Party like it's 1776

The Quotedian - Vol V, Issue 91

Never buy what you do not want, because it is cheap; it will be dear to you.

— Thomas Jefferson

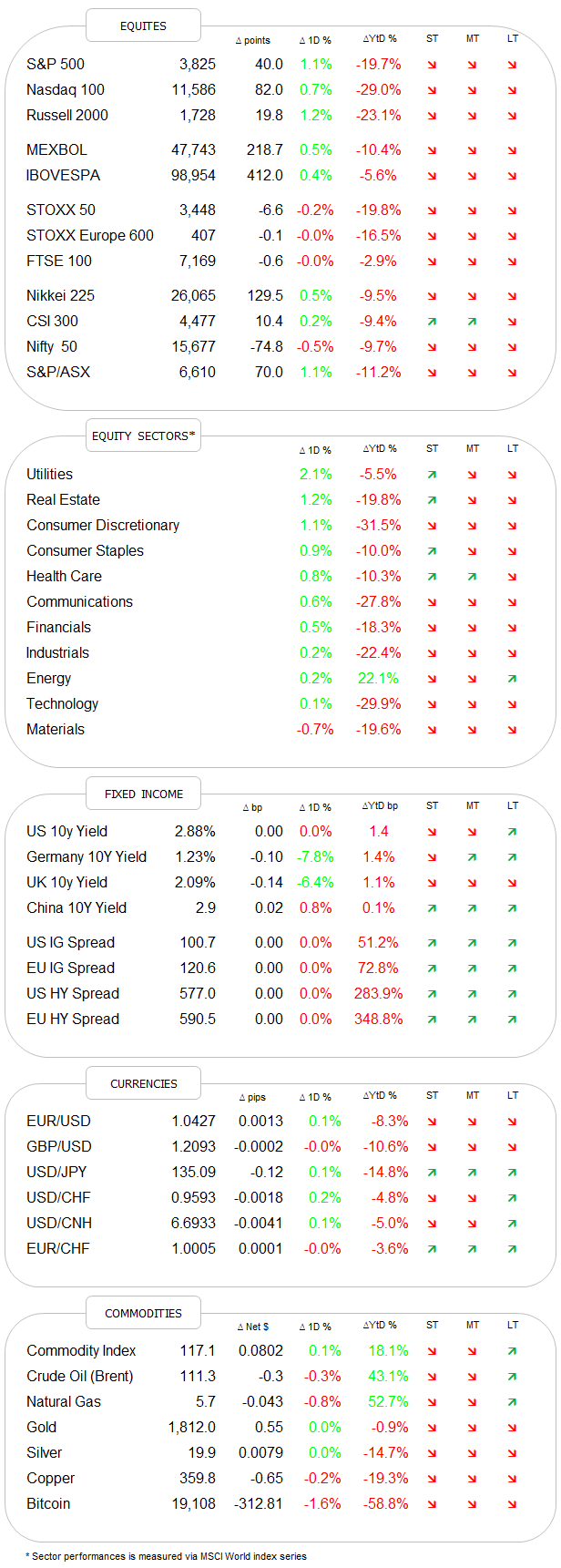

DASHBOARD

CALENDAR

CROSS-ASSET DELIBERATIONS

Friday was a comparatively quiet session on global financial markets. Today should be similarly calm, given the absence of US markets and investors, as they are happily barbequing in their backyards, maybe sipping a Bud or two (jealous, yes).

Hence, today’s Quotedian will be somewhat shorter, as you quickly review some “stuff” from Friday. Tomorrow we will take a novel and fun way to look at longer-term market trends. Let’s dive right in then…

Stocks did pretty well on Friday, especially in the US, where the bellwether S&P 500 index closed up over one per cent, going from strength to strength after an initially weaker start:

The heatmap of the S&P 500 quickly reveals that there was really only one pocket of weakness on Friday, with the rest of the market trotting higher:

Semiconductor stocks suffered after chip-giant Micron Technology lowered guidance citing an oversupply of consumer electronics and a certain saturation of customers for such products. After initially falling six per cent the stock closed down only about 3%, but their statement was enough to pull the entire sector lower.

Other stocks were probably more buoyant on Friday as the nationwide ISM report did not come in as bad as some were expecting. At 53.0 it was less than the 54.5 expected, but still above 50 (i.e. expansion). Not too hot, not too cold …

Indeed did bond yields drop on the ISM report, providing some extra juice to the equity rally. The 10-year US treasury yield dropped as low as 2.79% at one point during the session, though then recovered to around 2.88% where it still sits now. Moves on rates are quite stunning this year, with the Tens having more than doubled, but now down already 20% from their peak - all this packed into six months:

In currency markets, the USD has had a strong 5-days versus all other major currencies, with the notable exception of the Japanese Yen:

The JPY likely bucked the trend as some buyers finally showed up, after the currency was down over 20% since the beginning of the year:

The EUR/USD cross-rate in the meantime is sitting right on top of key support again, ready to break lower to make that parity headline over the coming months:

In the cryptocurrency space, Bitcoin is trading around the 19,000 level and continues to feel ‘heavy’:

This meme seemed spot on concerning cryptos:

Amongst commodities, the oil price continues to ping pong around, though the chart is hardly one of weakness:

We will end today’s Quotedian here, but as mentioned at the outset, make sure to read your favourite daily newsletter tomorrow, as we look at some longer-term trends for different assets.

CHART OF THE DAY

Renewables to replace fossils? Not tomorrow: