Pirate Credit

Vol VIII, Issue 28 | Powered by NPB Neue Privat Bank AG

“Only when the tide goes out do you discover who’s been swimming naked.”

— Warren Buffett

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Before I start, I do apologise upfront to those of you, who think by the end of these introductory deliberations, I put your business and/or income under threat. Remember, I try to be a humble observer of markets, though of course always have my opinions (aka my way of interpreting ‘stuff’ at hand). So, feel free to unsubscribe from this mail, which is the online equivalent of showing me your middle finger. For those who actually agree or at least partially liked my views, feel obliged to share, of course!

So, as only the smartest investors read such fine publications as The Quotedian, I am sure all of you have already figured out that this week’s title “Pirate Credit” is a wordplay Freudian misnomer of “Private Credit”.

Hence, let’s start with the definition of Private Credit (according to Google’s search AI):

Private credit refers to non-bank lending, where companies borrow money directly from private investors, rather than issuing publicly traded debt or relying on traditional bank loans. These privately negotiated transactions offer customized terms, often tailored to the needs of middle-market companies, and are a growing asset class for investors seeking higher yields.

Good. I can live that definition.

Now to my personal experience with private credit … during the GFC (2007-2009) I was heading up the investment services at a Swiss private bank in Gibraltar. Naturally, we had a lot of UK-based clients, which gave us a front row seat as the GFC was unfolding. Northern Rock went belly-up first in 2007 and was nationalised in February 2008. Royal Bank of Scotland (RBS), for a brief period in 2007 the world’s largest bank, followed shortly thereafter by having to be nationalized. Then HBOS. Then Lloyds TSB. Then Bradford & Bingley. You get the drift.

Hence, main street banks had to retreat from most of the lending business rapidly, especially to the SME (small- and mid-cap enterprises) market. Private credit funds started popping up and quickly filled the void left by the banks. For investors, this turned out to be pretty juicy investments, with lending rates usually well into the double-digits area.

A few years onwards, and interest rates in Europe (and the US) started dropping towards zero. Despite the nature of private credit arrangements being floating rate, spreads remained very juicy and made private credit investments even more interesting as investors were starved for yield.

Our investors really enjoyed the returns and I even became director of an (EXCELLENT) Spanish private credit fund based in Luxembourg of non-exe director until I had to resign to changing my residency back to Switzerland.

But overall, I started getting worried. Worried about the sheer size (not quantifiable) of the sector. Worried about news of traditional fixed income managers (you shall not be named) moving into private credit to join the party. Worried about major US banks (you shall not be named) suddenly higher thousand of people to roll out their ‘new’ private credit ventures.

Worried.

But somehow I also hoped that like in any other bubble, the extremes get much more extreme before the poop hits the fan, and hence, the final reckoning for the sector may be still years (decades?) away.

I am not so sure of that anymore.

A recent flow of news should catch our collective attention. In condensed, non-exhaustive chronology:

A Texas-based company that finances and sells used cars primarily to Hispanic immigrants with limited credit histories files for bankruptcy. Check out the yellow marked subtitles below the picture:

Instead of filing for bankruptcy under chapter 11, the company filed for chapter 7, which means the filing is decisive and sharp: liquidation, allegations of misconduct, and thousands of creditors all laid bare. The MIA amount went from a couple of hundred of million US Dollars to anywhere between $1 billion and $10 billion. Go figure.

First Brands files for Chapter 11:

CarMax, a used car retailer, issues a profit warning, and the stock drops 20%:

I know what you think, all this is tied to the (used) auto sector only. You know, these things at first always seem contained. I mean, remember the greatest central banker ever (yes, being heavily sarcastic here) in 2007, saying that the subprime crisis was contained:

But, hey man, André, you will be shouting at me, it is all just used car-related!!!

No, my dear friends.

One way to proxy the fortunes of private credit markets are BDCs. BDCs? What the heck are BDCs? Here’s what Google’s AI says:

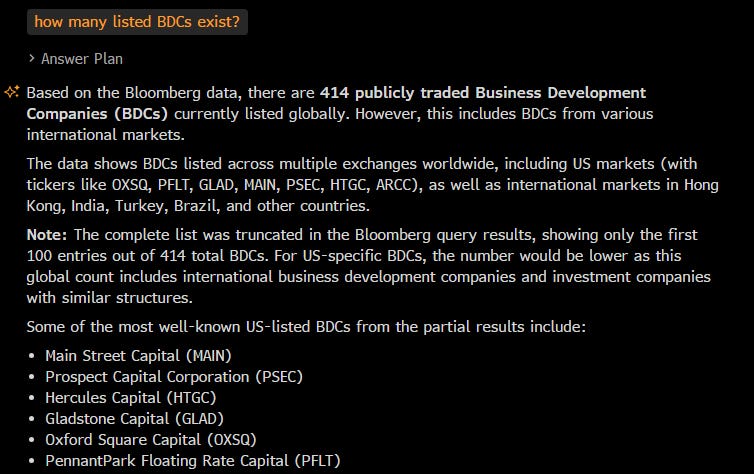

I asked Bloomberg’s new LLM-chat function (Bravo Bloomberg, great, great new function), called AskB, how many listed BDCs exist:

414!!!

As luck would have it, an ETF for the most important (US) ones exists - The VanEck BDC Income ETF (BIZD). So, how has BIZD been performing lately? Is it worth a short?

Ouch! In a bear market already since its February ATH! Now, in all fairness, this thing pays a quarterly dividend which annualizes to 12%, though recently dividend growth has been negative:

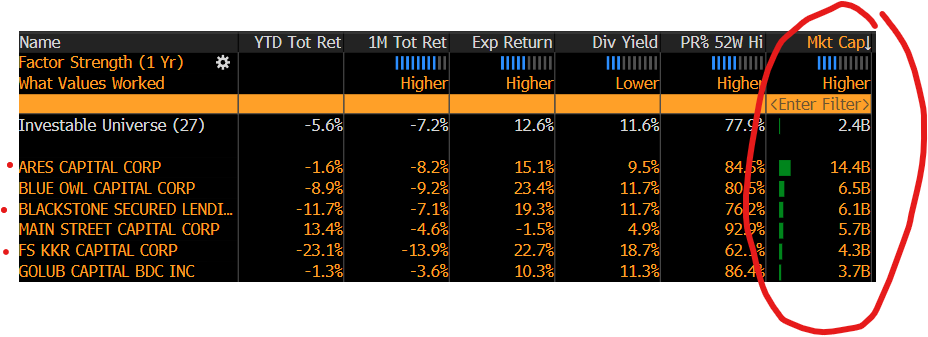

Looking at some of the largest weights in the ETF, it stands out to me that many names are “carve outs” from the real big private equity players globally:

Is this to protect the “mother” company, just in case?

Here’s the comparison of one of the more prominent PE names (BX) in the list to its private credit arm (BXSL):

Maybe the short is in BX? Stay tuned …

Anyhow, to wrap up this rant, here are three possible scenarios for the private credit ‘story’:

Bull Case - I am just an old fool shaking his fists at the clouds for anything that is not ‘plain vanilla’

Neutral case - This is a sector slowdown, a welcome sell-off to shake out the weaker hands

Bear case - Contagion. Nearly GFC all over again

I am somewhere between 2) and 3), but maybe it is indeed still too early for a full 3).

After this lengthy deliberation, I promise to keep the rest of the letter short!!

Amongst all the gloom and doom outlined in the section above, the broader (or narrower) equity market simply doesn’t seem to care. As a matter of fact, the first title I had lined up for today’s Quotedian was “Don’t Stop me now”, inspired by Queen’s fantastic 1979. I was also going to add a link to the lyrics (click here) and add the video clip, which I will still do to go through the equity section, as it seems so fitting right now. Pay close attention to the Freddie’s sung words and think of them in terms of the current equity rally:

Ok, off we go!

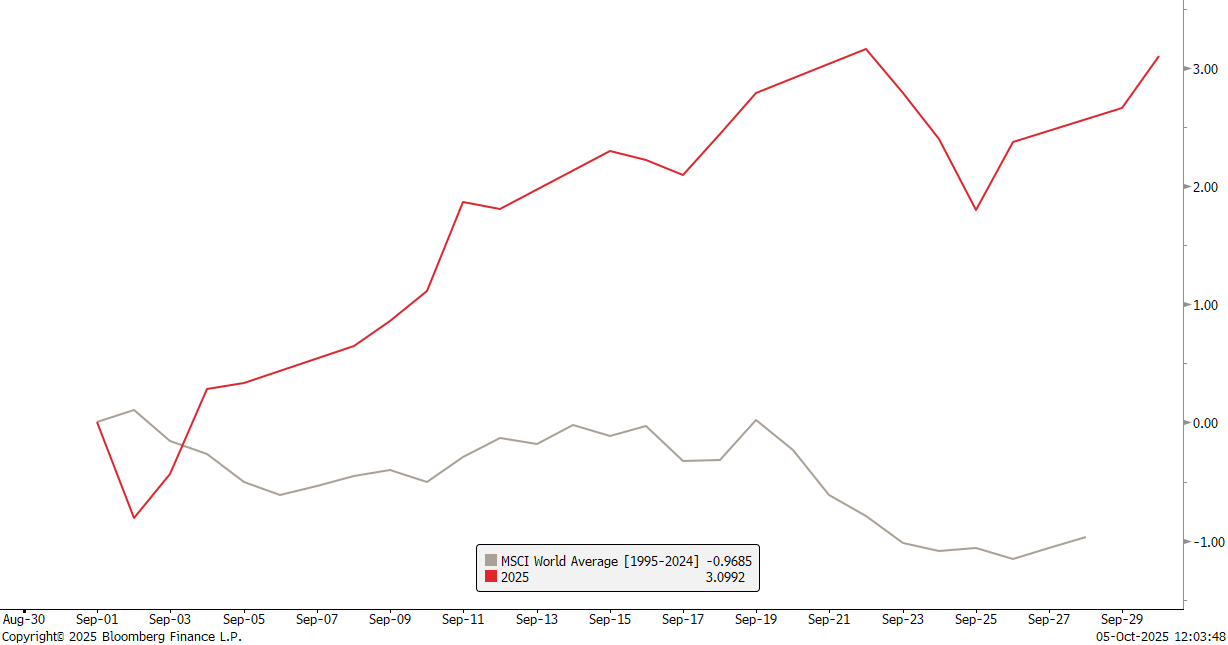

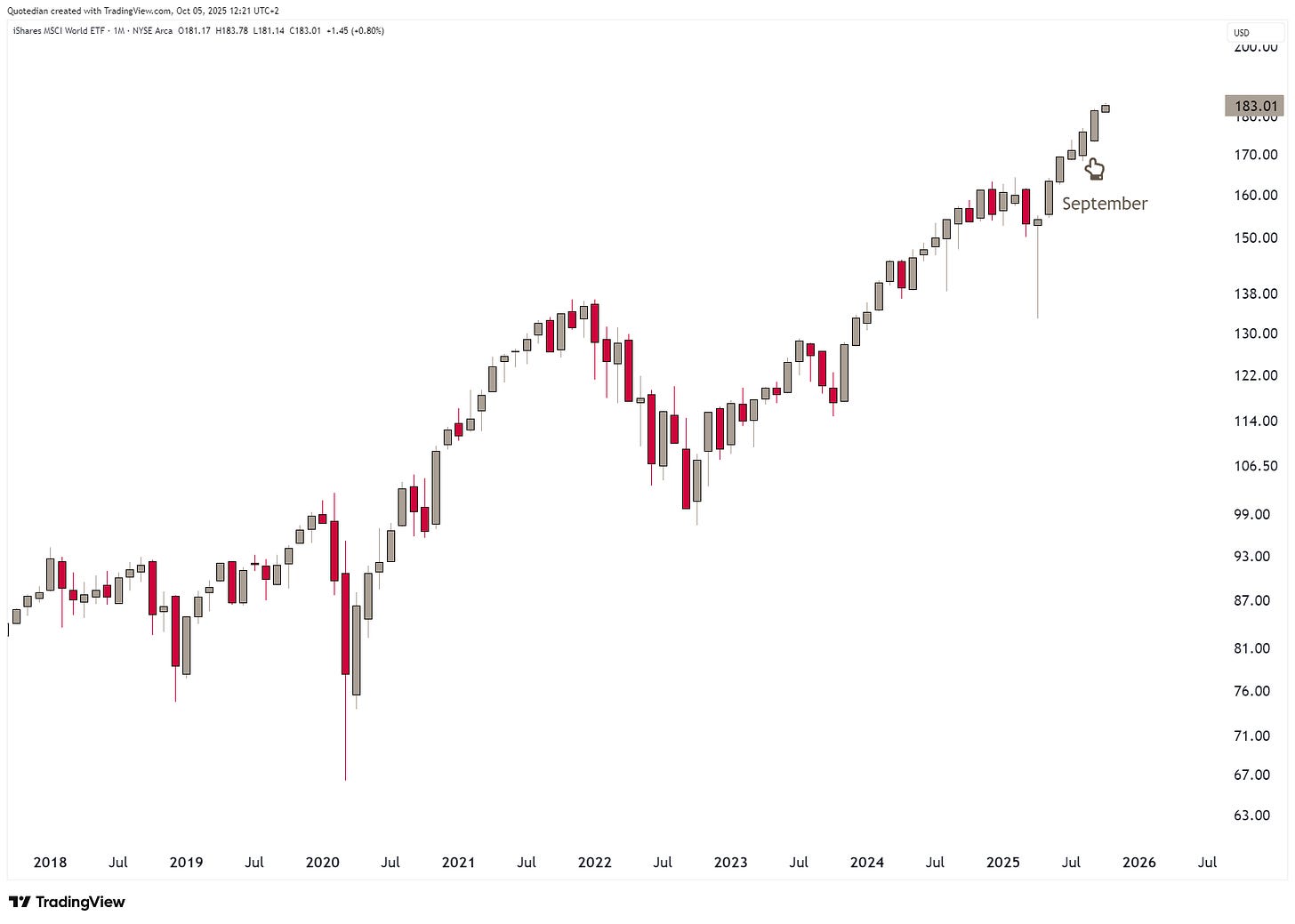

So, September is one of the worst months for stock we said, right?

WRONG! At least September 2025 turned out to be another great month for stock bulls. The MSCI World (proxied via the iShares MSCI World index - URTH below) added more than three percent in its sixth consecutive up month:

The S&P rose by about the same percentage (3.5%), but the Nasdaq added more than 5%:

But somehow, the real news was in US small-cap stocks, shortly rising above their all-time high set four years ago:

On a monthly closing basis the index beat the November 2024 by 2(!) index points - we are talking 0.08% here! The follow-through now in early October is encouraging though.

In Europe, small caps have been on tear for a while now:

Here the news is that Eurozone large cap stocks (SX5E) have closed at a monthly new all-time high (and there’s follow-through in October):

The broader STOXX 600 index also made a new monthly closing ATH … by quite precisely ONE index point:

In Japan, the BOJ’s announcement that they will start shedding off their massive equity ETF holdings has had little impact on the stock market:

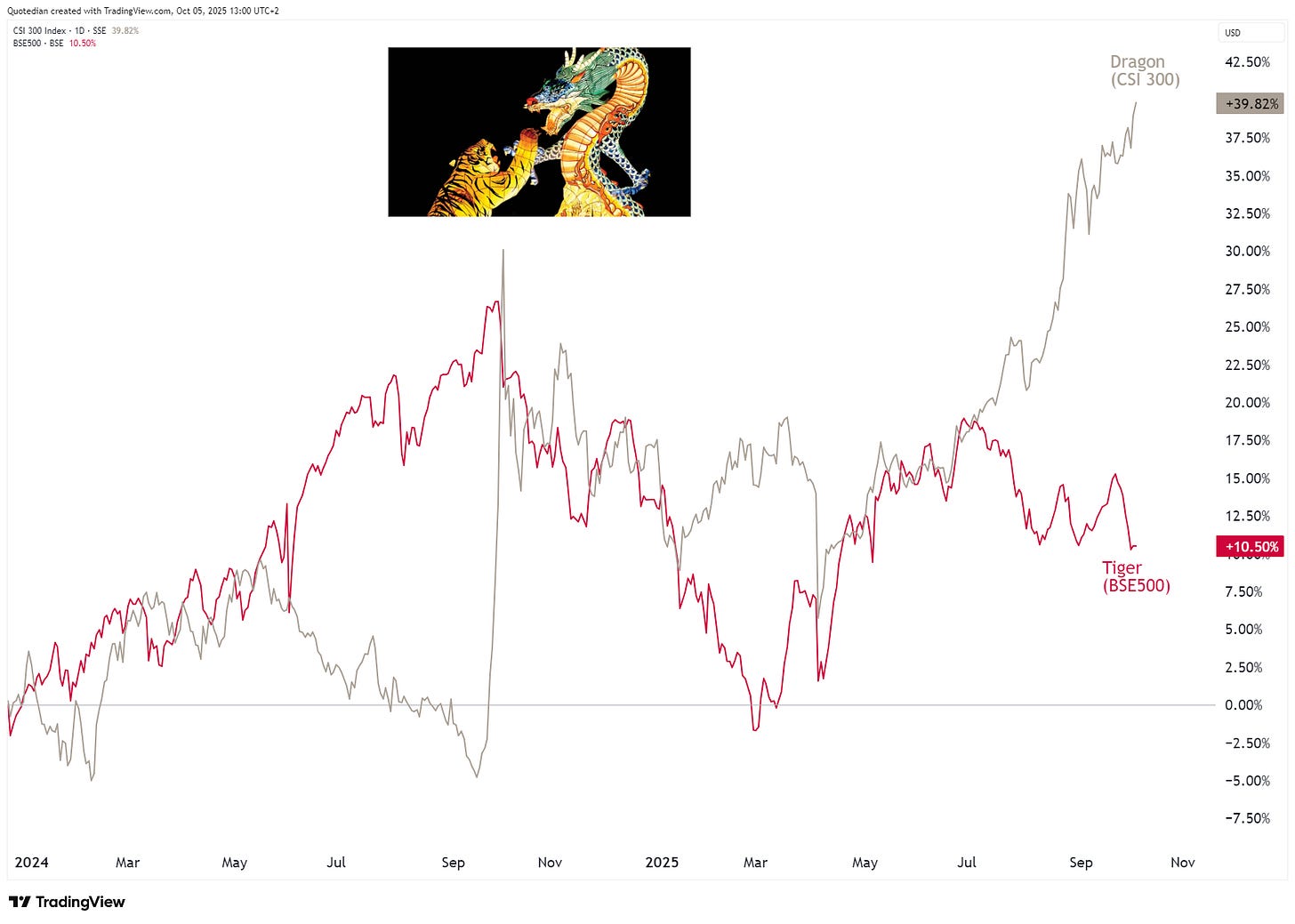

Since China has been declared ‘uninvestable’ in early 2024, stocks have been on a tear:

Maybe more importantly, in the game of “Crouching Tiger, Hidden Dragon”, the Dragon has quietly decisively taken the lead:

Ok, I promised to keep this short, so enough for the equity section.

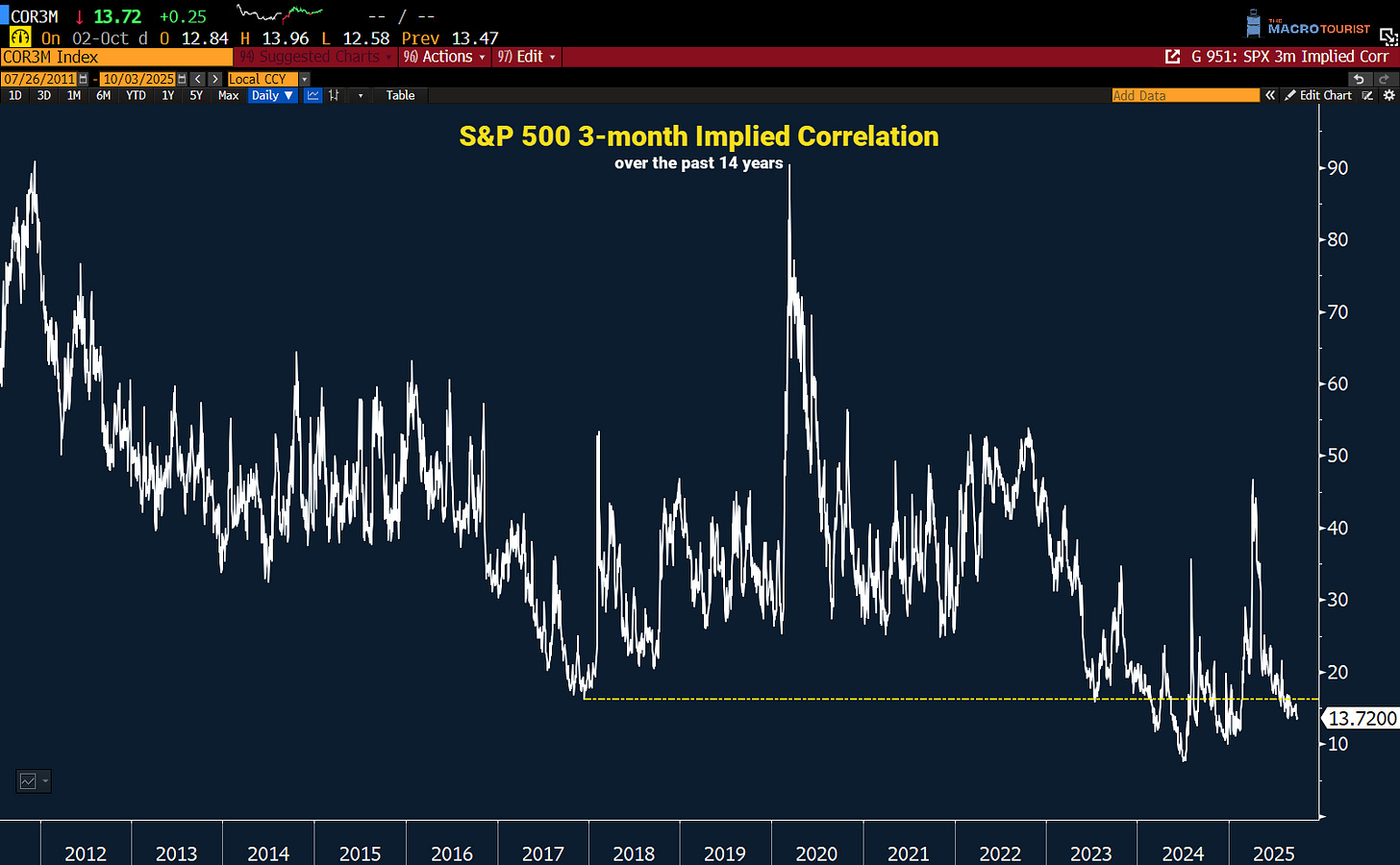

Maybe one more … the trend is you friend, but be careful, complacency is elevated!

S&P 500 3-month Implied correlation is melting again. Market refuses to worry about any sort of macro-related event.

In fixed income markets, remarkably little is happening (taking the monthly view):

But according to technical analysis 101, the fun should start soon, as the price action is moving in the last third of the apex …

In currency markets, you well know our view (click here), which is confirmed by a non-existent recovery in the US Dollar Index (DXY):

The pain for unhedged non-USD portfolios will be painful:

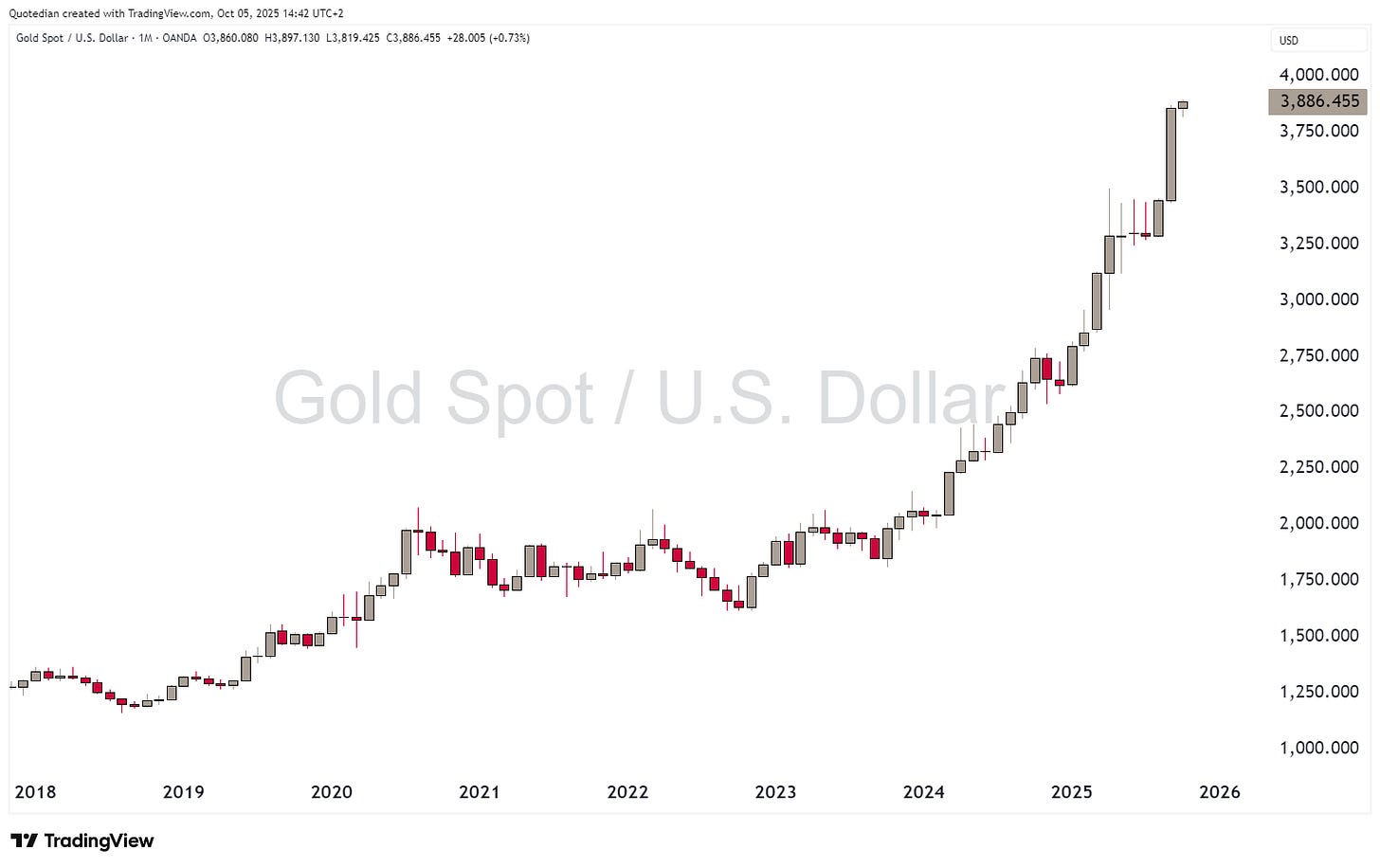

And finally, here’s the only chart you should really worry care about:

And with this, here I finish. Not so much because I have nothing else to say, but I promised to be short after the lenghty introduction, and probably more important, my wife just launched the two most terrifying word in Spanish at me:

TU SABRAS

Who understand Spanish culture, wish me good luck for the rest of the day. For those who not, wish me the same, please!

Have a great Sunday and start to the week!

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG

If lending standards are loosening while yields stay elevated, that’s a dangerous mix the pirates would love to exploit.