Pivot³

The Quotedian - Vol V, Issue 155

“With great power comes great electricity bill”

— Unknown

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Before we start, a quick apology for the “miss” yesterday. Even though it sounds like “dog ate my homework”, I did wake up in the dark yesterday morning. Literally. Turns out we had a wet power outlet somewhere, provoking a household-wide power outage. Being the handyman I am, it only took me about two hours to find out what caused it … by that time it was too late to even start thinking about thinking to write a Quotedian. Anyway, long story, happy end, power is back and normal today!

So, let’s start today’s Quotedian by reviewing the conundrum of the word pivot having become the financial market’s collective obsession, taking over from transitory.

As I see it, we are currently looking at three pivots, of which only one should really matter. In order of importance:

Pivot #1 - The Fed Pivot

By all means, even though this is the pivot I give the least importance to, it is the one that catches most attention in the press and among investors. Will the Fed pivot, i.e. change their monetary policy eventually? Of course! Eventually can be a very short- or a very long-term time after all. And then, what will the pivot look like? For now, investors seem to have switched from requiring a full U-turn to be content with a pause.

The truth is, that even the Fed does not know how long or when ‘eventually’ actually is. On the one hand, they are of course aware that CPI and unemployment are super laaaaaaaging indicators and what to avoid going too far. On the other hand, Powell made in his August Jackson Hole speech clear that he did not want to repeat the Volcker mistake of relaxing tight monetary policy too soon. See here (highlights mine):

That brings me to the third lesson, which is that we must keep at it until the job is done. History shows that the employment costs of bringing down inflation are likely to increase with delay, as high inflation becomes more entrenched in wage and price setting. The successful Volcker disinflation in the early 1980s followed multiple failed attempts to lower inflation over the previous 15 years. A lengthy period of very restrictive monetary policy was ultimately needed to stem the high inflation and start the process of getting inflation down to the low and stable levels that were the norm until the spring of last year. Our aim is to avoid that outcome by acting with resolve now.

Pivot #2 - The Xi Pivot

A lesser-discussed, but potentially more important pivot than #1, is the Xi pivot. I.e., when will China’s supreme leader pivot on the zero-COVID policy. By taking very personal responsibility to the COVID situation he has painted himself in a corner, with nobody else but himself to blame. Hence, Xi n ow really struggles to come out of this corner now, without getting a lot of political egg on his face. Should he however anyway U-turn on his own policy over the coming months, that could be a major (inflationary) boon to the global economy as Chinese travelling picks up again.

Pivot #3 - Your Investment Strategy

IMHO, the by far most important pivot is on how we should approach our investment strategy. Most of the tailwinds (relatively benign geopolitics, disinflation, globalisation, etc.) for financial assets are … hhhmm … pivoting 🤷♂️and this is having a profound impact on how we should invest. Over the coming few Quotedians we will have a look at some of those impacts, but to summarize in fancy speech:

It is time to take down the sails we used for smooth sailing over the past decades and start using the oars to navigate the waters ahead.

In less fancy speech, much more proactivity in your investment management may be required.

And no further than yesterday’s session do we need to look than yesterday’s session, to see some evidence of pivot #3: In yesterday's session, the S&P 500 for example closed slightly more than half a percentage point lower. Looking under the hood we notice, however, that well more than half of the constituents ended higher on the day, more stocks made new 52-week highs than 52-week lows

and six out of eleven sectors closed up:

This is then what Thursday’s market heatmap looks like:

Notice anything? Yes, correct! It is the largest ‘boxes’ which are most read. I.e., the largest cap stocks are down most (and this is before Apple and Amazon dropped another 3% and 16%(!) in after-hours trading post their respective earnings release…), which undoubtfully has a large impact on a market-cap weighted index such as the S&P.

And indeed, when comparing the S&P 500 ETF (SPY) to the S&P 500 equal-weighted ETF (RSP) over the past three sessions, we see a divergence of close to 200 basis points in favour of the latter:

So, in our “Sails ‘n oars” approach (I feel this is a metaphor we will use a lot going forward), it may be not enough to have equity exposure via a passive tracker, or at a bare minimum, greater thought needs to be spent on which passive tracker. Having said that, now please take a moment to scroll down to the end of this document and read bullet number two in the disclaimer section several times.

The Asian equity section this morning is decisively written with red ink, with “blood red” used for the Hang Seng (-3%) and the CSI 300 (-2%). The five percent plus drop in the Hang Seng Tech index would give away that it is mainly the technology stocks dropping most post the Amazon and Apple earnings results last night. Index futures in Europe and the US currently suggest that cash trading will see major indices opening down about one percent.

Switching to fixed-income markets, we of course need to take note of the two recent ‘dovish hikes’, also known as Pivot #1, by the Bank of Canada and the ECB. Focusing on the latter, markets were quick to adapt, with yields dropping and the curve steeping. Here’s the chart of the 10-year Bund yield:

If you remember, we ‘painted’ (I) and (II) at the outset of the current consolidation, asking the question which of the two will it be in terms of size. The potential for (II) has just increased.

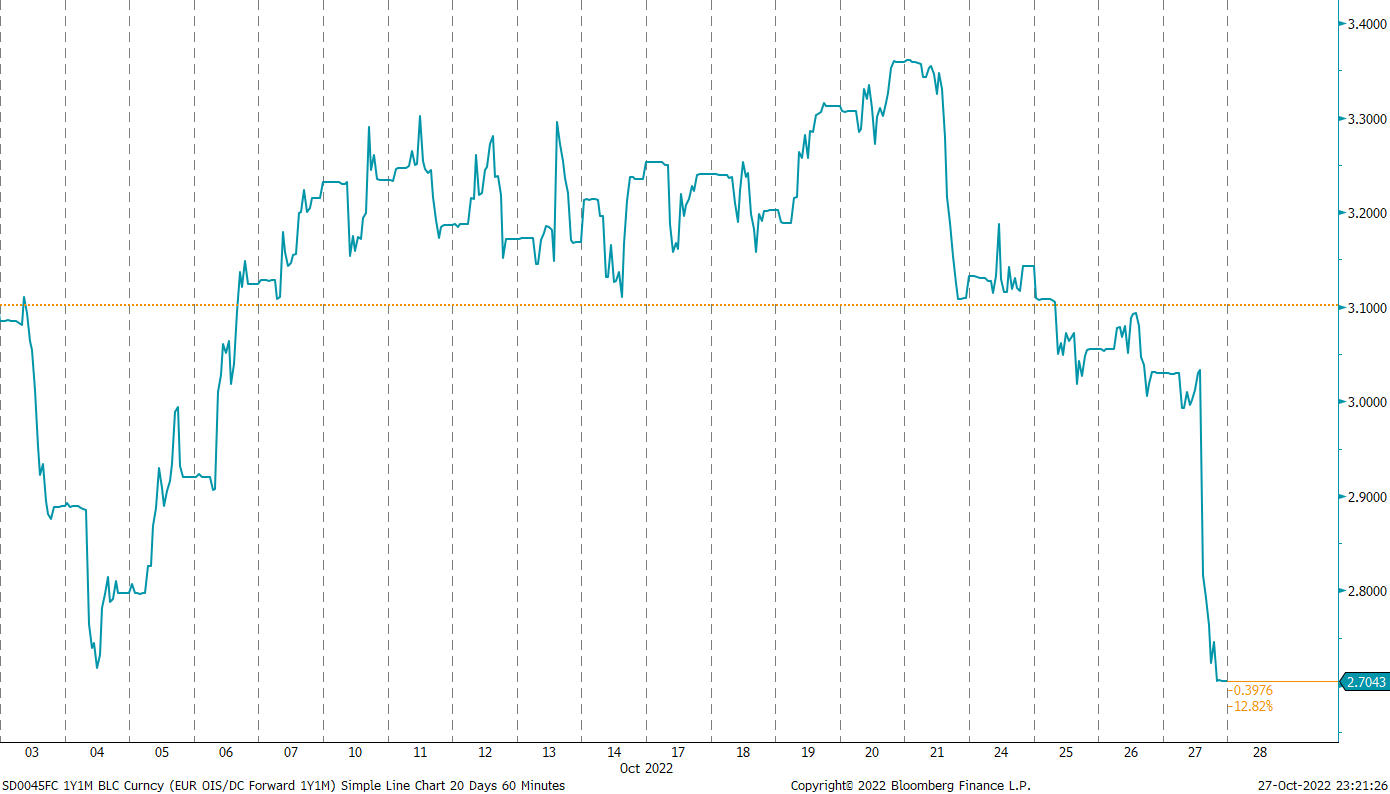

The expected terminal rate for the ECB key interest rate also plummeted by over 30 basis points:

US rates also weakened, dropping to their lowest of the past two weeks or so and right into some kind of (here we go again) pivot area:

Nothing specific to report back from credit markets, which more or less continue to tighten and widen together with the up and down moves in equity markets.

In currency markets, the US Dollar Index gained yesterday, but probably nearly the entirety of the gain can be attributed to the weakness in the Euro, the largest component of DXY, post the ECB meeting. Though the currency pair (€/$) remains in a firm short-term uptrend, the intraday move down was in excess of one big figure:

Currency volatility has been coming down somewhat over the past two weeks, though remains at elevated levels from a longer-term perspective:

Ok, time has come to hit the send button, so let’s leave it at this. A lot to digest anyway today, and as (nearly) always, the full-feature, weekly review edition should hit your inbox on Sunday afternoon/evening.

Enjoy your Friday and enjoy your weekend!

André

CHART OF THE DAY

Are bear markets a choice?

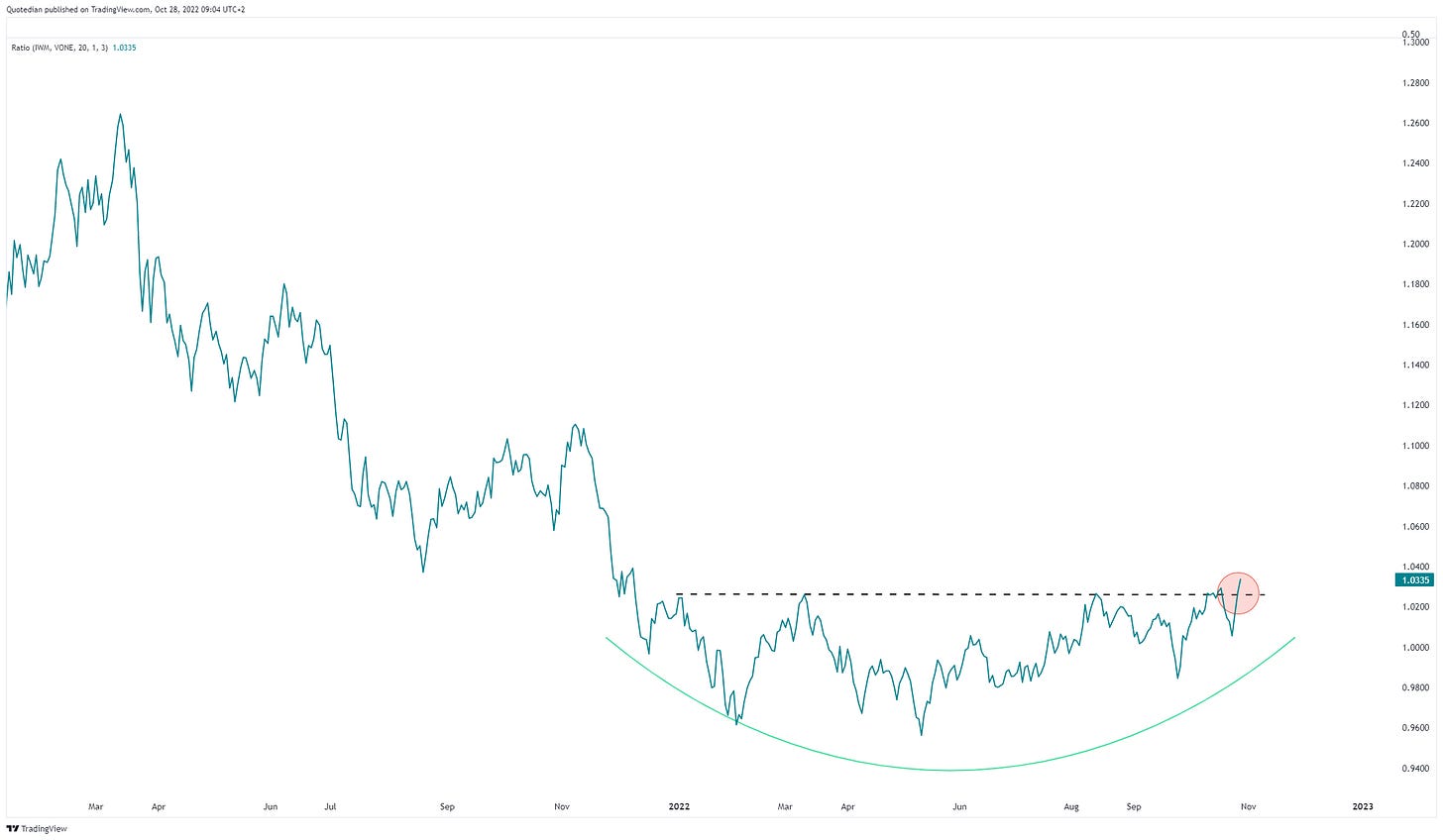

The following chart showing the ratio between the Russell 2000 (IWM - US small caps) and the Russell 1000 (VONE - US Large Caps) show that in relative terms small caps stocks are just hitting their highest levels this year.

We will have more on this subject soon, but in the meantime, remember:

There is always a bull market somewhere ;-)

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance