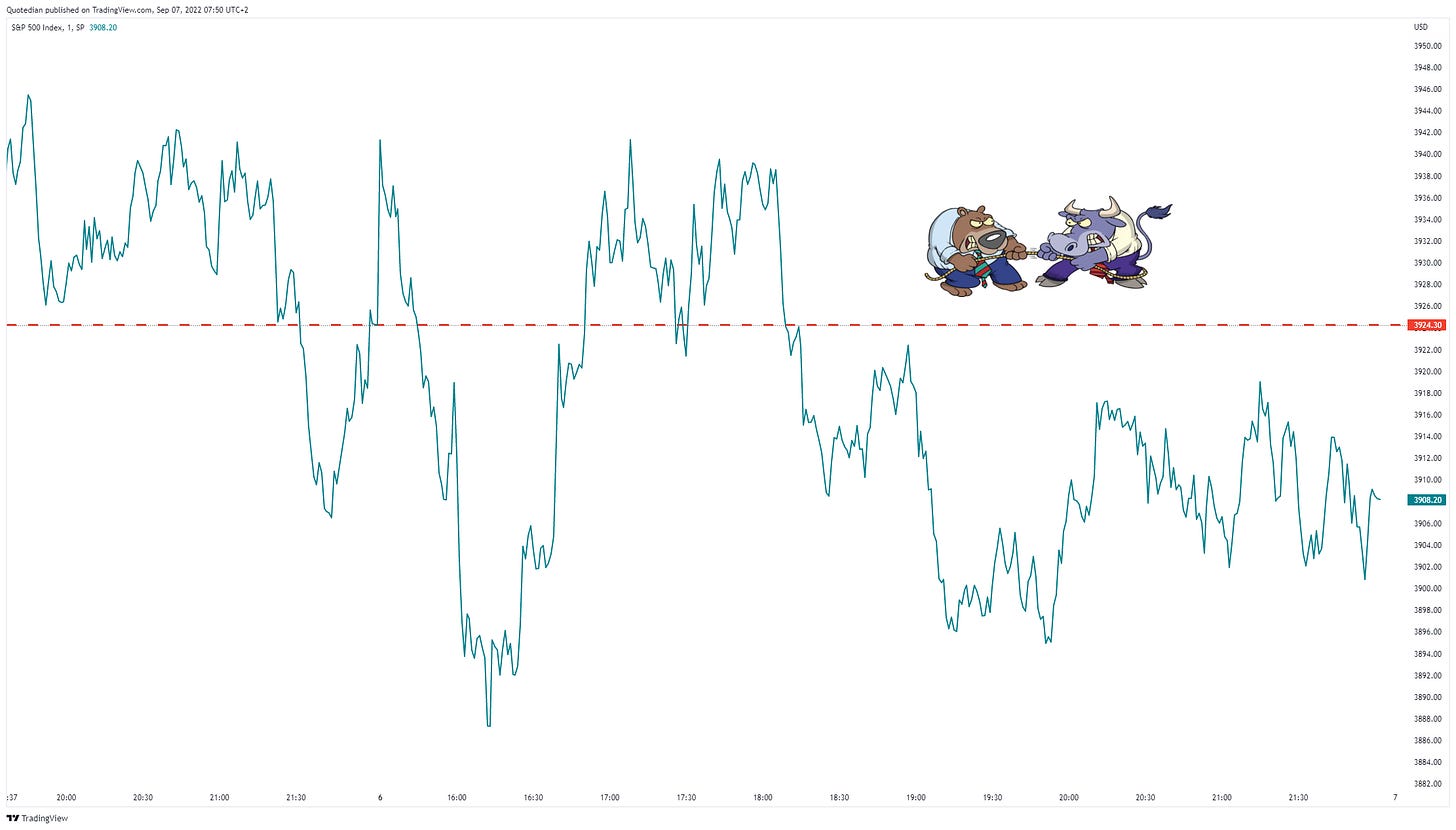

After the US market’s absence on Monday, yesterday's session was a clear tug of war between bull and bears, with the latter gaining an ever so slight overhand by the time of the closing bell. Here’s the intraday chart of the S&P 500:

This indecisiveness was then also visible when looking under the hood, with about two third of stocks ending the day lower and four out of the eleven sectors showing a positive reading:

In other words, not a clear home run for the bears yesterday, despite keeping the overhand.

What could have led to such indecisiveness in yesterday’s session. Still with our tactical lense on, we find some interesting support lines (black dashed) converging at the current level:

And putting a rosy filter onto our goggles, we could even argue for an inverted shoulder-head-shoulder pattern building (light green drawings):

Not my main scenario, but still a scenario, with the upper resistance coinciding with the longer-term “go green” signal on our inverted traffic light:

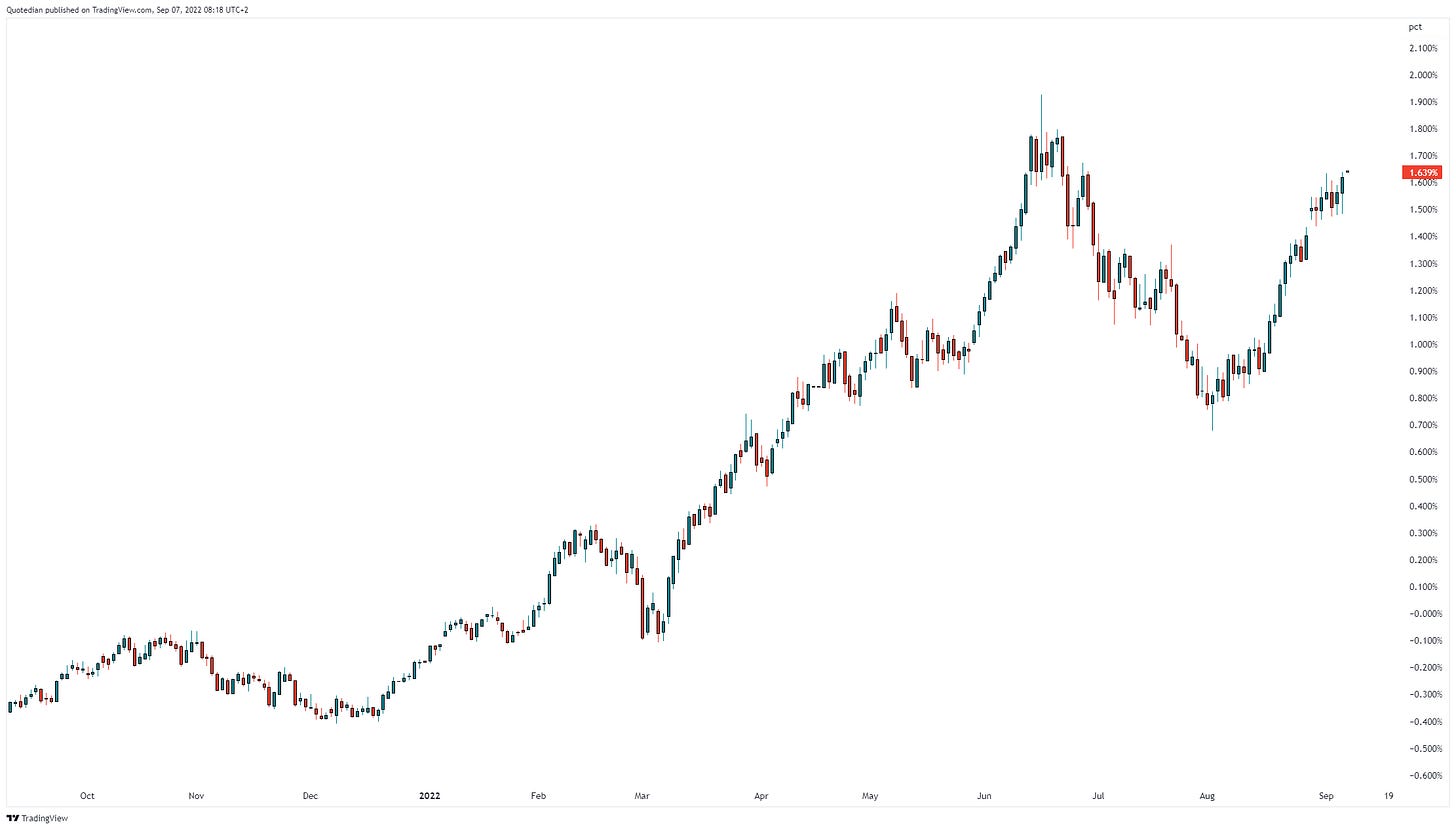

But, let’s turn briefly to the fixed income space, which all truth be told, was the real attention-catcher in yesterday’s session, as yields pushed higher on better-than-expected PMI readings. US 10-year yields pushed to 3.30%, closing in on their June 3.40% multi-year highs, but 30-year yields for example already exceeded those previous highs:

Similarly, in Europe the German 10-year Bund yield is also closing in on the June highs:

European peripheral country spreads to the Bund continue to rise in Italy and Greece, but have flatlined on the Iberian peninsula:

Tomorrow is of course the ECB meeting, where a 75 basis points is widely expected. This serves as a segue into currencies, where the mighty US Dollar continues to be strong, for example precisely versus the glittering wonder that is the Euro:

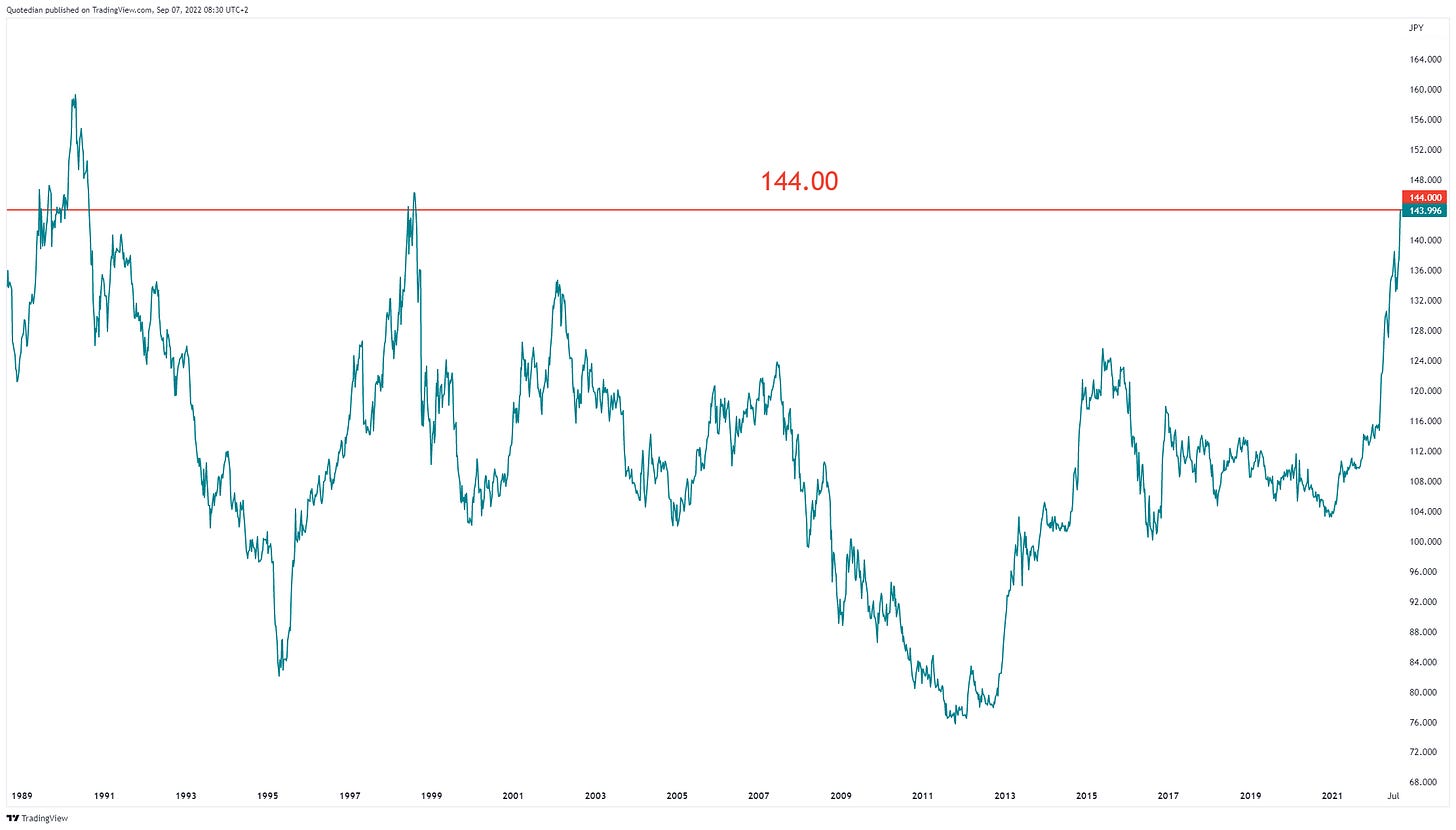

Or versus the Japanese Yen, where the BoJ/MoF stubbornly continues to defend the 0.25% ceiling on the 10-year JGB (aka yield curve control), completely sacrificing their currency in the process. $/JPY at 144.00 as I type, up four (!) big figures in less than two sessions:

Annualized, the JPY has now lost 60% since March or 180% since late July. Both numbers, but especially the latter, have never let to anything good in the past - stay very tuned on this one.

A lower Yen and a lower Euro of course mean that the US Dollar Index (DXY) is through the roof, trading at its highest since 2002:

BUT, it seems to me (which means I do not have hard evidence) that the long US Dollar trade may be the most overcrowded traded in any asset in quite a while. A reversal could be brutal.

Could an even larger ECB interest rate move be the trigger? And by the way, talking ECB, I omitted to mention in the Calendar section that the Bank of Canada also has its rate decision due today also, with a 0.75 basis point hike expected.

Ok, this letter is getting too long (once again), but please feel free to leave your feedback or a request on what I should cover going forward by clicking on the comment button below:

And, of course, do not forget to hit the Like button at the end of this mail.

Have a great Wednesday!

André

CHART OF THE DAY

The alternative ‘Quote of the Day’ to today’s, would of course have been “An Apple a day …” in honour of today’s release announcement of the iPhone 14. But the overcrowded was just too good and after all we only have to wait about a year for the next Apple event …

Anyway, AAPL did make it into the Chart of the Day section and let me copy/paste a comment made by the fine folks at Bespoke Investment Group on this matter:

Apple (AAPL) is expected to release a new version of the iPhone tomorrow, and while these events typically excite consumers and tech commentators, investors have tended to have a more muted reaction.

Historically, the stock has tended to have a negative reaction on the day new iPhone models were unveiled, and while short-term performance following the announcement has tended to be positive, returns are below the long-term average for the stock in all comparable periods during the iPhone era.

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

My dear friend, great macro view and analyses.

Thanks!!