Platform Economy

The Quotedian - Vol VI, Issue 30 | Powered by NPB Neue Privat Bank AG

"Whenever the Fed hits the brakes, someone goes through the windshield"

— Old Wall Street Adage

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

We have been living in a platform economy for over a decade now:

Uber has no cars,

AirBnB has not real estate,

Deliveroo has no kitchens/restaurants …

But, maybe this latest incarnation is taking it one step too far:

Banks have no money …

Ay, naughty me! But as I am on it already, here’s one more. This is from the bio of First Republic Bank’s Risk Officer:

‘nuff said … on with today’s (very short) Quotedian, which also has the potential of being this week’s last, as yours truly is taking two days off.

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is your reliable Jedi Mater for all aspects of asset management and investment advice, your level being Padawan or Jedi already.

Feel the force already? Contact us @ Jedi Master

The Fed came, saw and hiked as expected. And also kinda confirmed what the market was expecting already “One and Done”. In other words, the Fed meeting was quite the anticlimax, non-event.

Stocks and bonds were at odds, with stocks maybe realizing that ‘pause’ is not equal to ‘reversal’:

However, bonds took for a first time the opposite view, with yields at the short-end dropping some good 15 basis points:

Pushing bonds higher across the spectrum. Here the iShares 7-10 years Treasury bond ETF as a proxy for the entire bond market:

The US Dollar (DXY below) got completely confused by the opposing messages from stocks and bonds and decided to go nowhere:

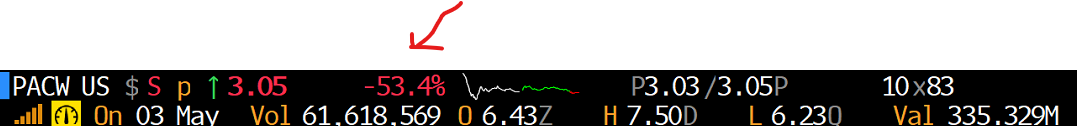

But the real ‘stunner’ came during the press conference following the FOMC meeting, where Powell kind of committed to a rate hike pause, but was largely in denial regarding the banking crisis. This is then what happened to PacWest, a regional bank, in after-hours trading after announcing they are reviewing their strategic options …

and this is the chart of the SPDR US Regional Bank ETF (KRE), which does not yet include PACW’s 53% after-hours drop:

The dotted line is where I originally wrote “watch out below” a few weeks ago…

In other notable events, Jim Cramer of “First Republic is a very good bank”-fame (not to mention Bear Stearns) gave his notorious kiss-of-death to Estee Lauder, tipping that Estee Lauder was, like LVMH and Hermes, to profit from China’s economic rebound:

Not sure the above chart is another falling off-the-platform stock …

Anyway, as I am officially “off” it is time to hit the send button, reminding you that today there is also the ECB meeting, where a slowing of pace via a 25 bp rate hike is expected. Also, the world’s largest bank (AAPL), reports after hours (which did not make it into the calendar above):

Stay tuned,

André

CHART OF THE DAY

I know, I know … bland, very bland …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance